The World's Most Valuable Per Employee Company: Supercell

When it comes to legendary cultures, and small teams redefining industries, Supercell is a shining example. Last week, The Information reported Tencent is in talks to buy out the remaining 16% of external investors in the Finnish gaming super company. In the process, it plans to mark up Supercell’s value to $11B.

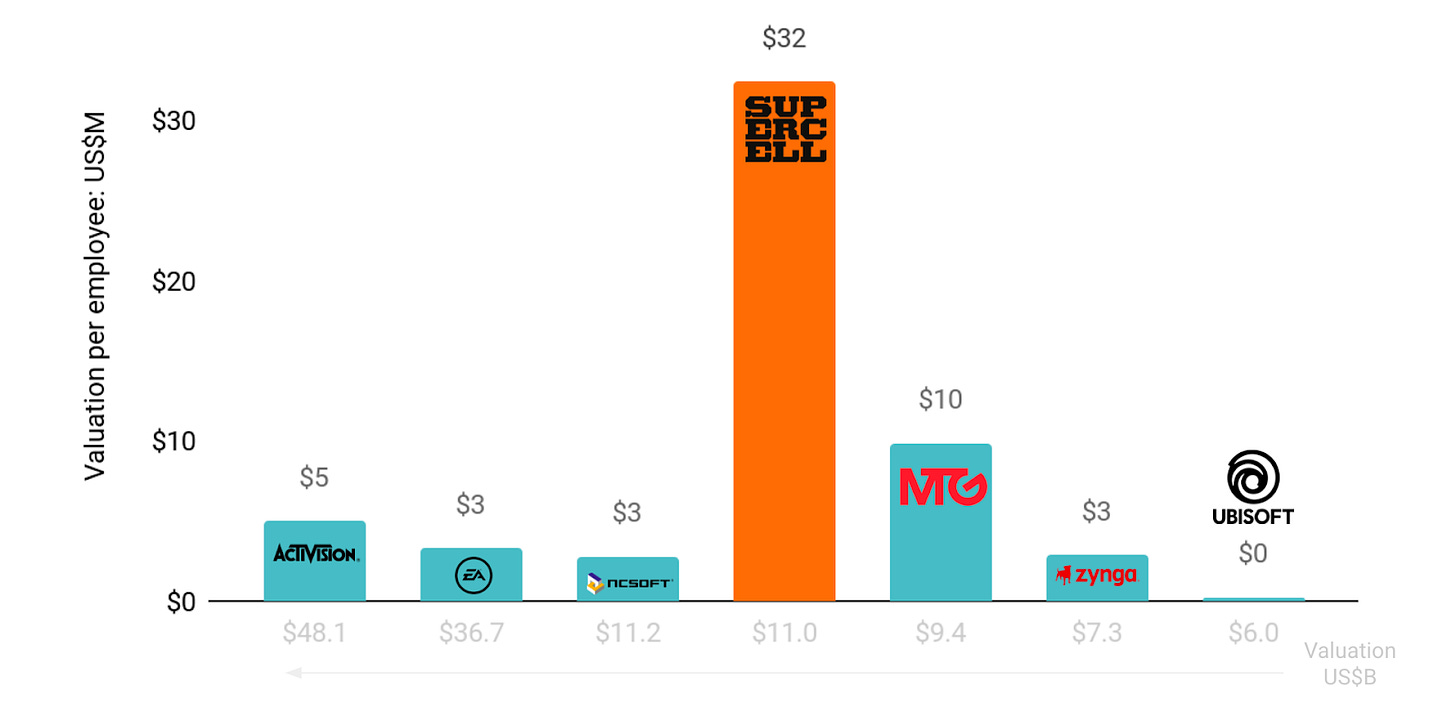

Supercell only employs 340 people. It has achieved a valuation of $32M per employee. You would be hard pressed to find a company in any sector anywhere in the world with a higher valuation per employee. Common examples when I searched and asked around include Shopify, $6M per employee as of publishing, and Apple, $18M per employee. Supercell blows them out of the water.

It is also higher than any comparable gaming companies in that valuation range. The closest is another European gaming company, Modern Times Group out of Sweden, at $10M per employee. The well-known American gaming companies are far behind: Activision at $5M, EA and Zynga at $3M. Supercell has created value per employee unlike any company in the world.

It continues to make shrewd moves to earn that valuation. Most recently, it sponsored Mr Beast’s real-life Squid Game YouTube video. The show was the most watched ever on Netflix. And, like the hit show, Mr Beast’s video had 456 people duke it out for a big cash prize. Of course, unlike the show, this time the games were not deadly.

The video was one of 2021’s breakout videos on YouTube. It broke almost every record in YouTube’s books. Among them: it was the fastest non-music video to surpass over 100 million views, a feat it pulled off in less than 4 days. As of publishing, 4 weeks later, the video has over 175M views. The Netflix show has had 142M viewers. So Mr Beast’s YouTube video has had more reach than the hit Netflix show. That is mind blowing.

As one of the most popular YouTube videos of all time, Mr Beast’s video can be expected to achieve many more milestones over its life. And, forever, Supercell’s Brawl Stars will be branded at the center of its prize pool. It was a huge moment for the game.

And it is a huge win for Supercell as a company. In the first week after the video was released, first time downloads of Brawl Stars saw a 4.5x surge week over week following the video. For a game that already has $1.4B in lifetime revenue, the new players will be a reinvigoration for the player base and developers alike.

Plus, Mr Beast’s video is likely to be the gift that keeps on giving. It is expected that the video has a long tail of views over its life. It would not surprise me if the video eventually surpasses 1 billion views.

As a result of Supercell’s shrewd move, along with many other things, Tencent is making the move to buy out other investors. But the $11B valuation is not all good news. The company had reached an implied valuation of $10B all the way back in 2016, when the first part of Tencent’s transaction to acquire 84% of the company happened.

Since then, yearly revenue at Supercell has actually decreased. That is remarkably mediocre performance, especially considering nearly every gaming company saw a gigantic bump in the Covid-lockdown year of 2020. So, what is the Supercell story? Let’s explore together:

How did it rise to be a Decacorn in just 6 years?

What happened to flatline it in the ensuing 5 years?

Can Supercell return to growing its enterprise value quickly?

Along the way, we’ll point out all the product growth principles the company used to be the highest valued per employee company I have ever analyzed.

The Supercell Story

Chapter 1 - Gaming Vets

A small nation of 5.5M, Finland can fly under the radar. In Bored Panda’s survey of American geographical knowledge, not a single one of the 33 participants could place Finland on a map. Probably not a stretch for a country in which 69% of citizens cannot place the world’s top tourist destination, France.

In 1999, Finland was, in the tech world, not so under the radar. Nokia, at the time one of the world’s biggest brands and mobile device makers, was a Finnish company. This led to several mobile companies succeeding in and around the Nokia ecosystem.

Moreover, gaming is one of the world’s truly global industries. As a result, Finland had its pockets of successful game studios since the 90s. Many were the types of places that made enough money off their games to employ game teams of 10-15.

One such place was headed by Mikko Kodisoja. Together with a group of game industry veterans, he co-founded the studio Sumea.

The next year, Mikko wanted to double click into game design. A game builder at heart, he wanted to outsource all the other activities to someone else. The rest of the team agreed. So they put up a job listing for a job without any pay to start, to do everything else in the company.

The job had a single applicant, Ilkka Paananen, a senior in college. After having started college with dreams of becoming rich as an investment banker, he actually changed his mind part way through his courses. He realized that a better path to riches more suitable to his personality, instead of what everyone else wanted to do, was to become an entrepreneur.

So when Ilkka saw the job posting, he actually thought it was perfect. Here was a group of veterans who wanted to start a company. That was exactly the type of technical resource he was looking for. It is fun to hear Ilkka tell the story:

Before I finished university, I decided I wanted to become an entrepreneur. Then, I stumbled up on these guys who wanted to set up a company. That company happened to be a games company. All these guys wanted to do is develop games. And they wanted someone else to do everything else. They could not afford to pay any salaries. So there was just one applicant, me.

The group of game devs headed by Mikko took their single applicant. Ilkka was hired, without a salary, and history would ensue. Ilkka did all the non dev work.

The Sumea team was very early to the mobile space. Their first game was not only a good game, but had a strong distribution strategy. Racing Fever was considered the best mobile racing game at the time, and Ilkka and the business guys secured carrier based distribution across the world. It was quite the coup for the fully self-funded game made by a group of guys in a dark room on the outskirts of Helsinki.

In particular, the visionaries would benefit greatly from their connections with Nokia. They would grow alongside the Finnish handset maker and create several of the first professionally produced mobile games. These games helped the company live through the dot com bubble and crash. Eventually, the company grew to 40 devs. In 2003, the company made over a million euros in profit.

On the back of its success, Sumea was acquired in 2004 by the founder of EA, Trip Hawkins, new studio, Digital Chocolate. Ilkka and Mikko became rich in their 20s.

They tasted games industry success, but they were not about to stop. Both worked. Ilkka served as president and Mikko creative director until 2010. They grew Digital Chocolate to nearly 200 devs. They got to see the EA way of building games, and both also did some games industry investing.

As hardcore industry participants, they also got to see the amazing impact of the launch of the iPhone in 2007. The touchscreen made the games much more easy to play, and controls could be architected in a fun way.

Then, in 2008, when the App Store launched, they got to see the revolution in distribution. Suddenly, games were not distributed as preloads by carriers. They were downloaded by volition of the user. These seismic changes in the mobile gaming landscape would be seared into Mikko and Ilkka.

Eventually, Mikko left. And Ilkka followed shortly thereafter. Ilkka tried his hand at Venture Capital at Lifeline Ventures shortly. There he learned the power of funding teams and letting them operate autonomously. But he quickly realized that doing so as an operator would suit him better.

The two got back to talking, and decided they wanted to create a different type of games company.

Chapter 2 - A Room of Game Devs

Ilkka and Mikko teamed up with some of the other great game devs they had gotten to know in the industry: Petri Styrman, Visa Forstén, Lassi Leppinen, and Niko Derome. Petri and Visa had been with Ilkka and Mikko since the Sumea days. Lassi and Niko joined in the Digital Chocolate days. Before Digital Chocolate, Lassi worked at Remedy, another Finnish gaming success that is now a publicly traded company (valued at $500M USD). Niko had previously worked at Sulake, which had created a predecessor to the metaverse with its Habohotel.

Like most of the history up until this point, there is remarkably little about this period on the internet. Despite the number of important companies for its relatively small population, Finland tech was not nearly as well written up as American tech in that period. The best we have is a sole tweet, which has 1 like - from me.

https://twitter.com/nestafo/status/37928984830287872?s=21

Being a set of grizzled veterans of the industry, the founding group came together with several opinions about what the company vision should be. The team ultimately coalesced on a few key principles:

The best teams make the best games

Small and independent cells

Games that people will play for years

As a result of the three principles, and in particular the cell concept, the group decided to name themselves Supercell. Ilkka and Mikko chipped in 250K each, the Finnish government’s technology funding arm invested 400K, and Lifeline Ventures invested several hundred K. With funding in place, the team was ready to begin work.

All three of the core principles are with the company to this day. It is remarkable how that founding DNA has stuck with them. The founders had learned from their analysis and experience in the industry. The first product is still the final product today.

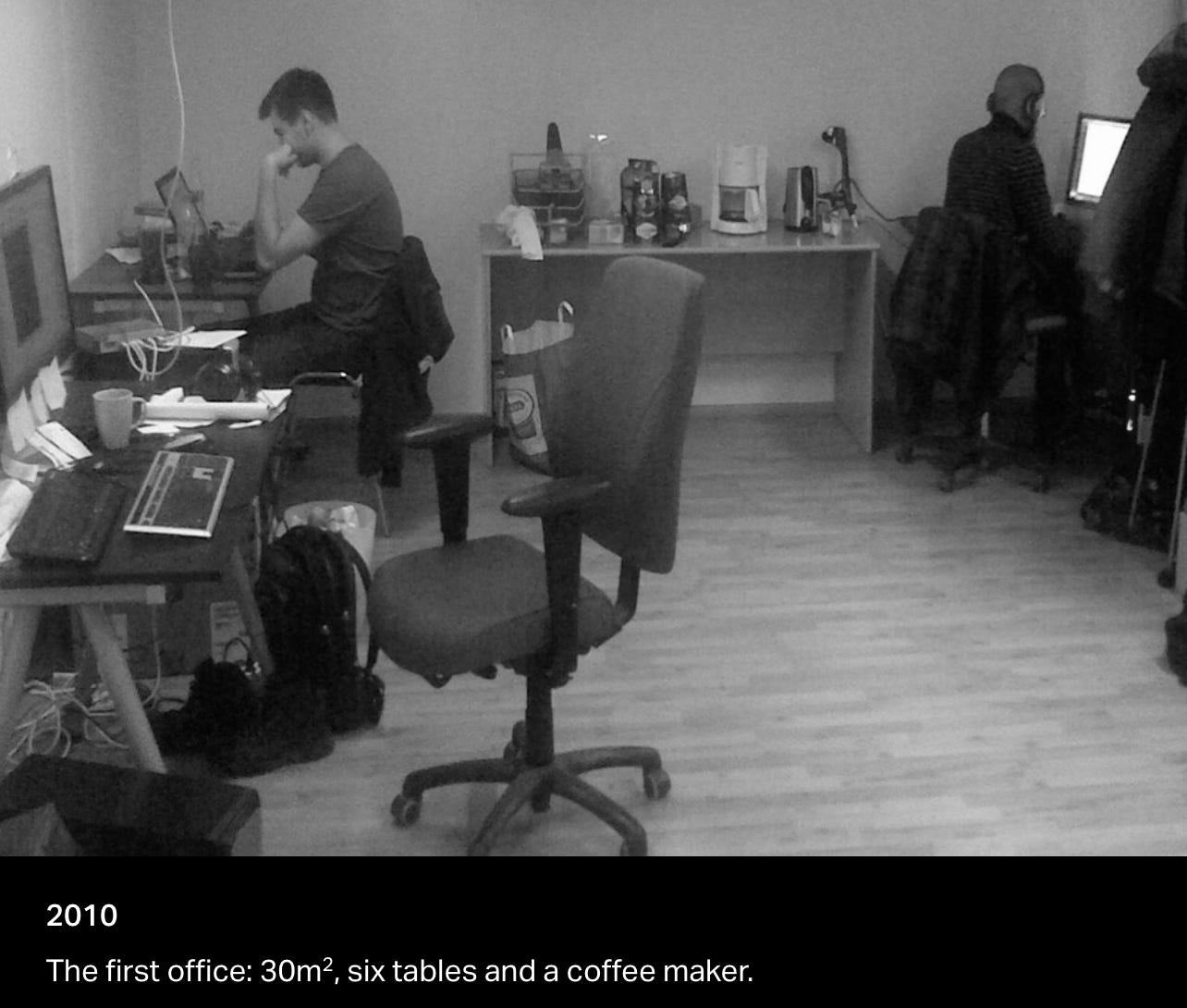

The company rented out one 30 square meter space in the suburbs of Helsinki, a place called Espoo. It’s a business suburb near Nokia’s headquarters. Furnished with six desks from a nearby recycling center, and a coffee machine, the team was ready to build.

They got to work on a game called Gunshine.net. It was a real-time massively multiplayer online role-playing game (MMORPG). The devs, and the industry at large, at the time were obsessed with World of Warcraft (which had released 6 years earlier in 2004 but was still going strong). So, they tried their hand at a game in the genre.

The team started with the largest platform at the time, Facebook for desktop web. As a result, they built the game on top of Flash technology. As they were building, they had to hire more developers. When they got to 15 people, Ilkka sat on a cardboard box in another room. The team was scrappy.

The team stood up the game quickly, launching private beta in 2011. The game did well. At it is peak, it had 500K monthly active users. The game was then rebranded Zombies Online. But the name change could not save the game.

They realized that the game, although it had a lot of initial excitement, was not retaining players after a few months. It would not be a game played for decades, a key part of the vision.

In addition, it was too hard to get into the game. Players who played had played a similar MMORPG like World of Warcraft. But new players were not joining. So it could not be a mass market hit, another part of the vision.

The final nail in the coffin of Zombies Online arrived when the devs had a box of iPads delivered to the office. They started calling it, “the ultimate games platform.” Everyone was having fun with the form factor and controls. It was an, “aha!” moment for the team.

The team decided to bet the company on that insight. In the fall of 2011, they killed all the ongoing productions for Web and Facebook, including Zombies Online. The company had already begun developing several games, so it was a big decision.

The biggest hard sacrifice for the team was killing an ongoing production codenamed, “Magic.” Magic was worked on by a team of 5 day and night for six months, and everyone in the office was excited about it. It was completely new for Facebook gaming. But it was not a fit for tablets. So the team killed it.

The team made several similar hard choices. But it was the right decision. The company shifted to a, “tablet first,” strategy which shortly thereafter became a, “mobile first,” strategy.

Chapter 3 - 2 Hits In a Year

2012 would prove to be the year the small team would change Gaming history forever.

By early 2012, the company had 5 teams building games. As they learned from the Gunshine failure, they wanted to kill games that did not work early. So they killed two games in February and April, Pets vs Orcs and Tower.

One game not to get killed was Hay Day. In May, they released the game in beta to Canada. From the get go, the game was a hit. Downloads and player engagement were far better than any of Supercell’s other games. They thought they might finally have a hit on their hands.

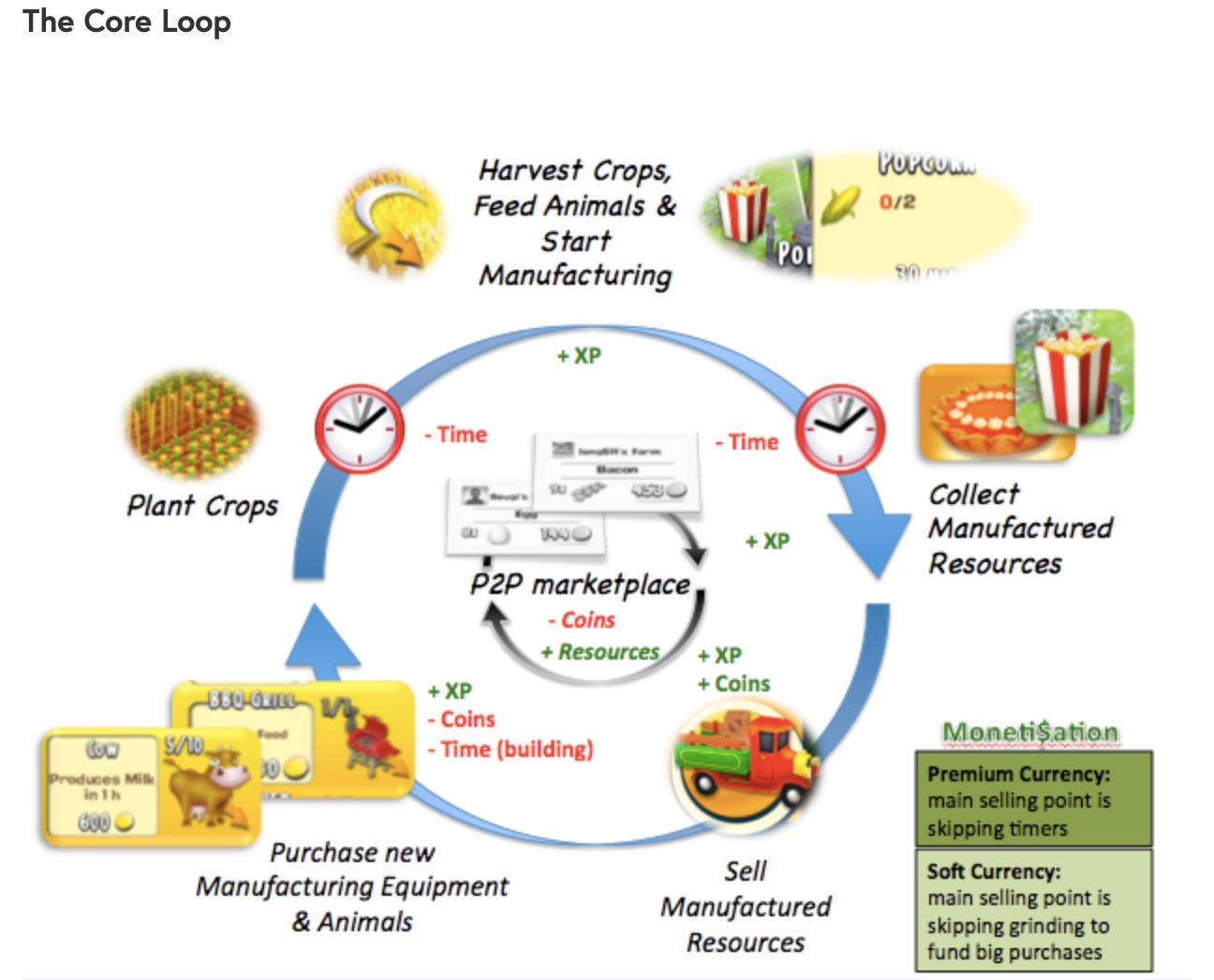

It was a perfect encapsulation of farming on mobile. The game asked players to harvest crops, feed animals and start manufacturing. This cost them time but gained them XP. From there, players collect manufactured resources, then they sell them. This allows them to purchase new manufacturing equipment & animals, to plant more crops, and start the process over again.

The game was launched globally on June 21st. June 21st is a special time in Finland. It is Midsummer’s Eve, one of the largest public celebrations. The game was such a massive success that the entire staff had to supplement the player support team by answering tickets while on holiday. The game was that much of a success.

Today, Hay Day is still alive and well, operating as a profit center. As it had set out to be, it is a true mobile farming sim. 9 years after launch, it is still one of the best. It has had lifetime revenues of over $2B. The team has nearly hit the decade mark it had set out to. It is also Supercell’s game most played by females.

But returning back to 2012, the team was not as certain of success. However, the next game to go to beta was also promising. Built by the same team which had built the Magic game that Supercell was sad to shelve the year earlier, everyone was hopeful. The new game from the team was a real-time strategy game that had done very well on other platforms, but had not yet done well on mobile.

The game? It’s the one you’ve probably heard of: Clash of Clans. Indeed, the second important game released by Supercell that year is one of the most important games in the history of games.

Clash would have all the characteristics of a game that are now archetypal Supercell. You collect resources to build, train, & battle. Gems can either be earned or bought. And, at its core, it is the genre Supercell is best at: PvP brawler. As a brawler, the game was a bit more male than Hay Day, and it also attracted an older audience.

The older, mass audience helped the game monetize well. Players loved gems. Three months after global launch, Clash of Clans would become the #1 grossing game in the US.

The fifth game Supercell worked on that year, Battle Buddies, was axed. Like many Supercell projects, it did not have high enough retention metrics in beta.

Chapter 4 - Kings of the World

By 2013, Forbes published a piece asking, “Is this the fastest growing games company ever?” TechCrunch noted that the company pulled in over $100M in a quarter with less than 100 employees. Both Hay Day and Clash of Clans were hit games.

Clash especially was a money maker. In 2013 and 2014, it was the most profitable mobile game in the world.

Even at the time, the press wanted to know if Supercell would scale its headcount. But Ilkka had a different vision for the company. As he said in an interview at the time:

I believe we have a pretty unique culture and organizational model, which is all based on trust in the best people, giving them freedom to do what they do best, and getting rid of all the unnecessary processes, overhead, and management that everyone hates. If in 20 years we can say that all of this is still true, then we have accomplished something great.

The goal was to long-term keep the company lean, based on the insights the team had gleaned from its prior experiences in gaming.

In 2014, the company released two games, one of which is still alive today: Boom Beach. It has grossed over $1B. Instead of Clash of Clans Tower defense mechanics, Boom Beach requires capturing the enemy HQ. As a result, it has a kind of capture-the-flag feel to it.

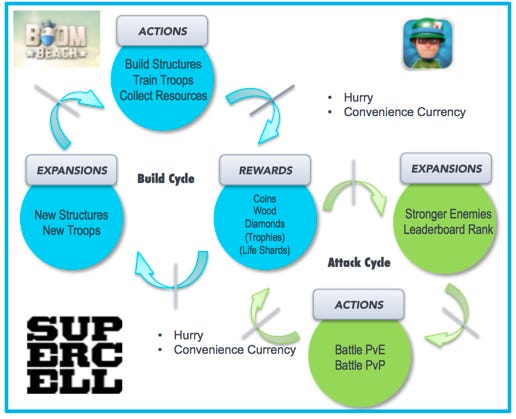

There is a build cycle and an attack cycle. In the build cycle, players build structures and take other actions to get rewards and then expand. In the attack cycle, players battle, which gets them rewards, and expansions like stronger enemies higher leaderboard rank. It felt like an evolution of Supercell’s core loops from Clash of Clans when it was released.

Clash of Clans, in particular, was the king of the world. It even had the fan favorite Super Bowl commercial in 2015. The team up with Liam Neeson highlighted the gameplay’s features, like PvP and barbarian character types, all while being hilariously played in a coffee shop under the playername ‘Angry Neeson 52.’

https://www.youtube.com/watch?v=GC2qk2X3fKA

Yep, the epic fourth Patriot Super Bowl victory over defending champion Seahawks. The Super Bowl where two top seeded teams faced off. The one where Tom Brady and the Patriots overcame a 10-point deficit during the fourth quarter to take a 28-24 lead with 2:02 remaining.

Yes, the one where the Seahawks nearly came back, until, on the last play of the game, Russell Wilson was intercepted at the Patriots 1 YARD LINE! Indeed, for a Tom Brady mega fan, Supercell had the best ad in the best Super Bowl of all time.

And, so, Supercell saw the massive impact that splashy marketing could have.

With three games buzzing - Hay Day, Clash of Clans, and Boom Beach - Softbank bought out many of the early VCs in the company to round out 2015. Things seemed to be going swimmingly at the company.

Chapter 5 - Clash Royale

In 2016, the company released Clash Royale. The game would smash records, with $1B in gross revenues in its first year.

Versus Clash Royale, Clash of Clans feels like a strategy action game. In Clash of Clans, your focus is to build a strong village, and defend it from real-world opponents. On the other hand, in Clash Royale, your focus is to destroy the tower of your enemy in tower defense format.

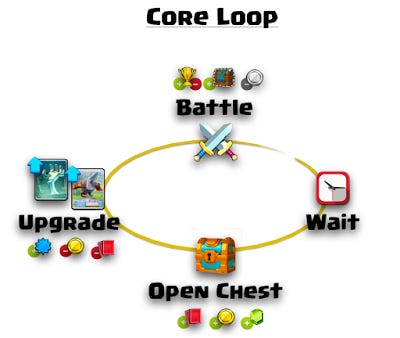

The core loop of Clash of Clans has a strong element of collecting and building. Clash Royale, on the other hand, was more action oriented. The core loop is battle, wait, open chest, upgrade, and then battle again. It takes collectible card game and multiplayer online elements to replace solo grinding.

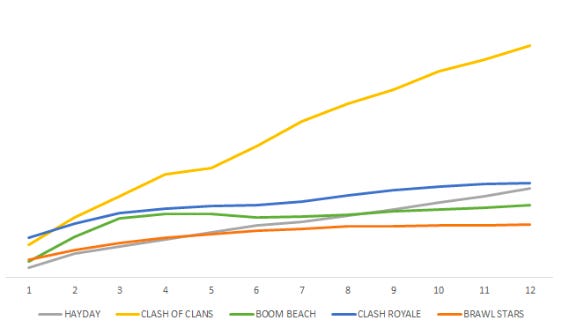

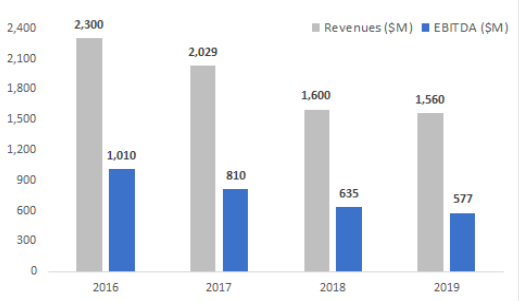

Based on Clash Royale’s success, Supercell would end the year well, at $2.3B in revenues. As a result, that year, Ilkka and Mikko would top the list of earners in Finland, a country where such data is made available. They had become the richest men in their country by the time they were 40.

However, 2016 would prove to be the high watermark for Supercell. The issue was that Clash Royale’s success came at the cost of Clash of Clans. The revenue was part cannibalization. As a result of the cannibalization and ongoing decline of the games, Supercell has not exceeded 2016’s yearly revenue since. In 2017, full year revenue fell to $2.0B.

Chapter 6 - Brawl Stars

By mid 2018, revenue from both Clash of Clans and Clash Royale had decreased more than 50% from the peak. Boom Beach was also declining. The company was feeling pressure to produce another hit game.

However, several things had changed in between the launch of Clash of Clans and Brawl Stars. A big one was that older players stopped downloading new games. So they wanted to create for a younger audience.

The team set out to create a team based game similar to League of Legends and Overwatch. However, of course, the game would be mobile.

The core loop was iterated upon several times in soft launch, so older articles do not quite do it justice. In fact, Brawl Stars spent the longest time in soft launch of all of Supercell’s games.

But, eventually, the team found a working formula. The final product is a playful team action shooter.

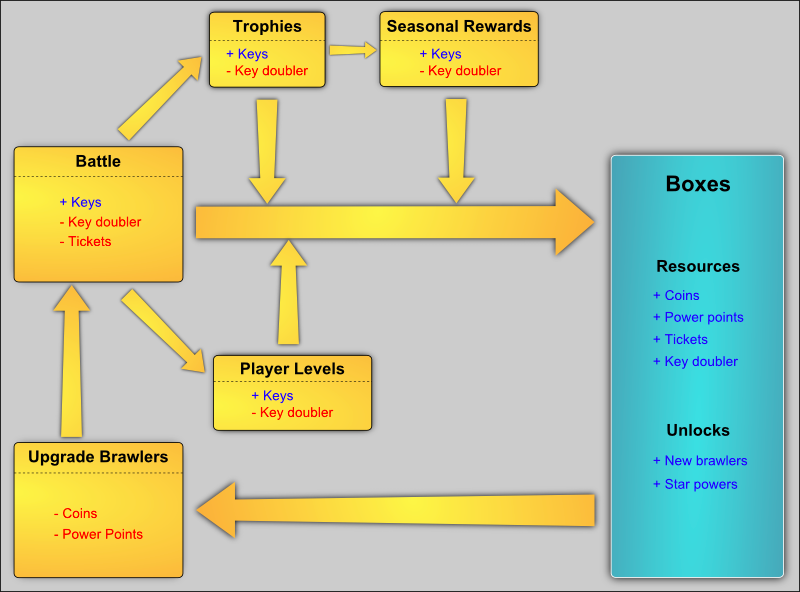

The core loop is battling to win keys, which help open boxes, which unlock new brawlers and brawler upgrades. As a multiplayer online battle arena (MOBA) on mobile, the game brings many familiar Supercell elements to the genre. But instead of PvP, the action phase puts 3-10 players on a map.

The game was a success from the get go, even though some reviewers were skeptical. As usual, Supercell let the metrics do the talking. They took the game to global launch.

Although Brawl Stars was a much needed boost for Supercell, the company still ended total revenue down from the year prior, at $1.6B.

Chapter 7 - No New Games

Since Brawl Stars, the company has tried its tested process. It pilots small teams into games for a few months then does a company playable. Maybe it graduates the game to soft launch. But most get cut.

This resulted in few new games being released for the company in the period. The problem further compounded because each game since Clash of Clans had a lower 12 month revenue per install.

As a result, 2019 would turn out to be another down year for Supercell. Total year revenue was $1.56B. This has many, including investors, questioning if the company should change its strategy.

Early in 2020, just before Covid took off, Illka published his take on that controversy. He reaffirmed Supercell’s commitment to stay lean. And he shared that the company even doubled down on its “small teams” strategy, promising to slow headcount growth significantly. It was an amazing stance to take given the situation. Most people do not love charts down and to the left.

Of course, not all was bad. The teams within Supercell continued doing their thing.

Within the existing game franches, the small cells each individually tried to innovate. If there was a major theme across all five games, it is that they all worked particularly hard to add more social features.

Chapter 8 - Covid

Then, the Covid-19 pandemic began to rock the world. By mid-February 2020, global gaming companies like Supercell were seeing spikes in engagement. Prohibited from in-person social engagements by their governments, global citizenry were turning to gaming to connect with their fellow humans.

Supercell tried its best to strategically take advantage of the increased engagement. One of the trends in the industry was towards bigger, better battle passes. These are mega-packs of content that drop regularly to keep players engaged. They usually come up with gameplay and third party integration tie-ins. Supercell upgraded its battle passes.

https://www.youtube.com/watch?v=tAST728YVaA&t=1953s

As a result of those and other innovations, Brawl Stars became the fourth Supercell game to surpass $1B in lifetime revenue. It was the highest grossing mobile game in Europe for the year. With its total gross of $526M, it more than doubled its lifetime revenue.

But despite Covid and Brawl Stars success, Supercell would end the year on a downtrend. 2020 revenue was $1.48B, down again from 2021. On the other hand, many gaming companies like Roblox saw revenue up 100%. So, this was not a great outcome.

Chapter 9 - Mr Beast and Beyond

But, as always, Ilkka seemed calm. In his yearly review post, Ilkka primarily was proud of Supercellians for taking the transition to work from home well. He also highlighted several of the new content releases the five live game teams made, and also that all five games crossed $1B in lifetime revenue.

As always, Ilkka took the long view. And it would prove to be prescient. 2021 looks like the year Supercell will surpass the prior year’s revenue. The Mr. Beast video has helped.

Supercell is also back on the expansion train. It just announced a new North American studio.

https://twitter.com/supercell/status/1471088906603008000?s=21

Clearly, Ilkka and the team are ready to create a few more cells around the world. It will be interesting to see if 2022 can bring continued revenue growth.

Can Supercell Return to Enterprise Value Growth?

For investors, another question is: will 2022 and beyond bring enterprise value growth? Between 2016 and 2021, Supercell only had 10% enterprise value growth. Most of its investors were looking for 15%+ yearly. So, it has certainly underperformed.

The company is not going to shift off its small teams strategy, but it is expanding the number of teams. That is promising. It is also following industry trends like Battle Passes well. As a result, there is a bull case. But the bearish case still centers around the team size question.

Will the Industry Require Bigger Teams?

Free to play has been evolving. As games become live operations, players expect not just new cosmetics, but new items and maps, new storylines, concerts, and integrations with other brands.

A true supercell, in tornado terms, is absolutely gargantuan. So, it would be interedtp see Supercell the company build a supercell team for a game. The Fortnite team that I was on, for instance, had thousands of people. And all of them worked insane hours. That’s a true single game supercell.

Take Hay Day. The game has been outdone recently by Playrix’s Township. Township has a much larger developer team, which releases content at a much faster pace. It has regular high quality events and social gameplay features. The team has also responded to community feedback to remove mechanics players did not like.

As Miikka Ahonen says:

Creating content is a lot of work, and keeping up with competitors that don't employ similar team size restrictions has proven tricky for Supercell.

If the company is not going to increase team sizes, there is one other hope.

Will Supercell release more games?

Supercell has gone many years of its history without a global game launch. This discipline has helped Supercell maintain profitability and high valuation per employee. But they have hurt revenue growth.

For Supercell to continue its revenue growth trajectory, it likely needs to continue to release games with accretive, not cannibalistic, revenue growth. Tencent is betting Supercell can do just that with its latest investment. As someone who took a deep dive on the Supercell team, I tend to agree with Tencent.

The Supercell team is just full of great builders.

Lessons for Builders

Given that Supercell has such great builders, and such a great track record, what should we as readers of history and product growth practitioners take away?

Lesson 1 - Metrics are the North Star

The brutal soft launch process we have covered at Supercell is how the company has been able to maintain its insane valuation per employee.

This company has complete conviction in its process. It targets a single metric, 30 day retention rate, and evaluates games based on that. As Ilkka says:

By far the most important metric for us is retention, and specifically 30 day retention rate. This gives us confidence this could be a game people could, in fact, play for years. And then we release globally.

Another really important element of the company's process is that although metrics are important, the team still decides. As Mikko explains:

Ownership is with the team to decide if they want to kill or continue the game.

For the company to release more games, it may need to continue to accept longer soft launch periods like Brawl Stars. The cells have proven an ability to improve the games during soft launch, and even after global launch. So, although metrics matter, the company has a long-view on those metrics.

As Ilkka says, we can have a north star, but we also need to understand the medium. Building games is about fun. It is an art form.

Games are an art form, not a form of science. The teams use data a lot, but what they use data for, is to validate how these games are doing. Ultimately, games are about fun.

This same value can apply to companies. Share data transparently with employees so they can use it, but ultimately the goal is user value. For games, that is fun.

Lesson 2 - Insane Focus

From the very beginning, Supercell made a decision of what type of company they wanted to be. As a result, they could stay lean. One of the keys is not doing everything. As Ilkka said:

We are a content company, not a technology company.

Many gaming companies expand. Some have gaming engines. Others have huge publishing arms. Some bolt on distribution. Supercell has avoided all of that. They focus on making great content. They do not move into technology.

Even within content, the company has stayed maniacally focused on the mobile free to play space. This conviction stems from the company’s focus on impact. Mobile is the biggest platform, and the company wants to have the biggest possible impact. This means not creating niche great games.

A big value is for impact, not just quality. We want to touch the lives of 100s of millions of people.

Lesson 3 - VC Gaming Company

As Forbes said:

Most game studios have an autocratic executive producer green-lighting the work of designers and programmers

This is the kind of leader that we see in season 1 of Apple TV+’s Mythic Quest. Ian Grimm runs the show in the game, with all decisions going through him. As they say in the trailer, “One man will rise… to take all of the credit.”

https://www.youtube.com/watch?v=ih2ODfe71mI

Supercell is the opposite. It is almost like a VC firm as a company. Ilkka is maniacally obsessed with supporting great teams. It has been the topic he comes back to in every interview I read, since 2010. He called himself, “the world’s least powerful CEO.”

The company, like VCs, does support the teams a bit. But it is not in the details. Instead, it is more like an investor and advisor.

This gaming company that is kind of like a cross between a VC, an incubator, and a company that is finding the best talent, is at the core of how Supercell succeeds.

Lesson 4 - Marketing is Fuel to the Fire

Supercell does spend a lot on marketing, but it does so strategically. As Ilkka explains:

If you have a great product, and you put great marketing on top of it, it is like pouring fuel on the fire. But you first need a fire, and that fire is a great product.

The company never fully invested in marketing. The core is always the creative pipeline of games.

Lesson 5 - Leaders Lead with Vision

Ilkka’s management style seems rooted in philosophy. Foucault’s Biopower appears to be an influence. Instead of exercising the control mechanisms that management in traditional companies pursue, Ilkka completely trusts the teams. As he says, the only thing he does to manage is:

Obsess about the team composition. Teams that are complete, with diverse viewpoints and professional skills in place.

Mikko further expands on this. Each cell is in complete control of its own destiny.

A cell is a game team. That is where the name Supercell comes from. The creative control is within this small team.

So if management does very little, what do they focus on? Mikko explains that it all starts with vision:

What is the key to Supercell’s success? It all actually starts from all the employees at Supercell understand what is the vision of Supercell. Why are we here? We are here to create games that people would remember after 10s of years. We would like to create these types of brands so that as grandfathers and mothers we could talk about those to our kids. To accomplish that, you have to create hit games, with mass market appeal.

The leaders lead with vision. And then they supplement with transparency. All employees get the daily metrics. Instead of focusing on comp - where Zynga can always win - the management team tries to make Supercell the best place to work.

For instance, every employee got an iPhone 6. This supplements the vision with practical gifts. The iPhone says, “let’s build great mobile games for this fun device!”

Lesson 6 - Small, Empowered Teams

Game teams are from 10-15 people. On our biggest games, it’s like 15 people.

As Mikko says, even the company’s billion dollar games do not have teams larger than 15. The company has been stringent about this since its inception.

There are many problems with bigger teams:

We need to stay small to prevent having more processes. That comes from experience, what we have experienced when we exploded the size of the team, all of the sudden. You need to create more processes and have more meetings. Game leads create tasks out of nothing so everyone has something to do at a time. So it’s really important to keep the team small.

Bigger teams have tons of process. They have more meetings. And, one of the most insidious things is that they have scope creep. Instead, Supercell obsesses about small teams.

But, how exactly does the company do this? The company has been able to maintain such a low head count by hiring generalists.

So, an artist will have to be good at hand drawing, creating 3d assets, and high end marketing material. A client programmer everything to do with the frontend. And a server programmer will do everything with the backend. These types of full-stack game developers allow the teams to stay lean.

In addition, the team needs to have complementary strengths and weaknesses of individual team members. Not everyone should be the same. So, Supercell management pay very close attention to the team composition. Everything starts with the game lead:

The team built around the strengths of the game lead, who can be an art director, or server programmer, or business guy.

The team fills in people around the game lead who will help the overall team have the right set of skills.

So, as the company scales, the challenge is assembling the right teams. It does not hire bigger teams.

How has Supercell changed as a result of its massive success? The last couple of years, we have more game teams. But, that’s about it. Currently, it’s about trying to find more genres.

Supercell has remarkable conviction in its core beliefs.

Keep Your Eye on the Nordic Region

Supercell, along with Minecraft, King, Modern Times Group, Stillfront, and many others has helped establish the Nordic region as one of the premiere gaming regions in the world. Michail Katkoff, the leading analyst of the free to play space at Deconstructor of Fun, has also founded a studio - Savage Game Studios - that is worth keeping an eye on.

The talent that has been developed in and around the ecosystem is likely to deliver many future hit games and gaming companies. As a whole, many of the region’s companies were very early to the trend of mobile free to play. But they have not yet embraced web3. The question is, will they embrace play-to-earn, blockchain, and metaverse gaming?

https://twitter.com/amytongwu/status/1470063275132039183

I, for one, am bullish. As we touched on in Chapter 1, the metaverse is not new to these grizzled gaming veterans. Niko worked on an early metaverse game in the 90s. So Supercell does not necessarily want to be early to the space this time around.

Take the recent wave of social gaming in the past five years. Supercell waited to watch the Chinese companies succeed. In fact, it was even the same for a high pace of content updates. Supercell was more of a second mover. Last year, Deconstructor of Fun was begging them to do more. Only recently have they delivered.

As a result, I do expect the Nordic gaming companies that exist, but also the new one’s that are bound to spring up, to help define the next wave of gaming based on player ownership, interoperability, and lasting economies.