How Spotify Stole Podcasts from Apple

Since Apple introduced the world to podcasts in June, 2005, the medium has been on an unstoppable ascent. That same year it was New Oxford American Dictionary’s Word of the Year.

By 2006, 11% of Americans 12+ tried listening to the bite sized audio delivered over the internet. Today, that number is 57%. And more than a third of Americans have listened to a podcast in the past month.

Generally, throughout the history of podcasting, Apple has been the top dog. Most podcast listeners started there, so they tend to stay there.

That is not for lack of competitors trying. Airr is one example of a podcasting app focused on clipping highlights as written notes for later that hits a niche audience well. It has wonderful design, as well as transcripts of almost every podcast I listen to. It even has 3x speed, which, as a former policy debater and daily article writer, I use frequently.

But, for the vast majority of users in the Apple ecosystem, that has not been the case. Apps like Stitcher (which was acquired by SiriusXM for $325M in 2020) and Breaker exist, but the majority of users have historically gone with the podcasts app. It is naturally bundled with each iOS, and reinstalled if you remove it. Being an Apple app, it integrates well with Carplay and Airpods.

Plus, Apple has continued to innovate. Each edition of iOS came with a set of major feature releases to the podcast app. Even relatively small iOS updates like 14.6 came with huge updates to the podcasts app. This continued product development has kept the app fresh, and hard for anyone to compete against.

That has made podcasts an unsung winner for Apple for many years, a future profit center that it had barely explored. That was until Daniel Ek, the CEO of Spotify, set his eye on the podcasting market. In June 2018, he boldly announced the company would spend $500M to invest in growing its podcasting business.

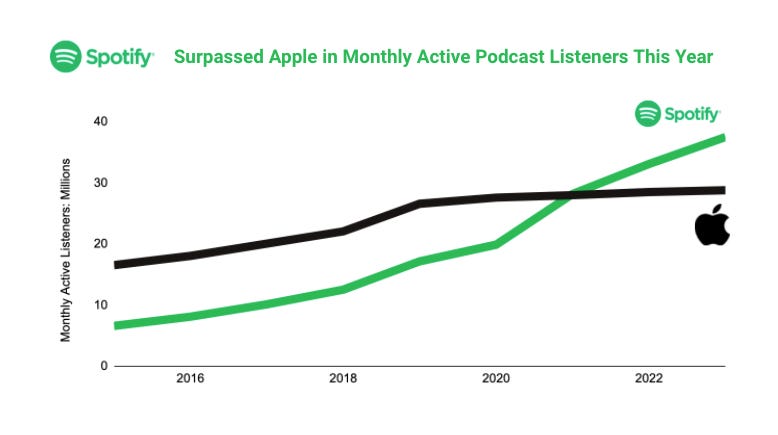

Just three years later, the efforts have borne fruit. Spotify just passed Apple for monthly active podcast listeners, and it is set to vastly outgrow Apple over the coming years. By 2023, analysts expect Spotify to have 30% more MAU than Apple.

It is a trend that has surprised even the smartest tech analysts. But just how did Spotify steal podcasts from under Apple’s nose? Especially when it was so public about its intentions? Let’s find out. To get there, let’s explore:

Apple’s Role in the History of Podcasting

Podcasting’s Value Chain

Spotify’s Strategy

Apple’s Response

Along the way, we’ll focus on tips for product builders and growth architects. After all, who doesn’t want to compete in a big market like podcasts - and win?

History of Podcasting

To fully appreciate the significance of Spotify stealing podcasts from Apple, one needs to know the history of podcasting. Along many steps of the way, Apple has been a driving force of its success.

Chapter 1 - Internet Radio and RSS feeds

The dawn of podcasting was the early 90s. Carl Malamud launched the first internet talk show called Internet Talk Radio. He interviewed experts every week, and set out the template for millions of internet radio hosts, now called podcasters, since.

For over 10 years, users accessed asynchronous radio files by downloading them. For early internet users, it was more of a pull than a push situation. But plenty of shows, like the Dan & Scott Show on AOL, gained cultural relevance.

Then, in 2003, software developer Dave Winer figured out a way to send attachments to RSS feeds for his friend Christopher Lydon. Chris was a news anchor, talk show host, and former New York Times writer. So he held some gravitas. The medium got attention.

One person who noticed was MTV VJ Adam Curry. He decided to launch his own: the Daily Source Code, the first daily podcast. The pitch was news, on your iPod. He even put an iPod belew the microphone in the cover art. From the earliest days, podcasts were associated with Apple.

Adam’s entry helped the medium gain validation, and many more began entering the space. But it was still fairly niche and wonky. Towards the end of the year, Winer would present podcasting technology at the first-ever BloggerCon. This helped launch the new medium to a brand new audience, and usage kept growing. Thousands of podcasts entered the scene.

Chapter 2 - The iTunes Addition

Then, in 2005, podcasting got its real validation with Apple introducing the category into iTunes. Steve Jobs picked a media format. So everyone had to pay attention. It’s worth reading just how praiseworthy he was of the format:

Podcasting is the next generation of radio, and users can now subscribe to over 3,000 free Podcasts and have each new episode automatically delivered over the Internet to their computer and iPod.

Steve fundamentally understood that podcasts represented the next generation of radio, because the automatic delivery of what you want gave you access to more relevant audio content. This vote of confidence from the visionary himself said to every technologist, “this thing is real.” It was a historical moment. The live demo even included an f bomb from Adam Curry. I still cannot tell if it was intentional. I like to think Jobs slid it in there on purpose. He seems to have a look of clever naughtiness on.

https://www.youtube.com/watch?v=9g0nNB4bskc

The Jobs endorsement did more than just set off interest in the space. Apple also helped provide a central place for people to go to find podcasts. Before that, finding a podcast was like finding a website or this newsletter. You kind of have to luck into it. It was also impossibly difficult to actually subscribe, download it, transfer to your device and listen.

Apple also actually allowed a pretty high file size and the featured podcasts had generally high audio quality. This also helped to increase the audio standards in the industry. Very few mainstream podcasters used a bad webcam. Most got microphones.

Chapter 3 - The Rise of Mobile

Although the iPhone would be released in 2007, podcasts still lived within the iTunes app. But this would not stop their rise. Radio was primarily an activity done ‘on the move,’ and with smartphones, so too could podcasts. Usage nearly doubled.

Podcasts get their next primetime moment in 2012, again from Apple. In June, Apple launched the podcasts app. And, surprisingly, they did it quietly. It was not even aligned with a major iOS release. The company was not sure if splitting the app out would work.

It ended up working wonders. Although the app was simple, it was separate, and by being separate, it got attention - from every single iPhone user. This created a huge funnel of users into the ecosystem.

Chapter 4 - Tim Ferris and the Creators

Apple’s app also created a huge signpost for creators, “here is this new medium you can use with access to a huge audience.” One creator who read the tea leaves was Tim Ferriss. In the same year, 2012, he launched his podcast. It would go on to become one of the engines for podcast growth over the years, perennially one of the most downloaded and listened to podcasts.

Tim is also something of a role model in the creator space. He set the model that podcasts can help you interview great people, and those great people can help validate you by rubbing off some of their validation. As a result, now nearly every creator has a podcast, from David Perell to Packy McCormick. Many comedians joined as well.

Nowadays, Tim is best known as a podcaster. He rarely blogs, publishes books, or makes splashy investments. Podcasting has such a high reward to work ratio, that even a man who has no need to work does it. Many creators and comedians agreed with that reward to work ratio and followed in his footsteps, with fairly low-production-required podcasts.

Chapter 5 - Podcasts as Productions

Then, in 2014, Serial was released. The series was the fastest to 5 million downloads in Apple’s history. We still used Apple as the barometer back then. People talked about the show on the level of Game of Thrones. It was “must listen.”

This kicked off the era of podcasting including several highly produced shows. Companies like Gimlet Media sprung up to develop high quality content, produced well.

It also kicked off a glamorous era for National Public Radio. The Serial was actually a spin-off of This American Life, so no organization got to experience the success of Serial more intimately than NPR. And the organization has since invested into the space in a big way. It has grown from 2M users downloading their podcasts every week in 2014 to 15M today.

Serial also was the final step of cultural validation needed for the space. Podcasting went from tech nerdery to tech normery. People working in the space describe it as if a switch was flipped. Suddenly, everyone understood what a podcast was. That has led to the medium’s relentless ascent till today.

Covid-19 helped. With people locked into their homes, experiences suffered and media soared. 2020 turned out to be a monumental year for the industry, with revenue exceeding $1B a year sooner than analysts predicted.

Now, at the end of 2021, podcasting has become a global activity. The US is not even the biggest market. In technologically advanced South Korea, 58% of the population has listened to a podcast in the last month, nearly double the US. Typically where South Korea goes, the rest of the world eventually follows.

It is the story of the growth of a medium. Podcasting is no longer a niche activity. It is mainstream.

And, remarkably, as we can see from podcasting’s history, Apple played an important role each chapter of the journey. So, that is why it is so remarkable what Spotify is doing. Indeed, Spotify is most likely to be the company featured in Chapter 6.

But just before we dive into Spotify’s history and strategy in the space, let’s start with an understanding of the podcasting value chain.

Podcasting Value Chain

Podcasting is not all about being the distributor of content - the app that people use. That market is well analyzed. Podcasting has roughly three key elements of the value chain: creation, distribution, and monetization.

Within each element of the value chain, valuable companies will be built to:

Do the thing - create like Gimlet, the Ringer, and Parcast

But also to help do the thing - creator tools, like Anchor

And finally to distribute the thing - like Stitcher and Megaphone

So, we will see creator tools, distribution tools, and monetization tools companies, as the market develops.

With this understanding of where one can make money in the podcasting ecosystem, we can better understand Spotify’s genius strategy.

Spotify’s Strategy

When Spotify was founded in 2006 by Daniel Ek and Martin Lorentzon, the intention was to deal with music piracy. They never had a vision to become a listening company. But in 2015, with over 60M users, the company added podcasts to the app. It was a fairly low cost experiment, but it proved successful: users flocked to the service, and it quickly grew as both a driver of incremental playtime, and its percentage share of overall playtime.

But while playtime was going sky high, revenue in the industry was not. Valuations for podcast companies with hundreds of millions of listening hours were only in the hundreds of millions. Daniel saw this opportunity.

In 2018 Spotify made quite the bang, with its announcement to invest heavily in podcasting. At the time, the conventional wisdom was that the medium was heavily used but that the market was small, because podcasters had not figured out how to monetize the listening time comparably to terrestrial radio.

So the move was not universally adored. In fact, most takes out there were negative. Really smart people like Justin Jackson argued:

Many participants and investors are acting as if podcasting is bigger than it really is

VCs and bigger companies in search of "the next YouTube" fundamentally misunderstand podcasting's growth curve

Investors are way too bullish on Spotify's strategy

However, Daniel Ek plays a long game. He was optimizing for his longer term vision and did not listen to the detractors. Instead, he executed on Spotify’s strategy, which was to be audio-first. A16Z does a great highlighting the key points from his 2019 letter.

Podcast listeners have twice the time on the platform. The next step was clear: drive more podcast listening. Time on platform, engagement drives future bottom line. Daniel and the Spotify team recognized this early, and used six strategies to make it happen.

Component 1 - Exclusive Content

The most well-known and prominent part of Spotify’s podcasting strategy is exclusives. The first thing it did with its podcasting budget is spend $230M on Gimlet Media, the makers of popular, highly produced podcasts like Science Vs. Gimlet has been called “the Marvel to Spotify’s Disney.” It is content that brings people in.

Spotify followed Gimlet a month later with a $110M acquisition of Parcast, a network of scripted true crime podcasts. It went big on getting content. After reflecting for a short while, Spotify felt like the strategy worked.

They doubled down. In February of last year, the company spent $200M for The Ringer’s website and podcast network. Then in May, the company spent more than $100M for the Joe Rogan podcast. It was the most listened to podcast of 2020. His entire 11 year library went exclusive to Spotify last December. The Ringer is eventually going that way, but right now just has some Spotify-exclusive shows.

As a result of all of Spotify’s acquisition activity, the wars are heating up in the content acquisition space. Surprisingly, it was the New York Times that acquired the company behind the hit Serial podcast for $25M in June of last year. Apple, on ther hand, has been late to the game. It only in April started to tease notions of paying for production of its own exclusive content.

Component 2 - Constant Product Development

While Apple does consistently develop and update the podcasts app, it does not ship as fast as Spotify. Apple is a ‘release’ based company. New features come out on major dot releases, at most 6 times a year.

Spotify is a much newer and internet native company. New features are released when they are ready, by hundreds of distributed global product teams. This allows Spotify to achieve a speed of innovation that Apple does not. It has consistently focused on two product themes: fixing discovery and making user experience better.

In particular, the company invested heavily in algorithms to recommend podcasts for you. This follows from its strategy to convert more users to podcast listening habits of power users.

There were many more updates. The hundreds of changes came together to drive exponential growth. Daniel explains the power of this beautifully:

So why did we succeed this fast? Well, obviously our content investments have helped a great deal. But it’s also another proof point of the impact our platform improvements and product innovations are having on our business overall. And the velocity of shipping matters — from the recent launch of interactivity and enhancements like polls and Q&A, to the release of enhanced listening features and new original programming around the world. We fought hard to gain new listeners. And our success is not attributable to just one thing, but literally hundreds, if not thousands, of improvements that we’re working on in parallel for the benefit of creators, users and advertisers alike.

The company is shaping interactivity, polls, Q&A and other features at a velocity unseen before in the podcasting space. The team sets product and engineering teams a vision, then it lets them execute wildly fast to achieve it.

Component 3 - Power User Targeting

Spotify is trying to become like Google Maps. People who use Apple Maps are those who do not download the specialized app, but most people download the specialized app, because it gets the power user features right.

One of these power user features is handling high volume. If a user has more than, say, 25 subscriptions, when the Apple podcasts app is loaded up, it gets highly laggy. It can take 30 seconds to open and load. This was even worse prior to the app’s April update. Spotify takes advantage of these bad user experiences to build a product for people who are more than light users.

As Ek says:

The company’s culture of innovation leads to an improved user experience

The company makes sure to use its product like a heavy user and figure out what the heavy user figures out. Then they build for them, instead of the massive, general audience.

Component 4 - Make Life Better for Podcasters

Alongside its mammoth acquisition of Gimlet in 2018, Spotify also acquired podcaster toolset Anchor for $100M. That acquisition is paying off. In 2020, Anchor powered 80% of new podcasts on Spotify. And this is the content people listen to. These shows drive more listening than any other third-party content provider, including NPR, the New York Times, and other big networks on Spotify.

Unlike most acquisitions, Anchor actually got better once it became a part of Spotify. Anchor CEO Michael Mignano explains:

Daniel [Ek, CEO of Spotify] said something to me, which I think is awesome and which really resonated with us, which was that he and Gustav [Söderström, chief R&D officer at Spotify] and the wider Spotify organization wanted to give Anchor superpowers. What that meant was really around giving us the support and the infrastructure to be able to make better tools, to be able to offer better data, and, in general, make podcasting better.

Indeed, Spotify makes significant investments in creator tooling. It experimented with tips and monetization long before Apple. In October of that year, Spotify launched a specific part of its web and app surfaces for creators. These moves would take Apple years.

The area Spotify has gotten much better traction than the competitors is podcasting. Spotify’s Streaming Ad Insertion technology is the clear leader in personalization, conversion rate for advertisers, and monetization for creators. More personalized ads means happier listeners, creators, and advertisers.

In November of 2020, Spotify further doubled down on distribution by purchasing podcast hosting company Megaphone. This allowed Spotify to apply its ad insertion technology into even more podcasts.

The prescience is paying off for Spotify’s bottom-line. The company had its biggest-ever quarter for ads in Q3, fueled partly by podcasts. In 2021, Spotify will surpass 1 billion euros in yearly ad revenue for the first time.

Component 5 - Build Across the Value Chain

Spotify built tools for creation, distribution, and monetization. Apple focused just on distribution. By generating broader coverage across the value chain, Spotify was even able to take away the leading spot in distribution.

Ek explains how the three come together to form a flywheel:

All of these things coupled together — users, creators and advertisers — unlock the power of our flywheel

By building a vertically integrated solution, Spotify was able to enhance a product for users by shipping a feature for creators. This allowed the attractiveness of its platform to increase exponentially instead of linearly, because the metrics a feature could improve multiplied.

Component 6 - Integrate the Experience

Where Apple zigged, Spotify zagged. Apple has split out the Podcasts app from its music experience. Spotify views listening as an integrated experience across the two, and its app is organized to reflect that pattern of thinking.

These six strategies have come together beautifully for Spotify, and just recently it surpassed Apple for podcast MAU. It is no surprise. But will Apple, the $2.9T behemoth, worth 70x Spotify, even care? It sure seems like it does.

Apple’s Response

This year, Apple has begun to take Podcasts more seriously again. Knowing Apple’s development cycles, that means it probably started last year. Cleary, the team saw that Spotify was passing it, in the medium it had made happen.

In April, we got to see Apple’s attempt at writing the next chapter of podcasting history, “Apple leads the next chapter of podcasting with Apple Podcasts Subscriptions.” The company that had written the first five chapters did not think it presumptuous to write the sixth.

This includes three major product moves.

Podcast Subscriptions - getting into the monetization game

Podcasts for creators website

Original podcast production

It remains to be seen whether these moves will pan out. Some, like the Verge, are skeptical Apple is really getting seriously into the original content production game. It seems like many of the shows are made to promote its revenue driving service, Apple TV+.

Others, like the Vulture, are bullish that Apple is offering more monetization options than Spotify. It is hard to pontificate the future. The Motley Fool makes the case that because Apple is charging $20 per year for access and taking a 30% of first year revenue + 15% thereafter, that makes it less attractive than Spotify’s payment processing + 5% after 2023 model. I tend to agree with the economics argument The Motley Fool makes.

But the proof will be in the pudding. Knowing Apple, it does not always need to be the first mover. It may just be watching Spotify’s strategy and perfecting the execution. That has always been the Apple playbook, anyways.

https://twitter.com/utsavverma/status/1402812151526428672

What will the future hold?

Analysts, like eMarketer in the chart at the top of this article, are not bullish on the Apple approach. They judge it as too little, too late. The expectation is that Spotify will have 50% more MAU than apple by 2025.

I am not sold on the analyst’s point of view. First, never underestimate Tim Cook and Craig Federeghi. My brother was a PM at Apple for years and vouches that the two have a legendary understanding of consumers and product strategy.

Second, as readers to this point know, Apple virtually carried podcasting to where it is today. It would be a surprise for Tim to let it lose torchbearer status now. Why would the company give up on the medium it is responsible for growing?

Lessons for Builders and Product People

While there were several strategic lessons we have already covered, there are several specific lessons for product teams and builders that are worth double clicking on.

Lesson 1: Don’t be afraid to make your intentions known

Many product teams have a reflex to be secretive about their performance and intentions. Why would I let my competitor know my roadmap? That will decrease the impact of those features.

Will it really? I would push that line of thinking. I think teams should not be afraid to build in public like the Solana team, or make their intentions known like Spotify.

In fact, double down and make a big hoopla of your intentions. This signals to investors, consumers, podcasters, and the ecosystem. The world has changed from when an intention to investors did not leak back into the zeitgeist. These days, an investor product announcement can drive real future consumer behavior over long time scales, when executed with a solid strategy.

Not enough product teams invest in product strategy announcements. Spotify’s work. So can yours.

Lesson 2: Solve problems for both sides of your marketplace

One way to think about the podcasting app wars is that they are really about bringing together two sides of a marketplace: podcasters and podcast listeners. Whereas Apple primarily took a podcast listener centric approach with its app but few tools or monetization options, Spotify built for podcasters early, and helped them monetize as well.

Lesson 3: The market values companies. It does not solve problems for users

The market response to Spotify’s strategy was a chorus of dissent. The stock had a hard few years. The market thought Spotify’s investments were burning cash alongside the street.

They could not see the very real problems Spotify was solving in creation, distribution, and monetization. But Spotify’s company and product leadership endured the turbulence. That has opened up a new opportunity no one dreamt of - even the company, Apple, that pushed the medium to where it is in the first place.

As product leaders and builders, we need to think big. This often means zigging where others zag, and making bets the market does not approve of in the short term. That is how we win in the long term.