The Next Austin or Salt Lake? The Triangle, NC

A Rising Tech Ecosystem

The Triangle is slated to be the next Austin or Salt Lake City. I ran the numbers and analyzed the companies to find out.

The area has seen over $2B of venture investment in just the first three quarters of 2021.

Yet, whenever I talk to my friends on the coasts, they tend to have a hazy picture of the Triangle. They have heard the fundraising numbers. But they do not know the companies.

Having moved to the Triangle 3 years ago after a decade in the Bay Area, I wanted to share some of the amazing companies in the Triangle.

In particular, the Triangle has stellar founder-led software companies at every level. Here are a few of the companies I have gotten to know that I want to highlight:

Startups (<50 employees)

ndustrial, led by Jason Massey

Device Magic, led by 🏏 Dusan Babich

Medium, funded companies:

Spiffy — On-Demand Car Care, led by 🐧 Scot Wingo

Levitate, led by Jesse Lipson

ServiceTrade, led by Billy Marshall

Teamworks, led by Zach Maurides

Spreedly, led by Justin Benson

>$1B market caps:

Pendo.io, led by Todd Olson

Bandwidth Inc., led by David Morken

>$10B market caps:

Epic Games, led by Tim Sweeney

SAS, led by Jim Goodnight

Venture Capitalists:

Bull City Venture Partners, led by Jason Caplain and David Jones

Cofounders Capital, led by David Gardner

I want to share the love for these amazing companies and founders. 👏

Student looking to work in tech in the Triangle? Investor considering the area? Professional considering a move to cheaper cost of living? These are the first companies I would consider.

When you add up all the folks from these companies, plus all the others, it amounts to about 100K people self-reporting they work in technology on LinkedIn.

Taken over the Triangle’s 2.1M people, that makes for a 4.8% techie density. That is ahead of Atlanta, NYC, Charlotte, Chicago, Detroit, and Miami. But it is behind the Bay Area, Seattle, Salt Lake, Boston, and Austin.

How did WeWork Turnaround?

WeWork – $WE – is a public company now. What happened in the two years between pulling its initial IPO and eventually going public?

After the IPO was pulled, Softbank stepped in, and Adam Neumann was pushed out. Originally the reporting was a $1.7B price tag.

But, after all was said and done, Adam received~$845M cash: $745M for shares, $50M for legal fees, a $50M special payout + a $430M credit line.

After injecting WeWork with emergency capital, Softbank was left with a company valued at “zero,” per Marcelo Claure, chariman of WeWork & COO of Softbank.

They installed Sandeep Matrani as CEO of WeWork. Perhaps no man in the world could be more credentialed: he was formerly CEO of two public real estate companies, including the highly prestigious Brookfield Properties Retail Group.

Matrani has cut $1.9B of yearly costs:

1. Exited vanity projects like Welive, Wegrow, and Risebywe

2. 2/3rd of staffers were laid off

3. SG&A is down from $823M in Q4 ’19 to $225M in Q2 ’21

He has also refashioned the company “space as a service.” WeWork has a $100M software biz even. Now, the company is certainly not worth zero. Mathrani has completed a remarkable turnaround.

The SPAC deal gives $WE an equity value of ~$8B, and it is up about 11% as of publishing, giving it an equity value of ~$9B. Of course, this is lightyears away from the $47B IPO the company attempted in late 2019.

The company continues to burn cash, with a net loss of $923M in the second quarter. Without the SPAC, the company would run out of cash. The SPAC does improve the cash position, and the company believe will set it on the road to profitability, as soon as next FY.

Recent metrics do support this improving picture:

1. September was the best revenue and YoY growth month of 2021

2. Total occupancy continued to trend upwards at 60% at the end of Sep, up from 52% in Q2

3. Enterprise 12+ month commitments are >50% of the biz

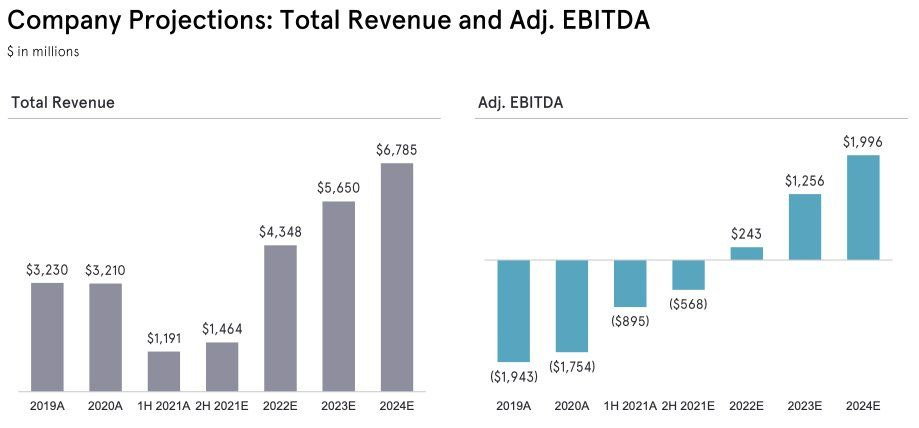

So, is WeWork worth the investment? If it hits its 22 estimates, it would trade at 2.5x FY22 sales, and 45x FY22 Adj Ebitda.

That’s not bad. So, WeWork is really a covid value rebound play. As the return to office materializes, WeWork will benefit. Take London. WeWork has <1% of the office space, but accounted for 37% of the leasing activity

Why did Vivek Ranadive – owner of the Sacramento Kings – take WeWork public via SPAC?

“If you think about companies that could be worth $100B, WeWork is that kind of company.”

The Bull Case for Rent the Runway

We’ve all heard the bear case on Rent The Runway ($RENT post IPO), but what about the bull case? 🐂

1: Covid Rebound Value

2: Strong Team

3: Organic Grower

So we understand, what are the most compelling parts of the bear case?

– Declining revenue

– Tough unit economics with inventory costs (clothes wear and need to be procured)

– Weak cash position is forcing IPO

So, how can the business still be worth investing in?

1: Covid Rebound Value

Although revenue and subscribers are down, that’s because the value prop is for workers who are still WFH. But these city folks are going to have to dress well again, and RTR will be there for them. It’s one of the few businesses YET to fully bounce back.

Before Covid, the business was a steady grower. We might expect it to run to those types of rates once the world returns. H1 saw 16% YoY subscriber growth, starting down the path. It’s a Value Tech Stock, IPO’ing. That’s a unique opportunity.

2: Strong Team

As a tech growth company, one of the key elements to evaluate is the team. Since the earliest days of founding the company at HBS, the team at RTR, led by Jennifer Hyman has demonstrated unusual grit, ingenuity, & innovation.

This started with Jennifer’s 2008 meeting with Diane von Furstenberg. It has extended through 2011’s launch of a vertically integrated fulfillment center, 2014’s reusable packaging, 2016’s unlimited subscription, and making it through the Covid storm in 2020. One might expect the team to continue the innovation and grit post IPO.

3: Organic Grower

The company spends remarkably little on marketing. For every dollar spent on marketing, it spends 2.7x on tech.

It is growing through two sided network effects & product. That type of growth generates improving margin profiles as the business scales.

In sum, RTR is still early – capital from the IPO could help it rebound.

The product is ahead of its time. It helps consumers be more environmentally conscious, dress better, and save money. This should help it address the bear case criticisms over time.

What do you think – would you invest?

Scott Galloway wasn’t even sure RTR will make it public, after analyzing the S-1. As someone who has been watching their product innovation for over a decade, it sure will be interesting to watch.

Eren Bali: The Next Elon Musk or Jack Dorsey

Eren Bali has built not one but two multi-billion dollar companies – Udemy and Carbon Health. His story is fascinating.

Udemy

Eren grew up in a small village in Turkey. As a kid, he kept his asking his parents for a computer. Finally, in 1998, as a teenager, Bali’s family got a used computer.

Eren’s new device delivered on his wildest dreams. Eren used it to level the playing field and learn, studying up for his math competitions. He deeply got to learn the power of the internet. Eren went to get a degree in mathematics, thanks to online learning.

In 2007, Eren and his longtime friend Oktay Caglar built software for a live virtual classroom. They saw potential in the business.

In a bold move, they moved to Silicon Valley to double down on their dreams. They linked up with Gagan Biyani and founded Udemy in 2010. Udemy was and still is a platform for instructors to build online courses.

In 2012 it raised a series B. In 2014, Eren stepped back from the CEO role to become chairman. The Udemy rocket would continue. The company has had exponential growth in learners:

1M learners in 2014

10M learners in 2017

44M learners in 2021 – 44x in 7 years

But that is just the B2C side of the business!

In 2015, Udemy launched a subscription product for business. Udemy Business (UB) is the ace in the hat for this unique investment opportunity. UB is now up to $182M in Q2 21 ARR. It had 80% growth YoY. 🤯

So how do the numbers all add up?

↗️ The consumer business is on an exponential curve.

🔁 The Net Dollar Retention Rate on the subscription business is 121%.

💰 2020 FY revenue grew 76% over 2019.

📠 The company generated over $141M in gross profit just in H121.

Back to Eren. Now that we know Udemy, what about his other company?

Carbon Health

After he stepped away from the CEO role in 2014, Eren spent three months in Turkey to help his mother. He saw first-hand inefficiencies in health care.

In 2017, Eren joined forces with former ER doctor Caesar Djavaherian. The two set out to build a company to make health care affordable to as many people as possible.

Carbon Health was born. The company combines brick-and-mortar clinics with app-based telehealth. It has since grown more than 39,734 percent over the past three years. It brought in more than $45 million in revenue in 2020.

Eren describes it as “a full-stack, omnichannel primary care provider with an obsession for inclusion and being accessible to everyone.” Now, there are more than 81 Carbon Health Clinics in 11 states, with 1,500 more planned by the end of 2025.

Eren never stops thinking big.

Like Udemy, Carbon Health is headed for IPO. Carbon Health was last valued at over $3B. “Our business model demands that we grow as fast as possible,” Eren says.

Can’t wait to get the next S-1 from this next Steve Jobs / Elon Musk / Jack Dorsey type. 🙌