How to Build a SuperApp 🇮🇳 The Story of the Company that Digitized India’s Payments

PayTM, now IPO-ing, digitized payments for 333MFew apps change how an entire nation behaves. PayTM can claim to have done so by helping India digitize its payments. 11% of India’s 1.38B people have paid with PayTM in the last 12 months. As many people have PayTM wallets as live in America.

Behind any such rise is a fascinating story. Paytm was until recently the most valuable startup in India. So strap in as we learn how Vijay Shekhar Sharma took what started as a prepaid mobile recharge platform to a US$ 20B valuation in 11 years. The grit, tenacity, and veritable variety of FinTech lessons are bound to place Vijay in the pantheon of the world’s great FinTech entrepreneurs.

Vijay’s first business started when he was in college. The website, indisite.net, eventually sold in 1999 for half a million US dollars.

Like any classic serial entrepreneur, Vijay leveraged the capital to start his next venture. In those days, Indians on the move were fanatical about checking Cricket scores. Before smartphones, they could not just pull up a scoreboard. So they would dial 197. Vijay named his company after this: One97. It provided the data to mobile operators.

This quickly grew into a big business. One97 even added a primitive version of mobile music streaming. You could call the number to stream your favorite song. While the iPod was out of reach for most Indians in the early 2000s, calling the number was not. Yearly revenue reached an impressive $1B.

But the competition was fierce in mobile content. Eventually, One97 lost its biggest client. Market share slipped away. In 2010, PayTM filed its first IPO prospectus. But the market was not interested in the waning company. The company pulled the IPO.

Lesson 1: Wedge Into the Market With a Painful, Wide User Problem

Like the phoenix that rose from the Ashes, PayTM also rose from the crucible of disaster.

The pulled IPO caused the team to re-examine its product offerings. At the time in India, 97% of mobile phone users were on prepaid plans. The vast majority of those paid in cash at local stores to “top up” their prepaid plans to make more calls and have connectivity. Americans, who at the time were only 19% prepaid may not understand the pain, but “topping up” was a major part of middle & upper class Indian’s lives in 2010.

At the same time, Vijay tweeted about a change that would be going into place:

https://twitter.com/vijayshekhar/status/20049213752610817

The Reserve Bank of India had embraced the use of one time mobile password solutions. These OTP solutions had the potential to make mobile payments substantially more secure.

This convergence of a painful user problem, new technology, and governmental regulation created opportunity. Vijay and the team realized the future would not be going in for a top up, but to pay directly through the mobile device. So they named the service in an almost comically literal fashion: “Pay Through Mobile,” or PayTM.

The future FinTech giant was born. This wedge would prove to tap into a painful, wide enough user problem as to be the background driver of PayTM’s incredible growth since. Topping up via your phone required you to set up a digital wallet. This created the building block for PayTM’s future payments system.

Lesson 2: Layer on Use Cases for Customer Acquisition

With the immediate success of mobile top up - PayTM - Vijay had a crucial insight:

https://twitter.com/vijayshekhar/status/75461449484484609

The smartphone could create new business models, like mobile top up. PayTM would continue to create wedges into the overall FinTech market by creating new business models with the smartphone. After top up for mobile prepaid, in 2010 PayTM added direct-to-home television bill pay and internet data card recharges.

Then in 2011, PayTM added digital satellite services. It continued on from there with bus tickets. These low usage, high frequency services helped keeped PayTM top of mind for consumers in other contexts. PayTM used that presence with consumers to add data cards, postpaid mobile, landline bill, and utility bill payments by 2013.

Through the constellation of payment services, PayTM used existing customer bases of the services being paid for to create a wedge for them to create a digital wallet with PayTM. This proved to be a genius long term customer acquisition strategy. As the company states in its IPO filing:

Payment services have attractive characteristics for consumer acquisition and retention, given the low cost of acquisition especially for certain categories such as bill payments, mobile top-ups, in-store payments and money transfers, and high engagement due to payments behaviour being high in frequency and repeat usage.

Lesson 3: Partner With Other Disruptive Businesses

In 2014, PayTM received a “semi-closed prepaid payment instrument (PPI)” license from the Indian Banking Authority. This allowed the company to create a digital wallet. A digital wallet allows customers to download money from their bank accounts into an account at PayTM.

While PayTM was flourishing with this newfound power; in India, Uber was struggling. It could not facilitate two factor authentication, a regulatory requirement for card transactions. Very little of the Indian population even had a card. So there was a ton of friction in payment, preventing Uber’s business from getting off the ground.

PayTM’s wallet created natural synergy between the two businesses. PayTM leveraged the opportunity to negotiate a landmark deal with Uber. PayTM’s wallet offered Uber’s customers an easier digital payment alternative. This turned out to be a consistent user acquisition engine for PayTM.

Indeed, I was acquired by this method, in this time period! I needed to use Uber and PayTM was the easiest way. Like me, Uber attracted a particular type of customer, who liked using technology products and had disposable income. This helped PayTM expand to a more affluent demographic.

For more traditional users of transportation, PayTM partnered with Indian Railways. This transformed PayTM from a mere payments instrument for one to two use cases to a rich payments and wallet app. Today’s core app arises from the hard work done in 2014:

This payments and wallet app was great at generating GMV and customer acquisition, but it was not generating cash flow from operations. By the end of the year, PayTM needed to raise funds for its aggressive expansion plans. Vijay telegraphed what he would do next in a Tweet, found in a bit of genius detective work by Marc Rubenstein:

https://twitter.com/vijayshekhar/status/411922571634806785

Vijay flew to see if his hero, Jack Ma, would be interested in helping fund PayTM’s vision for the future. Not only was Jack interested, he wanted to think bigger and move faster. Ant Financial invested $500M in the business for a 25% stake. To this day, Ant is the largest shareholder in PayTM, larger than Vijay himself.

With such ownership would come several ideas about the direction of the business. The funding would set up PayTM’s next act.

First, PayTM would, under the influence of Jack, expand into e-commerce. Where Alibaba had gone from e-commerce to payments, PayTM would make the reverse trajectory. And thus would be the genesis of PayTM’s modern SuperApp.

What step to take first in e-commerce? Instead of fulfillment or white label, PayTM built an e-commerce marketplace. This was a strategic choice. The marketplace helped PayTM deepen wallet access for consumers, by opening up more merchants. As Vijay said:

An independent payments business is an orphan business, without a marketplace to anchor it. It’s like the symbiotic relationship between a rocket (payments) and a launcher (marketplace). Our marketplace allows us to build relationships with merchants

The marketplace began to flourish as PayTM continued adding more taxi services alongside Uber. Then, it expanded to hotel and flight bookings, as well as toll roads. It began to cover all travel needs, in addition to payment needs. The SuperApp began to take shape:

The mechanics of all these deals were similar. Merchants - ie, the travel provider - paid for the service. Consumers did not. Typically the margins were dictated by the merchant rate minus PayTM’s transaction costs. In the early days, these were roughly 2 and 1%. So, PayTM earned a margin of 1% on its GMV.

It was a successful customer acquisition strategy, if not the most profitable. Paytm's registered user base grew nearly 10x in one year, from 11.8 million in August 2014 to 104 million in August 2015.

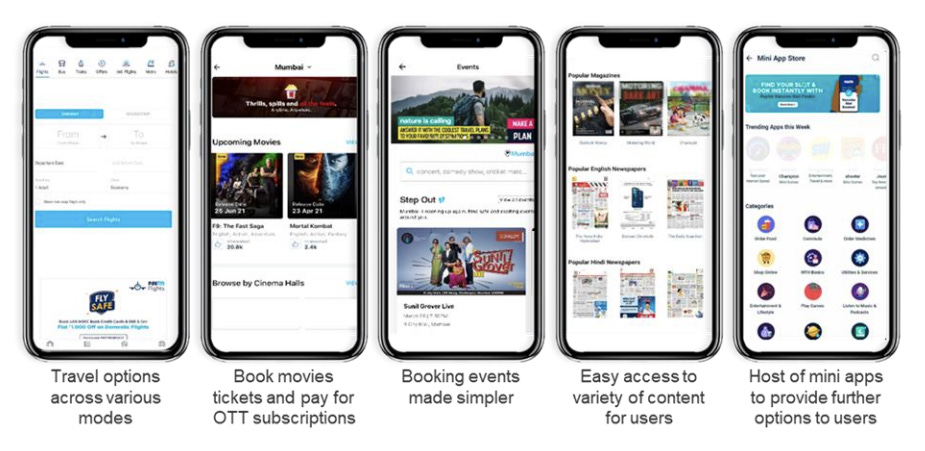

Fast forward to today, and these merchant relationships are amongst the most important assets for PayTM. In addition to travel, the entertainment segment has proved particularly important. PayTM was the second largest movie theater booking platform in India in FY 2020. It partnered with the disruption happening in movies:

This triumvirate of strong product offerings across travel, entertainment, and payments proved to be a strong product basis for PayTM’s next act.

To go big.

Lesson 4: Big Marketing Makes Sense if You’re Attractively Valued

Marketing would be the lever for PayTM to go big. The Ant Group funds would be heavily used on marketing.

In August 2015, PayTM acquired the rights to every national and international cricket match taking place in the premiere Mumbai grounds for four years. It also became the official partner of the IPL Mumbai team. These were expensive TV rights, designating PayTM the brand sponsor for India’s biggest team in its biggest sport.

PayTM would also go big on traditional out of home advertising. Billboards, bus posters, and signs outside street vendors became common-place.

As the out of home creative in the picture above mentions, PayTM also spent ubiquitously on cash back programs. These are just another marketing expense for customer acquisition, factored into the Cost to Acquire a Customer.

As Vijay would say on Twitter, he liked to acquire customers that way:

https://twitter.com/vijayshekhar/status/1094940428984635397

When PayTM was hit with Covid and its travel & entertainment businesses declined significantly, PayTM no longer had a comparative valuation advantage. So it decreased its marketing spend:

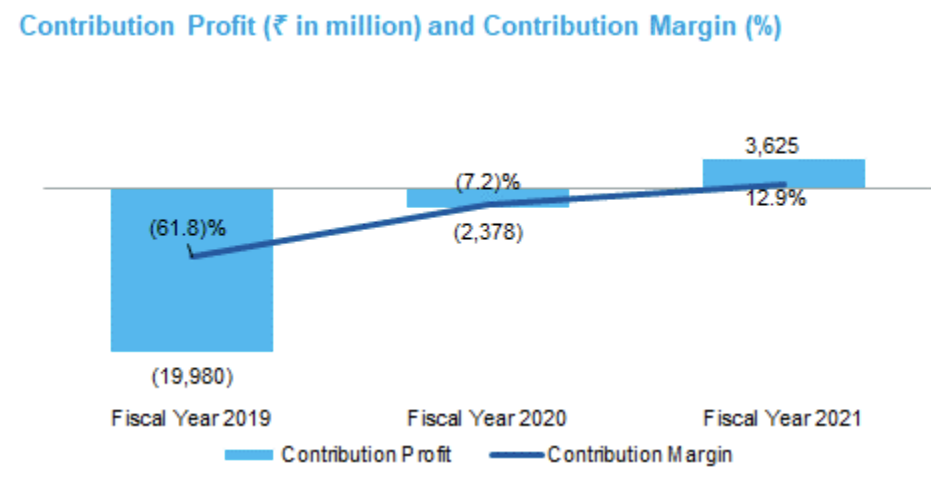

So between 2014-2019, when PayTM had access to cheap capital, and early in its life, it effectively used marketing to supercharge the size of its network. That is paying dividends now as the company shifts focus to improve its gross profit margins. It is reaping the network effects of scale:

One of the key lessons from PayTM is that spending on marketing is an effective strategy early in life, if a company raises at attractive valuations. Because capital is cheap, it makes sense to spend like that. Once that valuation premium vanishes, it is wise to stop spending.

Lesson 5: Go Offline to Enhance the Flywheel

PayTM is a two sided network: consumers and merchants. Merchants do not exist just online. In fact, in India, most merchants exist on the street-side. PayTM needed to become a player in this segment of commerce to truly impact payments in India. Around this time, PayTM established its mission to, “bring half a billion Indians into the mainstream economy.” This doubly motivated the company to go offline.

But Vijay was initially skeptical of formalizing this offline focus. He wanted to create an internet company. It was only a trip through Chinese markets in 2015, under the advice of Ma, that Vijay worked with the team to build a product for the Indian market.

Later that year, PayTM launched QR:

https://twitter.com/aditya1978/status/1311528772001169408

A relatively unimportant invention in the West at the time - although more Americans have now encountered it during the Covid-19 pandemic - QR proved very important in India. To support the expansion of QR, PayTM hired a dedicated salesforce. They used a network of agents to onboard merchants for commission.

The strategy worked. By the end of 2016, PayTM had onboarded 1.5M merchants to QR. As one convenient shop owner said:

It’s much easier than a bank transfer because they only need my mobile number to pay and I get the settlement within seven hours

Any visitor to India knows that shopping in Indian markets is a core part of the culture, and the QR code enabled that cultural experience’s payment using PayTM. PayTM QR codes became ubiquitous across the country:

Fast forward to today and 21 million merchants use PayTM QR. It is the market leader. Merchants love the zero upfront cost or MDR (merchant pay rate).

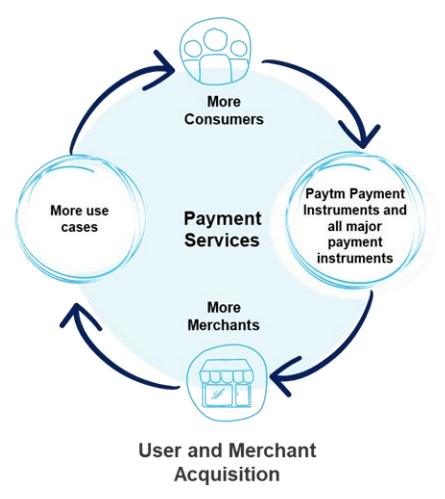

But why does PayTM provide this free service? PayTM uses QR to bring more merchants and consumers into its network. The PayTM flywheel is enhanced by providing more use cases for merchants and helping consumer by making PayTM a major payment instrument:

The larger the number of users who have the PayTM App and use PayTM Payment Instruments, the more attractive it is for merchants to start accepting these instruments from their customers. As more merchants accept these instruments, the consumers see that their PayTM Payment Instruments have wide acceptance, making it more attractive for consumers to use PayTM.

Lesson 6: Change Is An Opportunity

By mid 2016, PayTM had grown to 140 million wallets. Things were going well. Then, the Indian government rocked the world with the demonetization of the 500 and 1,000 Rupee Notes. 80% of paper notes were taken out of circulation. ATM lines were days long. As Indians scrambled to replace their paper bills, PayTM was at the forefront of a cashless future. This would be a great boon to the company.

In just a few weeks, PayTM acquired 40 million users. As Vijay said,

Overnight, we went from a new thing to a must-have.

The company suddenly had 180 million wallets. Amazingly, the company was able to handle the dramatically increased infrastructure loads. That is the good news.

The bad news was that the government also launched UPI, Unified Payments Interface. UPI was an open version of PayTM’s closed system, run for free by a government nonprofit. This drained the economics of PayTM’s option.

Nevertheless, UPI infrastructure became standard customer acquisition for payments companies. PhonePe used it to steal market share from PayTM. So, PayTM would eventually build for UPI rails.

A year later, PayTM launched on UPI. It worked. PayTM would jump to 37% market share, which it is around today.

This ability to pivot is reflected in a core company value:

Change is an opportunity.

A fact of life for companies operating in the payments space is that governments will have an interest. The critical lesson from PayTM is to adapt to the changing regulatory landscape.

In the story of lesson 1, Vijay observed OTP’s potential impact on mobile payments. In the case of UPI, Vijay was no longer a startup but an incumbent. Tthe largest player in the market may not always be first to market, as PayTM saw PhonePe take an early lead. But it is important to take action quickly nonetheless.

After seeing the success of a PhonePe, PayTM was not a Toyota watching Tesla, seemingly never to release an electric car. It did, in big company terms, take action quickly.

The strategy worked. In 2017, the company raised $1.4 billion from Japan’s Softbank at a $8B valuation. It was on to the next era of growth.

Lesson 7: Increase Velocity of Layering on Use Cases

The Softbank era at PayTM would see velocity increase on the playbook we have seen to date.

This began with acceleration of the travel segment. After the October 2016 merger of India’s largest online travel agency groups, MakeMyTrip and Ibibo, many industry analysts expected them to take the market. But PayTM added flights.

This was added to its already formidable rail segment, where PayTM was and still is the largest seller of train tickets. In smaller cities and towns, MakeMyTrip did not have an established brand. PayTM used rail and traditional travel for these travelers as a wedge in.

In June 2017, PayTM removed cancellation fees from flights. It also added flight insurance, which was a new product for India at the time. It proved to be a hit. Then, PayTM added wait lists for sold out trains. This level of product innovation helped PayTM maintain an 8-12% share of India’s travel market.

On the payments side of the business, PayTM doubled down on merchant service. Instead of battling cash back battles with PhonePe and Google on UPI rails, PayTM focused on building for merchant problems. As Vijay said:

Paytm wants to be the champion of merchant payments; Paytm wants to be the champion of the payments that drive economic commercial value. We are totally clear about that. Person to person money transfer does not drive any economic commercial value; we call it money transfer.

The strategy worked. In January 2018, the scion of Omaha’s firm, Berkshire Hathway invested $300M into PayTM at a $10B valuation. The company had become a decacorn.

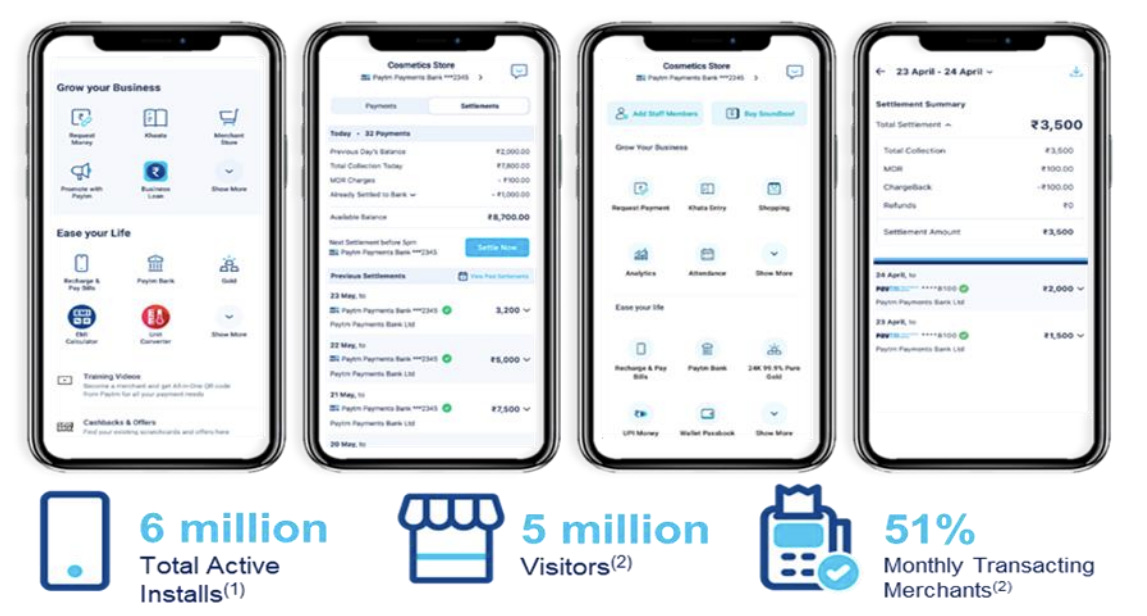

The additional funding helped the company double down on the merchant side of the business. The company launched the Paytm for Business app. The app offered instant payment settlement and monitoring. The app swelled to 7M merchants in a few months.

The merchant focus worked. The company amassed merchants across 26 use cases including electricity, cooking gas, water, mobile and broadband, credit card, rent, educational fees, city and town services such as challan or municipal bill servicing.

Lesson 8: 100% of Businesses Change Every Three Years

Over time, PayTM began to lose its group on India's $65 billion mobile payments market. An Information piece in January 2020 reported that the UPI, and the corresponding rise of PhonePe and Google Pay, contributed to the company losing its luster.

The competition from UPI and the Government’s initiatives to make wallets interoperable have nearly eliminated Paytm’s capacity to capture value from its closed payments model. Despite the rising penetration of digital payments, PayTM’s revenue growth has stagnated at a few percentage points over the past few years, after the meteoric 100%+ we documented in the years prior.

As Vijay says:

https://twitter.com/vijayshekhar/status/470185578890153984

So recently the company has undertaken its latest pivot. Enter the company’s shift into financial services.

Now, Vijay has this to say about the identify of the company:

We are payment, commerce and we are a financial services company. So Paytm wants to be the financial services company in the end and that is what we are headed towards.

PayTM went from a payments company to a payments and commerce company to a payments, commerce, and financial services company:

This started in 2017 with the launch of PayTM gold, which allows users to buy as little as 1 rupee (1.5 cents) of pure gold. PayTM tapped into a culturally sensitive product that only a homegrown fintech could: taking the trend of fractional ownership in stocks to fractional ownership in gold. Only 3% of Indians own equities but a much larger portion own gold. By fractionalizing it to such an extent, PayTM took a unique angle on its mission to bring half a billion Indians into the mainstream economy. It helped the remaining portion of India that did not own gold to own it.

In the same year, PayTM launched PayTM Payments Bank. This has allowed PayTM to venture into a variety of wealth management products like a Gold Savings Plan and Gold Gifting. The following year, 2018, it launched PayTM Money.

That year, it ran afoul of government regulation again. The Reserve Bank of India questioned the strategy of cashback acquisition covered in Lesson 4. This resulted in the separating of PayTM and PayTM Payments Bank.

Following its own lesson - change is an opportunity, 6 - PayTM has seized the day. Today, PayTM Payments Bank has over 60 million depositors holding over $450M in deposits. Now, Paytm generates around 4% of its revenue from financial services - 80% from payments and 16% from e-commerce - but its goal is to grow that share over time.

In addition to these core payments and wealth management use cases, PayTM has ventured into insurance and lending. Lending is the biggest growth opportunity in the PayTM business. In fact, it is the fastest growing part of the business from a revenue perspective.

The company operates a complete life cycle technology platform, with the goal of democratizing credit. The main outlet of that so far has been PayTM Postpaid, their Buy Now, Pay Later product. The latest quarter saw 1.4M loans through this mechanism, a meteoric growth:

As far as the bull case for PayTM’s future goes, financial services and lending lie at the heart of it. But the other key component is the revitalization of commerce and cloud services. A variety of arm-chair analysts of the IPO have rightly gawked at the decelerating recent revenue.

But split that revenue open a layer, and we learn that PayTM is the story of two dramatically different businesses:

Revenue from payment and financial services continue to grow, on the back of continued GMV growth of 33%. The reason PayTM’s total revenue has decelerated is the swift decline in the commerce and cloud services line, from 15 billion rupees in 2019 to 7 billion in 2021.

This is because PayTM is a leader in movie and rail ticketing, both activities that were significantly curtailed by the pandemic. Both these businesses can be expected to rebound over the coming months and years. PayTM remains a significant market share owner in each business.

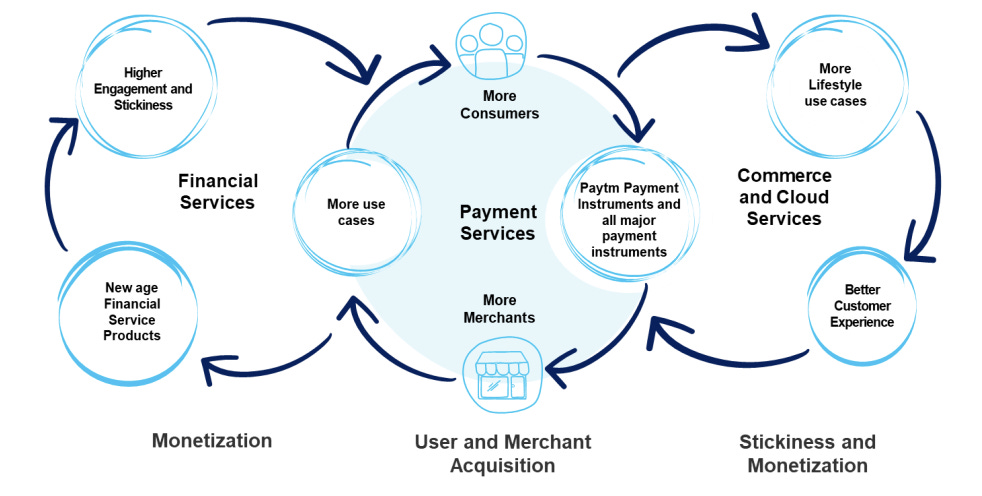

As these commerce businesses ramp up again, in combination with Financial Services, PayTM has a new and enhanced flywheel. Instead of being purely a payments flywheel, the flywheel now has three circles. Financial services operates on one side, and commerce on the other:

With its target to raise $2.46 B from the public markets, Paytm would surpass Coal India’s $2B issue in 2010 to become India’s biggest IPO. Of course, that is no surprise to anyone who has read this far. With digital payments expected to grow at a blistering 17% pace per year in India through 2026, PayTM will be a primary beneficiary.

The company that has digitized payments for a whole country is set to reap the rewards.