Falguni Nayar: Investment Banker to Internet Entrepreneur & Billionaire

This founder-CEO left her job as a Managing Director at one of the leading investment banks to start a beauty company. Today, her company IPOs, making her a self-made billionaire. It’s an inspiring story.

This rockstar is Falguni Nayar:

Her net worth will rise to nearly $3.8 billion pos the IPO of Nykaa, one of the hottest e-commerce companies in India. She is a personification of the saying, “age is just a number.”

Falguni Nayar's Story

Her story began at Kotak Mahindra Capital Co. where she spent 18 years rising to the level of managing director.

In 2012, she “wanted to experience the journey of creating something from scratch.” As a lover of makeup, she saw a market waiting for disruption. There was no singular platform for high-end products & they myriad of new direct-to-consumer brands popping up.

After waiting for long enough, she started her own.

It was a grind, especially at first. Her first order took 6 months. She had to beg friends to buy and borrow money. But she kept at it.

She established the company’s mission “To create a world where our consumers have access to a finely curated, authentic assortment of products and services that delight and elevate the human spirit.” She has relentlessly pursued it.

Company Success

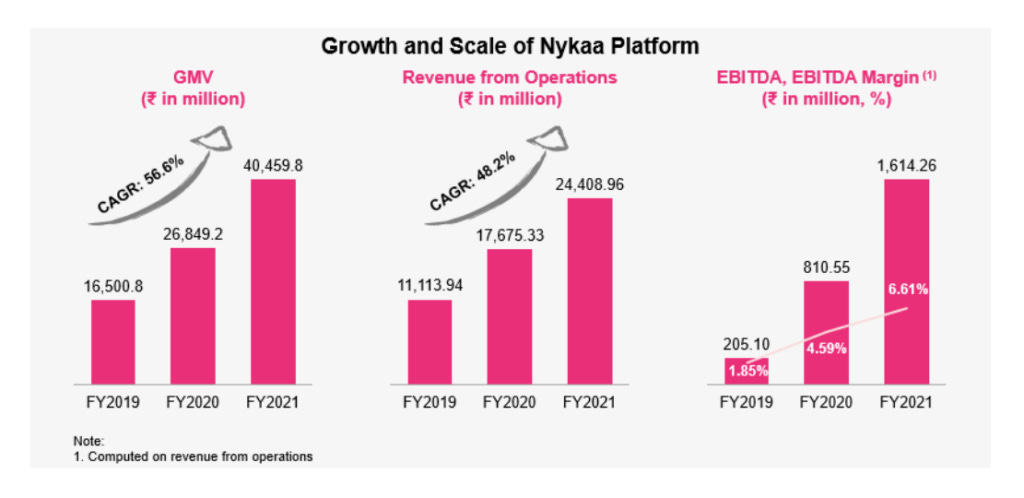

The investments are paying off. Between FY 2019-2021, the company has grown revenues at a 56% CAGR. It has also improved EBITDA margin dramatically at the same time:

In January, the company hit a $2B valuation. Today, Nykaa is set to IPO at a $7-8B valuation, because it is the rare company that is already profitable.

How does it do it?

White Label

Selection

Lifestyle Content

Sticky App

Growing Market

1. White Label

It has several brands, including NYKD, Pippa Bella, and 20 dresses. These brands represent 25% of GMV, a category leading proportion. They also have an AOV of 4000 rupees, which is higher than most white label makeup products in India.

Notice popular brand reps, like Bollywood star Katrina Kaif:

2. Selection

It offers over 200,000 products across 3,800 brands. This is the Amazon strategy - Nykaa simply has all the makeup from everyone you could want.

It is also omnichannel. It has 80 stores across 40 cities (8-10% of GMV).

3. Lifestyle Content

The Nykaa ecosystem is one customers want to be in. It has celebrities and influencers, ratings and reviews.

This gives people a reason to engage with Nykaa even when not purchasing, creating a self-reinforcing flywheel:

4. Mobile App

Nykaa has one of the hottest mobile apps in India. It has over 56M downloads.

It represents 88% of Nykaa’s GMV, another industry-leading rate that allows Nykaa to have really great margins. This is the hub for Nykaa’s purchasing journeys:

5. Growing Market

Part A - Internet Trends

The funnel for Indian online users is rapidly improving, with room to grow. By 2025, Indian should see an incremental 200-220M online shoppers:

This is due to cheap access to internet with reliance Jio offering less than $1 per GB.

Part B - Vertical Trends

This is translating into rapid growth for the online beauty and personal care market in India. It is currently US$18B and growing at 30% / year. It has more room to reach US penetration of 15-20% or Chinese penetration of 25-35%:

Nykaa is the Amazon of beauty products in India with #1 market share.

IPO Analysis

The company lists on the BSE and NSE (Indian exchanges) in a few hours . Head to a brokerage with international stocks. Interactive brokers is my favorite.

Is the valuation worth it? Most brokerages are concerned. It will trade at:

21X P/S multiple

809x P/E multiple

What do you think?

If you’re looking to start something, let Falguni Nayar be your inspiration.

No matter the phase of our life, with the grit and determination, we can do it.

Several more interesting Indian IPOs to come in the coming days: PayTM, Policybazaar, and Fino Payments.

Subscribe to the newsletter to get all the briefings.

Sources: Filing, Yugansh Chokra, LiveMint, Bloomberg Quint