The European Tech Market Map: Biggest Players, Startups, and Job Opportunities

There's surprisingly little good information out there. Here's a data-based breakdown of the biggest companies, hottest startups, PM job opportunities, and future for the market.

Europe’s tech market is unlike other global markets.

But it’s probably the highlight of Europe in the past 20 years. While GDP per capita has badly lagged the US, tech has exploded in Europe:

Number of $B+ companies is up 4.9x in 10 years

Total capital invested is up 20x in 20 years (from ~$2B to ~$40B)

$925B in total exits in the past decade, up 2.36x vs. the prior decade

Yet, Europe doesn’t grab headlines like Silicon Valley. And, as a result, when I talk to job seekers in Europe, they have no idea about this—or the top companies to apply to.

Why don’t we know more about Europe’s Tech Markets?!?

There’s No Good Market Reports

Europe’s tech market is strong but quiet. Analysis of the European tech market is surprisingly nonexistent.

So - I wanted to fill this gap with a deep dive into Europe's tech landscape in 2025, with a research report that is more than 7+ months in the making.

Introducing Ahmed Wafaey

I’m collaborating with Senior Director of Product in Berlin, Ahmed Wafaey.

He is the author and leader of Product Voyagers, a content-led community for PMs. He is also putting on the ProductLab conference in Berlin later this year, and launching Product Voyagers Conference in the MENA region (UAE and KSA).

Today's Post

We’ve come together to build the web's most comprehensive guide to European Tech:

The Biggest 50 European Tech Companies

Breakdown of Europe’s Regional Hubs

Top 25 European Startups to Watch

🔒 Key Industry Sector Deep Dives

🔒 Most Interesting Companies

🔒 PM Hiring and Forecast

🔒 Future Forecast

I’ve investigated the product analytics, sales tech, AI Job search, and Indian-Origin tech company markets. Today, we analyze Europe’s tech market.

1. The Biggest 50 European Tech Companies

After analyzing the data, here are Europe's leading tech companies by revenue and market cap:

Here are the key stats:

64% Public Companies, 36% Private

20% Enterprise Software, 18% Consumer Services, 15% FinTech

26% Germany-based, 16% UK-based, 16% France-based

44% B2B, 28% B2C, 12% Hybrid

Let’s crack each of these open a layer deeper.

2. Breakdown of Europe’s Regional Hubs

Unlike other global tech hubs concentrated in single cities, European tech has 6 major tech hubs:

Each region has its own strengths

1. The Nordic Region

Back in the 1990s, Nokia and Ericsson laid the mobile foundations that still echo in today’s unicorns.

Now, Sweden, Denmark, Finland, and Norway generate €50B+ in tech revenue, with Stockholm’s 46,000 developers fueling a startup boom.

The region’s strength lies in its “lagom” ethos—just enough, no excess—breeding flat hierarchies and trust-filled teams.

Spotify (€12B revenue) doesn’t just stream music—it curates your life’s soundtrack with eerie precision.

Klarna turns checkouts into a single tap, as smooth as a Nordic sunrise.

Startups like Northvolt, forging green batteries, and Finland’s Supercell—behind hit game Clash of Clans—prove small markets can conquer the world.

In 2024, Nordic tech raised €5.1B in venture capital, with 70% of startups eyeing global markets from launch.

2. Germany

Since the 1970s, when SAP’s founders left IBM to tackle enterprise software, Germany has been quietly building systems that run the world.

Today, it’s Europe’s largest tech hub, with €150B+ in combined revenue from its top tech firms and 178,000 developers in Berlin alone.

Companies like SAP (€31.2B revenue) power 87% of global commerce with ERP systems, while Siemens (€72B revenue) digitizes factories. But it’s not just giants.

The ecosystem thrives on “Mittelstand” values—medium-sized, often family-owned firms that prioritize longevity over hype.

Startups like Celonis, a process-mining unicorn valued at €11B, and FlixBus, revolutionizing intercity travel, show Germany’s knack for scaling niche solutions globally.

In 2024, German tech firms raised €7.4B in venture capital, second only to the UK, with 60% of funds flowing to enterprise and industrial tech.

Germany’s magic lies in its refusal to chase trends. While Silicon Valley pivots to the next shiny thing, German tech builds for decades, not quarters.

3. France

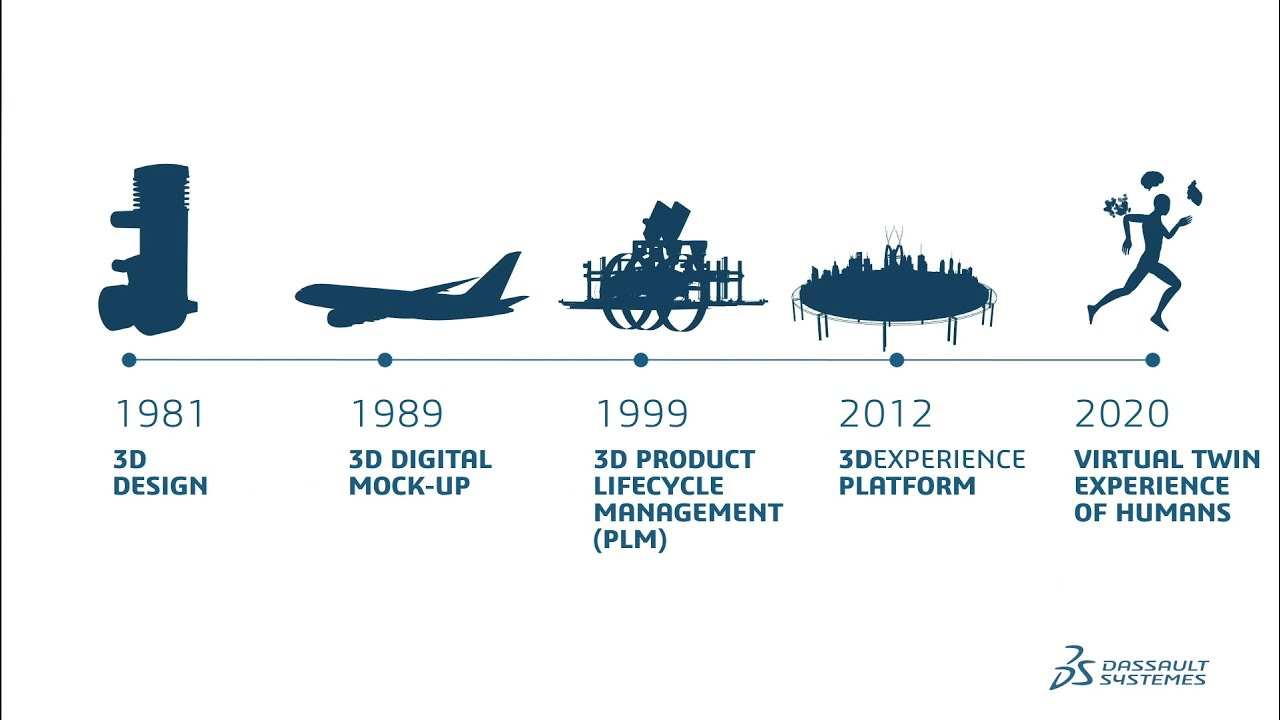

The 1980s saw Dassault Systèmes pioneer 3D design, setting the stage for a deep-tech revolution.

Paris now hums with 166,000 developers, driving €40B+ in tech revenue across AI and beyond.

Mistral AI, backed by €600M, crafts lean models that thumb their nose at Silicon Valley’s giants.

BlaBlaCar’s €1.5B ridesharing empire and Doctolib’s healthcare platform show consumer tech with French flair.

In 2024, €6.8B in venture capital flowed to French tech, with 40% powering AI and healthtech.

4. The Netherlands

The Netherlands’ tech scene goes in many directions, like its canal system.

Since the 1990s, when Booking.com reimagined travel, the Dutch have crafted tech that’s foundational,.

Today, it’s a €25B+ tech hub, with 123,000 developers in Amsterdam.

ASML (€20B revenue) monopolizes the machines etching chips for your phone and AI, a €200B giant without which tech would stall.

Startups like Adyen (€1.5B revenue), powering payments for Netflix, and Bynder, organizing global brand content, prove the Dutch range.

In 2024, Dutch tech raised €2.3B in venture capital, with 55% flowing to deep tech, from semiconductors to green energy.

5. The UK

The 2008 financial crisis birthed a fintech wave, amplified by a regulatory sandbox that let startups play with fire.

With 359,000 developers, the UK leads Europe, raising $10.8B in 2024 venture capital.

Revolut’s 30 million users wield banking like a superpower, sidestepping fees with a tap. Ocado Group ($3B revenue) runs grocery warehouses that hum like sci-fi sets.

The UK’s global DNA—talent from 100+ nationalities—fuels startups like Monzo and Exscientia, redefining banking and AI-driven drugs.

In 2024, 65% of VC targeted fintech, with healthtech soaring 30% year-over-year.

London blends old-world clout with new-world hustle.

6. Eastern Europe

Since the 2000s, when outsourcing hubs turned into startup hotbeds, Romania, Estonia, Poland, and others have redefined global tech.

Today, Eastern Europe is a $15B+ tech hub, with 120,000 developers and $3.7B in 2024 venture capital across its vibrant cities.

UiPath ($1B revenue) frees workers from spreadsheet hell with automation, while Bolt ($1.5B revenue) outpaces Uber from tiny Estonia.

Startups like Allegro, Poland’s e-commerce giant, and CD Projekt Red, crafting gaming epics, show the region’s creative and commercial range.

In 2024, Eastern Europe minted 12 unicorns, with Estonia’s e-residency program drawing global founders to Tallinn’s startup scene.

3. Exciting, Fast Growing Companies

Let’s break down what you need to know.

Keep reading with a 7-day free trial

Subscribe to Product Growth to keep reading this post and get 7 days of free access to the full post archives.