Anticonversions - Your Ultimate Guide to Cancelation

It's the dreaded cause of retention: your user giving up on you. Here's why it happens and how to overcome it

Updated 6/6/24

We spend so much time on conversions that we lose sight of their sinister cousin: anticonversions.

Churning out all of your existing customers is the most common cause of death in modern tech companies.

After all that effort to land the big client, 2-3 years later, they’re gone.

Companies don’t invest in reactivation, have a poor off-boarding experience, and lose customers forever.

Fun fact: The origin of the term anticonversions is from Reforge’s Pricing course.

Continuing our Pricing & Packaging Series

A week ago, we kicked off our Pricing & Packaging series with the Pricing Page.

Now, we march over to the next lever: cancelation.

This is one of my favorite levers, as I’ve worked on several cancelation flows in different industries: from consumer to enterprise B2B.

I’ve also spent the past few months buying and then canceling products to learn the fundamental essences of a good cancelation flow.

What I’ve learned is: the overall principles of what makes a good cancelation flow are surprisingly similar.

Today, we’ll break them down.

Anticonversions Matter

There’s three stats I want to highlight to emphasize the importance of this lever before we get into this:

40% re-subscribe rate: fully 40% of Netflix’s new subscribers are subscribers who canceled within the past 12 months.

18s to catch them before churn: that’s about how long it’s estimated (on average) that you have to recapture your user in your cancelation flow - or they’re lost.

5x cheaper to reach out to: canceled customers are much cheaper to reach via paid advertising, outbound, or other channels.

Today’s Guide

We’re going to try to create the guidance I would give to my own teams working on anticonversions:

Dissecting 6 of the best cancelation flows out there today

Why people cancel: when to optimize flows vs core

Encyclopedia of top 20 anticonversion tests

Ideal testing framework + metrics

Anticonversion’s 8 key principles

Top 7 big mistakes made

Cancelation prototype

This is the post to forward to your PM friend working on this. Or your product leader so you start.

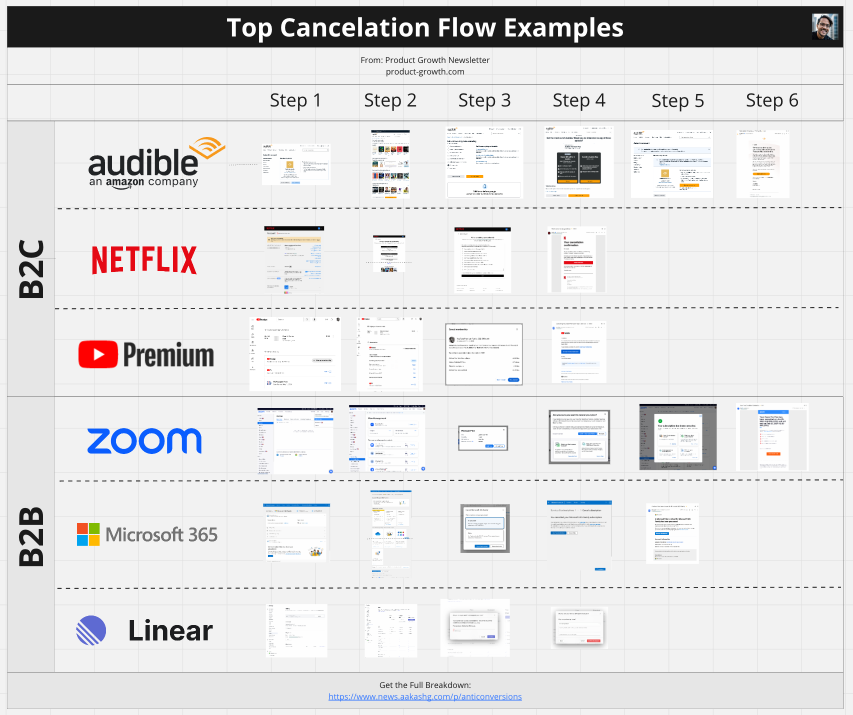

1. Dissecting 6 of the best cancelation flows out there today

The product surface that teams working on anticonversions tend to de facto own is the cancelation flow.

So let’s study 6 of the best.

B2C: Audible, Netflix, and YouTube Premium

B2B: Zoom, Microsoft 365, and Linear

You can all find the examples we cover in this holistic Miro:

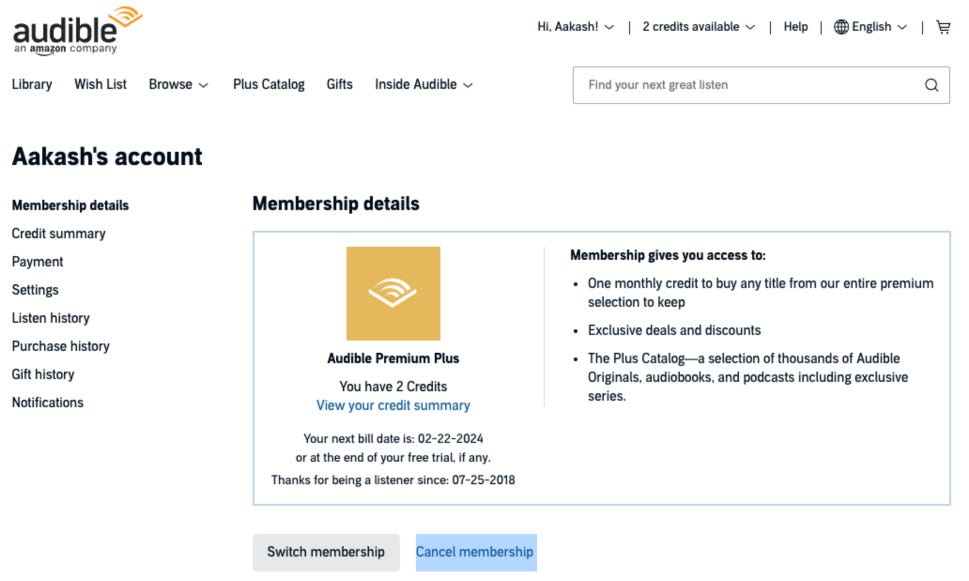

B2C Flow Example 1 - Audible

At 6 steps, Audible’s cancelation flow has a couple things that make it growth optimized. Let’s highlight some of the most important.

In the first step, it shows off the personalized number of credits you have left.

This plays on the behavioral psychology concept of loss aversion, which is one of the most reliable movers in cancelation flows.

Another growth optimization is, in the second step, you have to scroll down below the fold, past the benefits you’ll lose by unsubscribing:

This added friction is mostly “good friction” because it puts the product front and center - and gives you lots of opportunities to click into content you may like.

Finally, in the fourth stage, it offers not just a discount - 50% off for 3 months - it also offers a lower priced plan.

Those alternatives to the cancelation are, naturally, positioned as primary CTAs.

The big improvement area for Audible is to have a customized offer. The 50% off for 3 months is the same regardless of a user’s cancelation reason.

The best offers are customized (more on that later).

With over 5K words and 40+ images, you may want to jump over to a browser:

B2C Flow Example 2 - Netflix

I’ve included Netflix here because they have industry-leading retention:

Netflix 12 month retention: 68%

HBO Max: 45%

Starz: 32%

They’re more than double the bottom performer, Starz.

On top of that, as I mentioned at the beginning - 40% of their new subscribers have churned recently.

Netflix has completely optimized the anticonversion engine.

We couldn’t not study them.

And it’s amazing how little they optimize for growth in their cancelation flow.

They clearly are optimizing more for re-subscribing:

There is nothing above the fold that gets you to try not to cancel. The finish cancelation CTA is prioritized above pausing or downgrading too.

It puts the user first.

On top of that, the survey is not before cancelation - it’s after it:

So they really have 1-step cancelation.

On top of that, Netflix will automatically cancel your subscription if you aren’t using the service.

Despite all these steps that put the user first, it has some of the best retention and re-subscribe numbers out there.

This is a crucial lesson we’ll cover more: your core product value matters more than your cancelation flow in optimizing anticonversions.

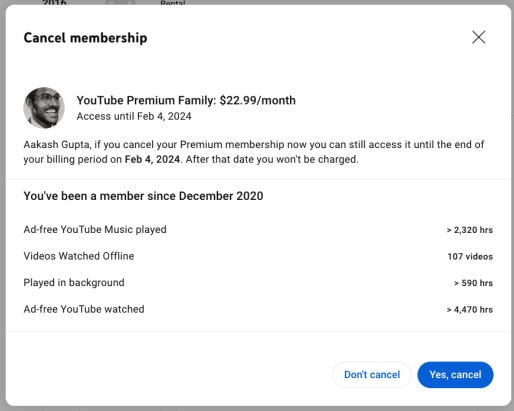

B2C Flow Example 3 - YouTube Premium

Let’s end our tour of B2C cancelation flows with YouTube premium.

It’s nicely optimized for growth, in between Audible and Netflix.

In the manage membership section itself, it begins to prime you to pause instead of cancel:

Once you click cancel, it has a great example of using loss aversion with specific stats about your usage:

There’s no discount or more basic plan.

After that, you’re canceled.

With a nice finishing touch - it does make it 1-click to restart your membership over e-mail:

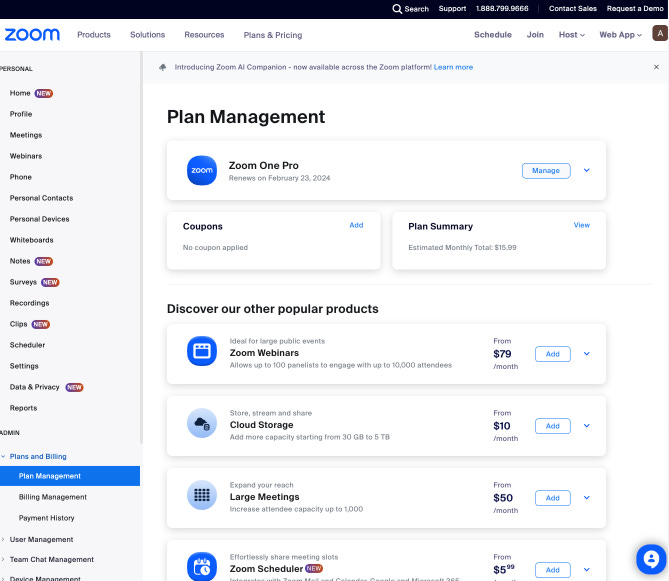

B2B Flow Example 1 - Zoom

Now - let’s move into B2B. And I’ve started with one of the most ubiquitious PLG B2B products out there.

Zoom’s retention rate has fallen from the 2020 days of 140% to 105% for enterprise, and below 100% for SMBs.

We’ll see why.

The first thing to notice is that Zoom doesn’t make cancelation easily accessible from your normal settings page, like every B2C example did.

It separates it:

Upon clicking, it takes you deep into the admin settings.

This is the typical type of difference in B2B:

From there, it’s multiple clicks to cancel - hardly 1-click cancel like Netflix or YouTube.

Once you arrive to the cancelation screen, continues to growth optimize a bit.

It tries to encourage you to pause or downgrade:

Even after cancelation, it makes it easy to reactivate, pause, get an offer, or fill out a survey after canceling:

Not everyone does that.

Overall, Zoom has a relatively easy flow. The survey was after cancelation and not required.

But it wasn’t quite B2C.

Overall, with Zoom’s increasing anticonversions, it clearly has inspiration it could take from more growth optimized cancelation flows like Audible or YouTube Premium:

Specific User Loss: It wasn’t very in your face with what you’re losing. In fact it didn’t cite loss aversion at all.

UX Friction: It also kept cancel as a primary CTA that required no scrolling everywhere.

B2B Flow Example 2 - Microsoft 365

Microsoft 365 has a 92% 12-month retention rate, easily the highest of any product catering to SMB and consumer I have ever seen.

That’s how it’s managed to reach an astounding 345M paid seats. It was 60M in 2015. That’s 5.7x in 9 years.

I would have thought it had peaked.

Some small percentage of users are moving to Notion and GSuite, but not many.

So, kind of like Netflix - we have to take a look at its cancelation flow.

It is really short, but they’ve packed in a few growth optimizations.

You do have to scroll to the bottom to cancel:

In that space, it tries to get you to dowgrade, take an offer, and see all the value you get.

The CTA is also ‘I don’t want my subscription’ which is more anxiety-inducing than something like YouTube ‘Yes, Cancel’.

After that Microsoft 365 actually does one thing that none of the other examples do: it offers a prorated refund:

This is easily the most user-friendly feature in a cancelation flow we’ve seen.

When you’re playing from a position of strength like Microsoft 365, and you’ve created an ‘essential’ product suite, you can be very user-first.

B2B Flow Example 3 - Linear

Let’s end on one of the hottest companies in B2B SaaS right now, Linear.

They have a single PM and famously don’t optimize for growth.

But their cancelation flow is actually quite growth optimized.

First, there is no notion of cancelation, it’s just updating the plan:

Once you do update plan, you don’t cancel.

You just downgrade to the free plan:

And they use the opportunity to highlight a free trial to upgrade as well.

There is a final message showing what you have used the product for:

This is a good use of loss aversion.

Finally, before you downgrade with a red button, you have to say why:

This multi-step cancelation is quite well done.

It’s optimized partially - but not totally:

Notably - they don’t follow up with a cancelation email to allow you to resubscribe though.

And there’s no personalized offer if Linear was too expensive.

Let’s go through how to totally optimize.

2. Why people cancel: when to optimize flows vs core

We’ve just gone through 6 cancelation flows.

But the biggest misconception you could take from today’s piece is optimizing your cancelation flow is the best way to optimize anticonversions.

Keep reading with a 7-day free trial

Subscribe to Product Growth to keep reading this post and get 7 days of free access to the full post archives.