Not Just Hype - Roblox as the Shopify of Gaming

Key Takeaways

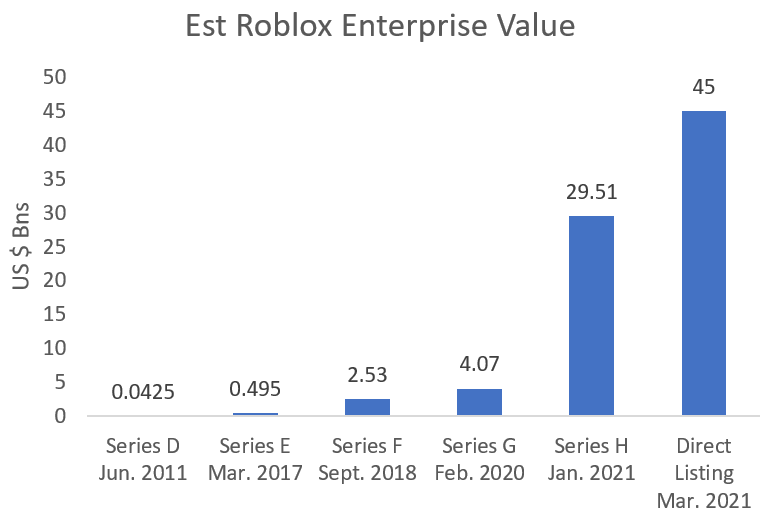

• Roblox raised capital at a valuation ~35% too low with its series H/direct listing

• Roblox has had ~80% annualized growth in monthly active users, a one of a kind growth trajectory in gaming

• The public market has the right idea, valuing Roblox like Shopify at ~40x sales

In its Direct Listing week, Roblox received a bunch of thoughtful commentary – Stratechery amongst my favorites. Now that some time has passed, I wanted to revisit the story for those interested in more insight on the business. One question, for instance, is “was it all hype?” Indeed, investors are wondering whether Roblox can sustain and continue its amazing growth. Another question is, “can it last?” Maybe another is, “What do gaming industry insiders think?” Finally some might be asking, “Do you think it’s a buy?” I don’t know if I can answer all those questions satisfactorily, but here’s my key thoughts on the direct listing and potential trajectory of Roblox.

Listing in the Rearview Mirror

Twice delayed, Roblox finally released only to have massively underpriced in the private markets. Comparing the January 2021 Series H to the first day close of their direct listing, Roblox raised capital at a ~35% discount to what they could have in a truly democratized IPO available to all. So their process did not achieve their goal of not leaving money on the table. They may be able to marry such a process even with the benefits of direct listing providing immediate liquidity to existing shareholders. The future of this space for highly promising companies like Roblox will be one to watch.

Source: Sharespost; Chart my own

Taking the long view, Series D investors Chris Fralic of First Round Capital and Anthony Lee of Altos Ventures made >1000x on their investment. TechCrunch didn’t even give them an article, it was essentially a 5 paragraph press release with a skeptical, “but failed to provide numbers to adequately back up that claim,” added. It wasn’t the buzziest round at the time but we did know Roblox had kids spending 19 million hours per month on the platform. The trick to finding consumer gaming businesses like this at early stages is to look at hours played plus consistent growth.

Best of Breed

Even amongst games, Roblox has a uniquely sustained growth trajectory. As a result, it has started to rifle past the competition. Simply put, Roblox numbers are always going up and to the right. This is very unique in the gaming industry. Only truly platform games can achieve such unique trajectories. The biggest games like Call of Duty, Grand Theft Auto, and Madden do not have this type of monthly engagement increase always. They have sawtooth patterns around major releases. Major online games like World of Warcraft, League of Legends, Valorant, etc reached a peak and then forever slowly declined.

Since 2013, when I could find press releases with their MAU (before that they refer to things like website visitors), Roblox has maintained an incredibly impressive growth. This is something on the order of annualized 80% MAU growth for 8 straight years. And Roblox shows absolutely no signs of stopping. The latest estimate from RTrack, not official, is that Roblox is at nearly 199 million monthly active users.

Source: RTrack for Jan 2021, Roblox Press Releases for everything else; Chart my own

The platform’s percentage of female players particularly sets it apart. This is not a first-person shooter that primarily caters to boys. Even the few games globally that could potentially challenge Roblox’s throne today – Minecraft, CrossFire, PUBG, etc – have not demonstrated the nearly limitless market size for their games that Roblox has. In gaming, MAU is a holy grail metric: monetization can and will follow. But growing this key metric so steadily is something nearly no other game ever has done.

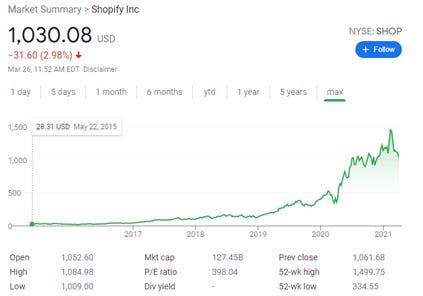

Shopify for Gaming

This brings us to the comparable for Roblox. Gaming comparables likely don’t apply (especially since the best, Minecraft, is buried inside Microsoft numbers.) Roblox is providing a platform for gaming like Shopify provides a platform e-commerce. Like Shopify, Roblox keeps growing its most important metrics quickly and steadily. As a result, its trajectory in the public markets is much more likely to be one of “beat and raise,” like Shopify over the next five years. You could have, in Mar 2017, thought, “wow, at 48 million MAU Roblox is as big as any game out there. It can’t get any bigger.” But you would have missed out on 150 million more MAU since then. I think the likely trajectory for Roblox is similar.

Shopify Revenue:

Source: MacroTrends

Shopify consistently executed at the 80% growth level and then trailed off. Nevertheless, its stock continues exuberant growth. I think even in the case where Roblox growth trails off like Shopify, it can continue its stock growth.

Source: Google Stocks

These types of platform businesses that never stop growing and catch the occasional tailwind of a black swan events like Covid continue to churn out impressive results. Shopify trades at 42x actual LTM revenue. Roblox trades at 38x LTM. As we can see, the market is onto this, and I think Roblox can continue to trade at Shopify-like multiples. These multiples may appropriately come down as rates rise but the overall story for Roblox is user growth continuing, driving revenue, and enterprise value for a long time to come in the public markets. It has not even begun to capitalize on esports, so I expect there is a lot of room to grow.

In Summary

No, it was not hype. Yes, it can last. Inside the gaming industry, I look at it and am very impressed. I think it is a long term buy and hold.