The Product Analytics Market: Overview and Deep Dive

It's a key tool for any PM in 2024: Product Analytics. Here is the web's first deep dive of the space, including interviews with product leaders at the 4 biggest players, market map, & magic quadrants

Where is the content?

If you search the term ‘product analytics market map’ on Google, there are literally no results. This blew my mind.

The closest is a PLG market map from 2022 with zero categorization of analytics players. There’s no Gartner report, nothing. This is a huge miss by all the major industry research players.

And if you’ve been a long-time reader of the newsletter, you know: I just have to write about these types of topics.

So, I’ve spent the past 3 months talking to the VPs of Product at the largest product analytics companies, researching the data, and talking to customers of the tools to produce the web’s deepest report yet on the product analytics market.

Today’s Deep Dive

Words: 11,291 | Est. Reading Time: 51 mins

I’ve interviewed the VPs/Sr Directors of Product at the 4 top players and talked to 25 buyers of product analytics solutions over the past 3 months. Here’s what I learned:

Why Product Analytics Tools Matter

The Complete Product Analytics Stack

The Product Analytics Magic Quadrants

Deep Dives Into 5 Players - Including Interviews with their Product Leaders

Amplitude

Mixpanel

Pendo

Heap

June

The Keys to a Successful Product Analytics Tool Deployment

1. Why Product Analytics Matters

There’s hardly any software that’s going to contribute more to your product growth than a good product analytics tool.

I didn’t believe this before I used them. I grew up in the world where hardcore PMs queried the SQL database and used a tool like Snowflake for direct access to the warehouse.

But I’ve changed my tune since using these tools at companies like Affirm and Apollo.io.

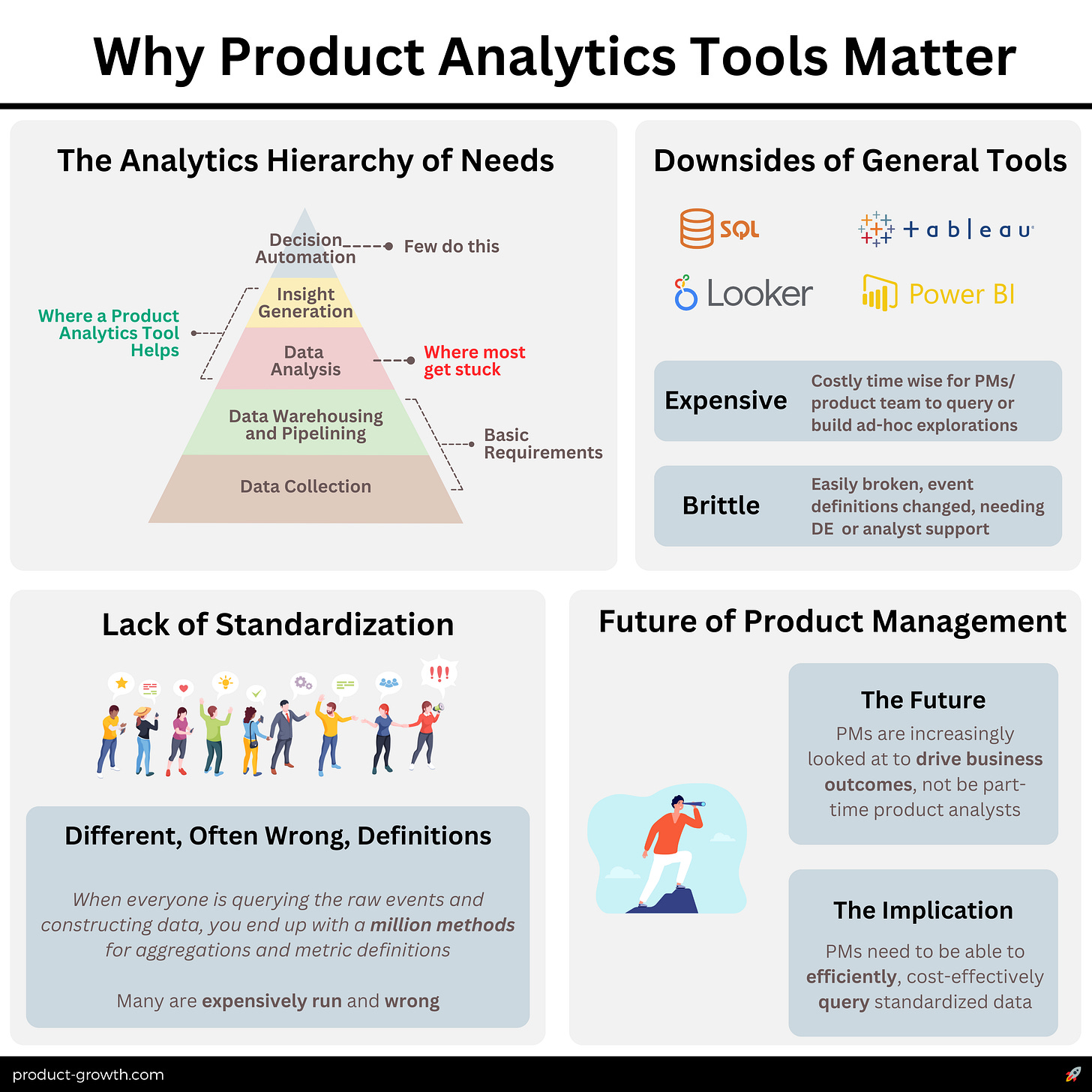

Reason 1: The Analytics Hierarchy of Needs

You've seen Maslow's Hierarchy of Needs. I think of an Analytics Hierarchy of Needs.

At the base of the pyramid, we have Data Collection. This is the foundation upon which all analytics is built. We need to be able to collect data from various sources, and pipe it into a usable format.

Next up, we have Data Analysis. This is where we take the data and turn it into something human-readable. We need to be able to see trends, patterns, and correlations. But here's the thing: most companies stop here. They think that data analysis is the end goal. But it's not.

The real magic happens at the next level: Insight Generation. This is where we take the data and turn it into actionable insights. We need to be able to say, "Based on the data, we should do X, Y, and Z." We need to be able to identify opportunities, and prioritize them.

And finally, at the top of the pyramid, we have Decision Automation. This is where we take the insights and turn them into automated decisions. We need to be able to say, "Based on the data, we should automatically do X, Y, and Z." Some people are using bandit algorithms to make decisions like this, but the overall group doing so is very small.

Most companies are stuck in the Data Analysis phase. Analysts are spending all their time building custom dashboards, PMs are querying SQL, and neither group is spending enough time generating insights. As a result, they're not using data to drive decision-making.

This is where a product analytics tool comes in, and why they can be so powerful.

Reason 2: The Dark Side of General Analytics Tools

Unfortunately, too many teams are struck by the siren song of ad-hoc querying and a general purpose analytics tool like Looker or Tableau.

It's tempting to think, “we can build something bespoke, something tailored to our exact needs.” But here's the thing: custom solutions are a recipe for disaster.

Two reasons:

They’re expensive, in time

They’re brittle, and easily broken

I've seen companies spend millions of dollars building custom Tableau and Looker dashboards, only to realize they're not scalable. They're not flexible. They're not maintainable.

And then there's the opportunity cost. Every dollar spent on a custom dashboard is a dollar not spent on something else. It's a dollar not spent on product development, or customer acquisition, or retention.

So companies often find savings just by switching from a general analytics tool to a dedicated tool for product analytics.

Reason 3: Lack of Standardization

We're living in a world where product analytics is a Wild West of metrics and tools.

Every company is reinventing the wheel, creating their own bespoke analytics solutions. This leads to a lack of standardization, making it impossible to compare apples to apples.

I've seen companies waste months building custom dashboards, only to realize they're measuring the wrong things.

Take, for instance, the humble "Active User" metric. Sounds simple, right?

I've seen companies define it as anything from "logged in once this month" to "completed three actions in the last week." This inconsistency makes it impossible to benchmark against industry averages or even compare performance across features.

As a product manager, you need to be able to speak a common language with my stakeholders. You need to be able to say, "Our onboarding funnel is 20% better than the industry average," and have that mean something.

Without standardization, we're stuck in a world of anecdotal evidence and gut feelings.

But what does this framework look like?

It starts with a set of agreed-upon metrics and definitions.

We need to define what an "Active User" is, and what a "Healthy Customer" looks like. We need to establish benchmarks for key metrics like retention and engagement.

A Product Analytics Tool can be the physical manifestation of software to do that. Unlike a Looker or a SQL, it’s not as free reign for anyone to have their own definition of each metric.

Reason 4: The Future of Product Management

Product management is changing. We're no longer just responsible for defining product requirements; we're responsible for driving business outcomes.

We need to be able to speak the language of the business. We need to be able to say, "This feature will drive X% increase in revenue, and Y% increase in customer satisfaction."

And that's where product analytics comes in

By providing a standardized framework for metrics and tools, product analytics can help us drive business outcomes. It can help us make data-driven decisions, and prioritize our product roadmap.

The future of product management is all about using data to drive decision-making. It's about using analytics to inform our product strategy.

And that's why the lack of a product analytics market map is such a big problem. We need to be able to navigate the complex landscape of analytics tools, and find the solutions that work best for our business.

We need to be able to make sense of the chaos, and drive real business outcomes.

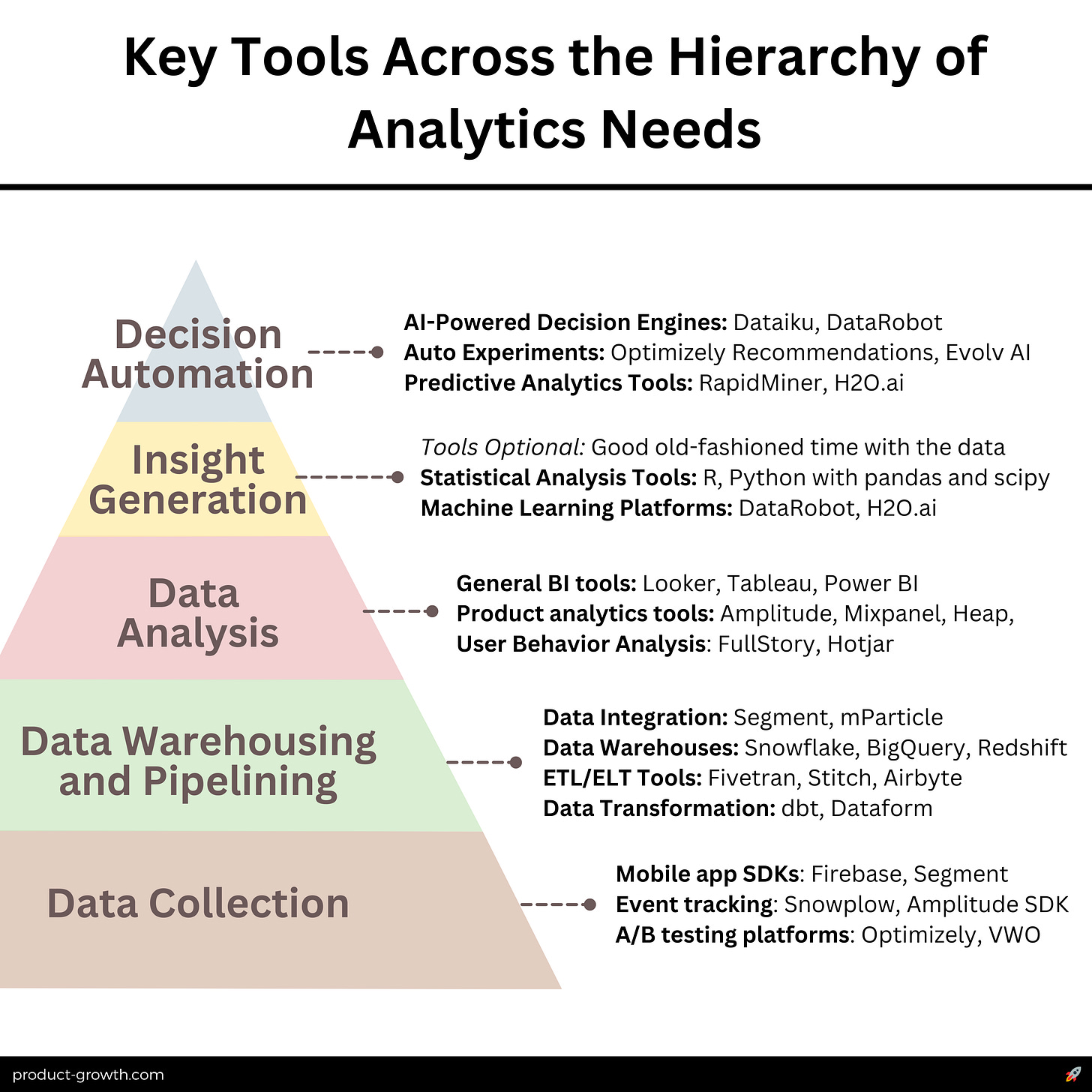

2. The complete product analytics stack

But, before we get there, we need to cover one more thing. What is Product Analytics not?

Another way to pose the question I want to answer for you is: What else goes into in the world of product management software to accomplish the Analytics Hierarchy of Needs?

Layer 1 - Data collection

This category is about capturing user interactions, events, and key information across all product touchpoints.

There are three essential sub-areas: mobile app SDKs, event tracking, and A/B testing platforms. These categories cover the main ways users interact with digital products: through mobile apps, on websites, and across various features and experiments.

Mobile app SDKs

Mobile app SDKs integrate analytics directly into mobile applications, providing insights into how users interact with apps on their devices.

Firebase: Google's mobile platform offering real-time analytics alongside other app services

Segment: A flexible SDK that collects and routes mobile data to various analytics tools

Event tracking

Event tracking tools allow for granular insights into specific user actions and interactions within applications or websites.

Snowplow: An open-source, customizable platform for handling large-scale, complex event tracking

Amplitude SDK: Focused on product analytics, helping teams understand user behavior and feature adoption

A/B testing platforms

A/B testing platforms allow companies to compare different versions of their products, features, or content to determine which performs better.

Optimizely: A full-stack experimentation platform for web, mobile, and server-side testing

VWO: Specializes in website testing with a user-friendly interface and visual editing capabilities

Layer 2 - Data Warehousing and Pipelining

This layer focuses on storing, moving, and preparing data for analysis. It's critical because it ensures that data from various sources is consolidated, transformed, and made accessible for insight generation.

I think of it in four main areas: data integration, data warehouses, ETL/ELT tools, and data transformation.

Data Integration

These platforms collect and route data from various sources to multiple destinations, acting as the connective tissue in the data stack.

Segment: Offers a central hub for collecting and distributing customer data

mParticle: Specializes in mobile and web data integration, with a focus on customer data platforms

Data Warehouses

Cloud-based solutions for storing and managing large volumes of structured and semi-structured data, serving as the central repository for an organization's analytical data.

Snowflake: Known for its scalability and separation of storage and compute

BigQuery: Google's serverless data warehouse, integrated with Google Cloud Platform

Redshift: Amazon's data warehouse solution, part of the AWS ecosystem.

ETL Tools

These tools help move and transform data between sources and destinations, ensuring data is in the right format and location for analysis.

Fivetran: Offers automated data integration with a wide range of pre-built connectors

Stitch: Focuses on ELT (Extract, Load, Transform) processes

Airbyte: An open-source ELT platform with a growing community and connector library

Data Transformation

These tools allow for complex data modeling and preparation within the data warehouse, turning raw data into analysis-ready datasets.

dbt (data build tool): SQL-first approach to data transformation

Dataform: Offers SQL-based transformation with tight integration with BigQuery

Layer 3 - Data Analysis

Data analysis involves exploring and visualizing data to derive insights. This stage is crucial because it transforms raw data into actionable information.

You can think of it in three main buckets: general BI tools, product analytics tools, and user behavior analysis tools. These categories address different analytical needs, from broad business insights to specific product and user-level understanding.

General BI tools

These tools offer powerful data visualization and exploration capabilities for a wide range of business data.

Looker: Known for its modeling language and embedded analytics capabilities

Tableau: Popular for its intuitive drag-and-drop interface and strong visualization features

Power BI: Microsoft's offering, well-integrated with other Microsoft products

Product analytics tools

These platforms provide specific insights into product usage and user behavior, crucial for product-led growth strategies.

Amplitude: Offers advanced user behavior analysis and cohort comparison

Mixpanel: Known for its event-based analytics and user flow visualization

Heap: Automatically captures all user interactions without requiring manual event tracking

User Behavior Analysis

These tools offer detailed analysis of individual user interactions with websites or applications, providing micro-level insights into user experience.

FullStory: Provides session replay and heatmaps along with analytics

Hotjar: Offers heatmaps, session recordings, and user feedback tools

Layer 4 - Insight Generation

Insight generation focuses on deriving meaningful conclusions from analyzed data. It’s about interpreting the analysis.

This layer is critical because it bridges the gap between raw data and business decisions. Tools are not necessary for this area. A lot of it is old-fashioned time with the data and meetings.

But tools can help. The two main tools of the trade are statistical analysis tools and machine learning platforms.

Statistical Analysis Tools

These tools enable advanced statistical analysis and data manipulation, crucial for in-depth data exploration and hypothesis testing.

R: Open-source language with a vast ecosystem of statistical packages

Python: Versatile language with powerful libraries like pandas and scipy for data analysis

Machine Learning Platforms

These platforms facilitate the creation and deployment of machine learning models, enabling predictive and prescriptive analytics.

DataRobot: Automates many aspects of the machine learning workflow

H2O.ai: Offers both open-source and enterprise solutions for machine learning

Layer 5 - Decision Automation

Decision automation represents the pinnacle of data-driven operations, where insights are directly translated into actions. This layer is important because it closes the loop between data analysis and business processes, enabling real-time, data-driven decision making.

It’s split into three key areas: AI-powered decision engines, auto experiments, and predictive analytics tools.

AI-Powered Decision Engines

These platforms build and deploy AI models for automated decision-making across various business functions.

Dataiku: Provides end-to-end machine learning and analytics platform

DataRobot: Offers automated machine learning capabilities for various use cases

Auto Experiments

These tools use machine learning to automatically optimize and personalize user experiences, continuously improving based on real-time data.

Optimizely Recommendations: Automates content and product recommendations

Evolv AI: Focuses on autonomous optimization for digital experiences

Predictive Analytics Tools

These platforms help forecast future trends and outcomes based on historical data, enabling proactive decision making.

RapidMiner: Provides a comprehensive suite for data science and machine learning

H2O.ai: Offers tools for creating and deploying predictive models at scale

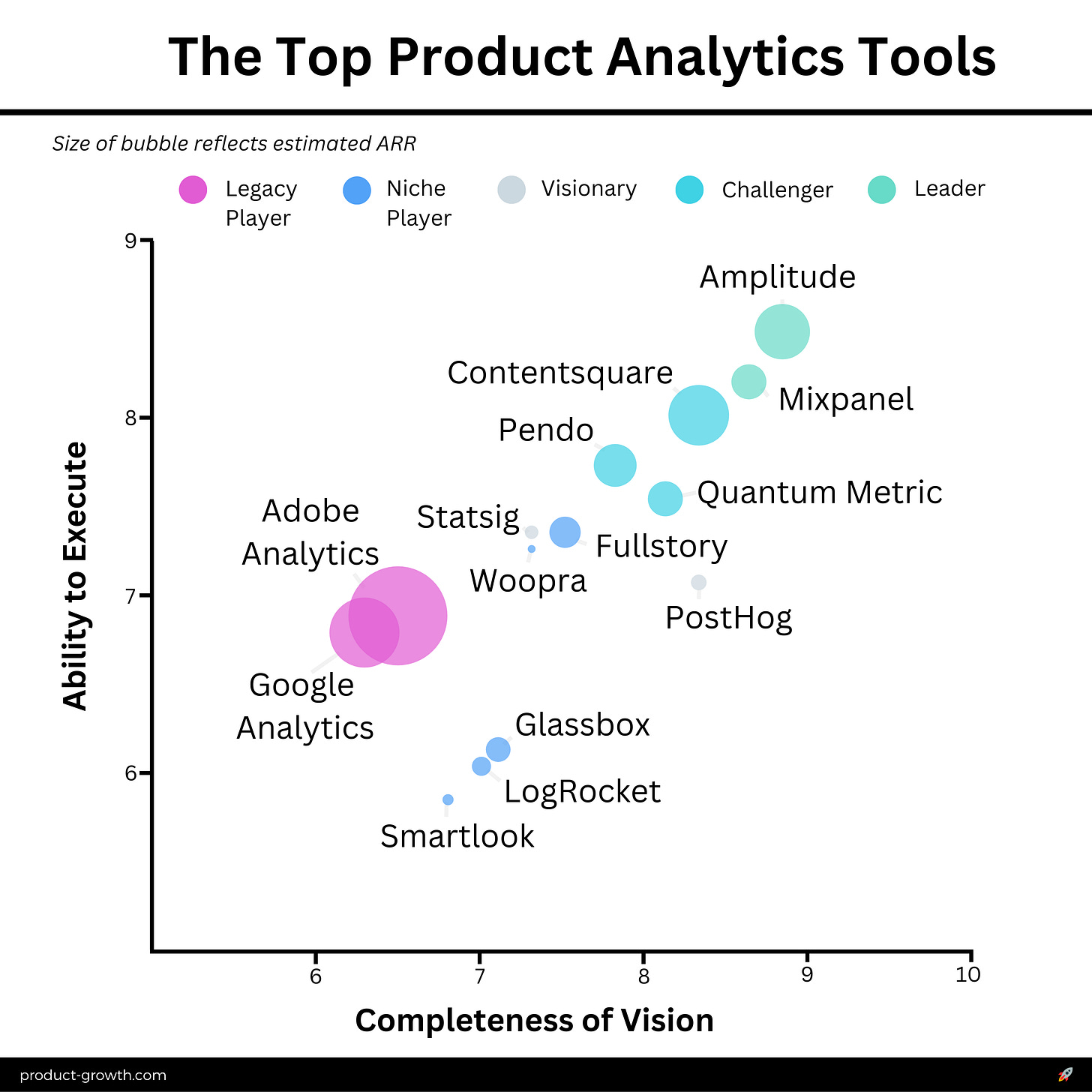

3. The Product Analytics Magic Quadrants

Now let’s get to the meat of it all: the Product Analytics Market Analysis.

Given Gartner has dropped the ball on this sector, I started with going deep Quadrant Style on the main players:

Let’s talk about each one. (If you want to jump to the complete market map, scroll to the end of this section.)

Leaders

Amplitude | Completeness of Vision: 8.5, Ability to Execute: 9.0, Est. ARR: $250M

Amplitude stands out as the leader in the product analytics market. 25 of 25 buyers we talked to for this piece knew about the company, and it was consistently recognized for its advanced capabilities in behavioral analytics and user segmentation.

It earned the highest Completeness of Vision score (8.5) because of its:

Focus on actionable insights: Amplitude is the leader in helping product teams translate complex data into actionable insights, and that remains its vision. It’s not trying to be everything for product teams, unlike other players.

Innovative features that matter: Amplitude's team is continuously introducing cutting-edge features, such as machine learning-powered predictive analytics and advanced cohort analysis. These keep it at the forefront of the industry.

Integrations leader: The platform's ability to ingest and analyze data from any warehouse, CDP, or other via its own SDK leads to a holistic view of user behavior across app, web, and more.

Amplitude's leading Ability to Execute score (9.0) is due to:

Market dominance: In conversations with over 25 buyers of product analytics tools, Amplitude was unanimously viewed as the best, most full-featured tool.

Reduced time to insight: Buyers consistently reported that Amplitude significantly reduces time to insight for product managers, a critical factor in fast-paced development environments.

Robust support and education: Amplitude's comprehensive support structure and educational resources enable clients to maximize the platform's potential. As a public company, it is putting its weight behind ARR.

Scalability: The platform is able to handle large volumes of data while maintaining super-fast performance for PMs.

Like everyone, Amplitude does have some challenges. Two came up most in customer conversations:

Price point: The platform's premium pricing can be a barrier for smaller companies or startups with limited budgets.

Learning curve: While powerful, mastering all of Amplitude's features requires significant time investment, which can impact initial adoption rates.

Amplitude's ARR of ~$250M last 12M reflects its strong market position and ability to attract and retain high-value enterprise clients. This financial performance underscores the platform's ability to deliver value in a competitive market.

A VP of Product at a Fortune 500 e-commerce company shared:

Amplitude has been transformative for our product team. Its ability to quickly surface user behavior patterns has cut our PM’s analysis time in half, and they’re doing more analysis.

The learning curve was steep, but the payoff in terms of product improvements and user satisfaction has been immense.

Mixpanel | Completeness of Vision: 8.3, Ability to Execute: 8.7, Est. ARR: $100M

Mixpanel is a strong contender in the product analytics space, known for its powerful event-based tracking and user flow analysis capabilities. In our conversations with buyers, it was frequently mentioned as a top choice, especially for companies prioritizing real-time insights and detailed user journey analysis.

Mixpanel earned a high score in Completeness of Vision (8.3) due to:

Advanced event tracking: Mixpanel's sophisticated event-based analytics allow for granular tracking of user interactions, providing deeper insights into user behavior.

Real-time analytics: The platform's ability to provide instant insights enables quick decision-making and rapid iteration for product teams.

Two-way integration model: Mixpanel has a holistic focus on warehouse integration to do analysis across product and business data and keep it all in sync.

Mixpanel's strong Ability to Execute score (8.7) is attributed to:

Intuitive interface: Many buyers praised Mixpanel's user-friendly interface, which allows for complex queries to be performed with relative ease.

Quick time-to-value: Users reported being able to derive actionable insights quickly after implementation, a crucial factor for fast-moving product teams.

Robust API and integrations: Mixpanel's extensive API and integration capabilities allow for seamless data flow between various tools in a company's tech stack.

Strong customer support: Buyers consistently mentioned Mixpanel's responsive and knowledgeable support team as a key factor in their success with the platform.

Mixpanel faces some challenges, as noted by users:

Integration complexity: While Mixpanel offers numerous integrations, some users report that setting up and maintaining complex data pipelines with multiple data sources can be challenging, especially for teams without dedicated data engineering resources.

Customization limitations: Some advanced users note that while Mixpanel offers a wide range of out-of-the-box features, there can be limitations when it comes to highly specialized or unique analytics needs that fall outside the platform's standard capabilities, potentially requiring workarounds or additional tools.

Mixpanel's estimated ARR of $100M indicates its solid position in the market, though it trails behind Amplitude. This reflects its strong adoption among mid-market and enterprise customers, but also suggests room for growth in capturing larger enterprise accounts.

A VP of Product at a fast-growing SaaS startup commented:

Mixpanel's real-time analytics have been a game-changer for us. We can now track the impact of new features instantly and make data-driven decisions on the fly.

The interface is intuitive enough that even our designers and engineers can dive in and extract meaningful insights

Challengers

Pendo | Completeness of Vision: 7.5, Ability to Execute: 8.2, Est. ARR: $300M

Pendo has carved out a unique position in the product analytics market by combining analytics with in-app messaging and user feedback tools. It was frequently cited by buyers as a valuable all-in-one platform.

Pendo's Completeness of Vision score (7.5) is based on:

Integrated approach: Pendo's vision of combining analytics with direct user engagement tools offers a holistic approach to product improvement.

Feature adoption tracking: The platform's ability to track and analyze feature usage provides crucial insights for product teams.

User feedback integration: Pendo's incorporation of NPS surveys and user feedback directly into the analytics platform allows for a more comprehensive understanding of user sentiment and behavior.

Pendo's solid Ability to Execute score (8.2) is attributed to:

User-friendly interface: Buyers consistently praise Pendo's intuitive interface, making it accessible to team members across various roles.

Effective onboarding tools: Pendo's in-app guidance features have been noted as particularly effective for improving user onboarding and feature adoption.

Strong integration capabilities: The platform's ability to integrate with various data sources and marketing tools enhances its utility across different departments.

Responsive support: Users frequently mention Pendo's customer support as a key factor in their success with the platform.

Challenges faced by Pendo include:

Analytics depth: Some users note that while Pendo's analytics are solid, they may not offer the same depth as some specialized analytics-only platforms.

Pricing for smaller companies: The platform's pricing can be a barrier for smaller businesses or those with limited budgets.

Pendo's estimated ARR of $150M reflects its strong position in the market, particularly among SaaS businesses focused on user retention and growth.

A VP of Product at a large apparel brand shared:

Pendo has been instrumental in improving our user onboarding and feature adoption rates. The combination of analytics and in-app guidance has allowed us to identify pain points and address them in real-time.

It's become an essential tool for our entire product team.

Contentsquare (including Heap and Hotjar) | Completeness of Vision: 8.0, Ability to Execute: 8.5, Est. ARR: $300M

Contentsquare, bolstered by its acquisitions of Heap and Hotjar, has emerged as a comprehensive digital experience analytics platform. Heap, in particular, was frequently mentioned by buyers.

Contentsquare's high Completeness of Vision score (8.0) is due to:

Comprehensive analytics suite: The combination of Contentsquare's digital experience analytics, Heap's automatic data capture, and Hotjar's qualitative tools provides a 360-degree view of user behavior.

AI-driven insights: Contentsquare's focus on leveraging AI for automated insights sets it apart in the market.

Cross-platform analysis: The platform's ability to analyze user behavior across web, mobile, and app interfaces provides a holistic view of the user journey.

Contentsquare's strong Ability to Execute score (8.5) is attributed to:

Powerful data capture: Heap's automatic event capture ensures no user interactions are missed, providing a comprehensive dataset for analysis.

Intuitive visualization: Hotjar's heatmaps and session recordings offer easy-to-understand visualizations of user behavior.

Robust integration capabilities: The platform's ability to integrate with various tools and data sources enhances its utility across different teams.

Strong customer success focus: Users frequently mention the platform's dedicated customer success teams as a key factor in achieving their goals.

Challenges for Contentsquare include:

Platform complexity: The breadth of features across the combined platforms can be overwhelming for some users, requiring a significant time investment to fully utilize. The tools are not properly integrated yet, as the Heap acquisition just closed this year.

Cost considerations: The comprehensive nature of the platform is reflected in its pricing, which can be a barrier for smaller organizations.

Contentsquare's estimated ARR of $300M demonstrates its strong market position and the value proposition of its comprehensive digital experience analytics suite.

A Senior Director of Product Analytics at a large e-commerce company commented:

Contentsquare has given us unprecedented insights into our customers' digital journeys. The combination of quantitative data from Heap and qualitative insights from Hotjar has been game-changing.

While it took some time to fully leverage all the features, the impact on our conversion rates and user experience has been substantial.

Quantum Metric | Completeness of Vision: 7.8, Ability to Execute: 8.0, Est. ARR: $100M

Quantum Metric has rapidly emerged as a significant player in the digital experience analytics market, focusing on real-time insights and continuous product design. It's frequently mentioned by buyers seeking to bridge the gap between technical performance and business outcomes.

Quantum Metric's strong Completeness of Vision score (7.8) is based on:

Continuous product design: Quantum Metric's vision of creating a continuous feedback loop for product improvement aligns well with modern agile development practices.

Real-time digital experience analysis: The platform's emphasis on providing instant insights into user behavior and technical performance sets it apart in the market.

Anomaly detection: Quantum Metric's use of machine learning for automatic anomaly detection in both user behavior and technical performance is forward-thinking.

Quantum Metric's solid Ability to Execute score (8.0) is attributed to:

Rapid time-to-value: Users consistently report quick implementation and fast insights, crucial for businesses seeking immediate impact.

Comprehensive session replay: The platform's detailed session replay capabilities, including technical performance data, provide a holistic view of the user experience.

Cross-functional utility: Quantum Metric's ability to serve both technical and business teams with relevant insights enhances its value across organizations.

Strong integration capabilities: The platform's ability to integrate with various tools in the tech stack increases its utility and adoption.

Challenges for Quantum Metric include:

Learning curve: While powerful, some users report a steeper learning curve to fully leverage all of Quantum Metric's capabilities.

Cost considerations: As a comprehensive platform, Quantum Metric's pricing can be a consideration for smaller organizations or those with budget constraints.

Quantum Metric's estimated ARR of $100M demonstrates its strong market position and rapid growth, particularly among enterprise clients seeking comprehensive digital experience analytics.

A Director of E-commerce at a large retail company shared:

Quantum Metric has been our secret weapon in the competitive e-commerce landscape. Its anomaly detection caught a major checkout bug during our Black Friday sale, potentially saving us millions in lost revenue. The real-time alerts have become indispensable for our operations team.

While it took our developers some time to fully leverage the technical insights, the combined business and technical view has significantly improved our cross-team collaboration.

Visionaries

PostHog | Completeness of Vision: 8.0, Ability to Execute: 7.5, Est. ARR: $20M

PostHog has disrupted the product analytics market with its open-source approach, appealing to businesses that prioritize data control and customization. It's frequently mentioned by technically savvy buyers who value flexibility and privacy in their analytics solution.

PostHog's high Completeness of Vision score (8.0) is based on:

Open-source model: PostHog's commitment to open-source provides unprecedented transparency and customization options.

Data privacy focus: The platform's emphasis on data control resonates strongly with privacy-conscious organizations.

Full-stack approach: PostHog's vision extends beyond analytics to include experimentation and feature flags, offering a comprehensive toolkit for product teams.

PostHog's Ability to Execute score (7.5) is attributed to:

Flexibility and customization: Users praise PostHog's adaptability to specific business needs and workflows.

Active community: PostHog's growing community contributes to rapid development and problem-solving.

Open-source transparency: PostHog's open-source nature provides transparency and allows users to understand the underlying technology.

Continuous innovation: Regular feature updates and improvements demonstrate PostHog's commitment to evolving with user needs.

Challenges faced by PostHog include:

Technical expertise required: The platform's flexibility comes with a steeper learning curve, especially for non-technical users.

Market presence: As a newer entrant, PostHog is still building its reputation in a competitive market.

PostHog's estimated ARR of $20M reflects its growing adoption, particularly among tech-savvy organizations and those prioritizing data privacy.

A CTO at a high-growth tech startup shared:

PostHog has been a breath of fresh air in analytics. I have used Amplitude and Heap in the past. I love PostHog.

The open-source nature gives us complete control over our data, and the ability to customize has been crucial for our unique needs. It requires more technical know-how, but for us, the flexibility is worth it.

Statsig | Completeness of Vision: 7.0, Ability to Execute: 7.8, Est. ARR: $15M

Statsig has carved out a niche in the product analytics market by focusing on feature experimentation and A/B testing integrated with analytics. It's often cited by buyers looking for a data-driven approach to feature management and product optimization.

Statsig's Completeness of Vision score (7.0) is based on:

Experimentation-first approach: Statsig's focus on making every product decision an experiment aligns with the growing trend of data-driven development.

Real-time impact measurement: The platform's ability to measure the immediate impact of changes is valuable for rapid iteration.

Developer-friendly tools: Statsig's emphasis on providing tools that integrate seamlessly into the development workflow resonates with technical teams.

However, the vision score is tempered by:

Narrow focus: While strong in experimentation, Statsig's vision is more limited compared to broader analytics platforms.

Limited predictive capabilities: The platform currently lacks advanced predictive analytics or AI-driven insights seen in some competitors.

Statsig's solid Ability to Execute score (7.8) is attributed to:

Rapid implementation: Users report quick setup and integration times, allowing for fast time-to-value.

Intuitive experimentation tools: The platform's A/B testing and feature flag capabilities are praised for their ease of use.

Strong statistical rigor: Statsig's emphasis on statistical significance in experiment results instills confidence in decision-making.

Responsive support: Users frequently mention Statsig's attentive customer support as a key factor in their success.

Challenges for Statsig include:

Breadth of features: Statsig may not offer the same breadth of analytics features as some competitors, limiting its use as a standalone analytics solution.

Market awareness: As a relatively new player, Statsig is still building brand recognition in the broader analytics market.

Statsig's estimated ARR of $15M indicates its growing adoption, particularly among organizations prioritizing a data-driven approach to product development, though it suggests room for growth compared to more established players.

Legacy Players

Google Analytics | Completeness of Vision: 6.0, Ability to Execute: 7.2, Est. ARR: $400M+

Google Analytics, despite its ubiquity, has faced significant challenges in recent years, particularly with the transition to Google Analytics 4 (GA4). While it remains a staple in many organizations, its lower scores reflect the struggles in adapting to changing market needs and user expectations.

Google Analytics' relatively low Completeness of Vision score (6.0) is due to:

Slow adaptation: The platform has been slow to adapt to evolving privacy regulations and changing user expectations around data collection.

Limited cross-platform capabilities: Despite improvements in GA4, the platform still lags behind in providing a truly unified view across web and app environments.

Lack of innovation: Recent updates have been more reactive than proactive, with Google playing catch-up rather than leading industry trends.

Google Analytics' Ability to Execute score (7.2) is attributed to:

Widespread adoption: Its massive user base and integration with other Google products ensure continued relevance.

Robust data collection: The platform's ability to capture a wide range of user interactions remains strong.

Improved machine learning integration: GA4's incorporation of machine learning for insights and predictions is a step forward.

Free tier availability: The free version continues to make analytics accessible to businesses of all sizes.

Challenges for Google Analytics include:

Complex transition to GA4: The shift from Universal Analytics to GA4 has been difficult for many users, with a steep learning curve and loss of familiar features.

Data privacy concerns: Increasing scrutiny over data collection practices has led some organizations to seek alternatives.

Limited customer support: Users often cite difficulties in obtaining direct support, especially for the free version.

Despite these challenges, Google Analytics' estimated ARR of $1B+ reflects its dominant market position and the revenue generated from its enterprise-level offerings and integrations with other Google products.

A Lead Product Manager at a mid-size SaaS company remarked:

Google Analytics has been our go-to for years, but the transition to GA4 has been painful. We're struggling to replicate our old reports and the new interface is not intuitive.

That said, it's still deeply integrated into our stack, and the price point (free) keeps us using it alongside more specialized tools.

Adobe Analytics | Completeness of Vision: 6.2, Ability to Execute: 7.3, Est. ARR: $800M

Adobe Analytics, part of the Adobe Experience Cloud, is a powerful enterprise-level solution that has struggled to keep pace with more agile, user-friendly competitors. Its scores reflect the challenges of balancing comprehensive features with usability and adaptation to market trends.

Adobe Analytics' Completeness of Vision score (6.2) is based on:

Comprehensive data integration: The platform's ability to integrate data across the Adobe ecosystem is strong but can be limiting for non-Adobe users.

Advanced segmentation capabilities: Adobe Analytics offers powerful segmentation tools, crucial for detailed analysis.

Predictive analytics: The incorporation of AI and machine learning for predictive insights is noteworthy.

However, the vision score is tempered by:

Slow innovation cycle: Adobe has been slower to introduce new features compared to more agile competitors.

Limited flexibility: The platform can be rigid, especially for organizations not fully invested in the Adobe ecosystem.

Adobe Analytics' Ability to Execute score (7.3) is attributed to:

Robust processing power: The platform excels at handling large volumes of data and complex analyses.

Strong enterprise support: Adobe's customer support and professional services are well-regarded in the enterprise space.

Deep integration with Adobe suite: For Adobe-centric organizations, the seamless integration is valuable.

Challenges for Adobe Analytics include:

Steep learning curve: Users consistently report difficulties in mastering the platform's extensive features.

High total cost of ownership: Beyond the high licensing costs, many organizations require dedicated resources or consultants to fully leverage the platform.

Inflexibility for non-Adobe ecosystems: Organizations not fully invested in Adobe products may find integration and customization challenging.

Adobe Analytics' estimated ARR of $800M reflects its strong position in the enterprise market and its ability to command premium pricing, despite the challenges noted.

A VP of Product at a large financial services firm commented:

Adobe Analytics is powerful, but it's like piloting a 747 - you need specialized training to use it effectively. We've invested heavily in the Adobe ecosystem, so the integrations are seamless for us.

However, we often struggle to find analysts who can fully leverage its capabilities, and the costs add up quickly when you factor in training and consultants.

Niche Players

Glassbox | Completeness of Vision: 6.8, Ability to Execute: 6.5, Est. ARR: $50M

Glassbox has carved out a niche in the digital experience analytics market with its focus on session replay and digital journey mapping. It's often mentioned by buyers looking for deep insights into user behavior and website performance issues.

Glassbox's Completeness of Vision score (6.8) is based on:

Comprehensive session replay: Glassbox's ability to capture and replay user sessions in high fidelity is a cornerstone of its offering.

Automatic insights: The platform's use of AI to automatically surface issues and anomalies in user behavior is forward-thinking.

Cross-platform tracking: Glassbox's vision of providing a unified view across web and mobile platforms aligns with the need for omnichannel insights.

However, the vision score is tempered by:

Limited scope: While strong in its core offerings, Glassbox's vision doesn't extend as broadly into areas like predictive analytics or advanced segmentation.

Focus on enterprise: The platform's vision seems primarily tailored to large enterprises, potentially limiting its appeal to a broader market.

Glassbox's Ability to Execute score (6.5) is attributed to:

Powerful replay capabilities: Users consistently praise the depth and accuracy of Glassbox's session replay feature.

Strong data security: The platform's emphasis on data privacy and security resonates well with security-conscious industries.

Effective anomaly detection: Glassbox's ability to automatically identify issues in user journeys is highly valued by users.

Challenges for Glassbox include:

Complex implementation: Some users report a steeper learning curve and longer implementation time compared to more plug-and-play solutions.

Resource intensive: The comprehensive nature of Glassbox's data capture can require significant server resources.

Pricing concerns: As a premium solution, Glassbox's pricing can be a barrier for smaller organizations.

Glassbox's estimated ARR of $50M reflects its strong position in the enterprise market, particularly in industries with high security and compliance requirements.

A UX Research Lead at a large financial institution shared:

Glassbox has been instrumental in helping us identify and resolve complex user journey issues. The session replay fidelity is unparalleled, and it's caught several critical bugs that slipped past our QA.

However, it does require a dedicated team to manage and interpret the data effectively. The insights are invaluable, but they come at a cost of time and resources.

LogRocket | Completeness of Vision: 6.7, Ability to Execute: 6.4, Est. ARR: $30M

LogRocket has gained traction in the product analytics space by combining session replay with performance monitoring, appealing particularly to development and product teams looking to improve user experience and troubleshoot issues quickly.

LogRocket's Completeness of Vision score (6.7) is based on:

Developer-centric approach: LogRocket's vision of integrating frontend performance data with user behavior resonates strongly with technical teams.

Comprehensive error tracking: The platform's focus on connecting user actions with technical errors provides a unique value proposition.

Real-time monitoring: LogRocket's emphasis on providing real-time insights aligns with the needs of agile development teams.

The vision score is limited by:

Narrow focus: While strong for developers, LogRocket's vision doesn't extend as broadly into areas like marketing analytics or advanced user segmentation.

Limited predictive capabilities: The platform currently lacks advanced predictive analytics or AI-driven insights seen in some competitors.

LogRocket's Ability to Execute score (6.4) is attributed to:

Powerful session replay: Users consistently praise the quality and detail of LogRocket's session replay feature.

Effective error reproduction: The platform's ability to help developers quickly reproduce and fix errors is highly valued.

Strong integration capabilities: LogRocket's ability to integrate with popular development tools enhances its utility for technical teams.

Challenges for LogRocket include:

Learning curve for non-technical users: While developer-friendly, some organizations find it challenging to extend LogRocket's use to non-technical teams.

Data volume management: The comprehensive nature of LogRocket's data capture can lead to high data storage costs for some users.

Limited advanced analytics: Some users note that while strong in technical analysis, LogRocket lacks some of the advanced analytics features of more specialized platforms.

LogRocket's estimated ARR of $30M indicates its growing adoption, particularly among technically-oriented organizations and development teams.

A Senior Frontend Developer at a fast-growing SaaS startup commented:

LogRocket has been a lifesaver for our dev team. Being able to see exactly what a user did before encountering an error has cut our debugging time in half.

The performance metrics are also invaluable for optimizing our app. It's not the easiest tool for our product managers to use, though, so we often find ourselves playing 'translator' between the data and the business side.

Smartlook | Completeness of Vision: 6.5, Ability to Execute: 6.2, Est. ARR: $10M

Smartlook has carved out a niche in the analytics market by focusing on qualitative analytics, particularly session recordings and heatmaps. It's often mentioned by small to medium-sized businesses looking for user behavior insights without the complexity of enterprise-level solutions.

Smartlook's Completeness of Vision score (6.5) is based on:

Qualitative focus: Smartlook's vision of making user behavior visually accessible aligns well with the growing demand for qualitative insights.

Cross-platform tracking: The platform's ability to track user behavior across web and mobile applications provides a more complete picture of the user journey.

Event-based analysis: Smartlook's approach to combining quantitative event tracking with qualitative insights offers a balanced perspective.

However, the vision score is limited by:

Narrow feature set: While strong in its core offerings, Smartlook's vision doesn't extend as broadly into areas like predictive analytics or advanced segmentation.

Limited AI integration: The platform lacks some of the advanced AI-driven insights seen in more comprehensive analytics solutions.

Smartlook's Ability to Execute score (6.2) is attributed to:

User-friendly interface: Users consistently praise Smartlook's intuitive design and ease of use.

Quick implementation: The platform's simple setup process allows for rapid deployment and time-to-insight.

Effective heatmaps and funnels: Smartlook's visualization tools are highly regarded for their clarity and actionable insights.

Challenges for Smartlook include:

Limited advanced analytics: Some users note that Smartlook lacks the depth of analysis offered by more comprehensive platforms.

Scalability concerns: As organizations grow, some find that Smartlook's capabilities may not scale as effectively as enterprise-level solutions.

Limited integration options: While improving, Smartlook's integration capabilities are not as extensive as some competitors.

Smartlook's estimated ARR of $10M reflects its growing adoption among small to medium-sized businesses, though it suggests room for growth compared to larger players in the market.

A Group Product Manager at a growing e-commerce startup shared:

Smartlook has been a game-changer for understanding our user behavior. The session recordings have helped us identify and fix several UX issues we didn't even know existed. It's incredibly easy to use, which means our whole team can dive in and get insights.

We do sometimes wish for more advanced analytics features, but for our current needs, it's spot on.

FullStory | Completeness of Vision: 7.2, Ability to Execute: 7.8, Est. ARR: $80M

FullStory has established itself as a strong player in the digital experience analytics space, offering a comprehensive suite of tools including session replay, heatmaps, and funnel analysis. It's frequently cited by mid-market and enterprise companies looking for deep insights into user behavior and experience.

FullStory's Completeness of Vision score (7.2) is based on:

Holistic digital experience analysis: FullStory's vision of providing a complete view of the digital experience, from high-level metrics to individual user journeys, is compelling.

Proactive issue detection: The platform's focus on automatically surfacing experience issues and anomalies aligns with the growing need for proactive UX management.

Machine learning integration: FullStory's use of AI to uncover insights and patterns in user behavior demonstrates forward-thinking.

FullStory's strong Ability to Execute score (7.8) is attributed to:

Powerful search capabilities: Users consistently praise FullStory's ability to quickly find and analyze specific user sessions or behaviors.

Comprehensive data capture: The platform's ability to capture and analyze a wide range of user interactions provides deep insights.

Intuitive interface: Despite its power, FullStory maintains a user-friendly interface that appeals to both technical and non-technical users.

Strong customer support: Users frequently mention FullStory's responsive and helpful customer support team.

Challenges for FullStory include:

Data volume management: The comprehensive nature of FullStory's data capture can lead to high data storage costs for some organizations.

Learning curve for advanced features: While the basic features are intuitive, some users report a steeper learning curve for more advanced analytics capabilities.

Pricing for smaller organizations: As a premium solution, FullStory's pricing can be a barrier for smaller businesses or those with limited budgets.

FullStory's estimated ARR of $80M demonstrates its strong market position, particularly among mid-market and enterprise clients seeking comprehensive digital experience analytics.

A VP of Product at a large SaaS company commented:

FullStory has become our go-to tool for understanding user behavior. The ability to quickly search through thousands of sessions and find exact moments of user frustration is incredibly powerful. It's helped us prioritize our product roadmap more effectively.

The biggest challenge has been managing the sheer volume of data we're collecting, but the insights we've gained have been well worth the investment.

Woopra (AKA, Appier Airis) | Completeness of Vision: 7.0, Ability to Execute: 7.7, Est. ARR: $5M

Woopra has positioned itself as a customer journey analytics platform, focusing on providing a unified view of the customer across multiple touchpoints. It's often mentioned by companies looking to bridge the gap between marketing, sales, and product analytics.

Woopra's Completeness of Vision score (7.0) is based on:

Unified customer view: Woopra's vision of creating a single, comprehensive profile for each customer across all interactions aligns well with the growing demand for personalized experiences.

Real-time analytics: The platform's emphasis on providing instant insights into customer behavior enables quick decision-making.

Cross-functional utility: Woopra's approach to serving multiple teams (marketing, sales, product) with relevant insights demonstrates a holistic understanding of organizational needs.

However, the vision score is tempered by:

Limited predictive capabilities: While strong in descriptive analytics, Woopra's vision doesn't extend as far into predictive analytics as some competitors.

Narrow focus on journey analytics: While powerful in its niche, Woopra's vision doesn't encompass some broader aspects of digital experience analytics.

Woopra's solid Ability to Execute score (7.7) is attributed to:

Powerful segmentation: Users consistently praise Woopra's ability to create detailed, dynamic customer segments.

Intuitive interface: The platform's user-friendly design allows for quick adoption across different teams.

Strong integration capabilities: Woopra's ability to integrate with a wide range of tools enhances its utility across the organization.

Responsive customer support: Users frequently mention Woopra's attentive and helpful support team.

Challenges for Woopra include:

Scalability for large enterprises: Some users report performance issues when dealing with very large data sets.

Depth of analysis: While strong in journey analytics, Woopra may not offer the same depth of analysis in specific areas (like product usage) as more specialized tools.

Market awareness: As a smaller player, Woopra faces challenges in brand recognition compared to larger competitors.

Woopra's estimated ARR of $5M suggests it's still in a growth phase, with potential for expansion as more companies recognize the value of customer journey analytics.

A Senior Product Manager at a mid-size B2B company shared:

Woopra has been a revelation for our team. The ability to see a customer's entire journey, from first touch to latest interaction, in one place has transformed how we approach personalization. It's incredibly intuitive, which means our marketing, sales, and product teams can all use it effectively. We've seen a significant uplift in conversion rates since implementing Woopra.

The main drawback is that as we've grown, we've started to hit some performance limits, but their support team has been great at helping us optimize.

Complete Market Map

So those are all the key players Gartner style. For those who need an even more complete market map, here’s one layer deeper into the market:

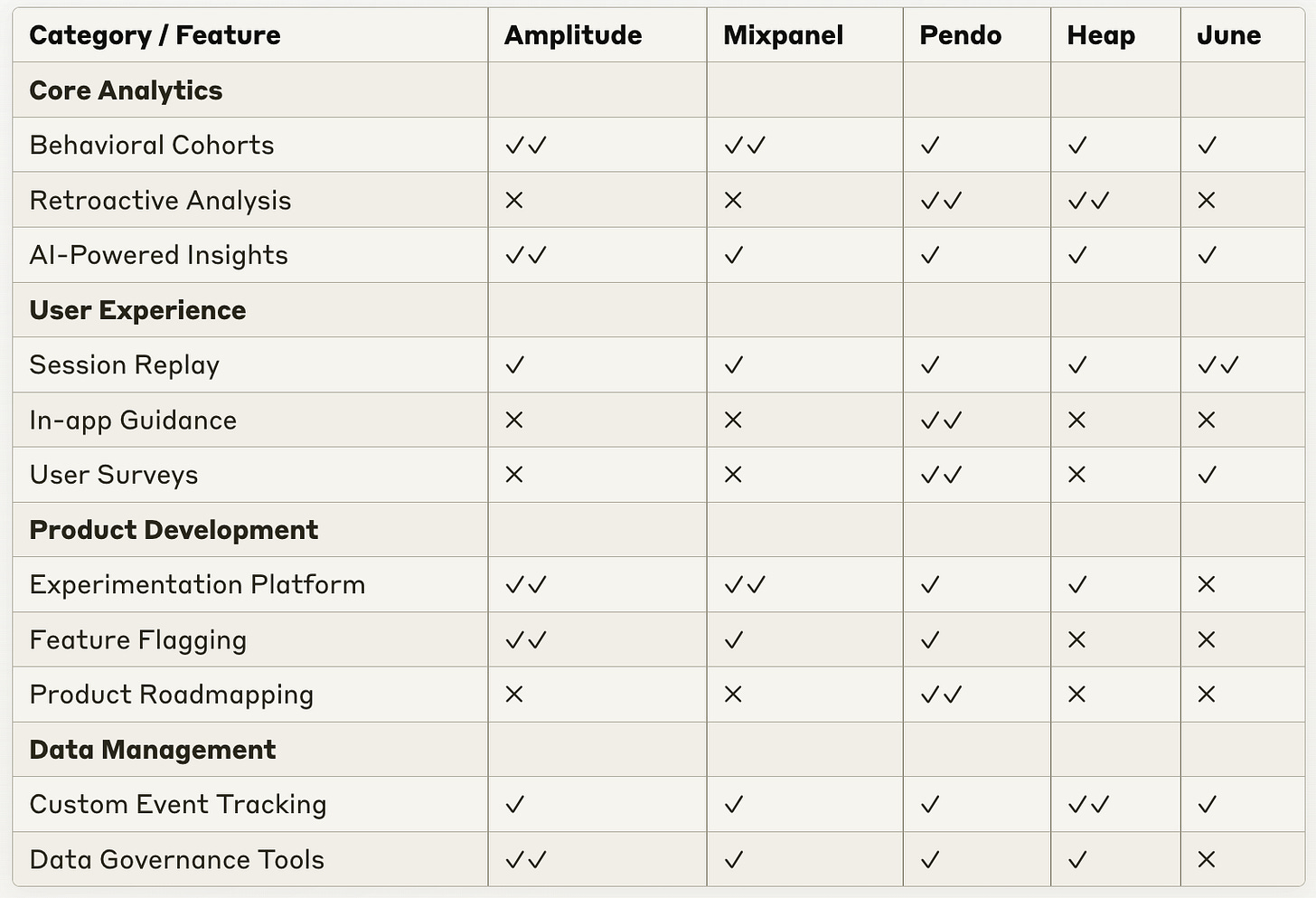

4. Deep Dive into 5 of the top Players

Let’s start with a quick feature overview so you can understand where these 5 players sit:

Now let’s get into each tool.

Deep Dive: Amplitude - The Product-Focused Analytics Powerhouse

Amplitude has established itself as a leader in product analytics, focusing on providing deep, actionable insights for data-driven product decisions.

VP of Product Interview

So, we’re very fortunate to hear from the man who led Amplitude’s core product teams for the past 4 years, Ibrahim Bashir (also write Run the Business).

Here’s what he had to say about Amplitude and its market position:

Their focus? Helping product teams make data-driven decisions fast. As Ibrahim put it: Amplitude is a decisioning tool. It helps teams make the right choices, quickly.

Key Differentiators

There are 4 main differentiators to consider when thinking of amplitude:

Behavioral Cohorts: Amplitude's advanced segmentation capabilities allow teams to create complex, behavioral cohorts. This feature enables product teams to identify patterns in user behavior that correlate with key outcomes like conversion or retention.

Experimentation Platform: Amplitude offers a robust, integrated experimentation platform. This allows teams to seamlessly move from insight to action, testing hypotheses generated from their analytics data.

Data Governance: As organizations scale, data complexity increases. Amplitude provides strong governance tools, enabling teams to maintain data quality and consistency across large, complex environments.

Decision Automation: Amplitude supports decision automation better than others. This allows teams to not just analyze data, but to automatically trigger actions. This level of automation moves Amplitude into the topmost layer of the Analytics Hierarchy of Needs.

Recent Product Developments

Amplitude continues to push the boundaries of what a product analytics tool can do, helping it maintain its market leading position.

Key recent launches help reveal that focus:

Session Replays (Q2 2024): This helps bring in the qualitative insights into the platform, a la a Pendo or other competitors.

AI-Powered Insights (Q3 2023): Automated anomaly detection and insight generation, reducing time-to-insight for product teams.

North Star Planning (Q2 2023): A new feature helping teams align on and track key metrics, facilitating strategic product decisions.

Enhanced Collaboration Features (Q3 2022): Improved sharing and reporting capabilities, facilitating better cross-functional alignment.

Market Position and Target Audience

Amplitude primarily targets mid-market to enterprise customers, with a strong focus on digital-native companies and organizations with sophisticated product-led growth strategies.

Their ideal customers are often larger tech companies or traditional enterprises undergoing digital transformation. As a public company with a struggling stock, Amplitude pays close attention to devoting sales and product efforts in the enterprise segment, where NDRs and expansion are much more possible.

Pricing

Amplitude's pricing tends to be on the higher end of the spectrum, reflecting its comprehensive feature set. They offer a free tier with limited functionality, but their paid plans can be significantly more expensive than some competitors, especially for larger data volumes.

Go-to-Market Strategy

Enterprise-focused sales team for high-touch, consultative selling

Strong emphasis on thought leadership and executive-level engagement

Product-led growth motion with a free tier to seed adoption in organizations

Robust partner ecosystem for implementation and integration support

Benefits for Product Leaders and Managers

Comprehensive suite of tools reduces the need for multiple point solutions

Advanced experimentation features enable rapid hypothesis testing and validation

Strong data governance features support scaling analytics across large organizations

Amplitude's focus on providing a comprehensive, enterprise-grade analytics solution positions it well for product managers in larger organizations or those dealing with complex, data-intensive products.

Its ability to support sophisticated analysis and experimentation makes it a powerful tool for product growth.

Deep Dive: Mixpanel - The Event-Based Analytics Pioneer

Mixpanel has established itself as a leader in product analytics, focusing on making data accessible and actionable for all team members.

VP of Product Interview

We're fortunate to hear from Vijay Iyengar, who has been with Mixpanel for 8 years and now leads their product teams.

Here's what he had to say about Mixpanel and its market position:

Their focus? Helping people who are building products build better products. As Vijay put it: Mixpanel connects what you've shipped with outcomes. It helps teams understand if they're moving the needle on growth, retention, or monetization.

Key Differentiators

There are 4 main differentiators to consider when thinking of Mixpanel:

Intuitive UI: Mixpanel places a strong emphasis on usability. Their interface is designed to be intuitive for PMs, engineers, designers, and analysts alike, promoting wider adoption across teams.

Data Warehouse Integration: Mixpanel offers direct connections to major data warehouses. This allows teams to combine product usage data with broader business data, providing more comprehensive insights.

Flexible Data Model: Mixpanel's architecture allows for quick changes to tracking without requiring engineering involvement, increasing agility in data collection and analysis.

Group Analytics: A unique feature allowing analysis of how groups of users (e.g., companies in B2B contexts) interact with products, providing valuable insights for complex business models.

Recent Product Developments

Mixpanel continues to innovate in making product analytics more accessible and powerful:

Mixpanel Spark AI (June 2023): An AI-powered analytics assistant enabling natural language queries, democratizing data access across organizations.

Impact Analysis (May 2023): A feature to measure the impact of product changes on key metrics, facilitating more informed decision-making.

Data Quality Warnings (April 2023): Automated alerts for data inconsistencies, helping maintain data integrity.

Snowflake Data Sharing (February 2023): Two-way sync with Snowflake, enhancing Mixpanel's data warehouse integration capabilities.

Market Position and Target Audience

Mixpanel serves a wide range of customers, from startups to enterprises, and claims to have the highest number of customers in the product analytics space. They particularly excel with:

Fast-growing startups and scale-ups needing quick time-to-insight

Mid-market companies looking for a balance of power and usability

B2B SaaS companies leveraging group analytics

Data-driven teams in larger organizations seeking self-serve analytics

Pricing

Mixpanel typically offers more competitive pricing than some enterprise-focused competitors, making it accessible to smaller teams and companies. They provide a generous free tier and their paid plans scale more gradually, allowing growing companies to expand their usage without dramatic price jumps.

Go-to-Market Strategy

Strong focus on self-serve adoption, leveraging their intuitive UI

Inbound marketing and content strategy to attract SMB and mid-market customers

Inside sales team for rapid response to inbound leads

Customer success focus on driving expansion within existing accounts

Benefits for Product Leaders and Managers

Intuitive interface reduces time-to-insight, allowing PMs to quickly analyze data without extensive training

Flexible data model enables PMs to iterate on analytics implementation without constant engineering support

Group analytics provide valuable insights for B2B product managers

Integration with data warehouses allows PMs to connect product metrics with broader business KPIs easily

Mixpanel's emphasis on usability and quick time-to-insight makes it a powerful tool for product managers who need to move fast and make data-driven decisions. Its balance of power and accessibility positions it well for growing companies and teams looking to build a data-driven culture.

Deep Dive: Pendo

Pendo has carved out a unique position in the product analytics space by offering a comprehensive suite of tools for product teams.

Sr Dir of Product Interview

We're fortunate to hear from Ryan Salomon, Senior Director of Product at Pendo and former CEO of Kissmetrics.

Here's what he had to say about Pendo and its market position:

Their focus? Helping product teams create products that users love. As Ryan put it: Pendo is about understanding, guiding, and improving the product experience across the entire user journey.

Key Differentiators

There are 4 main differentiators to consider when thinking of Pendo:

Comprehensive Platform: Pendo offers analytics, in-app guidance, NPS surveys, and user feedback collection in one integrated platform, reducing the need for multiple tools.

Retroactive Analytics: Pendo allows teams to analyze historical data without pre-planning every event, providing flexibility in data exploration.

Easy Implementation: With a single line of code, Pendo can start collecting data, making it easier for teams to get up and running quickly without heavy engineering involvement.

Qualitative and Quantitative Insights: Pendo combines analytics with user feedback and NPS data, providing a holistic view of the product experience.

Recent Product Developments

Pendo continues to expand its product experience platform:

AI-Powered Insights (2023): Introduction of 'Listen', a feature that uses AI to synthesize customer feedback quickly.

Enhanced Mobile SDK (2023): Improved capabilities for analyzing and guiding mobile app experiences.

Pendo Adopt (2022): A new product focused on driving software adoption in enterprise environments.

Data Warehouse Integrations (2022): Improved connections to data warehouses for more comprehensive analytics.

Market Position and Target Audience

Pendo targets a broad range of customers but is particularly strong in:

Large enterprises undergoing digital transformation

Companies looking to replace legacy analytics tools like Adobe Analytics

Organizations seeking to reduce reliance on engineering for analytics implementation

Product teams needing a full suite of tools for analytics, user communication, and feedback collection

Pricing

Pendo's pricing reflects its comprehensive feature set. While not the cheapest option, many customers find value in the breadth of capabilities offered. They provide tiered pricing based on product usage and feature needs, with enterprise-level plans for larger organizations.

Go-to-Market Strategy

Focus on providing a full product experience platform, not just analytics

Strong presence in enterprise accounts, particularly among Fortune 50 companies

Emphasis on easy implementation and quick time-to-value

Customer success team focused on driving product adoption and expansion across the platform

Benefits for Product Leaders and Managers

Comprehensive suite reduces the need for multiple tools, streamlining the product tech stack

Retroactive analytics provide flexibility in data exploration without extensive pre-planning

In-app guidance features allow PMs to directly impact user experience and adoption

Combination of quantitative and qualitative data provides a holistic view of product performance

Pendo's all-in-one approach positions it as a powerful tool for product managers looking to not just analyze but also actively improve their product experience. Its ability to cater to large enterprises undergoing digital transformation, combined with its ease of implementation, makes it a strong contender in the product analytics and experience market.

Deep Dive: Heap - The Automatic Event Capture Analytics Pioneer

Heap (now part of Contentsquare but as of writing still a separate product) has carved out a unique position in the product analytics space with its innovative approach to data collection and analysis.

Senior Director of Product Interview

We're fortunate to have insights from Vijay Umapathy, who has been leading Heap's product teams.

Here's what he had to say about Heap and its market position:

(The video on our recording unfortunately didn’t pan out. Rest assured, Vijay is great on camera.)

Their focus? Empowering teams to make data-driven decisions without the need for extensive implementation. As Vijay puts it: Heap is about capturing everything and asking questions later.

Key Differentiators

There are 4 main differentiators to consider when thinking of Heap:

Automatic Event Capture: Heap's standout feature is its ability to automatically capture all user interactions without requiring manual instrumentation. This "capture everything" approach ensures no valuable data is missed.

Retroactive Analysis: Because all data is captured from day one, Heap allows teams to analyze historical data for any newly defined event or segment without needing to wait for new data collection.

Virtual Events: Heap allows users to create new events and metrics on the fly using previously captured data, enabling rapid iteration on analytics implementation.

Identity Resolution: Heap's robust user identification system helps create a unified view of user behavior across devices and platforms.

Recent Product Developments

Heap continues to innovate in the space of automatic data capture and analysis.

Their recent launches highlight their product focus:

AI Copilot (Q2 2024): Takes natural language input to analyze data and deliver charts

Enhanced SQL Access (Q1 2023): Improved ability for technical users to query raw data directly.

Session Replays (Q4 2022): Adding in the ability to get qualitative insights from user sessions

Journey Maps (Q3 2022): Visual representation of user paths through products, automatically generated from captured data.

Market Position and Target Audience

Heap caters to a wide range of customers but is particularly well-suited for:

Fast-moving startups that need quick insights without heavy engineering investment

Product teams in larger organizations looking to democratize data access

Companies with complex user journeys that are difficult to map out in advance

Teams that value rapid iteration and experimentation in their analytics approach

Pricing

Heap offers a free tier for small teams and startups. Their paid plans are generally more affordable than enterprise-focused competitors, making them accessible to a wider range of companies. However, costs can scale significantly for very large data volumes.

Go-to-Market Strategy

Freemium model to drive initial adoption and product-led growth

Focus on ease of implementation as a key selling point

Strong content marketing emphasizing the benefits of autocapture

Customer success team focused on driving value and expansion

Benefits for Product Leaders and Managers

Eliminates the need for extensive tracking plans, reducing time-to-insight

Enables rapid testing of new hypotheses using historical data

Reduces reliance on engineering for analytics implementation

Provides a safety net against missed tracking, ensuring comprehensive data collection

Heap's unique approach to data collection and analysis makes it particularly valuable for product managers who need flexibility and speed in their analytics process. Its ability to provide retroactive insights can be a game-changer for teams discovering new questions about their product's performance.

Deep Dive: June - The B2B SaaS-Focused Customer Analytics Platform

June has positioned itself as a customer analytics solution specifically tailored for B2B SaaS companies, with a focus on simplicity and actionability.

Founder Interview

We had the opportunity to speak with Enzo, the founder and CEO of June.

Here's what he had to say about June and its market position:

Their focus? Helping B2B SaaS companies understand and act on their product usage data. As Enzo put it: June is about simplifying product analytics and making it actionable for B2B SaaS companies.

Key Differentiators

There are 4 main differentiators to consider when thinking of June:

B2B SaaS Focus: June is built specifically for B2B SaaS companies, with features like automatic company tracking based on email domains.

Simplicity: June aims to be as easy to use as Google Analytics, making product data accessible to non-technical team members.

Actionability: June goes beyond analytics by integrating with tools like Slack and CRMs, enabling teams to act on insights quickly.

Company-Level Analytics: Unlike many traditional tools that focus on individual users, June emphasizes company-level metrics and health scores.

Recent Product Developments

June continues to innovate in the B2B SaaS analytics space:

AI-Powered Insights (2023): Introduction of machine learning algorithms to surface relevant product insights automatically.

Enhanced Integrations (2023): Improved connections with popular B2B SaaS tools and data warehouses.

Company Health Scores (2022): Automated scoring system to gauge the health and engagement of B2B customers.

User and Company Profiles (2022): Detailed views of individual users and companies, combining product usage with other relevant data.

Market Position and Target Audience

June primarily targets:

Early-stage to mid-market B2B SaaS companies

Product teams looking for simple, out-of-the-box analytics

Companies transitioning from general analytics tools to product-specific solutions

Cross-functional teams (product, success, sales) needing a unified view of customer data

Pricing

June offers a freemium model with a generous free tier, making it accessible to startups and small teams. Their paid plans are competitively priced for the B2B SaaS market, with scaling based on tracked users and companies.

Go-to-Market Strategy

Strong focus on product-led growth (PLG) and self-serve adoption

Content marketing emphasizing B2B SaaS best practices and analytics use cases

Integration partnerships with popular B2B SaaS tools

Community building among B2B SaaS product managers and founders

Benefits for Product Leaders and Managers

Out-of-the-box analytics reduce time-to-insight for B2B SaaS metrics

Company-level analytics provide a more relevant view for B2B products

Integrations with other tools enable quick actions based on product usage data

Simplified interface makes product data accessible to non-technical team members

June's laser focus on B2B SaaS analytics, combined with its emphasis on simplicity and actionability, positions it as a strong contender for product managers in the B2B space who need quick insights without the complexity of traditional analytics tools. Its ability to bridge the gap between product usage data and other business metrics makes it particularly valuable for cross-functional teams in B2B SaaS companies.

Quick Summary

5. Keys to a Successful Product Analytics Tool Deployment

Keep reading with a 7-day free trial

Subscribe to Product Growth to keep reading this post and get 7 days of free access to the full post archives.