Check out the conversation on Apple, Spotify and YouTube.

Brought to you by:

Kameleoon: Leading AI experimentation platform

The AI Evals Course for PMs & Engineers: Get $1155 off with code ag-evals

Amplitude: The market-leader in product analytics

Today's Episode

Robinhood just crossed $100 billion in market cap. Its stock has 5.5x'd in the past year. It's one of the hottest companies in fintech.

But here's what most people don't understand: building products at Robinhood isn't just about moving fast and breaking things. It's about moving fast while navigating regulations that could shut you down.

Today I sat down with Abhishek Fatipuria, VP of Product at Robinhood, who's been there for 9 years - from intern to VP. He walked me through how they built products that democratized finance while staying compliant.

If you're building in fintech or any regulated industry, this is your playbook.

(By the way, we’ve launched our podcast clips channel, so don’t miss out: subscribe here.)

Your Newsletter Subscriber Bonus

For subscribers, each episode I also write up a newsletter version of the podcast. Thank you.

We've put together the complete guide to thriving as an AI product leader:

How to Win as a FinTech PM

Experimenting to the Max

How to Build an AI Feature

Make Legal + Compliance Partners

Key Takeaways from How Robinhood Builds Product

Insane Focus on UX

Thinking Product Roll-Out First

Give As Much Back to the Customers As You Can

1a. How to Win as a FinTech PM

1a. Experimenting to the Max

Most fintech companies launch a referral program and call it done. They copy what Amazon or Uber did - maybe $20 for $20 - and move on.

Robinhood ran 60+ tests on their referral program alone.

They started with cash ($10). It worked, but not well enough.

They tried variable cash. Better, but still not good enough.

Then they launched variable stocks. Much better.

But here's the insight most people miss: they discovered that customers weren't actually activating after getting the stock. So they added a step to make customers affirmatively claim their stock.

"They actually have to go in and like say like I want my stock. And that completely changed the trajectory of the conversion."

Then they sent price movement notifications about the stock you got. And news notifications. All to get you into the ownership mentality.

The key learning? "Customers actually weren't that sensitive to the expected value. What they really cared about was twofold: that they were getting a stock and that they had some chance of getting a really valuable stock."

Most fintech PMs stop at "let's give them $20." Robinhood asked: "What's the ride equivalent of our product?" For them, it was a stock, not cash.

1b. Building AI Features Well

Robinhood just launched Cortex, an AI assistant that helps investors understand why stocks move. When you get that push notification that a stock moved 5%, you open the app and immediately wonder: why did it move?

That's exactly the problem Cortex solves. It brings together news, research reports, trading data from Robinhood, and SEC filings to give you the answer.

(It’s a perfect example of building into the cake, not AI sprinkles.)

But building AI in fintech isn't like building AI anywhere else. You're dealing with people's actual money. You need a high degree of trust. The regulatory constraints are massive.

Here's how they approached it:

Curate the Data Upstream

"We secure licenses with the news providers we're using. We're getting research reports. We're using our own market data on pricing we're getting directly from the exchanges."

They didn't just throw public data at an LLM and hope for the best. Every data source is licensed and verified.

Design for Information, Not Recommendations

Right now, Cortex doesn't make investment recommendations. That's intentional. The regulatory bar for recommendations is much higher.

"You have to consider their existing portfolios. You have to consider all sorts of other data."

They started with helping customers make their own decisions, not making decisions for them.

Fit AI Into Existing Workflows

They didn't build AI for the sake of building AI. They looked at what customers already do and asked: where can AI remove friction?

"One thing we learned when we talked to customers - it's a very universal problem. Stocks move like 5% up or down. You open the stock, you see the chart, and the first question you have is like why did it move?"

The AI fits into that exact moment.

1c. Making Legal a Partner

Here's the reality of fintech: you have more cross-functional partners than any other industry. Legal, compliance, operations - they're essential political partners as a PM.

Most PMs see them as blockers. That's the wrong mindset.

Abhishek's advice for working with legal teams:

Assume Good Intent

"They're not there to make the product worse. Their job is to make sure that we are safely shipping the products we want to ship in accordance with the regulations."

Get Them to Buy Into the Vision

"When you have a legal partner or a compliance partner who's bought in to the vision of the product, the outcomes of that product are so much better."

Become an Expert in Their Constraints

"Actually understand like what's the rule like what is the issue that we're trying to solve. If you become an expert in it and you empathize with it, you'll find that most of the time there's a reasonable solution to it."

The secret sauce? Hire legal teams who are domain experts. Many of Robinhood's legal team worked at the SEC or as regulators. They know how to find solutions, not just identify problems.

2. How Robinhood Builds Product - And Wins

2a. Insane Focus on UX

Every other brokerage treats design like an afterthought. Robinhood treats it like the product.

"The attention to detail in the pixels that is expected by a PM at Robinhood is very very high."

This starts from how they treat their UX of their referrals program to their discipline in removing features that don’t work.

New PMs joining from other companies are shocked. They might have something get delayed because someone looked at it and said: "This doesn't feel right. We're not shipping. Fix it first."

But here's the thing: after a year, no PM complains about this standard. They feel prouder of what they're shipping.

The difference starts at the top. Vlad spends time with the pixels. The entire leadership team cares about the experience details that other brokerages ignore.

"I would imagine that the CEO of the company or like the leaders of the companies at other brokerages aren't spending a large share of their time thinking about how are we going to make this experience feel great? What's the animation going to be?"

This isn't just about pretty interfaces. It's about removing every possible point of friction when someone wants to invest their money.

2b. Thinking Product Roll-Out First

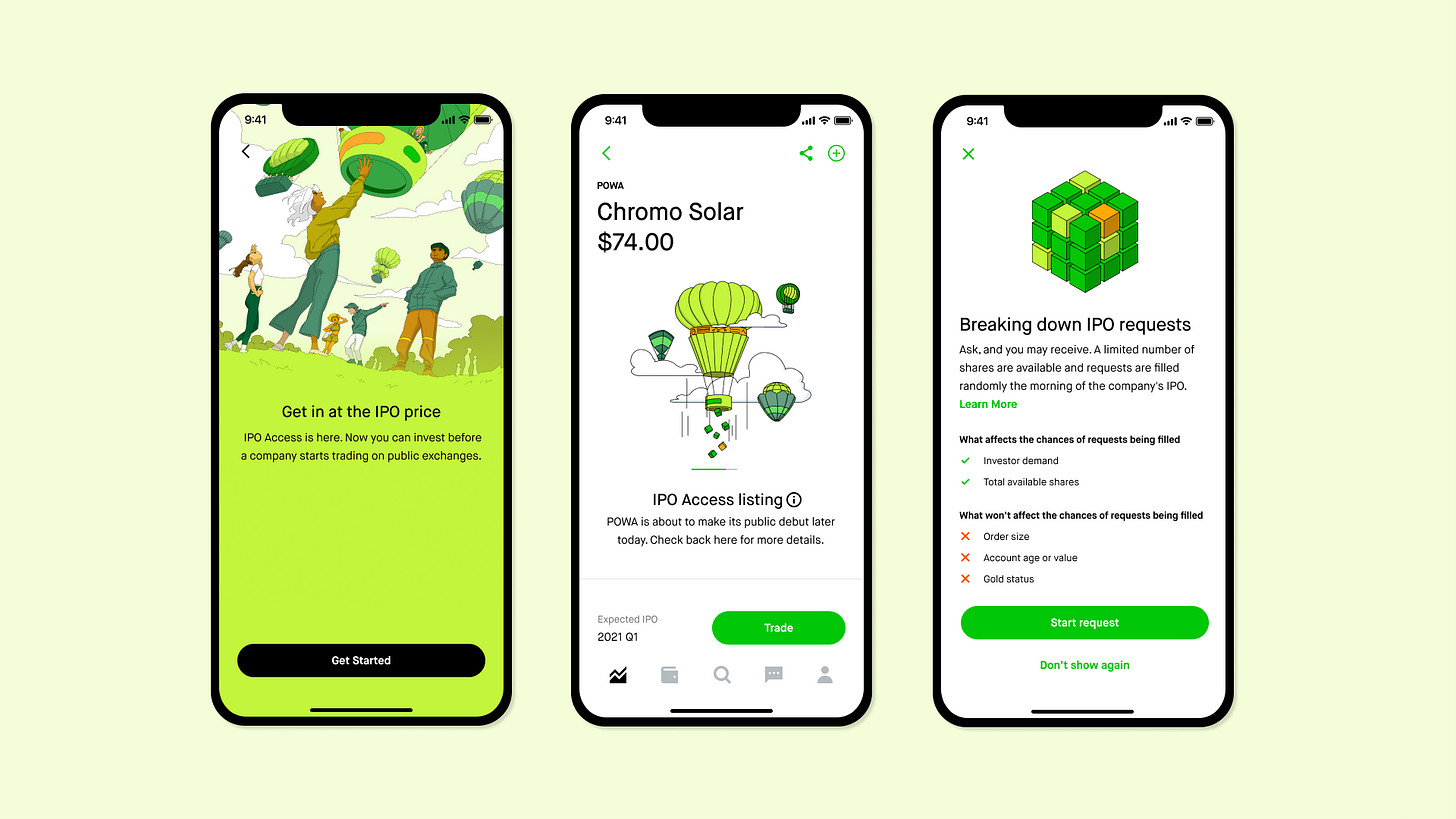

Robinhood uses "swipies" to force product clarity before they build anything.

Swipies are those full-screen takeovers you see when they launch a new product. Usually three or four screens with gorgeous animations and one sentence of text each.

But here's the brilliant part: they write the swipies before they build the product.

"I love just writing what are the swipies for this product going to be before we build anything because it forces you to succinctly summarize the product to a customer in like four small sentences."

Think about that. If you can't convince a customer to hit "Get Started" in one sentence, you don't have a great product.

For IPO access, they struggled with this for months. The final tagline? "Get in at the IPO price."

It spoke directly to the pain customers felt when they saw a stock chart: "The stock seems to have opened at 20, but it seems like it started trading at like 50. Like who got access at this $20 mark?"

The swipies framework forces you to think like Amazon's working backwards, but for mobile-first products.

You can think of it as another key part of your modern, AI-era PRD.

2c. Give As Much Back to the Customers As You Can

Robinhood isn't just a brokerage anymore. They're expanding into credit cards, banking, and international markets. The mission is broad: democratize finance for all.

Their approach to any new product remains the same: “give the most value back to customers and build the best experience.”

You can't ship a product that only has one of those. You need both.

They don’t price for profit. They price for value. Their equation of customer value + delightful experience, within regulatory constraints, is their secret recipe for winning.

You’ll want to watch the episode for his take on spending his whole career at Robinhood.

Key Takeaways

Where to find Abhishek Fatehpuria

Related Content

Podcasts:

Newsletters:

P.S. More than 85% of you aren't subscribed yet. If you can subscribe on YouTube, follow on Apple & Spotify, my commitment to you is that we'll continue making this content better.