Real Estate Investment Options in 2021

FinTech has been evolving rapidly in the Real Estate Investing Space - REITs, Equity Crowdfunding, P2P Lending, & Owning Outright. Given the plethora of new investing options, this post explores returns and AUMs. The Allure of Real Estate

The collective American (and global) consciousness places a high value on real estate ownership. For decades, this has resulted in a steady upwards trend in the value of real estate assets. Unlike most markets, the real estate market has many points of friction that result in a market that is anything from efficient. As a result, compared to stock equity or bonds, the asset class also has more outsized winners and losers.

The most sophisticated Wall Street veterans have always understood the power of this asset class. Blackstone, the financial giant, may be better known for its banner private equity moves. That business has no doubt been very profitable in the past year. But how many people know that Blackstone was also one of the largest owners of single-family homes near 2009? The investment firm has long had a lucrative real estate practice. It saw an opportunity coming out of the real estate financial crash of 2008, and it deployed its capital.

It is not just the sophisticated investment funds. The most significant limited partners are also heavily involved in real estate. Many of the world’s most iconic downtown buildings are held by international sovereign wealth funds, or even large pension funds and other large institutional allocators of capital. This historical and continued institutional support continues to make the asset class attractive to individual investors.

The asset is not entirely correlated with the stock market, it has a lower chance of going to zero than many individual stocks, it provides greater access to clever manipulations of the tax code, it offers the opportunity for significantly more leverage (than, say, 50% or 2x on a brokerage account vs Mortgages on expensive homes), and market inefficiencies provide opportunities for outsized returns. It is no wonder many individual investors are asking themselves, “how much should I invest in real estate and how?”

Options to Invest

Although there are many options to invest in real estate, five options for the average individual investor include public Real Estate Investment Trusts (REITs), equity crowdfunding (similar to private REITs), peer to peer lending, crowdfunding, and outright purchasing buildings. Where to invest and why depends on many factors but two include your level of sophistication and capital. Taking this a step further, one way to think about segmenting the market is recommended minimum sophistication & effort, as well as capital looking to invest.

REITs minimum investment is $1 with fractional shares at modern brokerages. A relatively unsophisticated investor could buy the entire global market for REITs through the SPDR Dow Jones Global Real Estate (RWO) ETF, or the entire US market for REITs through the Vanguard US REIT (VNQ) ETF. This gives the investor a fairly efficient mechanism to participate in the markets for real estate, with low fee access to many of the largest real estate holders globally. Investors could also buy specific REIT ETFs to represent a specific sector within real estate. Alternatively, investors even further out on the risk curve and looking for even higher returns, could buy single REITs who represent a specific package of properties that trust manages, lends to, or otherwise invests in.

Private REITs, or other real estate crowdfunding options with other names (like eREITs), generally have minimums from $500-$10K. They also represent a specific package of properties the company is offering in that package. So, they are further out on the risk curve, similar to single REITs, and require more sophistication, as well as effort to choose appropriate one’s with the potential to perform. The market is less efficient at this stage and the return spread amongst options is higher than REITs.

P2P Lending is specifically participating in the large debt part of the real estate market. These generally have minimums of $1000+. Typically, the investor is offering partial loan guarantee for a portion of a property or other asset. As a result, this represents even more risk than the eREITs, introducing specific lender and property risk. Inherent with the risk is also the potential for greater market inefficiency and outsized returns. But typically, it is recommended investors are sophisticated and put in the effort to do due diligence on the loans they support.

Crowdfunding means working with a private group of individuals to buy specific properties. This often has a higher minimum than P2P lending or private REITs. It is different from a private REIT because it is focused on a specific property. This can allow individual investors to make a bet on a specific property. By being property specific, it means more risk than a basket of properties that is often in REITs.

Owning outright is another option. Often, investors jump to thinking about this option, or think that because of this option’s capital requirements, they cannot invest in real estate. Indeed, this option tends to get the headlines. But, it is the furthest out on the risk curve, and it requires the most sophistication and effort. Although some players are receiving huge returns, the average player can easily get beaten by the market: buying when the market seems on an unstoppable rise, and then selling at inopportune times. Capital requirements for even the cheapest properties are usually in excess of $100K.

REITs

Market ETFs

There are many popular REIT ETFs available to individual investors today. Amongst the most popular are different variants of US funds; partly because the US real estate market has outperformed in recent years. The VNQ is the widest such basket and, also, by far and away, has the most assets under management (AUM). With 174 holdings and $39.0 billion in assets, it is the king of the market, almost an order of magnitude larger than the next player.

However, on 10-year Sharpe ratio (return / standard deviation; ie, reward / risk), the smaller and cheaper SCHH – only $5.7B AUM but 0.07% expense ratio vs 0.12% - has outperformed. With a more concentrated 139 names, is has returned a stellar 0.78 sharpe over the past 10 years vs 0.59 for VNQ.

Some investors look globally. The VNQI is the largest here, packaging all 661 global non-US REITs into one basket Investors have not been rewarded for the diversification recently. It has the lowest Sharpe ratio of any of the funds listed, and also has the second lowest yearly return.

The lowest yearly return is the fully global RWO ETF, which tries to represent global real estate, packaging the US and international. One issue with RWO is that it has a relatively small basket of 256 REITs, and it misses many of the big names. In fact, it does not even have American Tower, the largest REIT, which I detail more below.

Be fearful when others are greedy. Be greedy when others are fearful

-Warren Buffett

Of course, history is hardly a predictor of the future, especially in investing. Investors interested in zigging where others zag may be particularly attracted to the recent underperformance of global REITs.

REIT ETFs demonstrate one of the real estate (and any) market’s fundamentals: the more risk you take, the larger the potential for outsized return. The ETFs that are concentrated, in terms of total holdings and percent of holdings in the top 10, have outperformed. Although there are many factors influencing this correlation - including when the ETFs were released, the recent relative outperformance of the US - the basic principle of “more risk, more reward” is clear.

This attempt to take more risk for more reward is a key reason why investors should pursue the options below general market ETFs, explored below.

Theme ETFs

There is a subsector of ~9 recently launched theme ETFs within the REIT ETF market that give investors targeted exposure into a specific area of real estate. Recent entrants for the Data & Infrastructure (SRVR) as well as Industrial space (INDS) have particularly impressive returns to date. They have been driven by secular trends in their industries, as well as the Covid-19 pandemic accelerating the importance of those sectors of real estate.

These theme ETFs, by offering more targeted portfolios, are one step further out on the risk spectrum than the market ETFs. As a result, we see a wider range of potential outcomes. The largest, REM, actually has been a negative investment if you owned it since inception. Despite its rich dividends, it has seen overall negative price action. In the last 10 years, it has managed positive returns, but the Sharpe ratio for those returns was 0.34, so it came at the expense of considerable volatility.

The ROOF ETF is, in a sense, even closer out to the type of assets normal investors, equity crowdfunding, or P2P lending would access. By focusing on small-cap REITs, it has less of the large, expensive landmark downtown buildings - or other expensive commercial real estate like data centers and logistics facilities - that the bigger individual REITs or sector ETFs focus on.

Individual REITs

Individual REITs give investors the option to invest in a specific management team and company, relying on their portfolio of properties. If you were to have picked the winners when they came out, you tend to have achieved yearly returns higher than the S&P 500. The only REIT that hasn’t outperformed the S&P 500 since inception amongst the biggest American REITs is Equinix. This outperformance of the S&P 500 is what investors are after by investing in any individual REITs are any of the riskier options like eREITs, P2P Lending, and Owning Outright.

These outperforming returns do appear across different types of REITs as well – wireless infrastructure, logistics, data center, storage, mall, healthcare, multifamily, urban office. Top performers across different sectors have done well. But, the catch to these returns is that the risk-adjusted returns are rarely better than the S&P 500. Only 2 of the 14 largest analyzed here - Digital Realty, DLR, and Realty Income, O - had a Sharpe ratio higher than the S&P 500.

Nevertheless, some investors are interested in these REITs. Why? One reason is due to their low correlation with the S&P 500. The wireless infrastructure REITs have benefited from secular trends. American Tower only has a correlation of 0.29 with the S&P 500. So, investors who are able to pick the right winners are able to benefit from diversification with the REITs.

Private REITs

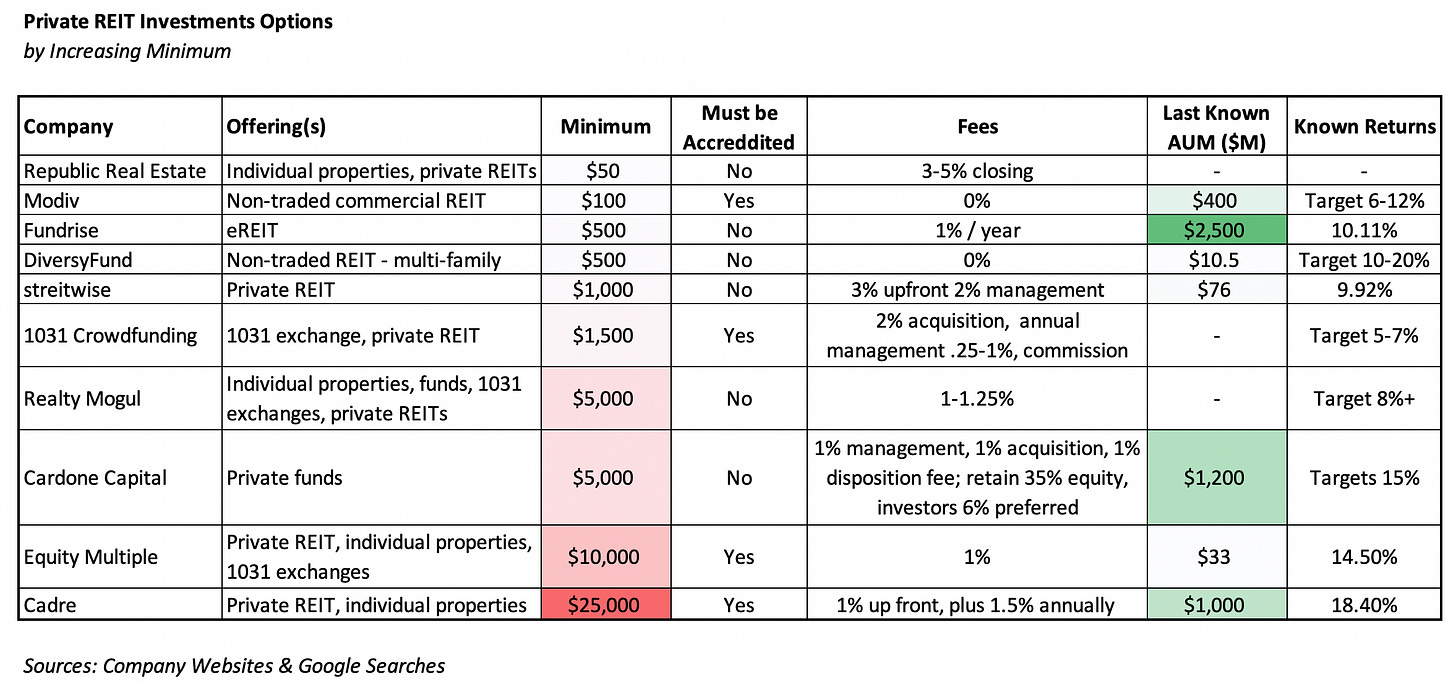

A variant of real estate crowdfunding platforms, private REITs, or similarly vehicles with different names, offer investors the opportunity to invest in REIT like structures for companies that are not publicly listed. These are inherently smaller than the public players, and, as such, are further out on the risk spectrum. They offer the potential for higher returns through efficiencies and strong teams selecting quality property / loan baskets. They however have higher than the $1 minimum for public REITs. The lowest minimum is Republic at $50.

Returns in the space are not verifiable and tough to find. But I have mined their websites to get a sense of targets or stated returns where I could find them. At the highest end of the reported range is Cadre, at 18.40%. This falls below DLR so seems feasible. Generally the returns target 10%+ returns, which is significantly above the market, with the exception of 1031 Crowdfunding and Realty Mogul who target 5-8%. Overall, a 10.11% return like that of Fundrise appears expectable. In that case, the investment is not really outpacing the S&P500 but is outpacing an ETF like VNQ due to the liquidity and size premia.

The largest player in the space appears to be Fundrise, which has an AUM of $2.5 billion. They claim to have helped create the legislation for the private REIT space. Cardone and Cadre also appear to be above the $1 billion mark. Equity Multiple and streetwise appear to be smaller players. As these players continue to grow and innovate, investors will want to pay attention to returns and correlations with other assets. These players could also become future public REITs.

P2P Lending

Another variant of the real estate crowdfunding platform, these providers offer consumers the opportunity to buy into pieces of loans. In essence, the investor is taking up the position of lender. Some of these loans are longer term, but the majority are bridge loans; for example, hard money loans for fix-and-flips. The majority of these products the lender is actually the platform and the investors fund the loans to get a portion of the payouts. The default rates on P2P loans tend to be higher, because they focus on borrowers with higher risk profiles and lower credit scores. With the greater risk also comes the opportunity of greater profits.

P2P marketplaces will often also include options to help lending in non-real estate contexts, to help borrowers who want to consolidate debt or cover large expenses. Interestingly, the category pioneer, LendingClub, closed its program to invest in notes. It has shifted to an institutional investor approach. Even the largest international player, Ratesetter in the UK, sold for a fraction of it max valuation. At this point, there are few at scale players remaining.

Known returns are hard to verify, like other private investment options. But the stated returns seem reasonable, between 6 and 11%. Groundfloor, which only has a $10 minimum, states returns of 10.50%. The larger AUM players like Prosper and Peerstreet, who each have $1B in AUM, have shown lower returns of 5.40% and 6.20% respectively. LendingHome, one of the more well known players has a minimum investment of $50,000.

Crowdfunded Real Estate

Splitting the difference in spirit between private REITs and owning outright yourself sits crowdfunding real estate options. This represents buying a property, or often farm, with a group of other potential individuals. Generally, this is an illiquid investment. Some of these target a 10-year holding period.

There are a variety of new fintech players in this space. AcreTrader has the lowest minimum at $5,000, though you do have to be an accredited investor. Some of these players, in essence, resemble a private REIT in that the platform will manage the land – maintaining tenants, collecting rents, etc. RREAF specifically tries to differentiate itself from the other players by touting its skin in the game, for instance.

Crowdstreet and ArborCrowd appear to be amongst the largest players in the space, with $1.2B and $2.0B AUM respectively. They however have minimums of $25,000. Crowdstreet claims returns of 17.7%. That is higher than any of the P2P lending options. It is similar to the highest private REIT or individual public REIT. Overall, the consensus seems to be the performance of these assets can be similar to or below public REITs.

Owning Outright

Owning investment real estate properties is an especially popular tactic. I often found myself in conversations with folks who know nothing about REITs, eREITs, or P2P lenders looking to own properties outright. These investors sometimes are not even invested significantly in the stock market. They often have seen their, or their family’s owned homes go up in value, and are interested in this exotic asset class. Perhaps they’ve read some Guy Kawasaki. This is a diverse investing class, and despite the stories people tell themselves, by focusing on one asset at a time, it is the highest risk.

With risk comes potential for reward. Because the real estate market is not efficient, there are opportunities for significant returns using this method. It also solves other investor needs like being an active project. A lot of people gain satisfaction out of fixing up a fixer-upper, being a landlord, or selling commercial leases to retail properties. These are all fine things to pursue, but they require more time and effort. Often, the less sophisticated players are the one’s who do all the losing, and the sophisticated players enjoy outsized gains. Some people gain 300% returns in one year, but will you?

Many people justify it to themselves with a focus on the long-term price appreciation in their market, anywhere from 5-7% usually. However, home ownership tends to drive ~5% per year of the cost of the home per year in unrecoverable costs (that is the price that should be compared to rent, not mortgage payments). In some markets, like the Bay Area or Vancouver historical price appreciation so far has beat that rate, often being 12%+. Of course, when prices have appreciated quickly recently, you can likely expect lower expected returns in the future.

Another benefit of owning outright is taking advantage of the tax code. This is how Donald Trump notoriously did not pay taxes for years. He passed through losses on one of his properties and claimed those losses forward for years. That is just one tactic that real estate moguls have devised, as well as worked into, the tax code over the years.

A final benefit, the revenue from any ownership outside of your own home for the most part, is potential rent. FinTech players have been popping up in this space. Companies like HomeUnion and RentersWarehouse can help facilitate the purchase of rental properties.

What’s right for you?

Consider your investor needs. What’s the time and effort you want to put in? Are you merely looking for returns or for a hobby? What is your tolerance for risk? What is your minimum capital? Very few of these options consistently beat the returns of the S&P 500. When they do, that is in part a liquidity premium you are earning – the S&P 500 is much more liquid. Are you okay with all your eggs in the equity basket, or do you want the diversification benefit of real estate? With that information in hand, choose away.

Methodology Caveats:

By using yearly return since inception, the data is affected by timing of the issuing ETF provider.

S&P 500 benchmark returns are calculated back to the date of the oldest other asset in the table.

Sharpe ratios calculated off of monthly returns.

Morningstar data as old as 3/31.

Portfolio visualizer data as old as 4/30.

In cases where the company operates in multiple of the market segments, I have tried to include them in the segment in which I believe they have the largest AUM portion.

For the private players, last known AUM and known returns can be off very significantly. These were just very quick google searches that are nearly impossible to, and I have not, interrogated.