Ultimate Guide: Consumer Software Pricing

How to supercharge your growth by evolving your pricing model

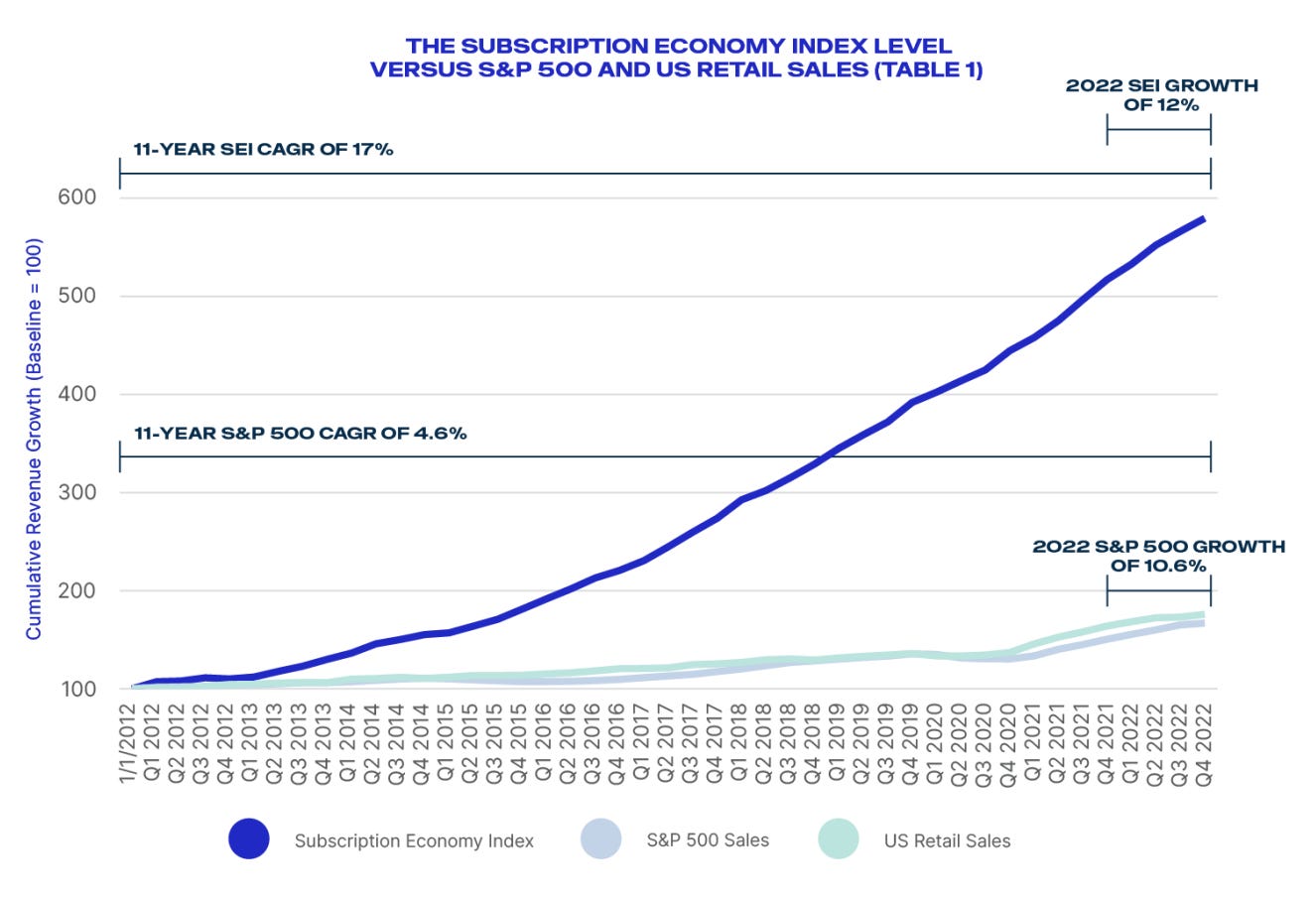

We all know the subscription has risen rapidly.

And so has the market cap of subscription companies:

Over the past 11 years, subscription-based companies have grown 3.7x faster than companies in the S&P 500.

But when did the consumer software subscription start, and who uses it?

And what drives this advantage?

The History of Consumer Software Subscriptions

There’s been 6 distinct chapters of the consumer software subscription economy’s growth:

1. Early Adopters (1980s - 1990s)

Antivirus programs like Norton and McAffee were the early adopters of the consumer software subscription. They bucked the trend of perpetual licenses, taking their cue from magazines, cable TV, and insurance companies.

2. Annual Upgrade Plans (1990s)

Software like Quicken, Macromedia Director and Grolier’s Multimedia Encyclopedia offered optional subscriptions, although the primary model for accessing the software was a perpetual license.

3. Subscription Video Arrives (Late 1990s)

In 1997, Netflix launched its consumer video subscription, which was the first purpose-built subscription outside of Antivirus software to gain widespread adoption.

4. Everyone Joins In (2000s)

Inspired by the B2B SaaS revolution of the early 2000s, consumer software began going subscription. Flickr launched with subscriptions in 2004. Then, Amazon Prime launched in 2005, and Skype also introduced a subscription. In 2008, Evernote, Dropbox, and Spotify all launched with subscriptions, as well.

5. Steady Diversification (Late 2000s - Early 2010s)

The launch of the Apple App Store (2008) and Google Play Store (2011) ushered in the era of mobile subscriptions apps. Popular products like VSCO and Peloton took off in this period. Subscription products like Birchbox and Dollar Shave Club also took off in this period.

6. Explosion of Subscriptions (Late 2010s - Present)

Now, we live in a consumer software subscription world. Adobe Creative Cloud (2015) and Microsoft Office (2017) switched over to subscription plans in 2011. Soon, players in every industry, from Duolingo to Substack (2017) joined.

It’s really taken off over the last decade. In the United States, consumer’s now on average have 4x the subscriptions they had in 2014.

A Forbes report highlights that in the first half of 2014, there were only 7.9 million paid music streaming subscribers in the US, compared to a staggering 90 million in 2024.

It can seem like everything is trending towards a subscription.

What is driving the shift to subscriptions?

The challenge in most great businesses (eg, public one’s) isn’t continuing the franchise of a great product like Microsoft Excel or Adobe Photoshop.

It’s getting your loyal users to keep paying you for it.

That’s where subscriptions come in. CFOs love them for 3 reasons:

Increased ARPU and LTV: customers tend to monetize more and for longer.

Reduced CAC: you need far less marketing & sales spend to get your loyal customers to pay again.

Stable Cash Flow: recurring revenue means cash flow becomes more predictable.

But it's not just on the business side. Consumer acceptance is on the rise.

Continuous delivery from product teams—delivered seamless via the internet or app stores in your sleep—has justified the continuous cost.

But subscription is hardly the only game in town for consumer software

Some of the most successful products I’ve worked on have entirely different pricing models:

Fortnite made $5.76 billion in 2021, primarily off the back of microtransactions in the app—with users being the in-game currency, which they then use to buy skins in the game

thredUP made hundreds of millions by selling used clothes per item

Rap to Beats sold in-app beats at premium prices to users

Affirm made money off interest per transaction

There’s so much more to pricing that just slapping on a subscription.

And even within subscriptions, there’s lots of room to optimize.

The Spotify Example: Growth from Sophistication

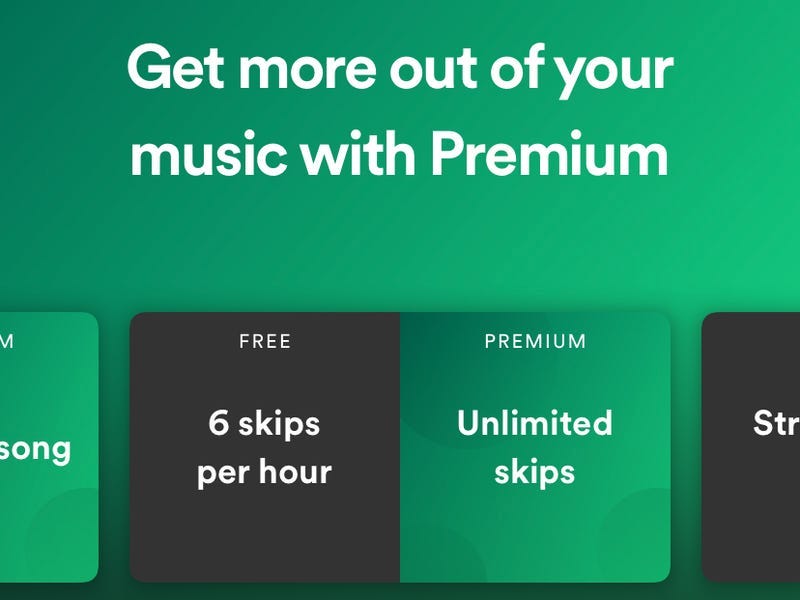

Remember the days of unlimited music skips on Spotify's free tier?

It was a golden age for music lovers. But, for Spotify, there was less gold than they hoped.

So in 2014, Spotify limited skips on the free tier to six per hour.

The headlines were:

Spotify’s free tier just got worse

I’m quitting Spotify

But 6 months later, Spotify had seen a 25% increase in paid subscribers—well above analyst expectations.

And, the cherry on top?

Churn rate among free users did not go up.

How did they do it?

The detail that is missing from 99% of commentary is: they implemented it as a reverse trial. Users experience unlimited skips for their first 7 days, but THEN hit the skip limit.

That’s the power of iterating on your pricing—and getting sophisticated—as a consumer software company.

It’s not just about adapting a subscription model.

It’s about getting sophisticated with your model.

Today’s Deep Dive

I’m going to help you go beyond a 201 understanding of pricing and really go deep.

Words: 5,345 | Est. Reading Time: 25 Minutes

Taxonomy of consumer software pricing models

The actual, relevant strategies that sit atop them

Deep study of prominent model changes

PM toolkit to pricing innovation

Including:

How to implement freemium or reverse trial

When to consider launching a subscription

Founder’s toolkit to choosing

The future: emerging trends

1. Taxonomy of consumer software pricing models and strategies

So if subscription isn’t the only game in town, what else do big consumer software companies actually use?

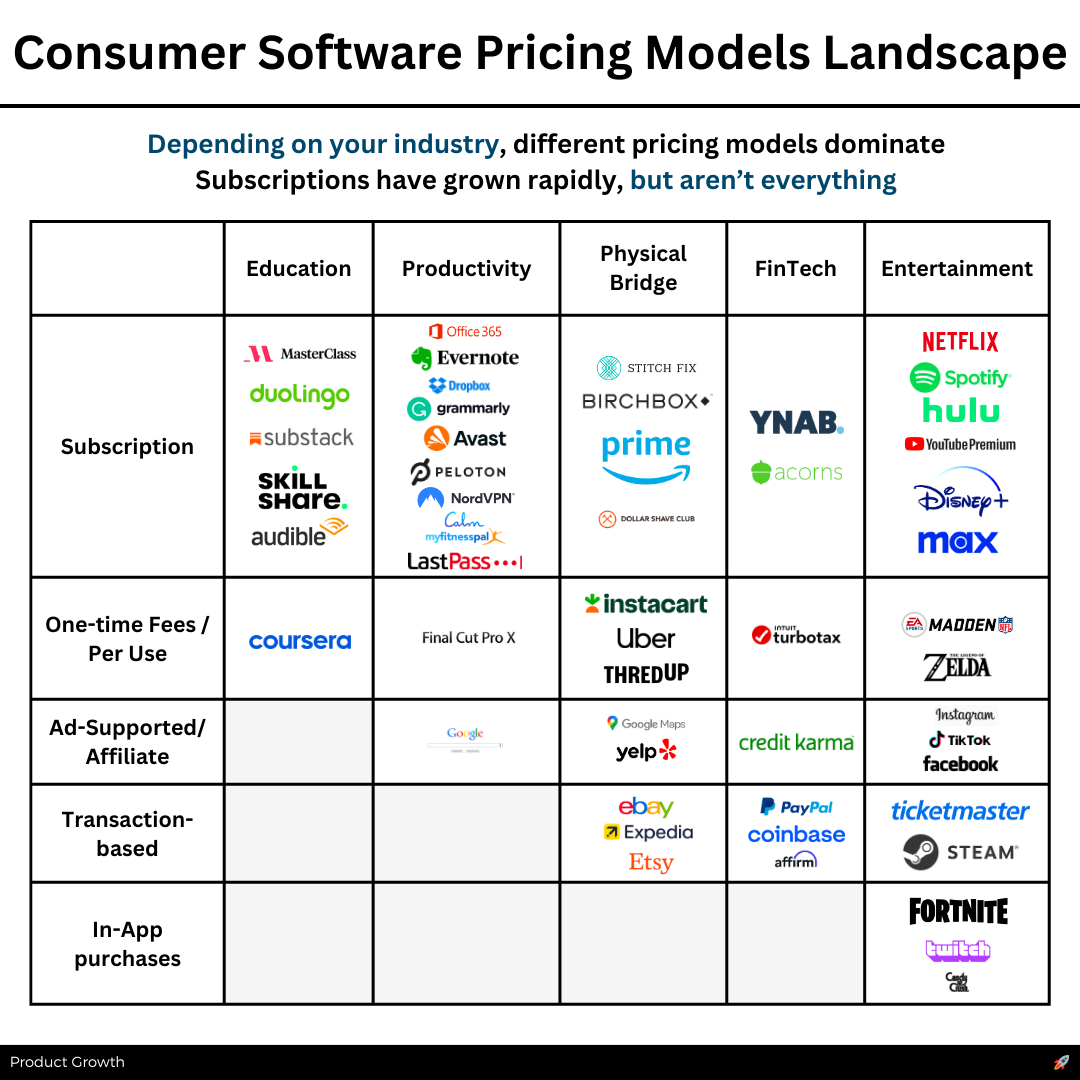

I analyzed 50+ of the top consumer software products out there. Let’s use this dataset to break it down.

The industry you’re in dramatically impacts your options of pricing models:

No matter what industry of software you are in, subscription products have become dominant players.

But their prevalence depends on industry—with education the least diverse and entertainment the most.

It’s hard to find examples that use microtransactions and in-app purchases at scale outside of entertainment, for instance.

Similarly, in the education and productivity spaces, it’s hard to find non-subscription offerings at scale. There are a few, like Coursera and Final Cut, Google Search, but they are far and few between.

Most interestingly - even those that end up in buckets line one-time—eg, TurboTax—often force a recurring pattern with annual upgrade options.

Subscription or “subscription-like” pricing is, in total, 56% of this list.

2. The key strategies that sit atop models

Adjacent to the core model is: what are your pricing strategies? These sit atop the model itself.

5 major strategies are trending right now (from most to least common):

Trials: allowing users to try before they buy for a limited time

Freemium: offering a completely free version of the software

Dynamic pricing: pricing based on variable demand factors

Drip pricing: having unavoidable fees in your pricing

Reverse trials: starting users on premium

Let’s go through the data and why on each.

Keep reading with a 7-day free trial

Subscribe to Product Growth to keep reading this post and get 7 days of free access to the full post archives.