The Rise of the Indian Gaming Market

India is exploding as a hub for innovation. These days, it seems more common to hear Unicorn announcements out of Bangalore than out of San Francisco.

The numbers back up the feeling. Unicorn announcements in India have literally 10x’d. In 2021, India had 44 new unicorn announcements. Only 37 companies had hit that mark in the prior decade. The country is minting unicorns.

With a total of 90 unicorns now, India is third behind the US (487) and China (301), but far ahead of the UK in fourth (39). All the funding has added up to Bangalore surpassing even Beijing and Shanghai for venture capital funding in 2021. Those are phenomenal stats for a developing country with a per capita GDP of nearly a fifth of China and a thirtieth of the US.

With all the funding and tech success has come the rise of gaming in India. India has always had a rich film market, and its audio market had developed in the last few decades, but gaming is really the story to come on in the last few years.

This week, I am very excited to present a collaboration with Joseph Kim, CEO of LILA Games, which is developing a mobile first-person shooter with 25 employees predominantly in Bangalore.

Before LILA, Joe has had a long career in gaming in the US, including recent positions as SVP of Gaming and Digital Platforms at NBCUniversal & Chief Product Officer at SEGA. Before that, he was the lead at FunPlus on King of Avalon, which helped establish the Chinese developer as a leader in the 4X game genre.

Most of us know Joe from his amazing content. I was first introduced to Joe as the lead MC of This Week in Gaming (TWiG) over at the Deconstructor of Fun podcast when I was working on Fortnite at Epic Games. A large percentage of the industry listens to that podcast. So, it should go without saying that he brings a unique, authoritative perspective on developing games in India.

Join us as we go 5,700 words deep on:

The History of Gaming in India

Market Size and Growth

Key Players

Trends Driving the Future

Key Obstacles to Overcome

Country Comparisons

History

Phase 1 - Almost No Traction

After gaining independence from the United Kingdom in 1947, India’s economic policy was influenced by the imperial experience. The government turned inwards, enacting and keeping up a series of protectionist policies.

The state intervened in many areas of the economy. Red tape was infamous. It was said that establishing a business was like winning the lottery, the paperwork and bureaucratic hurdles presented such long odds.

On the other hand, in the United States and abroad, video games have been a thing since at least the 1950s. From Atari to Sega and Nintendo, consoles and arcades were big business for decades in the US and Japan. In the 1970s and 80s, arcades also became huge.

But gaming did not blossom in India. The country’s protectionist policies created widespread economic stagnation. Although Nintendo was licensed to sell in the country, numbers were anemic due to the import tax, which was above 100%. For a country with already poor purchasing power, doubly priced devices were too much.

As it became evident that India’s economy was lagging behind its peers in the 1980s, the governments of Indira and Rajiv Gandhi began pursuing economic liberalization.

Then, following the tragic assassination of Rajiv Gandhi in 1991, the conditions were in place for massive economic liberalization. This is finally when the Indian flirtation with video games began.

Phase 2 - Coin Parlors

The 1991 liberation reform reduced import tariffs, deregulated markets, and reduced taxes. This led to an increase in foreign investment and the introduction of coin parlors and arcades.

Naturally, Japanese arcade companies like Sega, Konami, and Capcom became players in the market. Especially in urban centers, it was easy to find a parlor with international gaming machines. Pac-Man, Street Fighter, Contra, and Metal Slug did particularly well.

Meanwhile, globally, consoles like the SNES and Sega Genesis took the world by storm. These TV-gaming consoles were too expensive for Indian consumers. They did not take off. Instead, the consoles that were sold were made into arcade machines. More than any international machines, these were the bulk of most parlors.

But in a country of over a billion, the number of parlors is not estimated to have crossed the single-digit thousands. There were a few parlors in each city, but overall gaming was quite niched.

To this day, you can actually still find about the same number of gaming parlors throughout India. They exist as odes to this era of gaming in India when primarily the hardcore participated. While arcades saw a swift decline in the West in the early 2000s, they continued in India.

Arcades have two factors that make them more culturally significant and enduring to Indians than the West. First, they are social. India’s communitarian society especially values social experiences. Second, they enable players to buy in at low prices. While consoles and systems were large purchases, arcades were a relatively cheap visit.

Still, for the two-thirds of India living in rural areas, electrification was too much of a barrier. Expensive transformers were required to supply consistent electricity for the boxes, making parlors far less common in rural than urban centers. Throughout this phase, the average Indian remained unexposed to gaming.

Phase 3 - PCs

As the PC took off around the world, it also took off in India. Unlike gaming consoles, PCs had educational uses, like access to the internet and the ability to learn software engineering. This helped them take off in India in a way gaming devices could not culturally.

Although Indians culturally do not care about gaming, they do care about engineering and education. Scores of kids begged their parents for a PC, supposedly for school, but often also for gaming.

As a result, gaming really started to take off as electrified Indians started to get home PCs. Games like Aladdin, Prince of Persia, and, of course, Doom took off.

But, very few Indians paid full price for their games. The vast majority pirated them. The cost was often free, downloaded over the internet, or less than a dollar, purchased on a burned CD-R at the local market. Even games that seemed in proper packaging were often just pirated discs inside.

Phase 4 - Playstation

As consoles came to dominate the global market size for gaming in the mid-2000s and 2010s, they barely made a dent in India. The console to do the best was Playstation.

Somewhat like the arcade era before it, India lived in gaming history. While the rest of the world was playing on expensive Playstation 2s, Indians played Playstation. When the world was focused on Playstation 3, Indians were purchasing Playstation 2s like hotcakes. Sony revealed they sold over 1 million of the devices in the country.

Playstation 2s still sell in Indian markets today, in part due to the sheer volume of pirated games to play on them. The CDs were made for easy copying. Whereas a Western gamer contended with a game that was a fourth or a sixth ($50-60 for a game vs a $200-300 console) the price of the console, Indian gamers could enjoy games at a fraction of the cost ($0.50-$2 for a $200-300 console).

As Vice puts it:

Piracy helped grow the video games industry in India.

Playstation 3 games, on the other hand, are nearly impossible to pirate. Players prefer original games because they enable online modes and game updates. With the decline in piracy has come, again, a decrease in cultural significance in the ecosystem. PS4s, and now PS5s, remain too expensive for most Indians.

Phase 5 - Mobile Cambrian Explosion

Like PCs before them, the device taking video gaming to the next level for India is the smartphone. It has many more culturally acceptable uses than gaming.

Only the smartphone is penetrating even further than the PC. Indians who cannot afford an expensive home computing station if they were farmers still covet a smartphone. The country has over 800M smartphone users today.

And these smartphone users have data to spare. Data costs in India are much cheaper than in the West. Thanks to initiatives like Reliance Jio, Indians enjoy some of the cheapest per gigabyte 4G and 5G connections in the world.

This has led Indian smartphone users to be even bigger data users than Americans. The average monthly data usage per user in India is 15GB vs 11GB in the US.

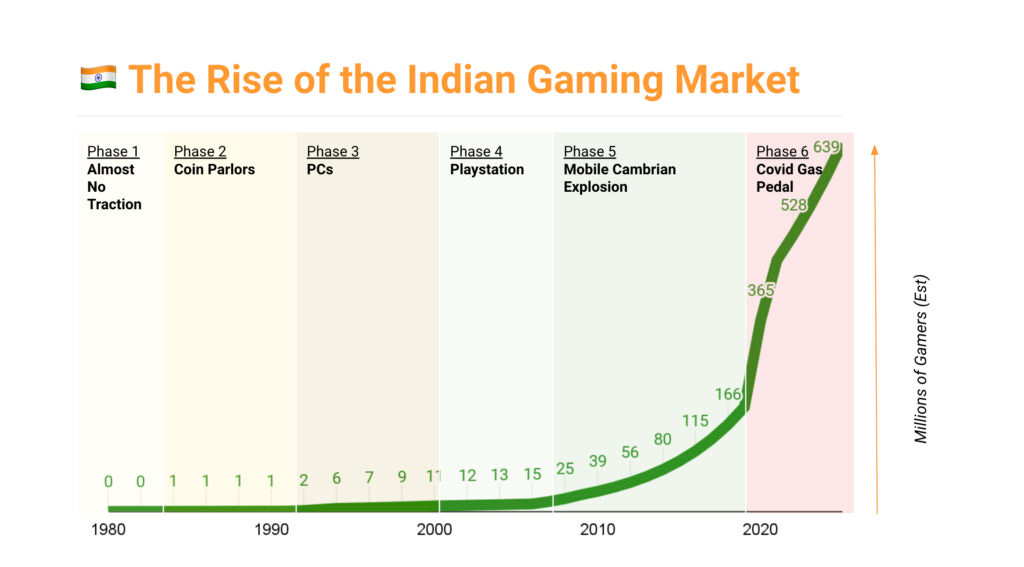

The increase in smartphones and data has led to a Cambrian explosion in the number of Indian gamers. Whereas many PC games were pirated paid games, most mobile games are free to play. As a result, the country has over 480M smartphone gamers today.

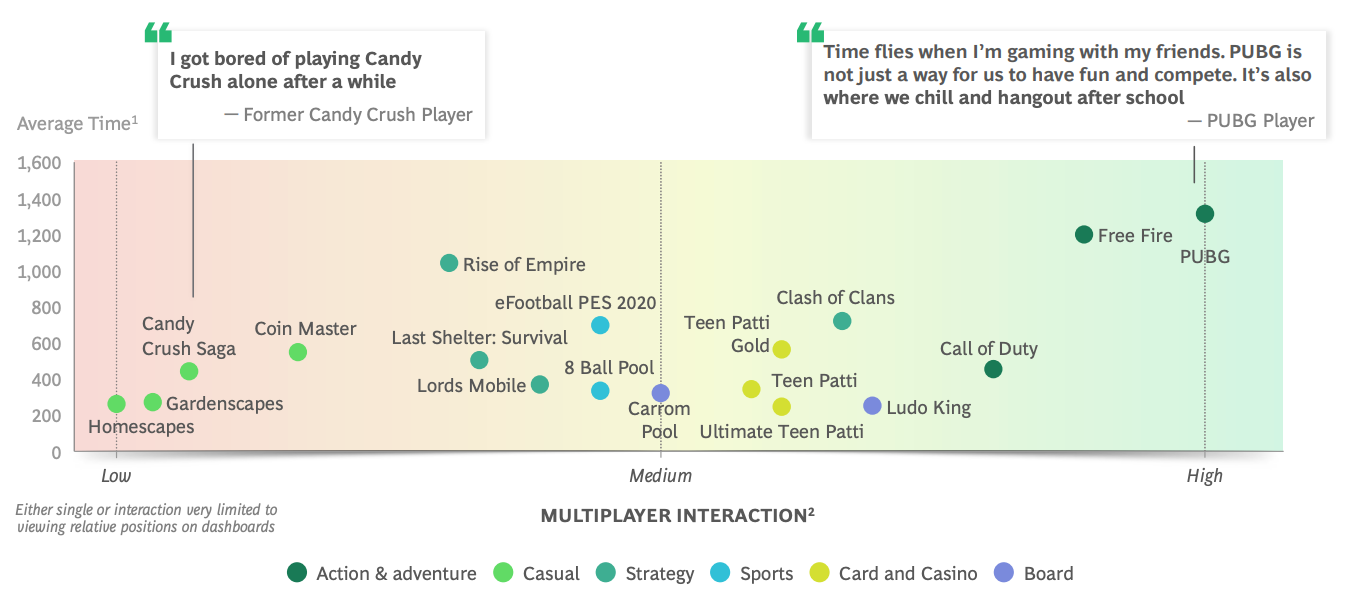

These internet-connected gamers play more and for longer because they have access to multiplayer. Indians getting hooked on shooters like PUBG play over 20 hours a month on average.

This massive growth in the gaming market in India has led to growth in the native gaming industry. There has been a dramatic growth in the number of designers & developers working for international companies, and homegrown game development companies.

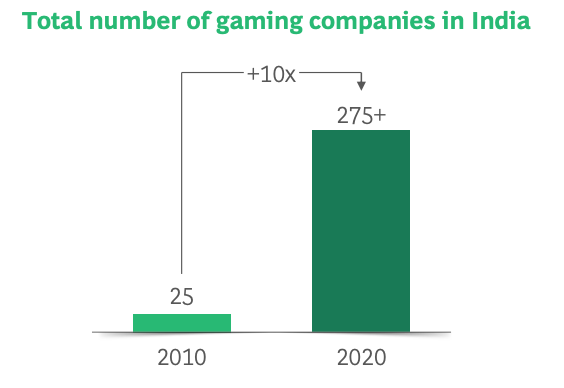

Between 2017 and 2020, more than 200 game development companies were started. These native companies have been releasing native games.

One of the most significant releases was Ludo King on February 20, 2016, by Gametion. Consistently one of the #1 apps since launch, the game has amassed over 500M downloads. Based on the Indian board game Ludo, it managed to build an India-first game that stuck.

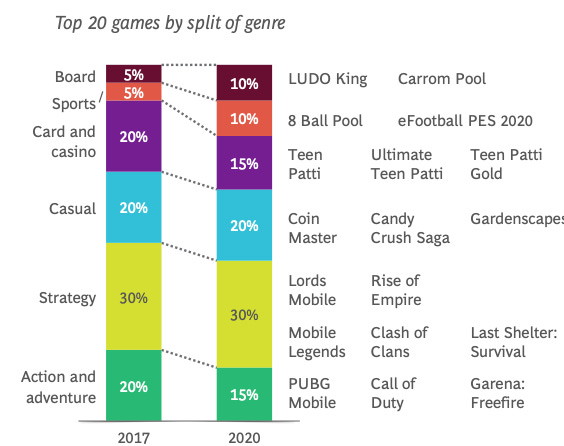

Indeed, between 2017 and 2020, more Indian games like Teen Patti and Carrom also made it to the top 20 games, changing the genre complexion to include more strategy, casual, and board games.

Phase 6 - Covid Gas Pedal

Trapped in their homes under strict lockdowns, the Covid-19 pandemic supercharged the growth of the gaming industry in India. According to the Broadcast Audience Research Council, the average time spent by gaming users per week in India increased by 44% during the pandemic, to 3.5 hrs/ per week. That’s a tremendous one-year increase.

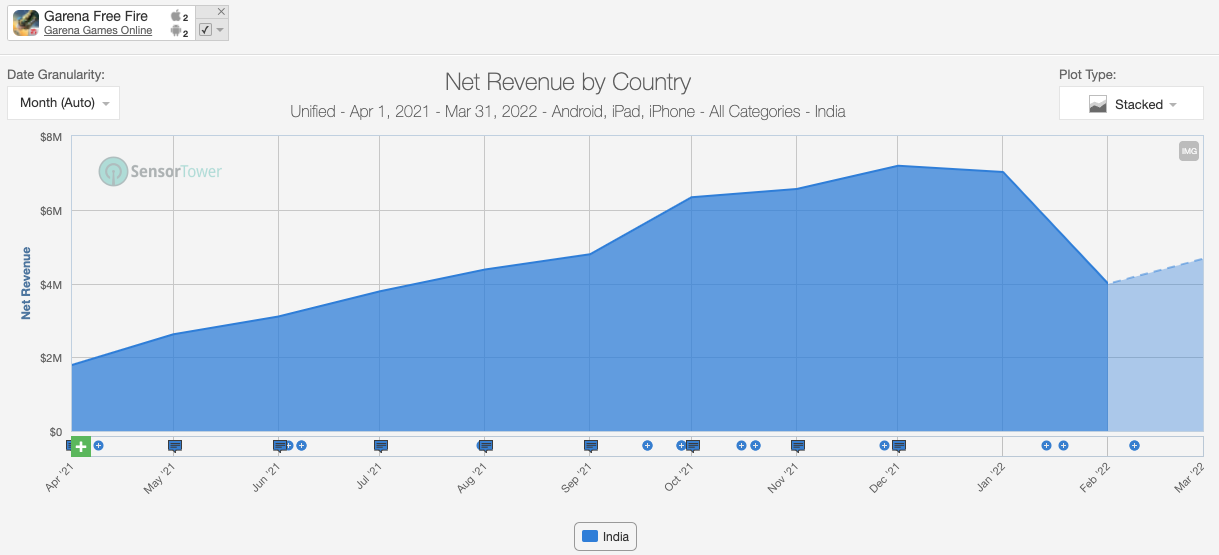

With the increase in use, gaming also got the attention of the government. The Modi government actually banned the South Korean shooter PUBG, which was the biggest game in the country at the time. But, since then, Activision and Garena have stepped in with Call of Duty Mobile and Free Fire.

In addition, homegrown Indian games have continued growing the overall domestic market size. Spurred by growing revenues due to the pandemic, Indian fantasy gaming company Dream11 made a splash when it become the official sponsor of India’s most popular sports league, the IPL in August 2020.

MPL followed that announcement in November, that it was sponsoring the Indian cricket team’s uniforms and kits. These massive marketing efforts in the country’s most popular sport have furthered the reach of gaming.

In addition to governmental and sports hooks, gaming also has benefited from the rise of YouTube and streaming. Many of the most subscribed Indian influencers are gamers. There are more than 17 Indian gaming YouTubers with more than a million followers.

This massive increase in consumer demand, from mobile and Covid, has helped grow the industry in India. In fact, the number of gaming companies has gone up >10x over the last decade.

A number of international studios such as EA, Ubisoft, and Zynga had set up game development centers in the early 2010s. Those companies have incubated the next wave of entrepreneurs we are seeing today. Ex-Zynga founders alone are responsible for MPL, Playsimple, Moonfrog, Bombay Play, and Hypernova Interactive.

Today, there are over 15K+ game developers in India. This growing base of emerging talent has made it an even more attractive place for folks like your author to set up their development team there.

India has a large proportion of the world’s largest number of software engineers, yet a far smaller portion of developers focused on game development. It is set up to catch up to its Chinese, Japanese, Turkish, and American counterparts over time.

Market Size and Growth

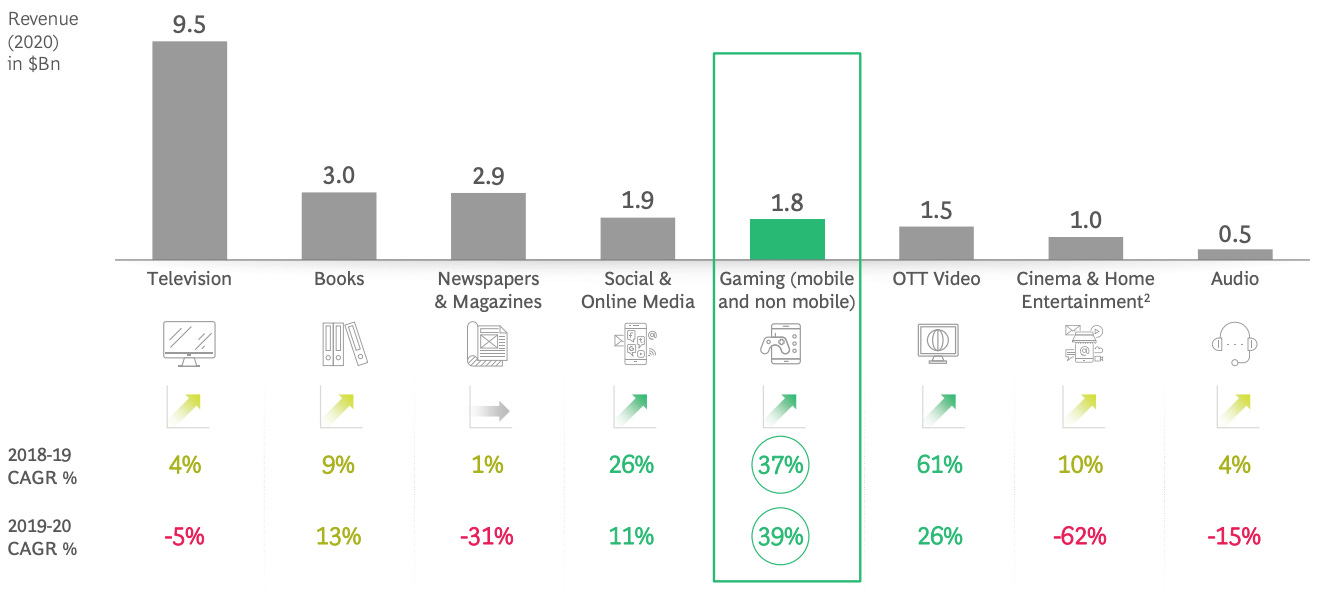

The Indian gaming market was valued at USD $1.8 billion by BCG and Sequoia in 2021. It is expected to reach USD $5 billion by 2026, per Mordor Intelligence. That growth rate is what makes gaming such an interesting market in the country. Gaming is growing faster than any other media sector in the country, including streaming video.

According to a survey conducted by Newzoo in March 2020, the total monthly users for leading games in Google Play in India was 481 million. That number is set to grow to over 650M users by 2025, and it doesn’t include PC or console gamers.

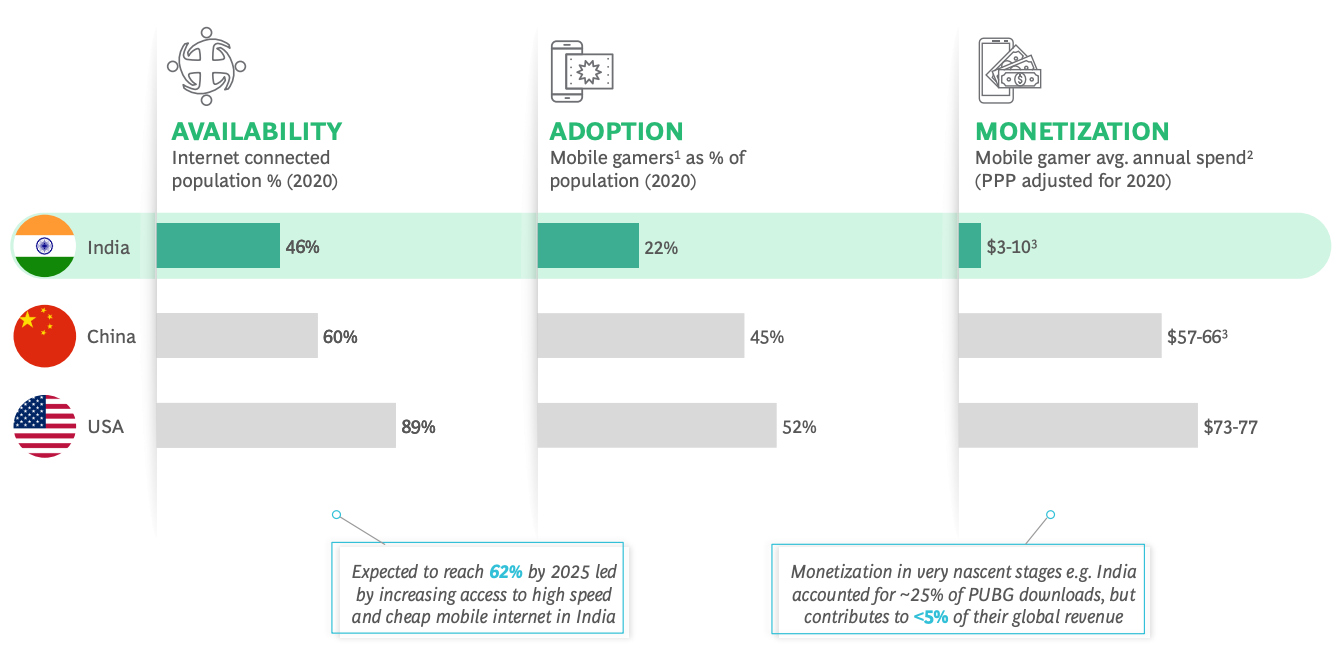

That makes India the #2 gaming market by the number of users. Quite impressive, but the average revenue per user is low. As a result, India is actually only the #16 gaming market in terms of dollar size.

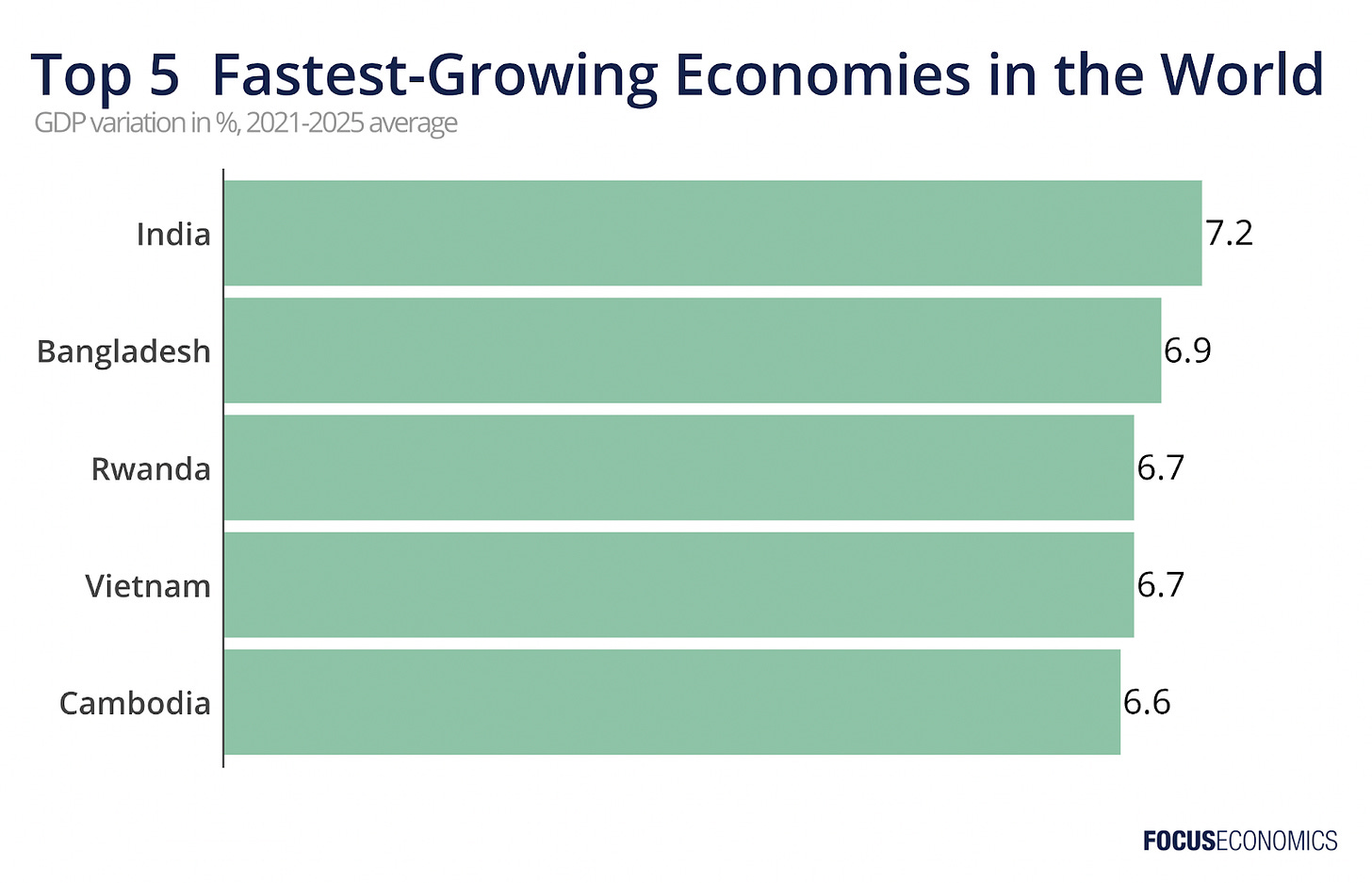

But, all signs point to it rising rapidly up those ranks. India is forecasted to be the single fastest-growing economy in the world over the next 5 years. As a result, it should only be a matter of time before India’s per player revenue starts to catch up with Tier 1 countries.

The country has also had notable successes. Garena Free Fire was on track for making over $10M per month from India alone. Like PUBG before it, Singaporean shooter Free Fire was blocked for distribution by the Indian government in January.

This presents a fresh opportunity to see which games will step into the void left by a top game. All signs point to that opportunity growing rapidly.

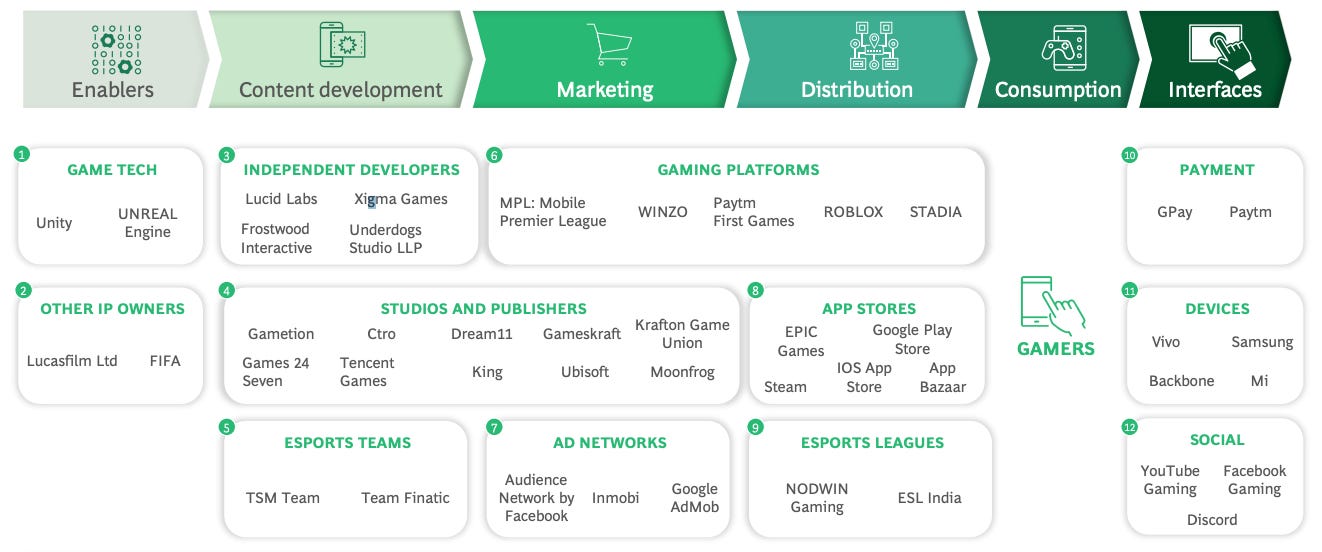

Key Players

Games

India has produced a number of notable games recently, including:

Ludo King

Teen Patti

Raji

Mumbai Gullies

Asura

Missing

Alter Army

Ludo King Introduced packs at prices as low as ₹10 to convert more users to conduct in app purchases. Since then, it has been able to double the portion of its revenue from in-app purchases to 40% of its revenue (the other 60% is ads).

Gaming Platforms

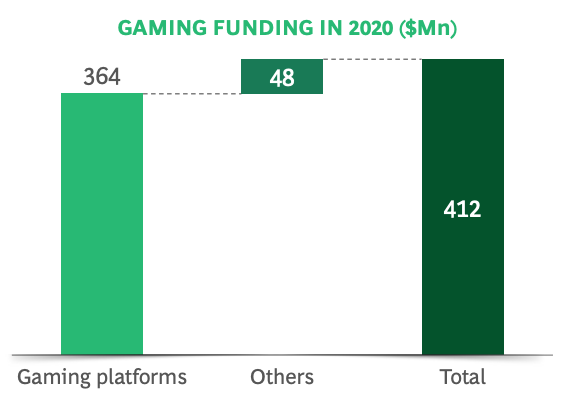

One of the key trends in India has been the rise of gaming platforms, which have eaten up the lion's share of VC funding, as well. Investors are bullish on gaming platforms because they mitigate the hits-driven nature of the gaming business. By BCG’s estimates, gaming platforms accounted for 88% of the dollar value of VC funding in 2020.

Major platforms include:

MPL

WINZO

Paytm First Games

MPL reported more than 70 million users in 2020. The company has built a multiple genre platform. This includes a growing developer ecosystem. It’s like Roblox in that, people are setting up their businesses to develop games for the platform. This sets up a powerful flywheel for growth.

Generally, MPL monetizes through head-to-head player battles, in which players put up as little as ₹3 ($0.04). It’s kind of like a skilled betting platform. MPL has been very aggressive with marketing, including the aforementioned IPL sponsorship, the signing of perhaps India’s most well-known sportsman Virat Kohli, and a partnership with the TV show Big Boss.

WINZO reported more than 20 million users in April 2020. Paytm first games reported more than 70 million users in December 2019. Both platforms continue to show promise.

Publishers

According to a report published in August 2021 by 42matters.com, There are more than 5,283 Indian publishers on Google Play. Out of a total of 166,039 game publishers, that means 3% of all game publishers on Google Play are from India.

Some of the most prominent Indian publishers are:

Nazara

Dream11

SuperTrident

Gametion (Ludoking)

Words Mobile

Moonfrog

Games2win.com

Nazara has been around for a while. It started before smartphones with simple web-based games distributed through telecom companies. Recently, it has been acquiring companies in two major categories: esports (NextWave, Nodwin, AbsoluteSports, HalaPlay) and gamified learning (Kiddopia). It went public in March 2021.

Dream11 is using fantasy sports to make sports more engaging. Using Indian cricket fans’ craziness for the sport to its advantage, it has deployed the Draftkings model to India.

Investors

Venture investors invest have traditionally invested in India for two different opportunity sets:

Growing Indian Market: With the massive growth of India, investors bet on companies that build platforms or games targeting the fast-growing Indian market. Most active investors in India fall into this category.

Globally Competitive Indian Game Development Teams: Betting on the Indian game development teams to be able to compete on a global market scale. These VC funds understand the potential of investing in an emerging game development ecosystem, as we’ve seen happen in China and Turkey. Very few investors in India currently fall into this category.

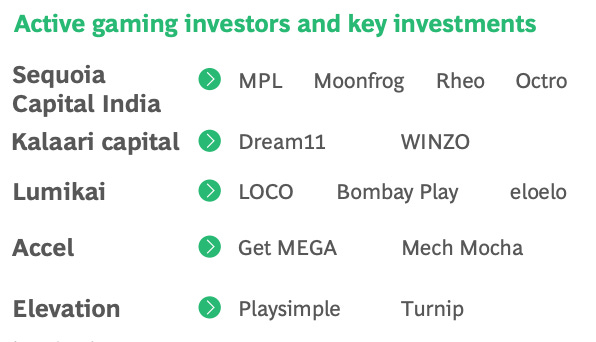

The name brand investors in Indian gaming startups include Sequoia Capital, Kalaari Capital, Lumikai, Accel, and Elevation. They have had a hand in all the players we just went over.

But they are not the only players in what has become a large market. VC investors in Indian gaming can be further subdivided into four specific forms.

Type 1: Global Gaming Funds

International firms focused on gaming like BITKRAFT, Galaxy Interactive, Hiro Capital, and Makers Fund all play in India. These funds look for investment opportunities on a global scale and often have people distributed globally to search for these opportunities.

Given the rise of the Indian developer, their attention has naturally begun to increase more towards the region. BITKRAFT, for instance, has invested in LILA, StockGro, and GameZop.

Type 2: Generalist Indian Venture Capital Firms

Traditional generalist venture firms in India are shifting funds into gaming. Sequoia Capital, Accel, Kalaari, Stellaris, Matrix, and Nexus have all made moves in this direction.

A big motivator has been the pandemic. Many of these traditional venture firms saw their portfolios on fire during the pandemic. Yet, during that time gaming continued to not only grow but thrive. As a result, gaming has increasingly been viewed as a hedge against recession and pandemics.

Add on the growth of Web3 gaming opportunities, and we have seen a fundamental shift in the distribution of capital allocation towards gaming over the last two years. These generalist firms are now firmly committed to gaming.

Type 3: India Specific Gaming Funds

In August of 2020, we saw the launch of India’s first gaming-focused VC fund: Lumikai. While the game development industry in India is still early, expect additional players besides Lumikai to emerge as the opportunity in India matures and becomes more obvious.

Given the early nature of the Indian game development market, and the global nature of markets, the pitch is that early-stage Indian game companies will be better served by venture firms that have in-depth knowledge of the industry and connections in the gaming industry globally.

That seems to be a resonant pitch so far, with Lumikai having scored participation in major deals like LOCO, Bombay play, and eloelo.

Type 4: Global Strategics

Leading the charge in investing in India, KRAFTON announced it would invest $100M in India in January of 2020. It quickly followed with a string of investments into gaming companies like NODWIN, Pratilipi, Nautilus Mobile, Loco, and LILA.

Some of the other most active global strategic gaming companies include Tencent, Alibaba, Netease, and Bytedance. However, all of these companies are Chinese. Given, the current geopolitical situation between India and China, it’s unclear the extent of investment that will occur from these companies in the near to medium future.

Geopolitics will likely play an increasing role in how global strategics consider investment, especially with the potential for additional fractionalization of global markets into Splinternet. The banning of PUBG and Garena Free Fire in India, China’s blocks on Western and gaming apps in general, and the pullout of many Western company games from Russia are just the start of how markets can potentially fractionalize in the future.

Currently, few other global strategics have bet heavily on India. But, it should only be a matter of time before more invest heavily. Several hundred of them read this newsletter. Perhaps they will begin now.

Trends Driving the Future

Trend 1: Mobile is Just Beginning

Although India has seen staggering mobile growth in the past few years - adding hundreds of millions of users - the growth story is not done. The number of users is set to continue to expand dramatically.

In addition, the average Indian user does not monetize very well on mobile. But, attitudes around this are slowly changing. As we saw from the history of Indian gaming - from arcades to Playstation 2 - culturally it is often ~10 years lagged from the West. About 10 years ago, the west started to see a huge rise in the market size of microtransactions. India is poised to see the same.

Trend 2: Cloud Might Matter

The “in the know” gaming press spends most of its time lambasting cloud gaming efforts. The failure and layoffs at initiatives like Google Stadia have not helped.

But, in India, cloud gaming might actually hold more potential. While smartphone penetration is high, unlike the west, console (let alone high end PC) penetration is not. As a result, Indian gamers see the value prop for cloud gaming much more acutely.

Trend 3: Attitudes Shift

Indian culture, until very recently, still held a stigma around video games that made it hard for them to attain the widespread cultural adoption they have in the west.

The ongoing change in Indian attitudes has only just begun. As one of your authors is an Indian-American, he has witnessed a transformation in his relative’s attitudes towards gaming. Especially the urban one’s, you find older adults and grandparents gaming Ludo or Dream11 on their smartphones.

Gaming has spread to all demographics, and, as a result, it is set to grow. Eventually, the type of money kids spend in the West on console games, should translate over as a proportional percentage of disposable income.

Trend 4: The Rise of the Developer

200 gaming companies in India is just the start. The United States has roughly 10x that. Even Finland, which has a population of less than 1% of India, has more than that.

As more Indian gaming companies do well, the ecosystem is bound to see the rapid growth that the rest of the Indian tech market has in the past decade, in the decade to come. As the early growth rates show for the 2020s, it looks set to be the decade of the rise of the Indian developer.

Trend 5: Capital Inflows

Gaming investment dollars into India are set to continue at a rapid pace. With the rise of general tech and gaming specifically, more and more VC attention is set to focus on the country.

Between 2014 and the first few months of 2020, India has attracted USD $350M in investments from venture capital firms, growing at a CAGR of 22 percent. More recently, Maple Capital Advisors reported gaming startups in India have attracted $1.6 billion just in the first 9 months of 2021 signaling a dramatic increase and exceeding the total value of all investments in the five years before then.

While 2021 was undoubtedly fueled by the global money printing machine, the long-term trend is clear. India, fueled by a base of 5 million-plus software engineers, more than the US’s 4 million, is set to continue to grow into this part of technology, as the cultural attitudes change.

Key Obstacles to Overcome

Obstacle 1: Breadth to Depth

The majority of games developed in India have 3-9 month-long development cycles. This compares to many Western game studios with 2-3 year game development cycles - and, in some cases, are followed by a soft launch of 1-2 years.

The majority of Indian mobile gaming companies have followed a strategy of developing easy-to-understand, fast-to-develop games for a casual audience. This made sense given the context of India’s gaming market:

Many of the early game companies were started by founders who weren’t experts in games. Naturally, these companies worked on games that were easily understandable.

They also tried to develop a portfolio of games, because they weren’t sure what would hit or not. The attitude of “I don’t know what will hit,” led to the distribution of resources allocated across a portfolio, rather than investing in a single big bet.

Midcore and hardcore games required significant depth and investment that were hard to monetize against a low payment market like India.

Deeper games required very specific expertise which wasn’t readily available in India.

However, as India’s gaming market grows and as India’s game development ecosystem matures, it needs to shift from breadth to greater depth.

The app store markets are global. The implication of global competition, however, is extreme depth. To compete with significant domain expertise and resources against companies like Riot, Timi, Lightspeed & Quantum, Activision Blizzard King, Supercell, Lilith, MiHoYo, and the rest, Indian game developers can no longer have superficial depth.

To get there, the attitude of Indian game developers will need to change from wanting to create mediocre, “good enough” products, to creating products that are the best in class. Further, Indian game studios will need to shift to making bigger bets and focusing resources and risk on a single product.

Obstacle 2: Live Ops to New Games

When Western studios initially set up in India, they employed developers often to service legacy games in decline or long-tail market positions. As a result, the primary focus of many experienced Indian game developers has been on content pipeline and live ops.

Moreover, often, these teams were service teams, directed by Western HQs.

These two factors have led to a lack of expertise on how to build new games vs. servicing games in decline with live ops. Developers lack the confidence and experience to make critical product decisions.

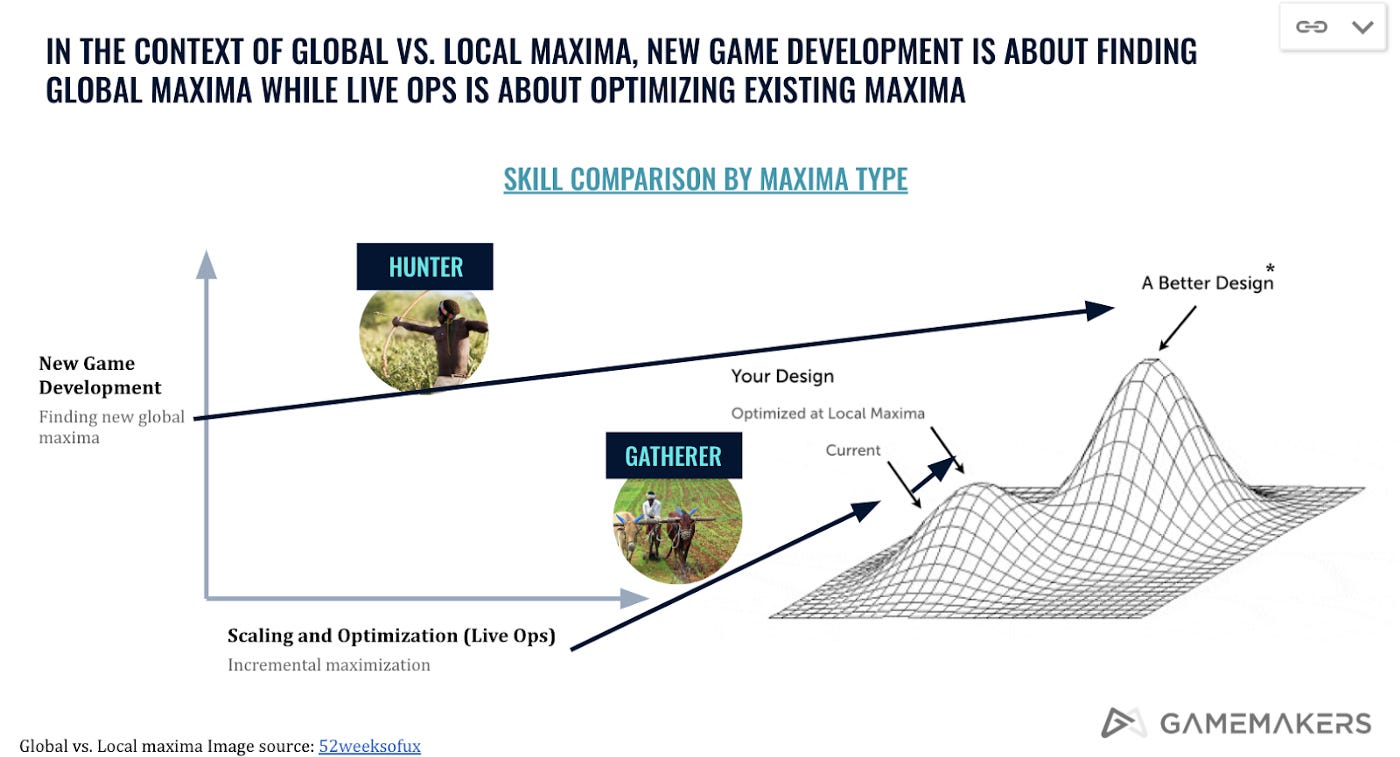

The approach and philosophy behind building new games fundamentally differs from live ops servicing. New game development is about finding global maxima. Live ops is about optimizing existing maxima.

The Indian game developers coming from content and live servicing organizations like Zynga, EA/Glu, will need to learn these hunter skills in order to build big new hits from India. The current mindset is focused on gathering.

Obstacle 3: Learning Fundamentals

As a consequence of focusing on content pipeline and live servicing often directed by Western teams, Indian developers lack experience leading and directing internally. Compared to other markets, many of the game “leads” and senior functional directors from India lack the fundamentals.

The question almost always missing is: Why?

Why are we working on feature X vs. feature Y? Why is our sprint 2-weeks vs. 3-weeks vs. 1 week? Why are we doing lead-based vs. peer-based code reviews? Why are we planning based on outcomes vs. features vs. gameplay-oriented product roadmap? Why is our team structured and staffed as it is? Why does battle pass work in some games and not others? Why should producers exist in some game teams but not others? Why does the zero-to-one game team curse so much?

The legacy of being service arms is that the developers primarily excel at following instructions and serving the customer at a low cost. The answers to those Why questions was determined elsewhere. Those days need to end quickly for the Indian game development ecosystem to emerge.

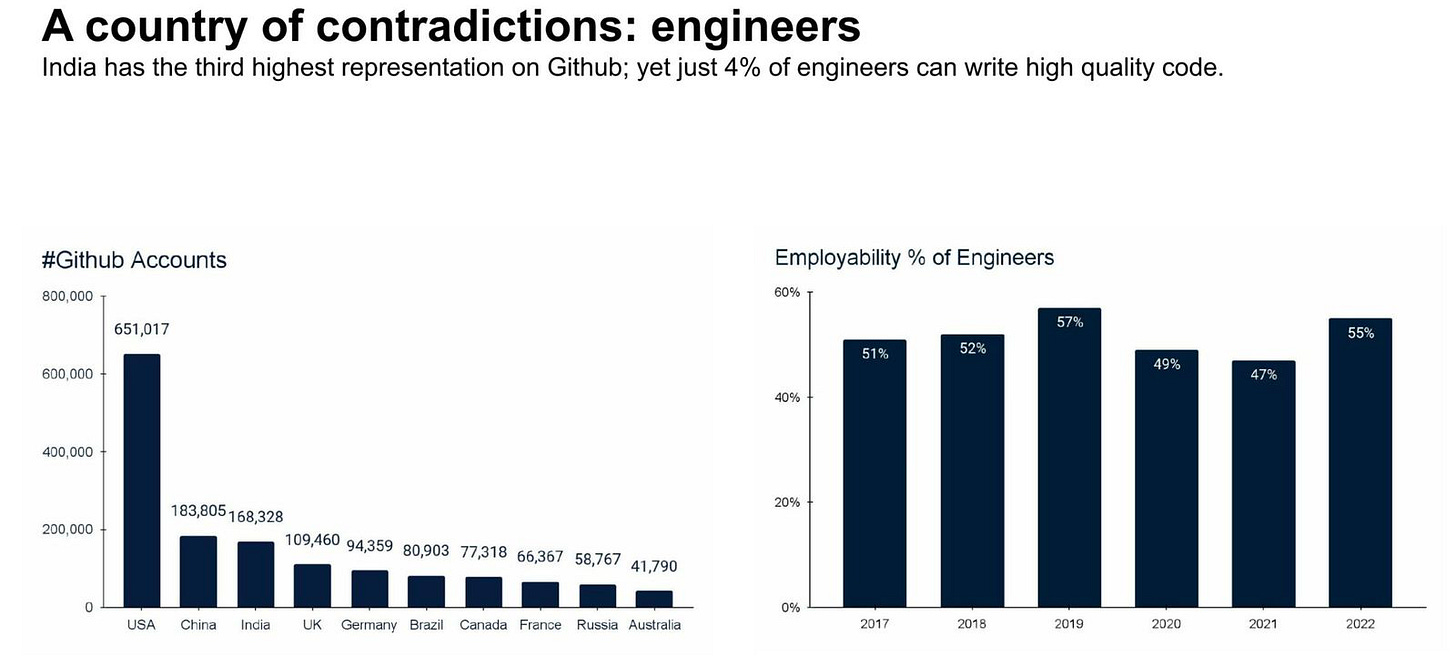

An adjacent but similar problem with Indian development is the quality of software engineering. While India has the third most Github accounts, only 4% of its engineers are considered to write high quality code, and only 55% of computer science graduates are considered employable.

Indian software engineers and game developers are currently not at the level of their global counterparts. But it is changing, as more and more developers answer Why.

Obstacle 4: Mastery Over Management

In Indian game development organizations, there’s an excess of focus on prestige. Title, salary, and size of the team are the primary measures of self-achievement. This is a far cry from other parts of the world, where game developers can be proud to be individual contributors their whole careers.

Instead, the pattern for many Indian game developers is to progress in careers through management instead of mastery. Instead of value being placed on skill and mastery over their discipline, they jump straight to management.

This problem is magnified because many Indian game companies design career progression at their companies around managing a bunch of junior people. Hence, the game designer with 5 years of experience may get promoted to become a manager and then focuses on building as large of a team of designers underneath them.

Unfortunately, many of these managers slow down in learning their craft. Instead, they focus on management.

Lack of mastery means a lack of depth. Fixing this structural problem will help the Indian games industry to create world-class products.

Obstacle 5: View of Innovation

In India, innovation is viewed as “risky.” Copying an existing model is viewed as a “safer” approach.

No doubt there are fast follow opportunities that can be somewhat lucrative. But, the safe bets prevent the truly huge home runs. India has not produced a Free Fire, PUBG, or Fortnite, because it has not gone all-in on innovation.

To grow, Indian game developers will need training around philosophies supporting new game development, like Peter Thiel’s concept of Zero to One. In addition, Indian developers will need to build discipline mastery around different established approaches to new game development.

Blizzard has an approach and philosophy around gameplay innovation and iteration. Riot has an approach around player feedback and building for an audience (aka “black licorice”). Indian gaming companies need to develop their own as well.

The Path Forward: Country Comparisons

If it can overcome these obstacles, the future is very bright for India. In fact, it is set to follow in the path of now-giants in gaming of China, Turkey, and South Korea.

China: Leads-based Model

China’s game development ecosystem is a monster feared by the world, including the biggest game companies around. Activision, Rockstar, and Ubisoft are terrified of Chinese game development.

China today has built incredible depth in specific genres like 4X, RPG, and Match-3 on mobile. More recently, it has also built significant depth into action RPG on console/PC, with the success of titles like Genshin Impact.

A key approach employed by Chinese companies to become globally competitive is a “leads-based model.” At FunPlus, for instance, the company hires key leads that have worked on successful titles or with the very specific domain expertise to the company. They are flown into Beijing and work with the local teams there and disseminate best practices.

Other Chinese game companies have also utilized this model. For instance, Firecraft Studios/Magic Tavern/Applovin hired key leads out of Jam City for their title Matchington Mansion.

The key lessons to be learned from China are:

To focus on specific genres

To invest heavily in the development of a local team against that genre

Then bring in key leads by overpaying them to teach best practices and to create extreme depth in specific genres.

Turkey: Mafia Effect

When one game company develops expertise and mastery in their people, employees from that company will eventually branch out and multiply success by building their own successful companies.

In Turkey, Peak Games, sold to Zynga, had developed extreme mastery in card games and match-3. That mastery has led to one of the most incredible success stories of last year.

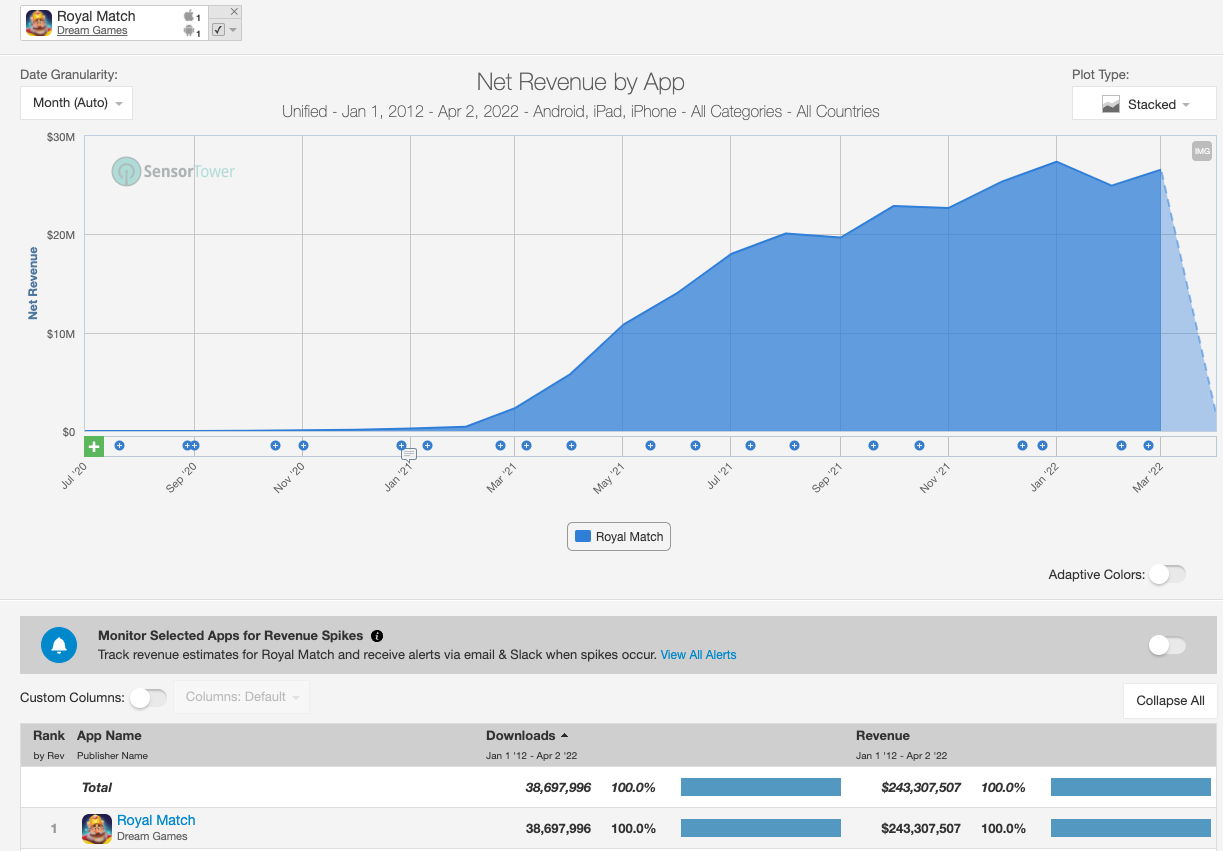

Founded by former Peak execs, Dream Games launched Royal Match into the entrenched, competitive, and difficult match-3 genre. And it managed to succeed. Dream Games’ Royal Match has already generated over $240M in net revenue (over $25M per month).

Dream succeeded in a market where hundreds of others have failed. It’s all because of the Peak Mafia

India has already begun to see the seedlings of the Mafia effect. After Tanay Tayal established Zynga in India, he went on to found Moonfrog. Other alumni from Zynga India in turn went on to found companies like MPL, Bombay Play, Playsimple, Hypernova Interactive, Kappuchin Games, Red Monster Games, and Nodding Head Studios.

As India progresses to the next stage, that mafia effect needs to continue to grow.

South Korea: Government Support

Emerging industries, which gaming in India qualifies as, need support.

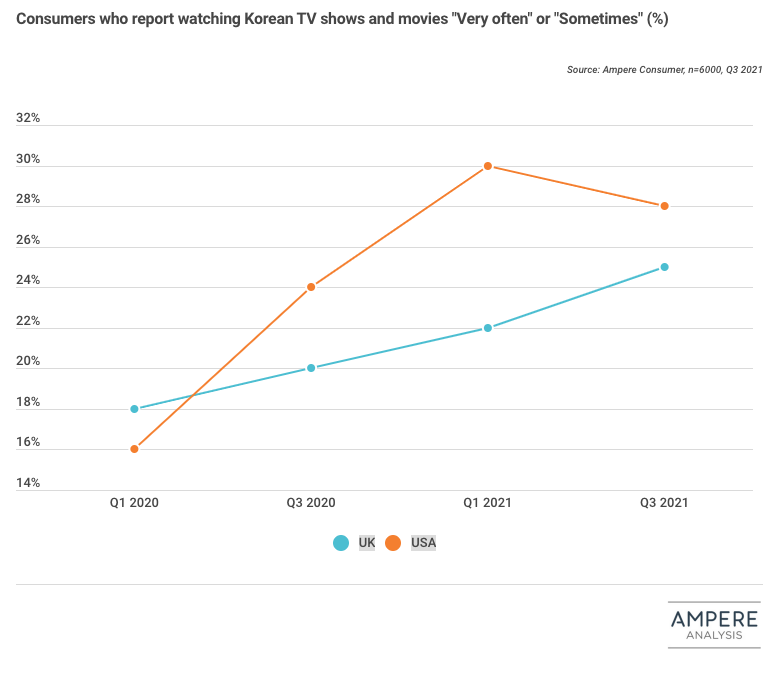

A great example of this is the success of South Korea’s support for their entertainment industries: music, film & television, and games. The South Korean government helped protect and foster their domestic entertainment industry through regulation (e.g., screen quotas), investing in infrastructure, the creation of trade organizations (e.g., G-Star), and supportive policies.

These initiatives have been very effective. There has been a global rise of South Korea’s music industry, South Korean created TV shows on Netflix, and South Korean F2P game companies.

Massive international hit TV shows coming from South Korea demonstrate the potential for small countries to become dominant global players in entertainment.

If India’s government steps up to support its emerging gaming industry, India could follow a similar path.

Conclusion

India represents the most dynamic and exciting future market and game developer ecosystem in the world. Global game companies and investors who aren’t paying attention based on the current metrics need to pay closer attention to the growth and trajectory of where India is headed.

Skate to where the puck is going, not where it has been.

Wayne Gretzky

Massive challenges remain and need to be overcome for India to accelerate its maturity into a globally competitive market. However, great rewards await those who can navigate this market and are willing to endure the challenges of the early marketplace as it develops.