How to Build a SuperApp 🇮🇳 The Story of the Company that Digitized India’s Payments

PayTM, now IPO-ing, digitized payments for 333M

Few apps change how an entire nation behaves. PayTM can claim to have done so by helping India digitize its payments. 11% of India’s 1.38B people have paid with PayTM in the last 12 months. As many people have PayTM wallets as live in America.

Behind any such rise is a fascinating story. Paytm was until recently the most valuable startup in India. So strap in as we learn how Vijay Shekhar Sharma took what started as a prepaid mobile recharge platform to a US$ 20B valuation in 11 years. The grit, tenacity, and veritable variety of FinTech lessons are bound to place Vijay in the pantheon of the world’s great FinTech entrepreneurs.

Vijay’s first business started when he was in college. The website, indisite.net, eventually sold in 1999 for half a million US dollars.

Like any classic serial entrepreneur, Vijay leveraged the capital to start his next venture. In those days, Indians on the move were fanatical about checking Cricket scores. Before smartphones, they could not just pull up a scoreboard. So they would dial 197. Vijay named his company after this: One97. It provided the data to mobile operators.

This quickly grew into a big business. One97 even added a primitive version of mobile music streaming. You could call the number to stream your favorite song. While the iPod was out of reach for most Indians in the early 2000s, calling the number was not. Yearly revenue reached an impressive $1B.

But the competition was fierce in mobile content. Eventually, One97 lost its biggest client. Market share slipped away. In 2010, PayTM filed its first IPO prospectus. But the market was not interested in the waning company. The company pulled the IPO.

Lesson 1: Wedge Into the Market With a Painful, Wide User Problem

Like the phoenix that rose from the Ashes, PayTM also rose from the crucible of disaster.

The pulled IPO caused the team to re-examine its product offerings. At the time in India, 97% of mobile phone users were on prepaid plans. The vast majority of those paid in cash at local stores to “top up” their prepaid plans to make more calls and have connectivity. Americans, who at the time were only 19% prepaid may not understand the pain, but “topping up” was a major part of middle & upper class Indian’s lives in 2010.

At the same time, Vijay tweeted about a change that would be going into place:

The Reserve Bank of India had embraced the use of one time mobile password solutions. These OTP solutions had the potential to make mobile payments substantially more secure.

This convergence of a painful user problem, new technology, and governmental regulation created opportunity. Vijay and the team realized the future would not be going in for a top up, but to pay directly through the mobile device. So they named the service in an almost comically literal fashion: “Pay Through Mobile,” or PayTM.

The future FinTech giant was born. This wedge would prove to tap into a painful, wide enough user problem as to be the background driver of PayTM’s incredible growth since. Topping up via your phone required you to set up a digital wallet. This created the building block for PayTM’s future payments system.

Lesson 2: Layer on Use Cases for Customer Acquisition

With the immediate success of mobile top up - PayTM - Vijay had a crucial insight:

The smartphone could create new business models, like mobile top up. PayTM would continue to create wedges into the overall FinTech market by creating new business models with the smartphone. After top up for mobile prepaid, in 2010 PayTM added direct-to-home television bill pay and internet data card recharges.

Then in 2011, PayTM added digital satellite services. It continued on from there with bus tickets. These low usage, high frequency services helped keeped PayTM top of mind for consumers in other contexts. PayTM used that presence with consumers to add data cards, postpaid mobile, landline bill, and utility bill payments by 2013.

Through the constellation of payment services, PayTM used existing customer bases of the services being paid for to create a wedge for them to create a digital wallet with PayTM. This proved to be a genius long term customer acquisition strategy. As the company states in its IPO filing:

Payment services have attractive characteristics for consumer acquisition and retention, given the low cost of acquisition especially for certain categories such as bill payments, mobile top-ups, in-store payments and money transfers, and high engagement due to payments behaviour being high in frequency and repeat usage.

Lesson 3: Partner With Other Disruptive Businesses

In 2014, PayTM received a “semi-closed prepaid payment instrument (PPI)” license from the Indian Banking Authority. This allowed the company to create a digital wallet. A digital wallet allows customers to download money from their bank accounts into an account at PayTM.

While PayTM was flourishing with this newfound power; in India, Uber was struggling. It could not facilitate two factor authentication, a regulatory requirement for card transactions. Very little of the Indian population even had a card. So there was a ton of friction in payment, preventing Uber’s business from getting off the ground.

PayTM’s wallet created natural synergy between the two businesses. PayTM leveraged the opportunity to negotiate a landmark deal with Uber. PayTM’s wallet offered Uber’s customers an easier digital payment alternative. This turned out to be a consistent user acquisition engine for PayTM.

Indeed, I was acquired by this method, in this time period! I needed to use Uber and PayTM was the easiest way. Like me, Uber attracted a particular type of customer, who liked using technology products and had disposable income. This helped PayTM expand to a more affluent demographic.

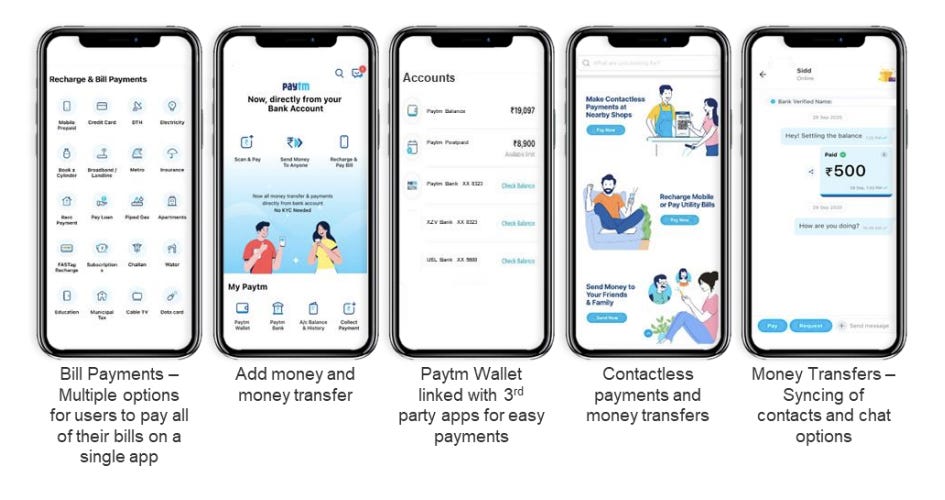

For more traditional users of transportation, PayTM partnered with Indian Railways. This transformed PayTM from a mere payments instrument for one to two use cases to a rich payments and wallet app. Today’s core app arises from the hard work done in 2014:

This payments and wallet app was great at generating GMV and customer acquisition, but it was not generating cash flow from operations. By the end of the year, PayTM needed to raise funds for its aggressive expansion plans. Vijay telegraphed what he would do next in a Tweet, found in a bit of genius detective work by Marc Rubenstein:

Vijay flew to see if his hero, Jack Ma, would be interested in helping fund PayTM’s vision for the future. Not only was Jack interested, he wanted to think bigger and move faster. Ant Financial invested $500M in the business for a 25% stake. To this day, Ant is the largest shareholder in PayTM, larger than Vijay himself.

With such ownership would come several ideas about the direction of the business. The funding would set up PayTM’s next act.

First, PayTM would, under the influence of Jack, expand into e-commerce. Where Alibaba had gone from e-commerce to payments, PayTM would make the reverse trajectory. And thus would be the genesis of PayTM’s modern SuperApp.

What step to take first in e-commerce? Instead of fulfillment or white label, PayTM built an e-commerce marketplace. This was a strategic choice. The marketplace helped PayTM deepen wallet access for consumers, by opening up more merchants. As Vijay said:

An independent payments business is an orphan business, without a marketplace to anchor it. It’s like the symbiotic relationship between a rocket (payments) and a launcher (marketplace). Our marketplace allows us to build relationships with merchants

The marketplace began to flourish as PayTM continued adding more taxi services alongside Uber. Then, it expanded to hotel and flight bookings, as well as toll roads. It began to cover all travel needs, in addition to payment needs. The SuperApp began to take shape:

The mechanics of all these deals were similar. Merchants - ie, the travel provider - paid for the service. Consumers did not. Typically the margins were dictated by the merchant rate minus PayTM’s transaction costs. In the early days, these were roughly 2 and 1%. So, PayTM earned a margin of 1% on its GMV.

It was a successful customer acquisition strategy, if not the most profitable. Paytm's registered user base grew nearly 10x in one year, from 11.8 million in August 2014 to 104 million in August 2015.

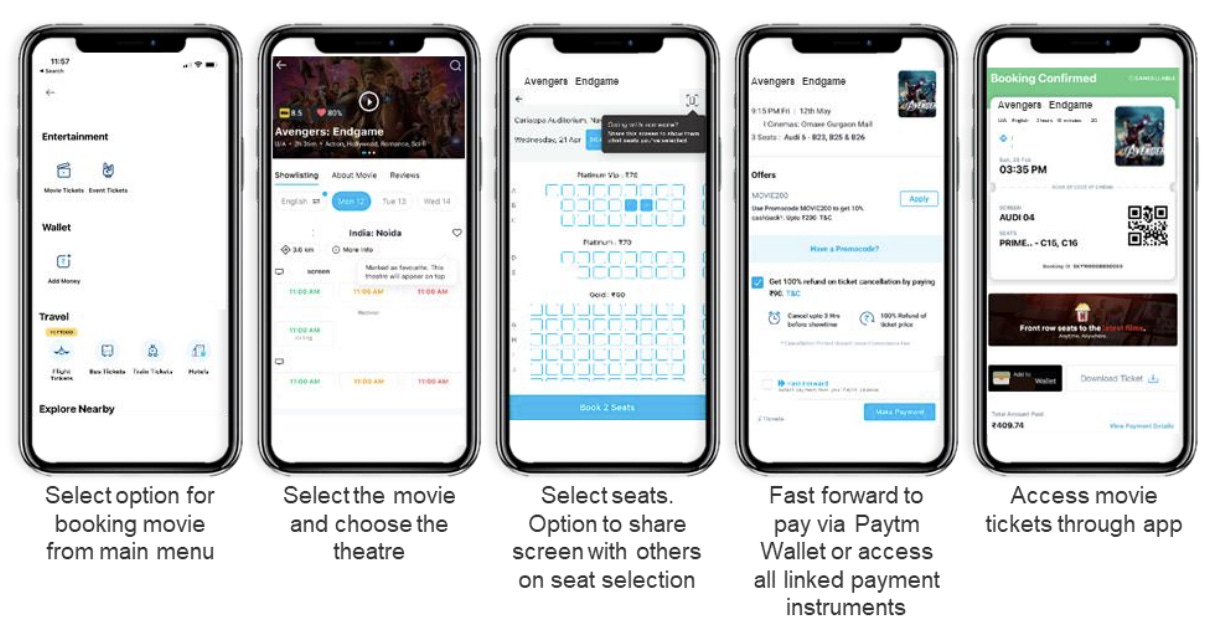

Fast forward to today, and these merchant relationships are amongst the most important assets for PayTM. In addition to travel, the entertainment segment has proved particularly important. PayTM was the second largest movie theater booking platform in India in FY 2020. It partnered with the disruption happening in movies:

This triumvirate of strong product offerings across travel, entertainment, and payments proved to be a strong product basis for PayTM’s next act.

To go big.

Lesson 4: Big Marketing Makes Sense if You’re Attractively Valued

Marketing would be the lever for PayTM to go big. The Ant Group funds would be heavily used on marketing.

In August 2015, PayTM acquired the rights to every national and international cricket match taking place in the premiere Mumbai grounds for four years. It also became the official partner of the IPL Mumbai team. These were expensive TV rights, designating PayTM the brand sponsor for India’s biggest team in its biggest sport.

PayTM would also go big on traditional out of home advertising. Billboards, bus posters, and signs outside street vendors became common-place.

As the out of home creative in the picture above mentions, PayTM also spent ubiquitous on cash back programs. These are just another marketing expense for customer acquisition, factored into the Cost to Acquire a Customer.

As Vijay would say on Twitter, he liked to acquire customers that way:

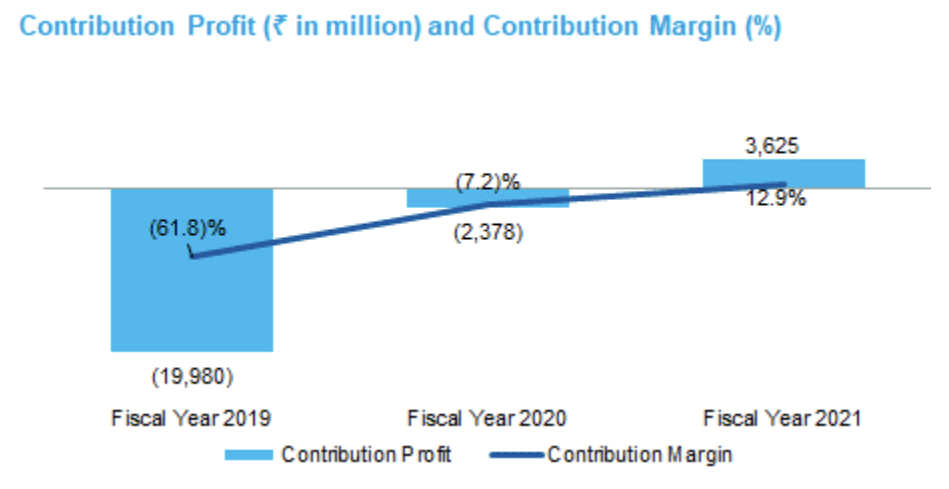

When PayTM was hit with Covid and its travel & entertainment businesses declined significantly, PayTM no longer had a comparative valuation advantage. So it decreased its marketing spend:

So between 2014-2019, when PayTM had access to cheap capital, and early in its life, it effectively used marketing to supercharge the size of its network. That is paying dividends now as the company shifts focus to improve its gross profit margins. It is reaping the network effects of scale:

One of the key lessons from PayTM is that spending on marketing is an effective strategy early in life, if a company raises at attractive valuations. Because capital is cheap, it makes sense to spend like that. Once that valuation premium vanishes, it is wise to stop spending.

Get the second half of the story by smashing this button:

Hope you enjoyed this week’s deep dive on PayTM. We’ll round this week’s newsletter out with two mini essays and my top Tweet of the week.

The Top Crypto Rorschach

Bitcoin, Ethereum, or Solana? Where would you invest if you could only choose one? This is a Rorschach test for your investment style.

To analogize to the stock market:

- Bitcoin is Berkshire Hathaway

It represents lots of assets (highest market cap) and most downside protection, but least appreciation potential.

- Ethereum is Amazon

It is the dominant platform (AWS) for building startups (new defi or crypto projects). It is big but still has appreciation potential.

- Solana is Shopify

It’s a fast growing, sexy new platform play for a certain type of crypto buidler. It’s expensive but has the highest upside.

No Floor, No Ceiling

The great online game is no longer optional. Everyone must play. We have little to lose because we already lost everything:

stable jobs

affordable homes

education that lasts a lifetime

worry-free retirement

dependable currency

Information moves around and knowledge becomes obsolete faster than ever. Geographical constraints no longer protect the average from the best. We can win world-scale prizes. But we have to play.

This is not the “rat race” our parents and grandparents participated in. That race was run within organizations.

Today, we face the opposite problem. We are individuals, at the whims of forces we do not understand, trying to convince ourselves that our old institutions have the power to save us.

There is no longer a ceiling above us to restrict our earning potential.

The overarching law of the internet: It gives more people an opportunity to win. But it forces everyone to play the game.

-

If that didn’t sound like my writing, that is because the language was pulled from one of the classic internet blog posts, in my opinion.

Finally, my top Tweet of the week: