Product Pulse #2: Were there too many PMs:Engineers in the ZIRP era?

And: Brex laying off PMs, Figma’s valuation reset, how MBA job switchers are finding it hard to break into PM, and what you can learn from Netflix’s latest pricing

👋 Hi, there. This is Aakash. Product Pulse is a new series covering the latest product news and tech news relevant to product folks. Have a source? Send me a message.

In Today’s Issue:

Brex laying off PMs and burning $17M/month: Examining Brex’s alumni list, leaked financials, and what they all say about the current state of the private Fintech Industry.

Were there too many PMs to Engineers? With everyone from Elon Musk to Sahil Lavingia talking about more engineers:PMs, I explore whether product leaders over-hired PMs in the ZIRP-era.

The right way to handle a valuation reset: Figma is setting a good example of how to treat employees with care after a shocking M&A outcome, in an effort to retain them.

MBA job-switchers are finding it tough to break into PM: The market for PM and tech roles for career switchers remains very rough, as the data from MBA programs confirms.

Why Netflix is axing its basic ad-supported tier and what it means for your pricing & packaging: Netflix is getting rid of its cheapest non-ads plan, as it continues to dominate the streaming market.

1. Brex laying off PMs and burning $17M/ month

Buried amidst all the news out of Brex this week, many missed the details of its layoff.

I got a copy of co-founder Pedro’s e-mail (at the bottom of this post) and the alumni list. Here’s what you need to know.

Who was hit by the layoffs?

The list includes 186 of the 282 employees Brex laid off. At 2/3rds, it’s a fairly representative sample. Here’s who was hit:

8 PMs (4.3% of the list): 1 PM, 5 Senior PMs, 1 Principal PM, and 1 Group PM

8 Technical Program Managers (4.3% of the list): 2 TPMs, 2 Senior PMs, 4 Staff PMs

91 of those laid off were Engineers (50.8% of the list): 10 Engineering Managers, 38 engineers, 39 senior engineers, 4 staff engineers

Basically every department was on the list: Sales (7.6%), Finance (7.0%), Analytics (7.0%)

Like most layoffs, it appears to have hit the lower and mid-levels the most. There is a single Director and no VPs on the list.

But, there could be more senior employees not on here. We do know that the COO and CTO are out.

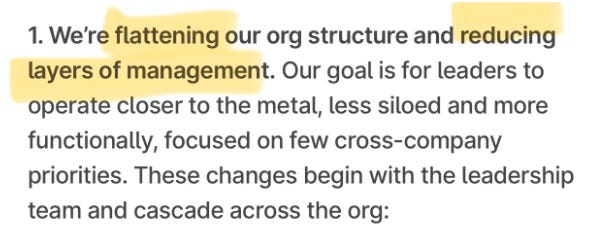

In his message to employees on the layoff, Brex co-founder Pedro said the company is flattening its org structure:

The data supports that. There are a lot of ‘first level managers’ on this list.

Given he uses the exact same language as Zuckerberg, it’s clear Pedro is taking cues from the Meta leader.

The targeting of the TPMs adds to this as well. Zuckerberg took an axe to them once already this year at Instagram, and Business Insider reports he is about to again broadly at Meta.

Clearly, there is now increased pressure on the TPM role across tech.

So what drove Brex’s layoff specifically? A few things:

Burn

My friend Mark Matousek at The Information broke several interesting stats about Brex’s 2023 financials:

Net revenue: $279M / year, up 32% YoY but flat for H2

Burn: $200M / year, down 23% YoY

Runway: 2 years

These aren’t great numbers.

Starting at the top, Brex’s revenue was flat in the second half of 2023 because it saw a big boost in revenue in H1 from the fall of Silicon Valley Bank. But since then, growth has been sluggish.

Lack of growth always puts pressure on unprofitable companies.

In this market, lack of growth means: the burn was clearly too high.

Inflated Valuation

This high burn was driven by a high valuation.

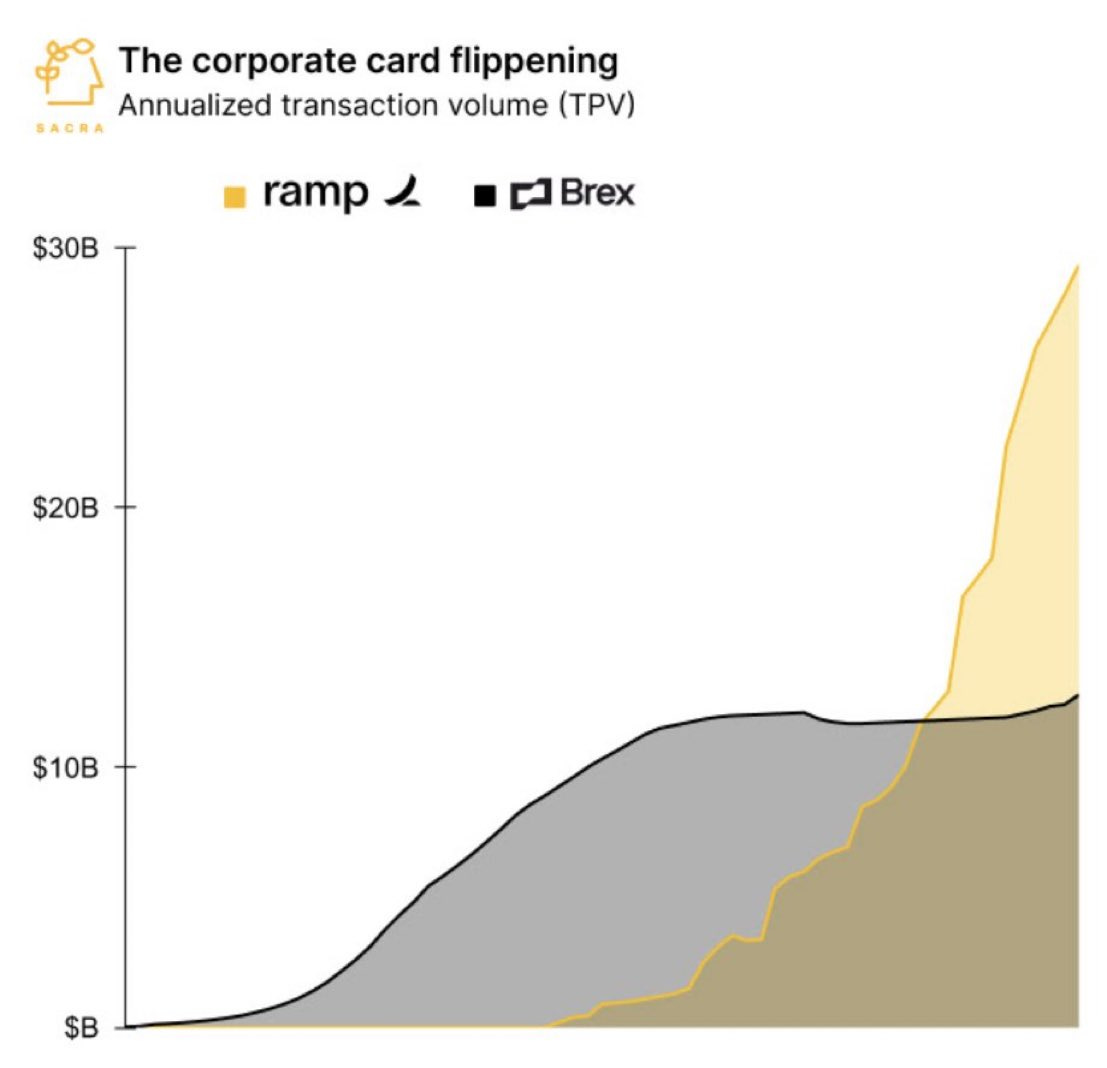

Brex was a prototypical case of growing too hot, too fast. The company had grown from 0 to $12.3B, on paper, in 5 years:

Along the way, it bloated its way up to 1,400 employees. That’s just too many for its scale.

That’s an ARR per employee of $197K — far below examples that we recently profiled like Notion, which is estimated to be 5x that.

Like so many overvalued companies, Brex began overspending.

A Performance Management Philosophy?

Interestingly - Brex is no stranger to layoffs.

This is its third one:

June 2020: 62 employees, 17% of staff

October 2022: 136 people, 11% of staff

January 2023: 282 people, 20% of staff

Notably, the first two of those happened while Brex was still on its J-curve of growth.

Brex seems to be eternally optimistic - over-hiring, and then needing to layoff.

The Overheated Private FinTech Industry

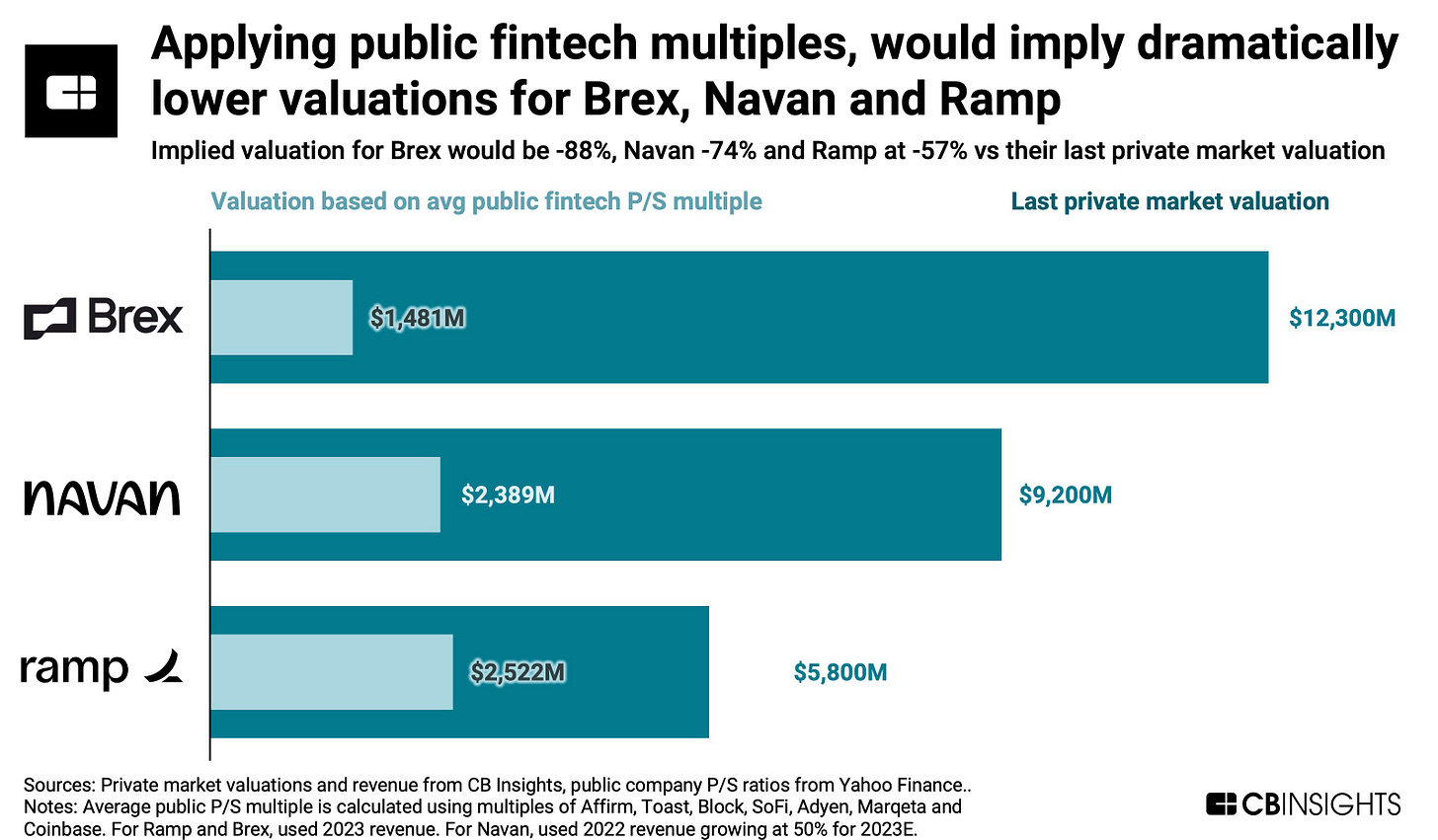

What Brex is facing is a recalibration of the private fintech markets to better match the multiples in public markets.

Its 44x net revenue valuation is far above the 5.7x that public fintechs boast.

As Anand Sanwal showed, it would more likely be worth something like $1.4B in the public markets:

That’s why Brex’s competitor Ramp, which is said to have a better Rule of 40 than Brex, raised a down round at a 28% valuation cut last year.

What does it mean for techies?

If you’re not in fintech, there’s not too much to read into Brex’s PM layoffs. The space is experiencing a tough time.

And Brex, in particular, is not winning in the market. As Delian Asparouhov of Founders Fund shared:

As a result - there’s not a larger takeaway about the job market for PMs getting dramatically worse than last week. Brex layoffs are mainly a Brex problem.

This week, Microsoft predictably joined the party. It was a predictable cut about 10% the size of last year, concentrated in the gaming divisions post the Activision acquisition.

But if you’re a TPM, it’s worth batting an eye. First Instagram, then more of Meta, now Brex, and soon to be many more copycats are pressuring the function.

The more “middle management” your job seems, the more likely it is at risk of being cut.

BTW, I’ve written a few new variants of ways to ask to expense a subscription:

2. Were their too many PMs to Engineers?

The data points keep piling up that the PM function may have expanded too quickly in the ZIRP era.

Two I saw recently:

A. The PM:Eng ratio at X

B. Gumroad CEO’s thoughts on PMs

A. The PM:Eng ratio at X

Another friend of the newsletter, Peter Yang, interviewed Chris Bakke, a PM at X.

Chris shared that X has very few PMs:

Peter: How many PMs do you have for 200-300 engineers?

Chris: To my knowledge, we have 6 people in product.

That’s 33:1 or 50:1 engineers per PM — quite a far-cry from the 5:1 or 7:1 PM:Engineer ratios we were seeing at the peak of the ZIRP-era.

The ratios matter for how many PM jobs are out there. Just to run the numbers on the estimated 1.6 million software engineers in the US:

5:1 ratio → 320K PM jobs

7:1 ratio → 230K PM jobs

33:1 ratio → 48K PM jobs

50:1 ratio → 32K PM jobs

(Note: more and more US-based PMs are leading developers in other parts of the world, so the numbers could be a bit higher than that. This is just napkin math.)

B. Gumroad CEO’s thoughts on PMs

Sahil Lavingia, the founder and CEO of Gumroad, posted this tweet that got a lot of traction on X:

He’s been a well-known PM-skeptic for years.

But there’s a reason posts like this are guaranteed a lot of social engagement: a lot of people feel the same way.

Especially CEOs, like Elon and Sahil - which is not a good sign for PM.

What Ratio Can We Expect?

No one thinks the function is going away - even Sahil and Elon - but it is getting pressured.

As a product leader in this era, I use the ‘we’ to say: we over-hired PMs in the ZIRP era.

The era of 5 engineers for a single PM is probably gone for good.

At the same time: the X and Sahil ratios only seem possible up until 200-300 engineers.

After that, communication breaks down. This is because the amount of it you need to do - with customers, stakeholders, and the rest - grows exponentially.

Engineers and designers begin to spend all their time doing what a PM could be.

The takeaway?

→ Startups probably over-hired.

→ But bigger tech companies still need PMs.

I expect the ratio to stabilize more around the 10:1 range over the next year or so.

This means that there will be less PM jobs than before.

But it’s not going to be a huge ax to the industry.

What do you think? Let’s crowd-source your thoughts, and I’ll report back in a future issue:

3. The employee-friendly way to handle a valuation reset: Figma’s example

Keep reading with a 7-day free trial

Subscribe to Product Growth to keep reading this post and get 7 days of free access to the full post archives.