How did WeWork Turnaround?

WeWork - $WE - is a public company now. What happened in the two years between pulling its initial IPO and eventually going public?

After the IPO was pulled, Softbank stepped in, and Adam Neumann was pushed out. Originally the reporting was a $1.7B price tag.

But, after all was said and done, Adam received~$845M cash: $745M for shares, $50M for legal fees, a $50M special payout + a $430M credit line.

After injecting WeWork with emergency capital, Softbank was left with a company valued at "zero," per Marcelo Claure, chariman of WeWork & COO of Softbank.

They installed Sandeep Matrani as CEO of WeWork. Perhaps no man in the world could be more credentialed: he was formerly CEO of two public real estate companies, including the highly prestigious Brookfield Properties Retail Group.

Matrani has cut $1.9B of yearly costs:

1. Exited vanity projects like Welive, Wegrow, and Risebywe

2. 2/3rd of staffers were laid off

3. SG&A is down from $823M in Q4 '19 to $225M in Q2 '21

He has also refashioned the company "space as a service." WeWork has a $100M software biz even. Now, the company is certainly not worth zero. Mathrani has completed a remarkable turnaround.

The SPAC deal gives $WE an equity value of ~$8B, and it is up about 11% as of publishing, giving it an equity value of ~$9B. Of course, this is lightyears away from the $47B IPO the company attempted in late 2019.

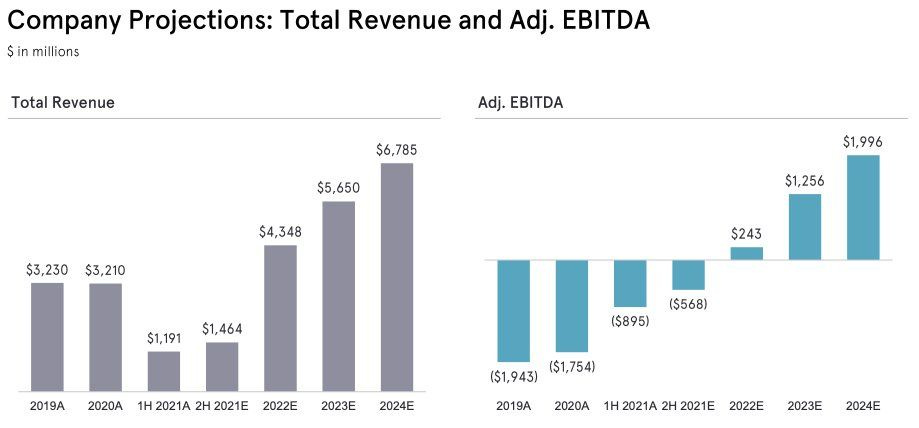

The company continues to burn cash, with a net loss of $923M in the second quarter. Without the SPAC, the company would run out of cash. The SPAC does improve the cash position, and the company believe will set it on the road to profitability, as soon as next FY.

Recent metrics do support this improving picture:

1. September was the best revenue and YoY growth month of 2021

2. Total occupancy continued to trend upwards at 60% at the end of Sep, up from 52% in Q2

3. Enterprise 12+ month commitments are >50% of the biz

So, is WeWork worth the investment? If it hits its 22 estimates, it would trade at 2.5x FY22 sales, and 45x FY22 Adj Ebitda.

That's not bad. So, WeWork is really a covid value rebound play. As the return to office materializes, WeWork will benefit. Take London. WeWork has <1% of the office space, but accounted for 37% of the leasing activity

Why did Vivek Ranadive - owner of the Sacramento Kings - take WeWork public via SPAC?

"If you think about companies that could be worth $100B, WeWork is that kind of company."