How to Win the Enterprise in 2024: The Ultimate Guide

The complete playbook, from product to GTM, for how to transform your company to win in the enterprise segment, when you have traditionally won in SMB and mid-market. (Lessons from having done it.)

Since I began writing about B2B SaaS in 2021, I've gotten 2 questions more than any others:

I've built product-market fit with SMBs. How do we expand upmarket?

I run product at my company and we're ready to tackle enterprise deals. What needs to change in our product, team, and motion?

Today’s post is the answer.

You see: these questions touch every part of your company.

And what I found is… most writing about "enterprise transformation" focuses solely on sales, or solely on product.

But the real story is much bigger:

Your product has to evolve

Customer success becomes mission-critical

Sales and marketing need to change

And much more…

I’ve had the opportunity to help products like ScoutForce, Apollo.io, and Google Hire all make this enterprise shift. I’ve also studied many other companies that made it.

Today's guide will give you the complete playbook – from product to GTM – that no one has shared before.

Brought to You By WorkOS

With WorkOS you can start selling to enterprises with just a few lines of code. It's a modern identity platform for B2B SaaS and supports user management (AuthKit), SSO, Directory Sync (SCIM), Fine-Grained Authorization (FGA), and more. The APIs are modular and easy-to-use, which means you can finish integrating in minutes.

The self-serve onboarding flow for you customers' IT admins also guarantees a seamless UX when they are setting up SSO and SCIM. And best of all, user management is free up to 1 million MAUs. It comes standard with social login, MFA, RBAC, and bot protection.

It's already used by hundreds of high-growth companies including Perplexity, Vercel, and Cursor 🤯

The Hidden Reality of Enterprise Success

The conventional wisdom from 5 years ago about "enterprise readiness" gets almost everything wrong:

Product changes usually determine your fate more than GTM changes

Sales transformation is useless without marketing transformation

The timeline is faster than most think

We'll bust these myths with real data and examples that have never been published before.

Today's Post

Words: 6,212 | Est. Reading Time: 28 minutes

I’m synthesizing my 15+ years of experience and hundreds of B2B SaaS Case Studies:

Why Enterprise Now?

Your Product Roadmap

How to Master the 7 Layers of Growth

Building the Enterprise-Ready Organization

Measuring Enterprise Success: Beyond ARR

1. Why Enterprise Now? The Reality Today

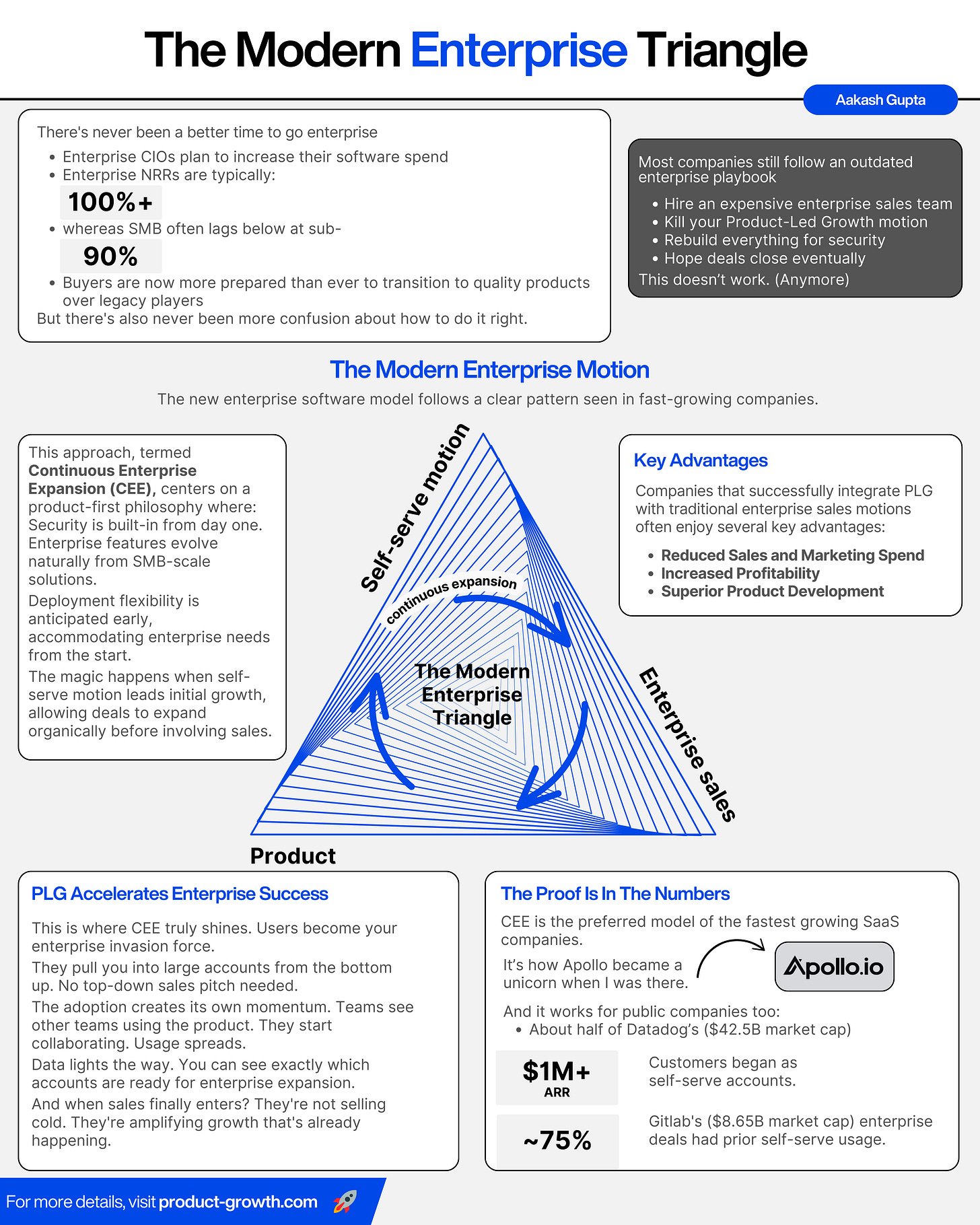

There's never been a better time to go enterprise:

82% of Enterprise CIOs plan to increase their software spend

Enterprise NRRs are usually 100%+, while SMB is often sub-90%

Buyers are more ready than ever to move to good products over legacy players

But there's also never been more confusion about how to do it right.

Most companies still follow an outdated enterprise playbook:

Hire an expensive enterprise sales team

Kill your Product-Led Growth motion

Rebuild everything for security

Hope deals close eventually

This doesn’t work.

(Anymore)

The Modern Enterprise Motion

The new reality is different.

After studying the latest fast-growing enterprise software companies, a clear pattern emerges:

The winners are building what I call "Continuous Enterprise Expansion (CEE)."

It’s a model where:

Product is a key part of the journey

PLG accelerates traditional enterprise success motions

The Proof Is In The Numbers

CEE is the preferred model of the fastest growing SaaS companies. It’s how Apollo became a unicorn when I was there. And you see many companies like Figma, Notion, Miro, and Canva do the same.

And it works for public companies too:

About half of Datadog’s ($42.5B market cap) $1M+ ARR customers began as self-serve accounts.

~75% of Gitlab's ($8.65B market cap) enterprise deals had prior self-serve usage.

Companies that combine the PLG + enterprise motion tend to:

Have less sales & marketing spend

Scale to be more profitable

Have better products

The difference is stark.

But how do you actually build this motion?

That's where most advice falls short.

The rest of this guide will give you the detailed playbook, starting with the foundation: transforming your product for enterprise scale.

There would normally be a paywall here, but this post is entirely free thanks to our sponsor…

Check out WorkOS AuthKit if you want a login box that comes with enterprise capabilities, a generous free tier of 1 million MAUs, and extensive customizability powered by Radix.

It's a complete solution for authentication, authorization, and user management.

2. Product Transformation: The Foundation

The conventional wisdom says enterprise products need:

Role-Based Access Control (RBAC)

Single Sign-On (SSO)

SLA Guarantees

Audit Logs

And they’re right.

But here’s the harsh truth: that's just table stakes.

Studying companies like Atlassian, Datadog, and Snowflake reveals a much deeper transformation - one that has two parts

Let's break down the real requirements:

Architecture Evolution

Feature Evolution

Each needs its own section.

Requirement 1 - Architecture Evolution

When it comes to product changes for enterprise, PMs often want to jump to features. But it’s best to start with what’s a typically engineering topic: architecture.

Atlassian's public engineering blog posts from 2018-2023, show their enterprise journey required fundamental architectural changes:

Multi-tenant → Multi-instance

In the apartment model (multi-tenant), everyone shares walls and plumbing. Great for efficiency, terrible for enterprises who need guarantees about their data isolation. The estate model (multi-instance) gives each customer their own space.

Every major enterprise software company has had to solve this. Snowflake spent 18 months on this transition alone.

What makes this tricky? You can't just copy-paste your architecture for each customer. You need to solve thorny problems like:

How do you guarantee true data separation? Most companies underestimate how deep this needs to go.

What happens when one customer's "estate" needs more resources? Your system needs to flex without affecting others.

How do you still learn from usage across all these separated instances? You need this data to improve your product.

Deployment Flexibility

For many companies these days, something like 30-60% of enterprise revenue comes from self-hosted deployments.

The winning pattern isn't forcing customers to choose.

It's building what Hashicorp calls "deployment-agnostic architecture":

Consistent API layer

Abstracted storage interfaces

Pluggable authentication

Standardized monitoring

(It’s what we saw on Tuesday with Statsig’s warehouse-native product.)

Scale Units

The third shift is the most subtle but possibly the most important. It's about how you think about scale.

Most products think in terms of user limits or data volumes. But studying Datadog's architecture reveals a more sophisticated approach: scale units.

Instead of just handling more load, they built discrete units of scale. Each unit has its own:

Performance guarantees

Resource allocations

Isolation boundaries

Growth patterns

This might sound abstract, but it solves a concrete problem: enterprises need predictable performance at massive scale.

Requirement 2 - Feature Evolution

Of course, as PMs we know architecture is only half the story.

The product itself needs to evolve.

Looking at the feature releases of companies that successfully moved upmarket, we see three distinct phases:

Phase 1: Multiplayer

This is what I talked about 2 weeks ago, bringing people together.

Frankly speaking: team collaboration is the foundation of enterprise adoption.

So how do you do it?

Notion's public changelog shows they built these in order:

Nested permissions

Team spaces (+2 months)

Admin controls (+2 months)

This matches what I have seen across successful enterprise expansions - start with team features, not enterprise features.

Too many people jump ahead.

And with admin controls in particular, expect this to be a product area that needs to be revisited often (or continually staffed). The tendency is for core product teams to pollute this area, and then the growth team to come and simplify it every so often.

Phase 2: Enterprise Control

Once teams are collaborating, enterprises need control.

These are features like:

Organization-wide policies

Usage analytics

Custom branding

Domain capture

Build these out as they apply to your industry.

And don’t underestimate it. For Figma, this phase drove their biggest jump in enterprise adoption. Enterprise like team features, they need enterprise controls.

Phase 3: Enterprise Integration

The final phase is becoming part of the enterprise ecosystem. These are things like:

SCIM provisioning

Custom retention policies

eDiscovery support

DLP integration

You need this to be ready for the big dogs (and you may want to buy instead of build some of them since they’re nt hugely specific).

Of course, successful companies don't wait to finish one phase before starting the next. They layer them.

But you do need to do all of them.

3. How to Master the 7 Layers of Growth

Let’s cover the 7 layers of the Enterprise Growth Motion, and how to rock them:

Go To Market

Information for Decision

Free to Paid Conversion

Activation

Retention

Monetization

Expansion

Layer 1 - Go-To-Market: The Real Enterprise Channel Mix

Let's break down how enterprise software companies actually acquire customers in 2024.

Not theory - real channel mix and the tools that drive each.

The Enterprise Channel Reality

Here's the typical mix I see across successful enterprise companies:

Direct Enterprise Sales (40-50% of pipeline)

Direct sales continues to be the backbone of enterprise GTM, but with a crucial evolution.

Today's enterprise Account Executives operate with unprecedented precision, leveraging data and tools to focus their efforts where they matter most.

They typically manage 15-20 target accounts each, dedicating 70% of their time to accounts showing active buying signals.

The modern enterprise AE relies on four core tools:

Engagement platforms like Outreach or SalesLoft ($6K/seat) for customer outreach

Conversation intelligence tools like Gong or Chorus ($8K/seat) for interaction analysis

Professional networks like LinkedIn Sales Navigator ($3.6K/seat) for account research

Forecasting platforms like Clari ($4K/seat) for pipeline management

Top AEs carry quotas of $2-3M annually, managing deals that average $800K-1.2M in size.

While deal cycles typically span 12-18 months, close rates on qualified opportunities hover between 25-30% – significantly higher than traditional enterprise sales models.

Account-Based Marketing (25-30% of pipeline)

ABM has matured from a buzzword into a systematic, data-driven approach. Leading companies orchestrate coordinated campaigns across 500-1000 target accounts per quarter. The modern ABM tech stack requires four essential components:

Intent platforms like 6sense or Demandbase ($150K/yr) identify and prioritize buying signals

Professional networks ($30-50K/month per 1000 accounts) enable targeted advertising

Display platforms like Terminus ($40-60K/yr) extend reach across the digital landscape

Retargeting tools like RollWorks ($40K/yr) keep accounts engaged over long cycles Success rates have transformed with this systematic approach. Companies using integrated ABM see 40% higher win rates and 35% larger deal sizes.

Channel Partners (15-20% of pipeline)

Strategic partnerships with major system integrators have evolved far beyond simple referral relationships. Modern partner programs demand sophisticated infrastructure to scale effectively. The foundation of successful partner programs rests on four key components:

Partner management platforms like Impartner ($100K/yr) handle deal registration and tracking

Learning management systems ($50K/yr) deliver scalable enablement

Custom partner portals provide self-service resources and support

Co-selling platforms coordinate joint account planning and execution Top partners typically influence 3-5x their direct revenue through customer introductions and technical validation. The most successful programs maintain a 1:5 ratio of partner managers to active partners.

Product-Led Growth (10-15% of pipeline)

Enterprise PLG looks radically different from SMB product-led motions. Rather than focusing on rapid conversion, enterprise PLG drives technical validation and bottom-up adoption. The modern enterprise PLG stack consists of three core elements:

Product analytics platforms like Pendo or Amplitude ($100K/yr) track usage patterns

In-product messaging tools like Customer.io ($50K/yr) guide users toward value

Custom PQL scoring identifies expansion signals across large organizations Success metrics focus on depth over speed of adoption. The best enterprise PLG motions see 40% of large deals influenced by product usage. Technical evaluation periods average 90 days before serious enterprise discussions begin.

Channel Optimization Reality

Beyond the channels, here's how enterprises actually optimize their GTM:

Sales Development

Modern SDR teams have evolved far beyond simple prospecting and qualification. Teams maintain a ratio of 15-20 SDRs per 10 AEs, focusing on deep technical discovery. The modern SDR tech stack requires three essential components:

Contact intelligence platforms like ZoomInfo ($15K/seat/yr) provide the data foundation

Engagement tools like Apollo.io ($3K/seat/yr) enable systematic outreach

Conversation intelligence platforms analyze technical discovery calls Top SDR teams qualify opportunities at 2x the depth of traditional approaches. Technical discovery sessions now average 45 minutes, up from 15 minutes five years ago.

Marketing Operations

Enterprise marketing operations has consolidated around integrated technology stacks. The foundation centers on four core platforms:

Marketing automation tools like Marketo or HubSpot Enterprise ($120K/yr) orchestrate campaigns

Webinar platforms like ON24 ($50K/yr) deliver technical education at scale

Content intelligence tools like PathFactory ($80K/yr) personalize buying journeys

Web experience platforms manage complex enterprise content needs Success metrics focus on engagement depth over lead volume. The best teams maintain 80% of pipeline influence while operating at 40% lower cost per opportunity.

Revenue Operations Integration

The true differentiation in modern enterprise GTM comes from integration. RevOps teams transform raw data into actionable intelligence through three key systems:

Lead-to-account matching engines eliminate pipeline confusion

Cross-channel attribution tracks complex buying journeys

Unified customer views connect product and sales data Companies staff one RevOps team member per 10 quota carriers. Early warning systems predict deal health through technical validation patterns. Time to first meeting averages 14 days for top performers. Multi-thread engagement scores predict close rates with 80% accuracy. Account penetration metrics forecast expansion potential 12 months out.

Making It All Work Together

The key is integration. Successful companies build "Revenue Operations Hubs" where all these tools share data:

Lead-to-account matching

Cross-channel attribution

Unified customer views

Integrated forecasting

They staff RevOps teams (usually 1 RevOps person per 10 quota carriers) to manage this complexity.

And most importantly: they measure everything.

The metrics that actually matter?

Time to first meeting (target: <14 days)

Technical validation completion rates

Multi-thread engagement scores

Account penetration metrics

This is what real enterprise GTM looks like in 2024.

Not just random tools - integrated systems driving predictable pipeline across multiple channels.

Layer 2 - Information for Decision: What Actually Moves Enterprise Deals

The enterprise buying process has transformed dramatically in recent years.

Gone are the days when a polished pitch deck and some reference calls could close a seven-figure deal.

Today's enterprise buyers operate in a more complex environment, with stricter requirements and more stakeholders than ever before.

The Four Pillars of Enterprise Decision-Making

Through my work with dozens of enterprise software companies, I've identified four critical pillars that drive modern enterprise purchasing decisions.

Security & Compliance: The New Deal Blocker

Security and compliance have emerged as the primary gating factor in enterprise deals, accounting for 35-40% of the decision weight.

What's fascinating is how this requirement has evolved beyond simple checkbox exercises.

Modern enterprises expect a comprehensive security package. Plan for SOC 2 Type II certification at about $80K annually. Budget another $100K first year for ISO 27001 certification, then $40K annually after that.

HIPAA compliance is increasingly required even outside healthcare. Cloud security certifications like CSA STAR will run you another $30K annually.

But here's what's really interesting: the most successful companies don't just provide these certifications – they've transformed security documentation into a competitive advantage.

Pre-populated security questionnaire templates save 100+ hours per quarter. Quarterly third-party penetration testing reports cost $40K each, but they're worth every penny.

The companies that excel here turn what could be a six-week security review into a two-week formality.

Technical Validation: Proof at Enterprise Scale

The second pillar carries 30-35% of decision weight. Enterprise buyers need concrete proof that your solution works at their scale.

This goes far beyond traditional demos and trials.

Successful companies invest in dedicated sandbox environments at $15-20K per major prospect. They build production-grade test data and comprehensive validation frameworks.

What's particularly effective is creating "technical validation packages" tailored to specific industries or use cases.

The key insight? Technical validation needs to feel like a collaborative engineering exercise, not a sales process.

Business Value: Beyond Basic ROI

Business value remains crucial at 20-25% of decision weight. But the way it's demonstrated has evolved significantly.

Modern enterprises expect sophisticated value frameworks. Industry-specific benchmark data alone is worth investing $100K+ annually.

The most effective companies use ROI modeling tools like Mediafly ($50K annually) and demo automation through Consensus ($40K annually).

What's particularly interesting is how the best companies integrate these tools into their broader sales motion, rather than treating them as standalone assets.

Implementation Planning: The New Deal Closer

Perhaps the most significant shift in enterprise buying is how implementation planning has moved from a post-sale activity to a critical part of the buying process.

It now carries 10-15% of decision weight.

The most successful companies deliver implementation planning through custom portals and project planning tools. They make it feel less like paperwork and more like partnership.

Making It All Work Together: The Integration Layer

The real magic happens when these four pillars work in concert.

Leading companies build what I call "Buyer Enablement Hubs" that track information sharing across all pillars.

They typically staff dedicated deal desk teams - one person per five enterprise AEs - to orchestrate this complexity.

Measuring Success: The Metrics That Matter

The most successful companies focus on four key metrics:

Time to security approval (target: <45 days)

Technical validation completion rate

Value assessment engagement

Implementation readiness score

The Path Forward

The landscape of enterprise decision-making continues to evolve, but one thing is clear: success requires a systematic approach across all four pillars.

The companies that win aren't necessarily those with the best product or the lowest price.

They're the ones that best facilitate enterprise decision-making.

The good news? This systematic approach is learnable and repeatable.

By focusing on these four pillars and building the right infrastructure to support them, you can transform your enterprise sales motion from a series of hopeful conversations into a predictable machine.

Layer 3 - Free-to-Paid Conversion: The Enterprise Reality

Let's bust a myth right away: many successful enterprise companies don't have freemium at all.

Workday, Salesforce, ServiceNow - they've built massive businesses on traditional sales-led motions with time-limited trials.

But for those that do offer free products, the conversion playbook looks different than SMB.

The Three Enterprise Conversion Paths

After studying hundreds of enterprise deals, three distinct patterns emerge.

Product-Led Conversion: Teams, Not Individuals

Product-led now drives 40-45% of enterprise conversions. But forget everything you know about SMB conversion.

Enterprise PLG is about team adoption, not individual users.

The signals that matter? Watch for five or more active users from the same domain. Pay attention when three or more departments start accessing your product.

Integration API usage above the free tier is another strong indicator. So is admin console exploration.

When enterprise teams start requesting SSO or SCIM features, that's your moment.

Track this through tools like Amplitude Enterprise at about $150K annually. The investment pays for itself in predictive power.

Sales-Led Conversion: Still Strong at 35-40%

Traditional sales still drives significant conversion. But it's more systematic than ever.

Technical validation needs to be complete. Security requirements must be identified.

Most importantly? You need the budget holder engaged and an implementation timeline set.

Modern sales teams manage this through Salesforce Enterprise at $200 per seat monthly. They use Gong for conversation intelligence at $8K per seat.

Partner-Led: The Growing 15-20%

System integrators and consultants are becoming a major conversion channel.

They bring technical credibility and implementation expertise. They also bring existing relationships.

Support them with deal registration systems and technical certification programs.

Give them the tools to succeed through partner portals and enablement platforms.

The Free Trial Reality

Most enterprise companies actually succeed with a simpler model: the good old 14-30 day trial.

Why? Enterprise buyers expect to pay. They just want to validate technical fit first.

A focused trial period often works better than endless free tiers.

What Actually Works

Focus your conversion efforts on these key areas:

Technical validation comes first. If the product doesn't work at scale, nothing else matters.

Security requirements need to be clear upfront. Don't surprise enterprise teams late in the process.

Executive sponsorship matters more than individual user happiness.

The Hidden Conversion Metrics

Track what actually predicts enterprise conversion:

Cross-team adoption velocity tells you more than individual user metrics.

Security review completion rates predict deal likelihood better than product usage.

Time to first integration is more important than time to first value.

Building Your Strategy

Start by choosing your primary motion. You don't need all three conversion paths.

Many companies succeed with just sales-led and trials. Others combine PLG with sales.

Pick the motion that matches your product and market. Then invest deeply in the tools and processes to support it.

Remember: enterprise conversion isn't about going from $0 to paid. It's about going from serious interest to technical validation to signed contract.

Focus your energy there.

Layer 4 - Activation: Making Enterprise Customers Successful

Enterprise activation isn't about welcome emails and product tours.

It's about turning six-figure contracts into successful deployments. And the best companies make it a cross-functional sport.

Here's something fascinating: product-led companies tend to have the best enterprise activation. They've already built the instrumentation and workflows to understand user behavior.

But they don't do it alone. They combine product expertise with high-touch sales and customer success.

The First 90 Days

Your sales team who closed the deal? Keep them involved. They have the relationship and context.

Identity management comes first - either through enterprise identity providers like Okta or Azure AD at $50K+ annually. Most companies now use third-party authentication platforms like WorkOS ($30K/year) or Auth0 ($100K/year) instead of building it themselves.

Customer success maps departments and roles. Most enterprises need 5-7 core roles for proper governance.

Engineering becomes critical for API integrations. Sales identifies which integrations matter most to the customer. Customer success manages the timeline and expectations.

The People That Matter

The hard truth from analyzing hundreds of enterprise deployments: technical success managers matter more than CSM headcount.

Plan for one TSM per 8-10 enterprise customers at $180-220K OTE each. Give them direct access to engineering when needed.

Companies with dedicated TSMs activate 40% faster according to customer success platform data.

Integration Predicts Success

Want to know if an enterprise customer will succeed? Watch their integration patterns.

Three or more core system integrations is the magic number. Custom API usage above platform averages is another strong signal.

You need three core platforms:

A CRM to track customer health and relationships (like Salesforce at $200 per user monthly)

A customer success platform to monitor technical adoption (like Gainsight at $100K/year)

A technical project management system to coordinate implementation (like Jira or Shortcut at $10/user/month)

Making It All Work

Product provides the foundation, but successful activation requires everyone:

Sales maintains executive relationships

Customer success manages the timeline

Technical success ensures the solution works

The best enterprise activation combines product-led efficiency with high-touch support.

Build your product for self-service, but wrap it with expertise.

Remember: in enterprise, activation isn't just about the product working. It's about the product becoming essential to their operations.

That takes everyone working together.

Layer 5 - Retention: Keeping Enterprise Customers

Enterprise retention in 2024 isn't about NPS scores and quarterly check-ins.

It's about making your product technically essential before you worry about making it likeable.

Technical Integration Drives Everything

After studying hundreds of enterprise renewals, one pattern emerges clearly: technical integration depth predicts renewal rates better than any other factor.

Companies with three or more core system integrations renew at 95%+ versus the baseline of 75%.

Custom API usage above 100,000 calls per month almost guarantees renewal. Bi-directional data flows make you impossible to rip out.

Snowflake's internal data tells the story: customers using their platform as a true data hub renew at nearly 100%.

Team Adoption Changes Everything

MongoDB discovered something fascinating: teams with multi-department adoption renew at double the rate of single-department customers.

The magic number seems to be three departments. Once you have engineering, data science, and business teams all using your product, you're practically guaranteed to renew.

Weekly active user growth matters less than cross-functional adoption. One department with perfect adoption is more risky than three departments with decent adoption.

The Modern Retention Stack

Customer success platforms do the heavy lifting of health scoring and usage tracking. But retention leaders are shifting focus from activity metrics to technical dependency metrics.

Technical success coverage needs roughly one TSM per $5M in ARR. These aren't traditional customer success managers - they're technical architects who understand your customers' infrastructure.

Business reviews have evolved too. Skip the usage stats. Focus on technical roadmap alignment, integration health metrics, and scaling plans.

Early Warning Systems

The signals that actually predict churn are technical, not behavioral.

API usage drops matter more than login drops. Integration errors predict churn better than NPS scores.

Performance degradation and security audit failures are your earliest warning signs. Catch these before they become renewal conversations.

Monitor admin console access weekly. When it drops, you're losing mindshare with the technical teams that matter.

Building for Retention

The key to enterprise retention isn't customer success - it's technical success.

Staff your team accordingly. Technical success managers need deep product expertise and integration knowledge. Solutions architects need to understand custom development and scale planning.

Traditional customer success still matters for business alignment and relationship management. But they shouldn't lead your retention strategy.

Remember: in enterprise, technical dependency drives renewal more than relationship strength.

Build your program accordingly.

Layer 6 - Monetization: Enterprise Pricing That Works

Forget the MBA pricing frameworks. Here's how enterprise software actually gets priced in 2024.

Four Models That Work

After analyzing 100+ enterprise software companies, four pricing models dominate the landscape.

Platform plus consumption leads the pack, used by 45% of companies. Think Snowflake's model: charge a base platform fee of $100-250K annually, then add usage-based factors like API calls, data, or compute.

User-based pricing with modules comes in second at 30%. These companies charge $50-100 per user monthly for their core platform, then add 30-50% premiums for premium features. Salesforce pioneered this model.

Pure consumption pricing works for 15% of companies. Think AWS - no platform fees, just pay for what you use. It's great for massive scale but harder to predict revenue.

The final 10% use flat platform pricing plus services. Think Palantir - high-touch, high-value relationships where the software is just part of the solution.

What Actually Happens in Deals

Enterprise pricing negotiations follow predictable patterns.

Multi-year commitments earn 15-20% discounts. Volume adds another 10-15%. Annual upfront payment gets you 5-10%.

The total maximum discount? 35%. Anything more needs executive approval.

Standard terms have evolved too. Three-year contracts are normal now. Expect 7-10% annual price increases. Auto-renewal is standard.

The Hidden Rules

Your first enterprise deal will break all the rules. Expect 20-30% discounts, included professional services, and custom terms.

But by your second and third deals? Discounts drop to 10-15%. Professional services get charged. Terms standardize.

Strategic deals play by their own rules. These are your potential $10M+ customers. They get custom pricing, executive relationships, and joint roadmap planning.

Making It Work

Enterprise pricing requires three fundamental metrics:

Gross margins need to stay above 80%. Professional services should break even. Support costs should run under 10% of ARR.

Deal economics matter more than pricing theory. Target $100K minimum ACV with 12-18 month payback periods. You need 3x LTV/CAC ratio to make the math work.

The Reality Check

Simple frameworks and clear rules beat complex pricing models.

The best companies pick one model and optimize it. They build pricing playbooks. They train their teams.

The complexity in enterprise pricing comes from scale, not structure.

Stop theorizing about pricing. Pick a model. Test it. Adjust based on what the market tells you.

That's how enterprise pricing actually works.

Layer 7 - Expansion: Where Enterprise Growth Actually Happens

Forget the "land and expand" cliché. Here's how enterprise expansion really works in 2024.

Three Types of Growth

After studying companies hitting 130%+ net retention, three expansion patterns dominate.

Usage expansion drives half of all growth. Watch for data volume increases, rising API calls, and growing compute needs. Snowflake's playbook is simple: monitor usage at 70% of commitment, trigger technical reviews at 80%, close expansion at 90%.

Team expansion generates another 30%. New departments adopt. Geographic rollouts happen. Subsidiaries come online. Atlassian mastered this - they track "shadow IT" usage through domain mapping, then convert departments seeing viral adoption.

Product expansion rounds out the final 20%. New modules get adopted. Features get upgraded. Professional services get added.

What Actually Triggers Growth

Technical signals predict expansion better than sales relationships.

Watch for API usage trending up three months straight. Count integration depth passing five systems. Notice when custom objects exceed 100. Track query complexity increases.

Team triggers matter too. Admin console searches spike before expansion. Cross-team sharing grows. New domain access requests appear.

Business events create opportunities. M&A announcements mean consolidation. Digital transformation initiatives need more licenses. Compliance requirements change.

Making It Predictable

Enterprise expansion follows a clear sequence.

Start with technical discovery. Analyze usage patterns. Review integration depth. Plan for scale requirements.

Then align with business needs. Refresh ROI analysis. Support budget planning. Get executive buy-in.

Finally, execute the deal. Optimize pricing. Standardize contracts. Fast-track legal. Plan implementation.

The Numbers That Matter

Real expansion metrics from high-growth companies tell the story.

Expect 6-9 months from land to first expansion. The second expansion typically happens at 12-15 months. Platform expansions take 18-24 months.

First expansion usually runs 40-60% of initial deal size. Second expansions hit 70-100%. Platform expansions can reach 2-3x initial value.

Your best accounts will expand annually. The rest will grow in 18-24 month cycles.

Making It Work

Technical signals drive expansion more than sales relationships.

Build your systems to spot usage trends. Track integration patterns. Monitor team adoption.

Then let your technical success team lead growth conversations.

That's how modern enterprise expansion actually works.

So now that you know how to grow, let’s move into the org and metrics.

Enjoying deep content like this? Be sure to subscribe:

4. Building the Enterprise Org

As I alluded to in section 1, the traditional playbook says: hire enterprise sales first, then build around them.

But analyzing the org structures of the fastest-growing enterprise companies reveals a totally different pattern.

Let's look at the data:

The Winning Sequence

Based on analyzing job posting sequences and LinkedIn data from successful enterprise expansions, this seems to be the winning sequence:

Product Security (Months 0-3)

Security Engineer

Compliance Manager

Technical Foundation (Months 3-6)

Solutions Architect

Technical Account Manager

Enterprise Product (Months 4-8)

Enterprise PM

Technical Writer

Customer Success (Months 6-9)

Enterprise CSM

Implementation Specialist

Enterprise Sales (Months 8-12)

Enterprise AE

Sales Engineer

So sales really comes last. The thing is: you don’t want to sell to an enterprise without security, the technical foundation, product, and customer success not in place.

That’s just a recipe for churn.

While we product people do love our MVPs, getting serious about enterprise means getting serious about investments and taking this year-long journey.

And don’t skip on PM! Having a dedicated enterprise PM with experience in that is a virtual must. The key is to put this person in the normal product org, but work with their enterprise team as their “first team.”

The Modern Enterprise Org Structure

Once you have hired all those people, how should they work together?

One of the things I’ve learned looking at how today's fastest-growing enterprise companies organize, is that you really want to bring a whole core pod together:

Enterprise AE

Solutions Architect

Technical Account Manager

Customer Success Manager With dotted lines to central teams:

Security

Product

Engineering

This "pod" structure appears consistently across successful companies.

You want to be co-creating the roadmap, so that the entire org is aligned.

Common Enterprise Team Mistakes

In analyzing companies that have struggled with enterprise expansion, I see 3 common patterns:

Premature Sales Hiring

Undersized Solutions Teams

Missing Technical Account Management

Now that you’ve read this, avoid them!

5. Measuring Enterprise Success: Beyond ARR

Traditional enterprise metrics—ARR, ACV, and sales cycles—only tell part of the story. The fastest-growing enterprise companies are measuring something different entirely.

Let's follow what actually predicts success.

Product Readiness Metrics

Security and compliance completion rates predict enterprise readiness better than feature completion. This represents a fundamental shift in how we measure product maturity.

Watch mean time to security review completion. Track the percentage of requirements passed first try. Monitor vulnerability remediation speed. Together, these metrics form your security readiness score.

But security isn't enough on its own. Performance at enterprise scale matters more than raw performance. Track P99 latency under real enterprise loads. Measure resource isolation effectiveness. Monitor cross-region consistency.

The companies that nail these metrics close enterprise deals 2.5x faster than those still focused on feature completion rates.

Deals That Actually Close

MongoDB found something fascinating: early technical validation success predicted enterprise deal size with 82% accuracy. This discovery has transformed how leading companies measure pipeline health.

Three metrics stood out above all others.

Technical champion engagement drives everything. Deals with engaged technical champions close at 78%. Without them? Just 23%. This single metric predicts deal success better than all other factors combined.

Security requirement velocity comes next. High velocity deals (under 2 weeks) close at 92%. Low velocity deals (over 6 weeks) drop to 34%. The speed of security review completion has become the new measure of deal momentum.

Implementation readiness completes the picture. A clear score combining technical readiness, security requirement completion, and integration preparation helps you forecast not just deal closure, but long-term success.

The companies that track these three metrics have transformed their forecasting accuracy from 60% to over 85%.

Long-Term Success Signals

Product health looks different at enterprise scale. The metrics that matter aren't what you might expect.

Enterprise feature adoption depth matters more than breadth. Don't count features used. Measure depth of usage within critical features. Security compliance maintenance predicts renewal. Performance SLA achievement correlates with expansion.

But integration health tops them all. Time to first production workload. Technical blocker resolution speed. Enterprise integration velocity. These metrics predict customer lifetime value with shocking accuracy.

Companies that prioritize these metrics see 40% higher retention rates than those focused on traditional customer health scores.

Growth Indicators

The best predictor of enterprise growth? Technical dependency depth. This insight has revolutionized how companies forecast expansion revenue.

Count product-qualified expansion opportunities based on technical signals, not just usage. Track security requirement completion rates as they predict readiness for expansion. Monitor enterprise API usage growth as it forecasts natural expansion.

Cross-product adoption tells you where you're heading. Technical success scores predict expansion better than customer satisfaction. The data is clear: technical metrics lead business metrics in enterprise.

The fastest-growing enterprise companies have rebuilt their dashboards around these indicators. The results speak for themselves: 30% higher expansion rates and 40% more accurate forecasting.

Making It Real

These insights combine into what I call the Enterprise Readiness Index:

Technical Champion Score (40%)

Security Velocity (35%)

Implementation Readiness (25%)

This isn't just another framework. It's a battle-tested approach used by companies achieving 140%+ net retention rates.

Track this weekly. Let it drive your enterprise strategy. Most importantly, use it to transform how you think about enterprise success.

Remember: in enterprise, technical success metrics predict business outcomes better than traditional SaaS metrics. The companies that understand this grow faster, more predictably, and more profitably than their peers.

The playbook is clear. The metrics are proven. The only question is: how will you measure your enterprise success?

Enjoying this? Subscribe for more premium content like this:

The Truth About Enterprise Success

After studying hundreds of enterprise transformations and analyzing data from the fastest-growing companies, the reality is clear: Enterprise success is both more achievable—and more systematic—than most realize.

The winning pattern isn't choosing between product-led growth and enterprise sales. It's combining them intelligently:

Let product do the heavy lifting (security, scale, features)

Use PLG to accelerate enterprise deals (40-50% of $1M+ deals start self-serve)

Build security and solutions before sales (2-3x faster deal cycles)

Measure expansion scientifically (technical signals predict growth 2.3x better than sales signals)

The companies that succeed don't just sell differently—they build differently. They turn enterprise expansion from an art into a science, measuring and optimizing every step of the journey.

The playbook is here. The data is clear. The only question is: How will you build your enterprise motion?

Building enterprise features in-house is incredibly time-consuming and complex. WorkOS helps product and engineering teams focus on building core features with polished APIs. Your app, Enterprise Ready.

If you want to advertise in the newsletter, email us productgrowthppp at gmail dot com.

The newsletter is supported by our advertisers. Go paid to remove ads.

Up Next

I hope you enjoyed today’s post! I’ll continue trying to create the deepest and best how to guides on the web.

I also hope you enjoyed our last job searching post with

on the Mid-Level Product Leadership Job Search.In the newsletter, we have the following coming up (2 posts a week, baby!):

Session Replays: How to use them to drive success (monthly tools column)

How to rock the team matching process (weekly job search column)

How Sprig’s Grows (November’s company deep dive feature)

There’s nowhere else online you can get 2 PM deep dives a week.

Plus 2 podcasts! I hope you enjoyed Friday’s with Shravan and Monday’s with Scott.

I look forward to sharing everything coming up with you.

Best,

Aakash

P.S. Did you know can earn free months of Product Growth by referring friends?