Uniswap 🦄 DeFi’s Most Interesting Player

12 lessons on building for web3 from crypto’s #1 DEXUniswap is, in my opinion, the most interesting company in decentralized finance (DeFi). Already the leading decentralized exchange (DEX) by market share last year, it survived the infamous SushiSwap “vampire attack,” and has continued to release noteworthy product innovations since, including becoming a decentralized autonomous organization (DAO).

What is the full story of this leading DeFi player? What lessons can we take for building web3 companies? Strap in, as we journey through 12 lessons about buidling - spelling intentional - for web3.

2016

Like many things in crypto, our story starts with Vitalik Buterin. The founder of Ethereum, and prolific writer, published a Reddit post, “Let's run on-chain decentralized exchanges the way we run prediction markets.” The post sports a mere 132 upvotes, a far cry from even your C+ meme.

Such is the nature of historic innovation. The rewards go to those who pay attention.

One person paying attention was Karl Floersch. At the time an engineer working at ConsenSys, Karl read the post and filed the ideas away. He, too, felt that decentralized exchanges on Ethereum could be improved.

At the time, the leading decentralized exchange on Ethereum was EtherDelta. EtherDelta was based on the order book model. This is how Coinbase and Binance, the NYSE and NASDAQ, as well as all the leading global exchanges, operate. In the order book model, buyers come together with sellers, and trades happen when both parties converge on a price. Sellers try to sell for as high as possible. Buyers try to buy the same asset for as low as possible.

What if there’s no one willing to place orders at a fair place level? This is where market makers come into play. They facilitate trading by always being willing to buy or sell the particular asset. This helps users to always be able to trade, without having to wait for another party to show up.

The problem is that the order book model on a layer 1 protocol like Ethereum is slow and expensive. Eth v1 can only handle 12-15 transactions per second with a 10-19s block time, plus has high “gas” fees. This is too expensive and slow for significant market makers to operate. As a result, as Vitalik wrote, spreads become wide: up to 10-15%. That, a liquid market, is not.

Despite the challenges, EtherDelta was one of the most popular exchanges by the end of 2016. Permissionless and decentralized trading, where anyone could trade anything, proved too important an offering to be deterred by slow transactions with high fees.

2017

As the great Initial Coin Offering (ICO) boom kicked off in 2017, EtherDelta was the place to be. It was one of the first and most liquid places for the long tail of new coins being put into the market. At this point, decentralized exchanges clearly had an important place in the trading market. But, the user experience was not quite there.

One protocol that attempted to solve the problems with EtherDelta was Bancor. The important innovation of the Bancor protocol was that it utilized smart tokens to create a liquidity mechanism. Its ICO raised a record-breaking $153M. Using its BNT token, it had created a second layer scaling solution on top of Ethereum that avoided the gas fees and scaling issues associated with EtherDelta. It was briefly the talk of the town when it came to Ethereuem DEXes.

Lesson 1: Take the Leap and Embrace the Future

Concurrent to this boom in ICOs in 2017, the old world company Siemens - founded in 1847 - was not humming in every business segment. Several hundred mechanical engineers had to get the axe. Hayden Adams was one of them.

Hayden turned to texting with his friend, Karl Floersch. In this story, Hayden is the Karate Kid and Karl is Mr. Miyagi. Mr. Miyagi showed the Kid the future:

Mechanical Engineering is a dying field. Ethereum is the future and you’re still early. Your new destiny is to write smart contracts!

And the kid listened!

Lesson 2: Anyone Can Build for web3

A mechanical engineer by training, not a software engineer, Hayden was worried. “Don’t I need to know how to code?” he asked Karl. Karl’s response: “Not really, coding is easy. Nobody understands how to write smart contracts yet anyway.” So Hayden spent the next two months learning the basics of Ethereum, Solidity, and Javascript.

Right around the time Hayden was fired, Vitalik published on the automatic market makers concept again. This time, instead of suggesting improvements to EtherDelta, Vitalik was suggesting improvements to the way Bancor worked. It left room for improvement in both market maker efficiency and market exploitability.

As history has shown again and again, there is a lot of money to be had building what Vitalik suggests.

On Karl’s suggestion to graduate from getting his feet wet to working on a real project, from October to November, Hayden set out to build a proof of concept of the automatic market makers Vitalik described. Instead of serving as market maker, the project used the concept of liquidity pools. Liquidity pools are a Constant Product Market Maker. They utilize a smart token pool locked in a smart contract to facilitate trading and provide liquidity.

When Karl, by this time a figure in the Ethereum scene and acquainted with Vitalik Buterin, told Vitalik that Hayden planned to name the project Unipeg, Vitalik replied,

Unipeg? it sounds more like a Uniswap

And so Uniswap was born.

In two months, Hayden released the still functional demo of Uniswap. It had a single liquidity provider and simple swaps. Hayden had turned his learning about smart contracts and javascript into a fully functioning open source web app using the blockchain.

It is a remarkable story of Zero to One. Hayden and the early Uniswap prototype exemplify the message, “anyone can build for web3.” As Karl said, because the tech is so new, no one is particularly great right now anyways. So the only difference is programming knowledge, not context knowledge.

The initial version of Uniswap had a better automated market maker implementation than Bancor. It was 10x more gas efficient and used Ethereum as a common pair. Because the technology was so new, a single 25 year old in New York was able to go up against the hundreds of millions in funding behind Bancor.

Lesson 3: Engage With the Community

The next steps were to expand beyond a single ETH/ERC20 pair, and work with more than a single liquidity provider. In a talk at that year’s Ethereum developer conference (Devcon 3), Karl gave a talk on the power of programmable incentives and Cryptoeconomics. In it, he used Uniswap as an example.

An attendee at Karl’s Devcon talk, Pascal Van Hecke, would come to be an important number three on the Uniswap team. Pascal started by giving Hayden a grant to fund the next month of his work. The two then held weekly calls to discuss progress.

Not only did these provide a sense of structure and accountability for the nascent Uniswap project, Pascal was an experienced engineer. He had co-founded Token Engineers and added another dimension of expertise to the project. Together, the two had extended Uniswap to multiple tokens and liquidity providers. Score 1 for engaging with the community.

Then in December, Hayden attended a NYC Mesh meetup with Karl. By this time Karl was famous in the crypto world and extensively quoted by a Coindesk reporter at the event. But Hayden also created the opportunity to chat with the Coindesk reporter himself. He was mentioned as “actively looking into how the meshcoin concept would operate”.

As a result, a friend of Hayden’s from elementary school reached out, Callil Capuzozzo. A designer at Microsoft and Google, he was able to quickly diagnose the next problem for Hayden to work on: front end design. Callil would go on to be a very important founding teammate of Uniswap.

Because of Hayden’s attendance of a meetup - yes, those horrible in-person events most developers loathe going to - he was directly connected to his next team member. Score 2 for engaging with the community.

Lesson 4: Prioritize Security First and Foremost

In December of 2017, EtherDelta was hacked. The hackers accessed the exchange’s DNS server, and replaced its web domain with a fake. When users traded their tokens, they went into the wallet of the hacker. Users were ultimately scammed for $800K. The founder, Zachary Coburn, was also unfortunately charged by the SEC for operating an unregulated security exchange. He settled for $400K. This further opened up space for a new leading DEX.

2018

Then, in July of 2018, Bancor was hacked. A wallet on its network was compromised, leading to the theft of $12.5M of ethereum and $1M of altcoin Pundi X. Immediately, it was compared to Mt. Gox, EtherDelta, and Coincheck. Once a reputation is compromised, it is hard to get it back. A further space was opened up in the DEX world.

On the other hand, Hayden kept building Uniswap’s reputation. Till this date, it has not had a hack or breach. Throughout the rest of the story, you will see Hayden’s consistent emphasis of security over speed. When building for web3, prioritize security first and foremost. One breach is enough to forever tarnish your reputation.

Lesson 5: Solve a Big, Unfulfilled Goal

In January of 2018, Hayden and Pascal had worked out the major smart contract issues. Uniswap supported multiple tokens and liquidity providers. Hayden reconnected with Calil, who helped design a sleek new interface for Uniswap. When it was clear that Hayden’s front-end code needed to be refactored, Hayden worked with his college friend Uciel to rewrite the front-end.

By March, Hayden, Calil, and Uciel had built a fully featured demo of Uniswap. But by this time, Hayden had been working on the project without a steady income for 10 months. After the great crypto crash of late 2017, his portfolio was down 75%. Despite the circumstances - including having never left the US in his 24 year life - he “yolo-bought” a last minute flight to Seoul, South Korea for the Decentralized Economy Conference (Deconomy 2018).

Unable to afford a ticket to the conference itself, he was rejected at the gate. The scene was set for a Hollywood-level disaster.

Instead, it had a Hollywood turnaround. Karl arrived and introduced Hayden to none other than Vitalik Buterin. Karl mentioned Hayden had built Uniswap. Vitalik asked if it were open source. Upon hearing it was, he asked for the URL. Without saying a word, Vitalik read the salient points of Uniswap’s github - on his phone, quickly. Then he provided the next steps for Uniswap:

Have you considered writing it in Vyper? Also, you should apply for an Ethereum foundation grant.

Immediately after returning from Seoul, Hayden rewrote the Uniswap smart contracts in Vyper. Unlike Solidity, Vyper had no guides or developer tools. At the time, there was only one complex example in the core Vyper repo. So he used that as an example to rewrite Uniswap.

The productiveness of Hayden’s meeting with Vitalik would not have been possible without Hayden having worked on a big, unfulfilled problem that Vitalik had written about. Uniswap was designed with the ideals Vitalik cared about in mind - censorship resistance, decentralization, permissionless, and security. To create serendipity with the founder of the blockchain you are building on, virtually a must to build an industry leading project, build things they will care about.

The world becomes smaller when you are building important things.

Lesson 6: Enlist Institutional Community Support

Hayden’s meeting with Vitalik also included Vitalik’s recommendation to apply for an Ethereum foundation grant. It is typically a good sign when the leader of a foundation tells you to apply for a grant from them.

For many builders in web3, it can seem like you do not want to work with centralized institutions.

But all about working with the right institutions. The Ethereum Foundation is one of those “right institutions.” Similarly for most builders, the institutions where the smartest people writing code in that ecosystem work, are good institutions to try to win grants from.

After meeting Vitalik and rewriting Uniswap in Vyper, Hayden continued to deepen his engagement with the community. He collaborated with David Knott to give a talk on Vyper at Edcon 2018. He collaborated with Dan Robinson to make Uniswap the most gas-efficient exchange. He also collaborated with Richard Burton, who gave Hayden a grant and office space to work.

At that point, Hayden had taken Uniswap as far as he could on his own. Uniswap required funding. Funding would allow Uniswap to create production-ready smart contracts, implement a responsive trading interface, complete a smart security audit, finish the whitepaper, and create developer docs. The Ethereum Foundation grant presented itself as a potential solution.

So, in May, Hayden applied for an Ethereum foundation grant for $100K. In his application, he outlined that he would use a portion of the funds for several projects from the firm Runtime Verification (RV). RV specializes in formalized models, code review, and contract verification. This would be very important for Uniswap to avoid the fate of future catastrophic DeFi projects like Yam, whose developers forgot to divide by 10 to the power of 18. It would also help harden Uniswap’s security.

While waiting for the foundation’s response, Hayden spent an increasing amount of time at the MakerDAO office. Here we see Hayden again finding his way into the right places. Fast forward to today, and Maker is the #1 place of total value locked (TVL) in the entire DeFi ecosystem. Working in such a smart office helped Hayden to build relationships with strong technical crypto people. They continued to provide feedback to help Hayden optimize Uniswap’s smart contracts.

The work paid off. In July, Uniswap received an Ethereum Foundation #Buidl - now does the spelling make sense? 😃 - Grant.

The money was put to good use. RV’s study ultimately led to adding extra safety checks and re-working the math to minimize rounding error, as well as favor liquidity providers over traders. The entire code base was refactored for the changes. In addition, Hayden hired Callil as a contractor to design the production version of Uniswap. Finally, receiving the grant further cemented Uniswap in the ecosystem. It ensured the attention of Vitalik.

When Hayden was giving a talk at ETHIS in Hong Kong - the flip from anonymous to crypto famous was rather swift - he had a chance to catch up with Vitalik. In classic Vitalik fashion, he caught an error that even RV missed. Having Vitalik’s attention is always helpful, and receiving the grant helped garner more of it.

Lesson 7: Use Industry Events

The power of industry events has popped up several times in this story already. NYC Mesh led to being quoted and working with Calil. Devcon 3 led to the initial Vitalik encounter. ETHIS led to the second Vitalik encounter and code review.

Understanding this power, Hayden was determined to launch Uniswap at Devcon 4. The five weeks between receiving the Ethereum grant and Devcon 4 would turn out to be the “busiest 5 weeks” of his life. Calil jumped in to build out the final design. Hayden recruited two more friends to build the launch interface, while also finishing the developer documents and whitepaper.

Two things remained. First, the team needed T-shirts printed for the conference. Second, RV had expressed that Uniswap needed to be studied more for re-entrancy attack before launch.

Both items ran right up until the last second. For the T-shirts, Calil had to pull an all-nighter. He was printing all night. But the team pulled through, and the two-sided T-shirts made it onto people Day 1 of the event:

The re-entrancy attack studies went even more last minute. Days 1 and 2 passed. Finally, on Day 3, Hayden’s security researcher friend was satisfied that no re-entrancy attacks could be done on Uniswap exchange contracts, unless the token transfer function was designed for that.

So, on Day 4 of the conference - the final day - the team deployed the Uniswap exchange contracts to the Ethereum mainnet. The project and app URL were set live on the web, and a liquidity provider split $30K across three tokens. And so, on November 2nd, 2018, Uniswap was live.

Launching at Devcon 4 helped make the launch a big event, and keep up momentum for the new exchange. In just two months, Uniswap would more than 10x its liquidity.

Lesson 8: The Power of Unstoppable Code

2019

As a result, Uniswap would begin 2019 with locked in liquidity of half a million dollars. Over the course of the next several months, Uniswap continued to gain organic traction. The team added two full time team members to make the team three.

In March 2019, the exchange hit $1M USD, or a little less than 10K ETH at the time, value in liquidity. The same month, it doubled to hit $2M. The growth was that of a classical product rocket. It did not need expensive brand or direct response marketing campaigns.

This helped Uniswap raise a $1M seed round from crypto hedge fund Paradigm in April. The Yahoo Finance article on the round was not particularly optimistic, stating, “the decentralized exchange space is crowded with AirSwap, 0x relayers, and Bancor all fighting over the same paltry volumes.” Early on in technological cycles, it pays to be contrarian and ignore the mainstream media. The team did just that.

The Paradigm team understood the value of Uniswap. It was a “self contained system with no admin keys.” Up until that point, the vast majority of apps being built in the space had some aspect of money custody and needed to conform with know your customer regulations. Uniswap, as financial infrastructure, bypassed that.

The funding helped the team further extend its runway with a reasonably low level of dilution. The team set out to work on Uniswap v2.

Meanwhile, Uniswap v1 showed the power of unstoppable code. Uniswap doubled its liquidity value three more times in the year. It would close the year with well over $10M of liquidity on the platform, completing a 100x over the year. The overall DeFi market only tripled.

Uniswap took market share because it increasingly became the place to trade long tail tokens. Smart contracts on the blockchain like Uniswap are completely permissionless. Anyone can use them. So people trading new tokens naturally went there. As trustless decentralized financial infrastructure, the line of people using Uniswap kept growing larger in 2019.

Lesson 9: Your Take Rate is My Opportunity

2020

In 2020, DeFi took off. Total locked-in value went from $700 million to $15 billion. Uniswap was a major player in the rise.

In May, the team launched Uniswap v2, written in Solidity. This significantly improved the user experience on the platform. The most notable improvement was ERC-20 to ERC-20 liquidity pools. Before v2, users always had to have ETH in the trade, which resulted in higher gas fees. Offering ERC-20 pairs was better for liquidity providers. They experience less “slippage” just making trades and can earn more on the “spread,” which is the fixed 0.3% the protocol allocates to liquidity providers takes on trades.

As a result of the launch, Uniswap protocol trading volume picked up. v1 was used actively alongside v2 for a while despite uniswap encouraging migration to v2. The power of unstoppable code continued.

Also in May, Compound launched $COMP tokens and their liquidity mining program. This kicked off what is widely known as “DeFi Summer”. It spawned an entire culture, propagated by “DeFi Degens.” Perhaps the subculture’s defining feature is humor, with memecoins like Dogecoin and $MEME consistently taking off. As the leading decentralized exchange to trade these memcoins, as well as liquidity mining coins like $AMPL, Uniswap became the most popular project on Ethereum.

In August 2020, after having more than tripled monthly volume between June and July, Uniswap raised a $11M series A from Andreesen Horowitz and Union Square Ventures. The funds were used to grow the team, and build uniswap v3. By the end of the year, volume was close to the top centralized exchanges, and above second-tier but formidable players like Kraken and Coinbase Pro.

As Chris Dixon says about web3, “Your take rate is my opportunity.” Uniswap’s push to lower fees in v2 and v3 helped catalyze its amazing growth throughout 2020. It became the de facto first place new Ethereum-based assets are listed and available. It also continued to eat away at market share from centralized exchanges with lower fees (take rates).

Lesson 10: Don’t Overreact to Forks

Would it be a crypto story without a dramatic forking? Uniswap experienced not one but two after the DeFi summer dramatically increased the attractiveness of creating a DEX.

Part One - Sushi

First, on August 23, the director of research at crypto research firm The Block tweeted a hypothetical thought exercise.

https://twitter.com/lawmaster/status/1297480268341796870

A few days later, his thought exercise was a reality. Led by an anonymous Chef Nomi, SushiSwap hit the market. A fork of Uniswap, SushiSwap made a few changes. It released a governance token, SUSHI. And, instead of giving all 0.3% in fees to active liquidity providers, SushiSwap would accrue 0.05% to the holders of the SUSHI token.

To convince the liquidity providers to move off Uniswap, Nomi offered them 2x the rewards for for providing SUSHI liquidity on Uniswap itself. But it was a limited time offer - after 15 days, the liquidity providers had to move to SushiSwap. This led to the creation of SushiSwap earning the label of a “vampire attack.” Just three days after launch, Sushi had managed to bleed Uniswap of more than half of its liquidity. Five days after launch, that number was up to two thirds. In less than a week after launch, SushiSwap became not only the largest DEX by TVL, but the top DeFi project period.

From outside and in, the attack looked devastating. Two thirds of liquidity - switched! But the lesson is Don’t Overreact to Forks… 🧐

SushiSwap fell apart as quickly as it rose. There was a 10% allocation of the SUSHI token for a “dev fund,” with no vesting or other required commitments. Chef Nomi withdrew half of the funds, 380K ETH or US $14M. Across the crypto community, Nomi’s move was branded an “exit scam.” Sam Bankman Fried (SBF), the CEO of FTX and leading crypto figure, tweeted “Chef Nomi sucks.” The community revolted.

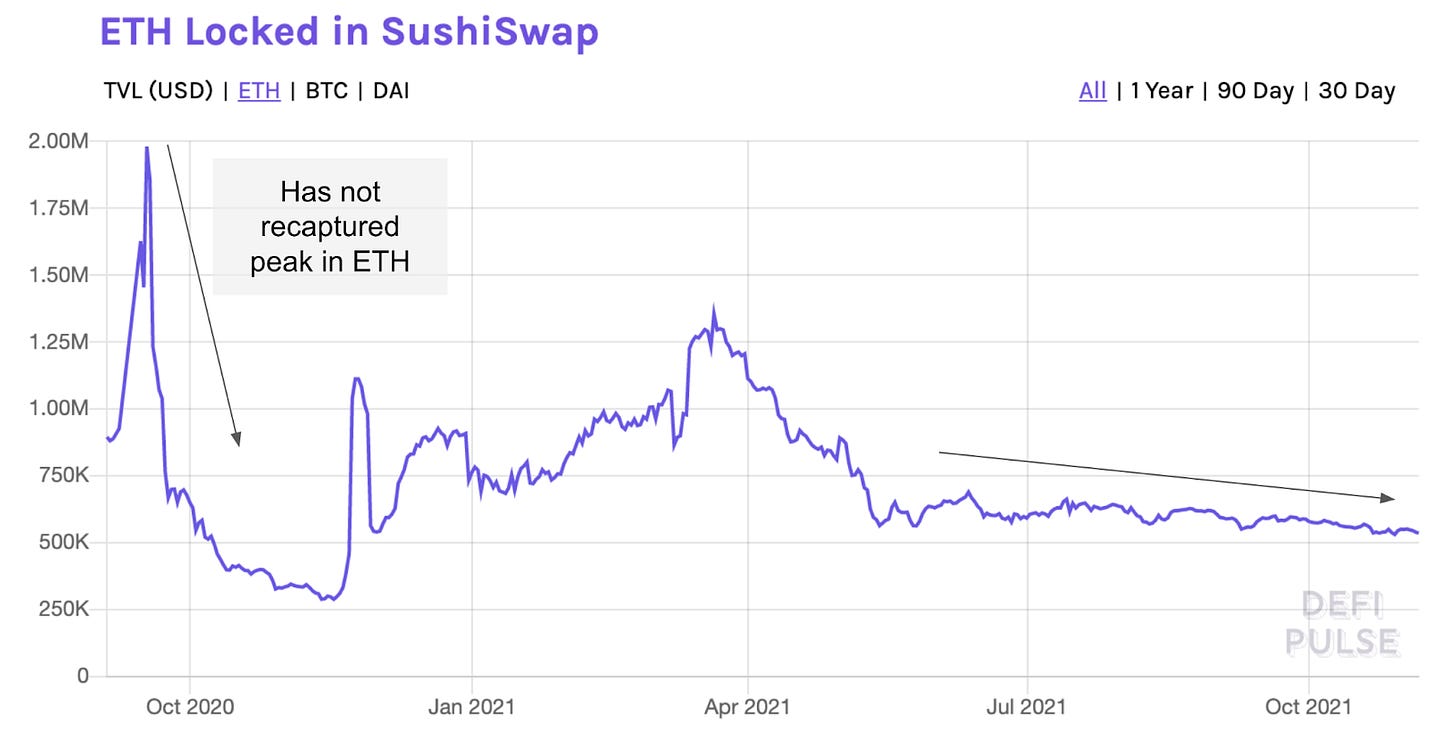

Chef Nomi handed over the keys to SBF, who created a new board to handle SushiSwap. A week later, Nomi also returned all 380K ETH. A day after that, he was never heard from again. Although the new board of “Masterchefs” has helped push SushiSwap forward with new product launches, it is not what it once threatened to be. It has yet to recapture the 2M in ETH locked in the protocol at launch.

Part Two - Pancakes

Just as the SushiSwap drama was abating, PancakeSwap (PS), another fork of Uniswap, launched in late September. PS is built on the Binance Smart Chain (BSC) instead of Ethereum. In doing so, PS trades off centralization for much better scalability, resulting in lower fees. Where a Uniswap transaction is subject to Ethereum’s expensive gas fees, PS trades execute cheaply. The PS docs want you to believe it is decentralized because “you have 100% ownership of your own crypto.”

However, the system is running on 12 servers at Binance. The BSC White Paper calls these “a few trusted nodes.” But what happens if Binance wants to change something? It can rewrite history. The trusted validators are all connected to the exchange to this day. Therefore, whether PancakeSwap is truly a DEX is the subject of debate. Dune Analytics does not include it in DEX analytics. CoinGecko does. For most, PancakeSwap is considered to be a leader in the Centralized Decentralized Finance (CeDeFi) space.

Whatever the categorization, users seem willing to make the tradeoff. Fast forwarding to the present for a second, PancakeSwap trading volume on some days surpasses Uniswap.

But, at launch, PancakeSwap included a complex SYRUP rewards system that had a bug the team had to address. It was not created as carefully as Uniswap, with review from RV, Vitalik, and blockchain security experts. As a result, early on in PancakeSwap’s life, instead of siphoning TVL or trading volume from Uniswap, PancakeSwap mainly served to increase exposure to the Binance audience to the long tail potential of permissionless exchanges.

In sum, Uniswap came out better on the other side of the SushiSwap and PancakeSwap forks. October trading volume was nearly double August, and has continued to grow since. A more nervous team might have overreacted to the simultaneous assault from SushiSwap and PancakeSwap. The Uniswap team did not.

Lesson 11: Quickly Take the Best From Your Competition

Instead, the Uniswap team took measured learnings from the competition, then quickly acted upon them. In particular, seeing the success of $COMP and $SUSHI, Uniswap launched its own token, $UNI on September 16th. This was mere weeks after SushiSwap’s vampire attack. The team acted fast.

Things are written in open source for a reason in web3. It is part of the ethos of building in this space to take the best of what others are doing. It is less copying than the table stakes growth strategy in the web3 world powered by builders moving at the speed of light.

With the announcement, Uniswap went from a protocol to a Decentralized Autonomous Organization (DAO). The $UNI token is a governance token, though designed to constrain governance to where it is strictly necessary to continue to embrace the philosophical tenet of trust minimization. Now, $UNI holders govern the protocol. It is publicly-owned, self-sustainable financial infrastructure. This includes governance of the community treasury, which has several billions $USD value in it.

In the initial, or genesis, allocation, 60% went to the community, 21.5% to the Uniswap team, 17.8% to investors and 0.7% to advisors. As some of the tokens were retroactively allocated, it has been called “the peak” of yield farming in late 2020. As UNI began trading on exchanges, it quickly hit $8 a coin. As a result, the initial 400 UNI rewarded to 50K ETH addresses was worth $3,200 USD for each.

Taking the best from its competition worked for Uniswap. While most DeFi applications hit DeFi winter at the end of 2020, Uniswap kept chugging. Many projects saw values down 70-90%. Uniswap, on the other hand, finished the year with monthly trading volume up 202x December compared to January.

Lesson 12: Never Stop Building #Buidl

2021

Although 2021 has seen comparatively less drama, the Uniswap team has sped up its pace of shipping. The results speak for themselves. Between January and the last full month, October, trading volume measured in $USD has increased 2.3x. 130% growth is Snowflake level. And the year is not even done. And Uniswap only has 40 employees. Uniswap is a classic product rocket 🚀.

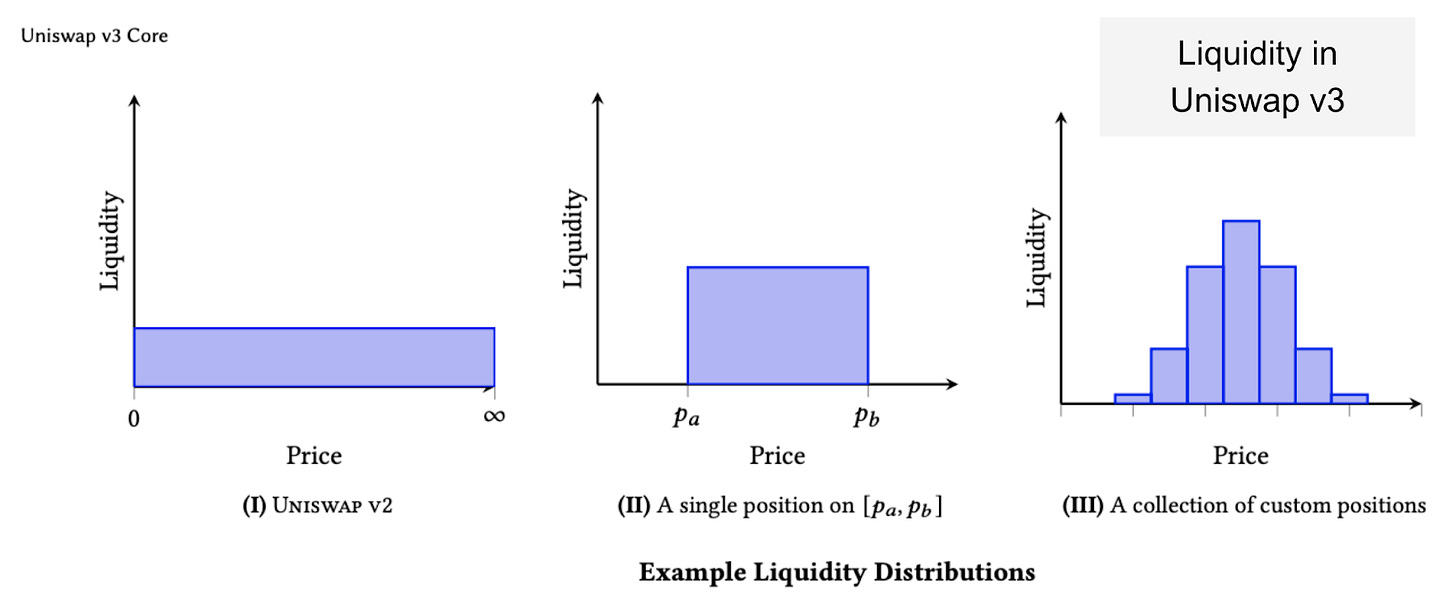

Uniswap has become a product rocket through relentless focus on innovation. In May, the team released Uniswap v3. It has loads of improvements. The most important is the concept of concentrated liquidity. In v1 and v2 of Uniswap, liquidity was provisioned for the entire trading range. As a result, 25% was never even touched unless the trading pair experienced a price distortion greater than magnitude of 16. This resulted in a calculated capital efficiency (daily volume / liquidity) of 26-28%. v3 dramatically improves capital efficiency to 76% by allocating liquidity to the most traded ranges.

This means that, with much lower TVL, the exchange can facilitate much higher trading volume. As Uniswap v3 ramps to 100% of Uniswap volume - today it is ~60% - TVL will become, increasingly, a vanity metric, to be replaced by trading volume. You will notice the shift in metric usage manifested in this article.

One of the big pieces of feedback to v3 was that it seemed harder to use. By having to target trading ranges, it stepped away from the simplicity of the automated market making in v1 and v2 that catered to the everyday user. In July, the team released auto fee tier selection and liquidity range charts to help democratize the process once again.

As the year progressed, PancakeSwap continued to gain momentum. Users could not pass up the long tail token access combined with low fees and fast transactions. Instead of sitting on their hands and waiting for ETH v2 to provide similar speed and fees, Uniswap began to build layer 2 solutions that managed to provide similar speed and fees without the sacrifice of decentralization that PS makes.

In response, in July, Uniswap launched Alpha on Optimism. Optimism is where Mr. Miyagi, Karl Floersch, is now CTO. Readers to this point know not to doubt Mr. Miyagi. Then, in August, Uniswap launched Alpha on Arbitrum. Pickup of these layer 2 solutions has been swift.

By September, each was doing more than $5M in daily trading volume. As a result, both were graduated to Beta, and supplemented with additional ease-of-use UX enhancements. In October, Hayden even said, “L2 season is here.”

https://twitter.com/haydenzadams/status/1450149479403958276

Present

DeFi has emerged as a “killer app” for blockchain technology. And Uniswap is the seventh biggest DeFI, representing ~7% of the locked-in value. As we know, TVL is not everything. Being the top DEX by trading volume, Uniswap has cemented itself as one of the most important projects in the DeFi space. Lending and trading are the two main use cases of DeFi today, and Uniswap is the leading trading player.

The protocol & DAO exemplify Ethereum’s ideals - decentralized, permissionless, and censorship-resistant. As a result, Uniswap has crossed half trillion in cumulative trading volume. If you do not count PancakeSwap as a DEX, Uniswap still maintains 60% of DEX market share. Regardless of the categorization of PS, Uniswap is #1, followed by either PS or SushiSwap.

PS has risen the wave of its new products like a lottery service and a NFT art platform. Versus PS, Uniswap represents a much purer implementation of the decentralization ideal of Ethereum and crypto generally. As Vas Rel Por said, “BSC sacrifices future innovation for today’s throughput.” As ETH v2 comes out and layer 2 solutions mature, Uniswap will benefit from that future innovation.

Versus SushiSwap, Uniswap also has a more focused strategy. SushiSwap has lending, a coin launcher, and NFT platform. Uniswap focuses on the exchange and dApps. Importantly, neither SushiSwap nor PS have Vitalik, Karl, and Hayden in their corner. Those are the three actually responsible for the innovation of Uniswap so far, andI expect them to drive the innovation in the future.

So, how valuable is Uniswap? The market cap of the UNI token stands at about $16B as of publishing. UNI token holders do not currently generate any fees from trades on the platform. But liquidity providers do generate 0.3% on all traded volume. Annualizing October’s $61B in trading volume, Liquidity providers for Uniswap are earning at a $22B run rate. That is nearly triple Coinbase’s annualized $8B revenue. 🤯

Future

Part One - Trading

Have you tried to sign up for a centralized exchange recently? It is a horrible experience. Until recently, the darling of the crypto world, FTX, had you enter your address three times. Gemini, Kraken, Coinbase and Binance all take days to verify who you are and meet Know Your Customer regulations in Anti-Money Laundering laws. Uniswap allows anyone to trade immediately. The user experience is 10x better from a trading perspective. Once fees come down and speed comes up, it will be a no brainer.

For layer 2 options like Arbitrum and Optimism, the fees are low and the trades fast. So expect those to drive Uniswap to continue to take trading market share from centralized exchanges. The benefits of immutability, being permissionless, and decentralization are simply too core to the entire crypto ethos for the centralized exchanges to stick around.

Also expect both forks - SushiSwap and PancakeSwap - to suffer as Uniswap v3 continues to propagate. v3 has a different license that prevents forking for two years. So, the capital efficiency of v3 is set to help Uniswap steal back trading volume market share over the coming months.

When ETH2 finally launches, then Uniswap is really set to take off, not only compared to the Binance Smart Chain, but also centralized venues like Coinbase and FTX. It will offer better speed, lower fees, with all the decentralization benefits.

With the Uniswap treasury stocked with multiple billions of dollars, we can expect the protocol to fund promising applications to only further improve the value of the Uniswap ecosystem - just as the Ethereum foundation funded Uniswap.

Part Two - dApps

In addition to trading, Uniswap has solidified itself as a crucial primitive in the DeFi Stack with the release of v3. Because of the efficiency of market arbitrageurs, any Ethereum app can call directly to Uniswap to understand the price of any trading pair. Traditionally, the crypto ecosystem has had to rely on Oracles for such information, since the Ethereum Virtual Machine does not interact with the outside world or APIs. Now, Uniswap can be that crucial building block.

One can imagine any app that is offering a financial product to use Uniswap as a shared layer, provided they are building on Ethereum. Uniswap becomes the Oracle to check the USD price of ETH, for instance. It lets any app swap assets in a trustless way. So any app, for example, with a liquidation layer, can rely on Uniswap to sell assets for a “fair market value.”

This is an exciting future, as DeFi increasingly becomes about more than just lending and trading, but actual borrowing and other financial use cases. Uniswap is set up to be a key player in this DeFi ecosystem to come.

Parting Takeaways - Building for web3

What are you waiting for? As the Uniswap story shows, the key is to take the leap to embrace the future and begin building (Lesson 1). Anyone can build for web3 (Lesson 2). Engage with the community (Lesson 3), prioritize security (Lesson 4), and solve a big, unfulfilled problem (Lesson 5). The rest will follow.