A Greener Crypto Future 🌳? The New #3 Crypto: Cardano

The top contributed to crypto project on Github, three years straight

Aug 21, 2021

💭 “Cardano… the altcoin I invested in back in 2017?”

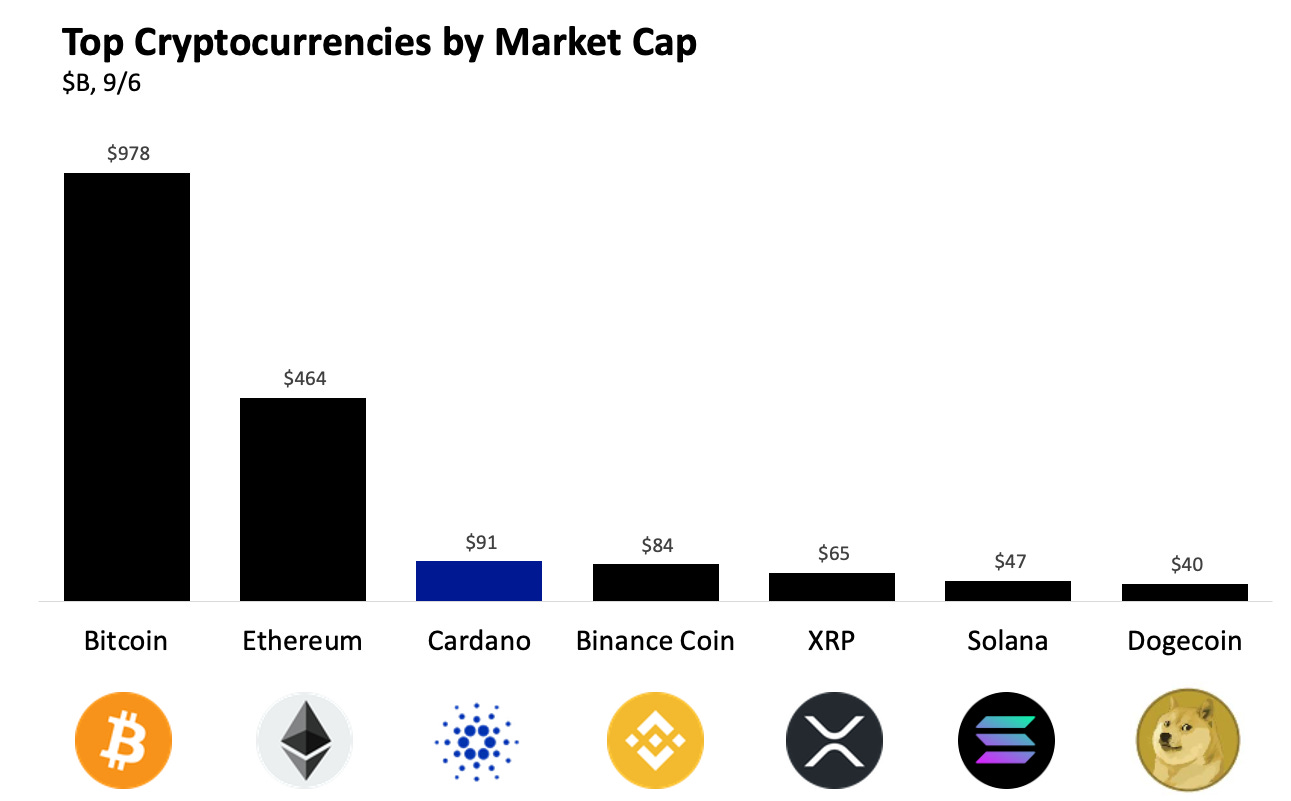

I was really surprised to see the headline that Cardano had become the #3 cryptocurrency a few weeks ago. That makes it the leading crypto behind Bitcoin and Ethereum. It is amazing something became so big with me knowing so little. As of publishing, the market cap is $91B. Cardano is worth more than Zoom, which has a market cap of $89B. Zoom is a profitable company growing its revenues at 400% per year.

At a market cap of $91B, Cardano is also more than 2x Dogecoin, the Elon Musk favorite. It is also ahead of the increasingly noisy Solana, which is worth $47B. But when’s the last time you heard about Cardano in the mainstream news?

🤔 “Is anything really being done there, or is it all hype?”

Looking just the first layer deeper, it turns out there is a mind-blowing amount of development happening on Cardano. 2021 to date, it has had the most Github activity of any blockchain. It also did the same in 2020. And 2019. Add on to that, the story of Cardano itself is dramatic, historic, and interesting. Let’s travel to that time together.

Part 1: How We Got Here 🔎

Generation 1 Crypto

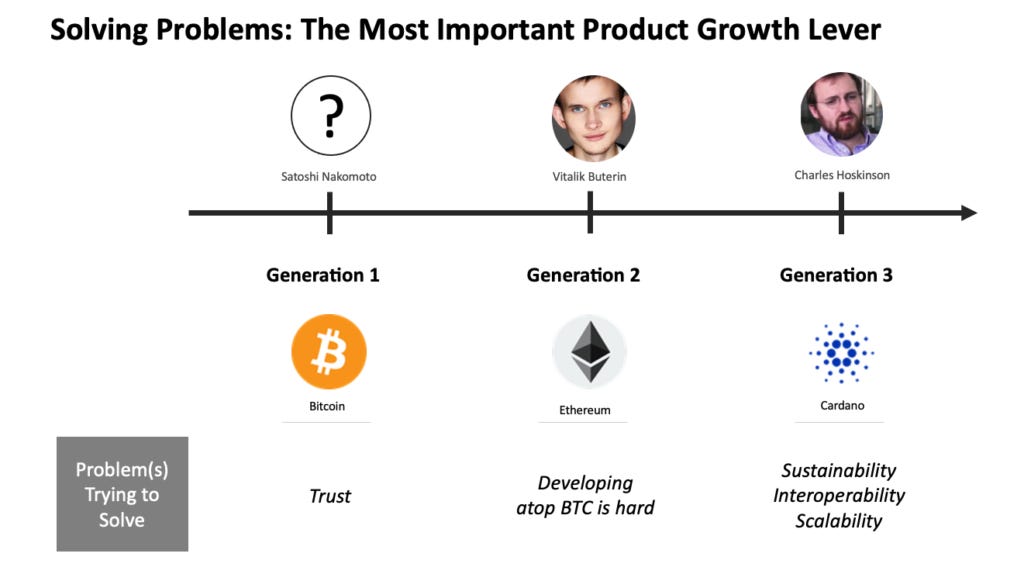

Cardano is a generation 3 Crypto. To understand what that means, let us first start with an understanding of generations 1 and 2[1].

2008

It was the end of the George W Bush presidency. Between the McCain-Obama race and ongoing collapse of the financial system, there was little room for anything else in America’s zeitgeist.

But, in cypherphunk circles[2], concerns were brewing. The Patriot Act had stripped Americans of privacy. Federal Reserves globally showed no signs of restraint with money printing. Debt ballooned. Financial institutions exposed their fragility. September 15, with the collapse in value of mortgage-backed securities, Lehman Brothers filed for bankruptcy.

Meanwhile, in some unknown corner of the world, Satoshi Nakomoto was concerned with this whole mess. All aspects of it. But he was not just concerned. He was working to design a solution to his problems. He was building Bitcoin.

On August 18, the world first learned about one of the transformative inventions in the history of mankind. Satoshi Nakomoto had registered the domain name bitcoin.org.

Six and a half weeks later, its design was revealed. Satoshi hit send on Bitcoin: A Peer-to-Peer Electronic Cash System. The text included the entire overview of Bitcoin. Satoshi clearly had experience with cryptography design. Descriptions are concise. Figures illustrative. Satoshi covers the design of the foundational cryptocurrency in 9 pages.

Importantly, from a product perspective, the paper also clearly walks through the motivation for bitcoin. This is a historical product growth lesson.Bitcoin solves a critical user problem. That enables it to grow rocket-like on its own. 🚀

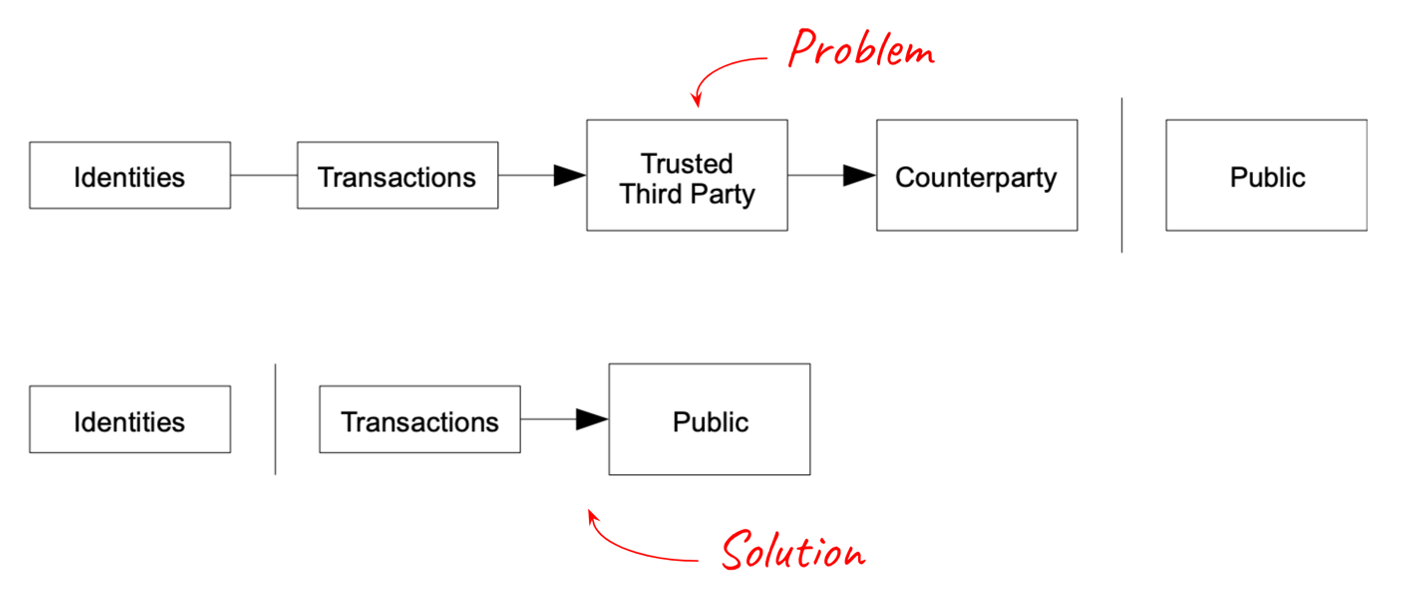

All financial transactions require trust. Modern participants in the economy, as a result, must rely on financial institutions. While the system works well enough, most of the time, its participants are also completely at the whim of these financial institutions.

Bitcoin solves this trust problem that causes economy participants to have to rely on these institutions. With bitcoin, transactions are publicly announced. There is a system for participants to agree on a single history of the order in which they were received. Identities are not necessary. Supply is capped. As a result, it is a system for electronic transaction entirely without relying on trust:

2009

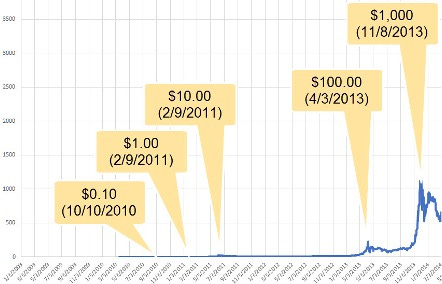

By January 3rd, Satoshi generated the first block in the bitcoin blockchain. January 12th, he sent bitcoin to Hal Finney. Things continued to move quickly from there. October 5th, the New Liberty Standard stock exchange listed one bitcoin at a cost of .07 cents. In other words, one could have over a 1000 bitcoin for less than one US dollar.

Over the ensuing years, more and more people found bitcoin useful. Bitcoin was solving trust problems, left and right. As a result, it saw massive product growth. People came to it to solve their problems. Just look at this chart:

Generation 2 Crypto

2011

One individual particularly interested in the nascent cryptocurrency was a young Russian immigrant living in Canada, Vitalik Buterin. His father, a computer scientist, told the young high schooler about Bitcoin.

He quickly grew more interested. Like any hobbyist, he began participating in internet fora focused on Bitcoin. It was there that he learned of a way to earn some of the cryptocurrency: writing articles. The owner of Bitcoin Weekly was offering 5 bitcoin per accepted article. In 2011, at the age of 17, Vitalik became an author. He would go on to co-found Bitcoin Monthly.

2012

Bitcoin Monthly quickly became the leading cryptocurrency publication. It even released a print edition. Vitalik matriculated at the highly prestigious University of Waterloo Computer Science program. But it was hard to say Vitalik was learning nearly as much at school as he did as co-founder of Bitcoin Monthly.

From his perch, Vitalik began to develop one of the most comprehensive understandings of the space. Ripple offered the freshman a full-time role. Were it not for Visa issues, he planned to join. But, the stars were aligned. Vitalik remained a writer. As he learned more, he continued to develop a perspective on how to improve bitcoin.

2013

By February 2013, the price of a bitcoin was $32, a massive 2000x appreciation since its initial pizza purchase. Cryptocurrency was picking up interest across the globe. Meanwhile, the young Vitalik and other industry observers were also crystallizing an understanding of its weaknesses.

Now 19 years old, and a central figure in the crypto community, Vitalik began arguing for a more advanced scripting language atop Bitcoin. Like Satoshi, Vitalik has a way with words. Interestingly, his work has been slightly less studied than Satoshi’s. I think simply because it is so voluminous. Take the Ethereum Whitepaper. It is much longer than Satoshi’s design document. Vitalik is a writer at heart.

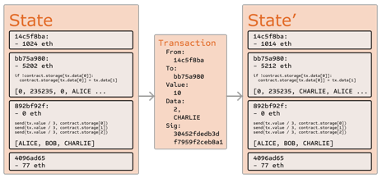

Despite the length, this work is as historic and important as Satoshi’s. Like Satoshi, Vitalik goes over the foundational motivation for Ethereum. It is hard to develop atop Bitcoin. Ethereum’s solution is a blockchain pre-packaged with a programming language that can be used to create contracts. These contracts allow the encoding of state transition functions. As such, they can be applied to create smart contracts, complex applications with digital assets and code. The vision was to be the ultimate platform layer for crypto.

Vitalik continued to turn Ethereum from a dream to reality. Unable to win the buy-in from the bitcoin community, he did what every good product growth professional does: pivots to find a better technology fit. Vitalik decided to create Ethereum as its own cryptocurrency. Ethereum was born. Vitalik made the second generation crypto.

In another corner of the world, Charles Hoskinson, a consultant, quit his job. He started the Bitcoin Education Project. Like Vitalik, he posted about his entire journey in the Bitcoin Forum. You can follow along here. He is an important character in this story. We will learn more soon.

Meanwhile, Bitcoin did another 31x through December to break through $100. Cryptocurrencies continued their momentum.

Generation 3 Crypto

2014

In January, Vitalik officially announced Ethereum at the Bitcoin Conference in Miami. He made an accompanying forum post that still lives[3]. There we meet Vitalik’s other early co-founders, Gavin Wood[4] and Jeffrey Wilcke. Gavin developed the Ethereum Yellowpaper, which includes the specification the Ethereum Virtual Machine (EVM). This allowed the EVM to be created in multiple programming languages.

Vitalik does not mention Charles Hoskinson in the forum post. There is an apocryphal story widely cited around the web that Charles was the CEO of Ethereum. If not CEO, almost every article single article, including Wikipedia, mentions Charles as a co-founder. But if you follow the citations, none provide proof of this.

As far as this author knows, it is a case of collective delusion. All we truly know is Charles was working on the project. Having carefully read all of Charles’ posts on Bitcoin Forum, he was working on the Bitcoin Education Project and Invictus, at the same time. So, even if he was involved with Ethereum, we do know it was in addition to other things. We also know that in 2015 Charles explicitly says he was not a founder:

Whatever the case, eventually, Vitalik and Charles had a dispute about whether Ethereum should be for- or not-for-profit. Vitalik was the true founder, which led to the firing of Charles in June. This would turn out to be one of the most consequential disputes in the history of crypto. Because it created the crucible for Cardano to be born.

Charles took 6 months off from the crypto world. During that period, he was approached by Jeremy Wood, another early Ethereum team member. The two created Input-Output Hong Kong (IOHK), a for profit blockchain engineering company.

2015

A group of Japanese businesspeople, Emurgo, approached IOHK with a proposition. They wanted to create a blockchain that would function as a cryptocurrency and smart contract, platform while complying with the increasing regulatory oversight in Asian blockchain markets. The market in the West was saturated, they reasoned, but Asia was under-penetrated. This request of IOHK led to the original thinking on Cardano.

Atypically, Cardano has no white paper. There is no single historical document for us to inspect, a la Bitcoin and Ethereum.

We do know that an Initial Coin Offering (ICO) was set up by September 2015. Cardano was set up as the blockchain, Ada as the cryptocurrency. Named after Gerolamo Cardano, the Italian Mathematician, and Ada Lovelace, the first ever computer programmer, the group set the tone for its work: academic and intentional.

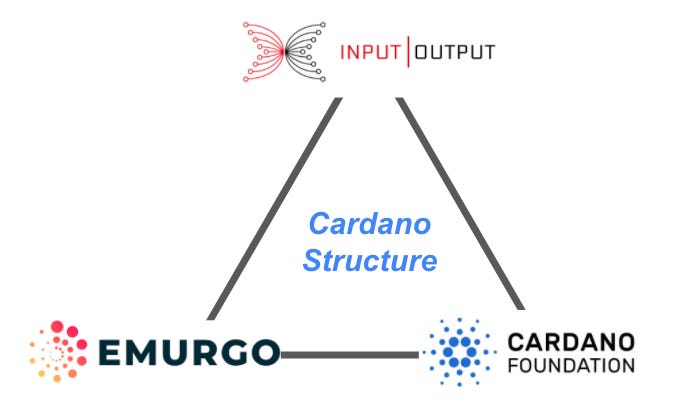

Cardano was built with a system of checks and balances. In addition to IOHK as developer, and Emurgo as commercial coordinator, the Cardano foundation was established for governance:

Interestingly, only non-American investors could buy-in to the ICO to avoid the additional compliance scrutiny. This led to a slightly slower take-up rate and smaller total than some competitors.

2017

Nearly a year and a half later, the ICO had finished. 30 of the 45 billion Ada were sold. In total, over $60M USD was raised.

By the end of the ICO, the development team also released Daedalus. It would go on to become the premier wallet to store Cardano. Today, Daedalus is to Cardano what MetaMask is to Ethereum.

The ICO funding then helped the three organizations double down on development. On October 1, Ada began trading on the US-regulated exchange Bittrex.

Finally, on October 26, we encounter our first historical Cardano artifact: Charles Hoskinson’s famous Whiteboard video. The overview video is to Cardano what Satoshi’s email was to Bitcoin and Vitalik’s whitepaper to Ethereum.

It clearly lays out the vision for generation 3 cryptocurrency. Cardano was built to extend crypto from the first million to the first billion. It does this by attempting to solve three problems with generation 2 crypto: scalability, interoperability, and sustainability. It is worth understanding the vision for each.

Problem 1: Scalability

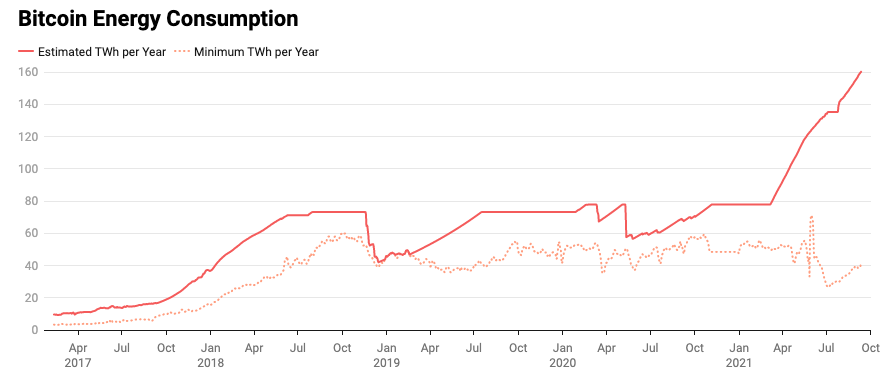

Bitcoin costs $3 million/ hour to maintain today. Charles Hoskinson was predicting this problem back in 2017, when the cost was only $300 thousand / hour. Cardano is designed to solve this scalability problem.

As a blockchain has more transactions per second, it generates more data. This quickly becomes intractable for consumer hardware devices. To solve these problems, Cardano is architected to get more TPS as more nodes are added to the network.

The team released a white paper for Ouroboros, a cryptographically secure blockchain protocol. It does not require the extensive computational resources that bitcoin requires to construct a block. It can operate parallelly. As a result, the system was built to be considerably cheaper to run.

Problem 2: Interoperability

It is difficult for Bitcoin and Ethereum to talk to one another. It is even more difficult for the legacy banking system infrastructure, Swift and ACH, to understand crypto. This results in value being stuck in its own silos.

The vision for Cardano is to solve the kingmaker problem, where small, centralized exchanges determine what trades can be made. To make interoperability more decentralized, it was set up with the vision for bridges that allow crypto to move between blockchains easily. The idea is that cross-chain transfers could happen without a third party.

Problem 3: Sustainability

By relying on proof of work, Bitcoin and Ethereum require a massive amount of energy to maintain. This is because miners need to buy better and better GPUs, and leave them running, to solve the increasingly difficult math problems. This is especially a problem as bitcoin becomes worth more fiat currency. As a result, the energy usage of bitcoin is so large, that it led to Elon Musk’s famous flip flop.

The Cardano team was expecting these energy problems back in 2017.

As a result, Cardano is designed to be a proof of stake currency, instead of a proof of work currency. Stakers validate block transactions based on how many coins they hold. This is a systematized version of the skin in the game concept, made famous by Niall Ferguson. It causes people to come together for the common good of the project.

Cardano also has a treasury. This is a decentralized bank account. Some of the mining fees miners receive in Bitcoin is actually going to this foundation in Cardano. It has a democratic process. People who own Cardano submit proposals to the treasury, where they are voted on by the token holding community. If a majority of token-holders support a proposal, then the amount is paid out to develop on Cardano. This creates a self-supporting loop to support development on the Cardano platform. It also allows the overall community to vote on hard forks to develop the protocol.

Unlike Bitcoin or Ethereum, Cardano did not come pre-packaged to solve those problems. So, we will return to the current progress and future milestones along these three core problems later in the article.

2017 Continued…

As 2017 carried on, cryptocurrencies took off. Cardano did as well. Charles Hoskinson even briefly became a billionaire. But the technology was still nascent. It was mainly speculation on the future value. As a result, the price of Ada returned to earth. The Cardano three went back to developing.

2019

Over the years, Cardano stayed true to its academic, slow process. It continued carefully developing the blockchain. By the end of the year, Cardano was ranked as the most actively developed cryptocurrency project that year.

2021

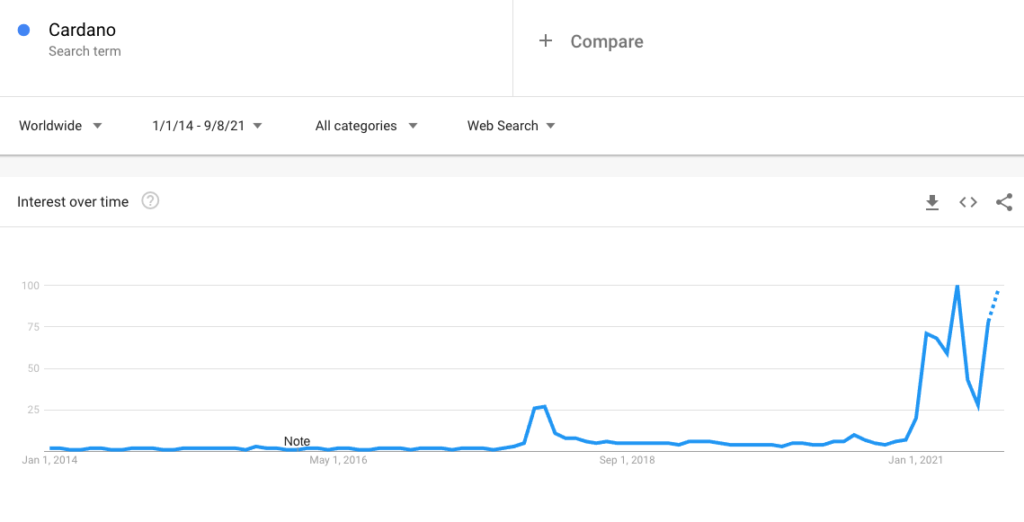

That brings us to this year. It has been a wild ride. The team has picked up momentum. Developments and deals are coming at a faster pace. As a result, the month-to-month interest has been spiky, but far greater than the last boom cycle:

It is so interesting that it is worth examining the history by month.

February

The cryptocurrency craze hit again. Right alongside meme stocks, most crypto took off. Cardano included. It crossed $1, for more than a 33x price appreciation since Hoskinson’s famous whiteboard video.

March

Three important things happened. First, Cardano successfully had its Mary hard fork on the first of the month. This allowed the creation of native tokens on Cardano. Second, it was added to Bloomberg Terminals on March 15. Third, it was added to Coinbase Pro, a major vehicle for professional Wall Street traders, on March 18. These announcements kept up the momentum, and significantly increased the pace of institutional investment.

April

Cardano continued the trickle of bullish news. First, Cardano partnered with Orion. Orion protocol is building a decentralized gateway to the market. It also announced a major user of the Mary hard fork functionality: AgeUSD, a stablecoin on Cardano. Then, Revolut added Cardano to its app.

Finally, at the end of the month, IOHK struck a deal with the Ethiopian government to use Cardano to track student performance. The company opened an office in the capital, Addis Ababa. It expects to launch the ID project in January 2022. The Ethiopia project opens up a brand-new set of problems Cardano can solve. The goal is to issue high school graduates near field communication chips that will contain their educational credentials. This allows the data to be available even if they do not have a device to connect to the system.

This will resolve the huge issue in the country of fake certifications. These fake certifications are holding back young Ethiopians with real certifications.

May-June

In May, Cardano was the #7 crypto. The University of Wyoming announced it was staking over $1M of Cardano.

July

July saw a slight dip, as interest in crypto generally waned. It was a bear market. However, Cardano kept up the momentum. First, it was added to the Grayscale Large Cap Crypto fund, as its third largest holding. Second, Grayscale announced it had filed for a dedicated Cardano altcoin fund, like its bitcoin fund.

Finally, at the end of the month, Wolfram held an Non-Fungible Token (NFT) live minting event on Cardano. This helped kick off a major wave of NFTs on Cardano.

August

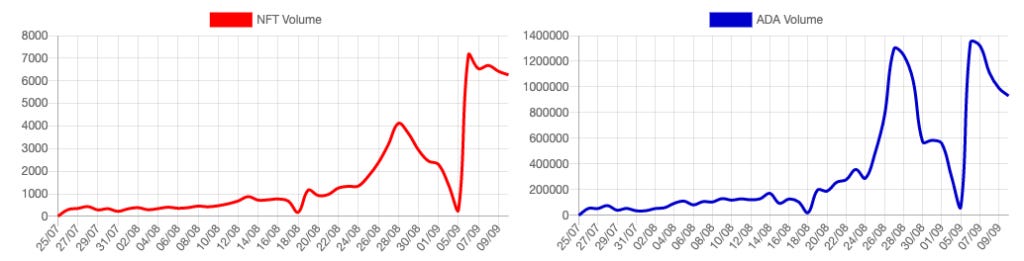

Everything started to take off. Japan authorized Ada at its exchanges. In addition, NFTs really started to take off on the Cardano blockchain, following the rise on Ethereum earlier this year. Just look at this trading volume:

This was a momentous change in crypto market caps generally. NFTs were now not unique to Ethereum and Solana[5]. This led to the absolute skyrocketing of Cardano. Cardano passed the $2 price level, a price it has sustained since.

August 20, 2021

The moment we started the article with. Cardano surpassed BNB, Binance’s coin to become the #3 cryptocurrency by market cap.

Since then, Cardano has kept up the stable of positive news. For instance, it announced Djed, another stable coin project.

Now that we have a good understanding of Cardano’s founding, its key figures and inspiration, let us turn to the project today. Where the last part of the article was more history, this part is more analysis. 🧮

Part 2: Cardano Today 🌝

This brings us to today. There is so much happening with Cardano. To organize the chaos, I will start with an overview of the development.

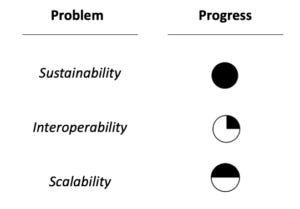

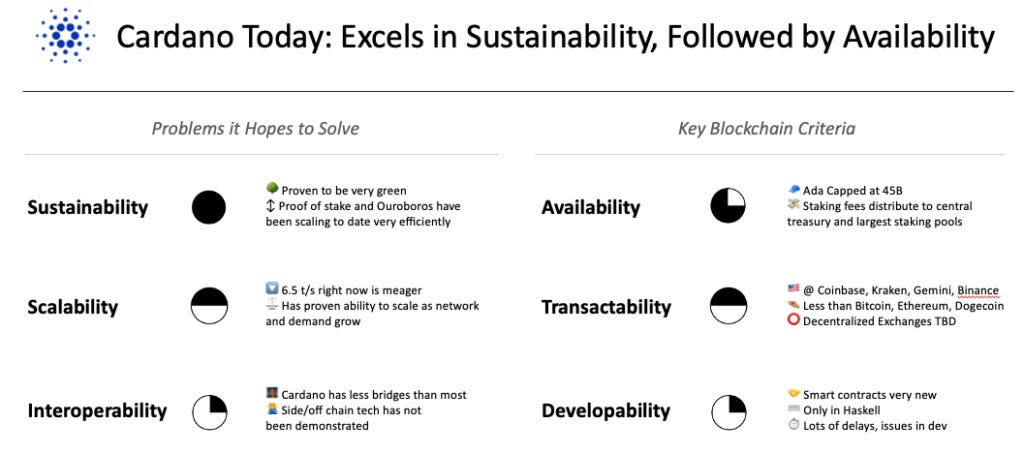

Cardano is a project designed to solve three main problems. So, after development, I will evaluate its progress against its three main problems: sustainability, interoperability, and scalability

After that, we will evaluate Cardano on three other criteria critical for any crypto in 2021: availability, transactability, and developability.

Development

Cardano’s development has been split into various eras. We are wrapping up the Goguen era. Activity has been brisk for the last 2.5 years. To date, and for both of the past two calendar years in total, Cardano has been the top developed crypto. Just look at its contributions on Github compared to the others:

September 12 is the Alonzo hardfork. That is the day of publishing. It will be the first step of many towards rolling smart contracts out for full general & public use. This will be one of the most important updates in the history of Cardano.

Staking

Ada held represents a stake in the network. This staking is fundamental to Cardano’s proof of stake and treasury voting mechanisms. Amazingly, 71% of Cardano is now in stake pools eligible to earn rewards. This process is supported by a full-node wallet, Daedalus, and a browser-based wallet, Yoroi. Depending on how you stake, you earn between 1.9% and 7% per year. This means about 7/10ths of the shareholder base is ostensibly made up of longer-term holders.

Now, let us shift to Cardano’s performance across the three core problems it intends to solve.

Progress on Problem 1: Scalability

Let us look at transactions per second today. That is the ultimate metric here:

Visa – 10s of thousands t/s

Eth – 20 t/s

Ada – 6.5 t/s

BTC – 4-4.5 t/s

➡️ Wait?! Wasn’t Cardano supposed to be at the top?

Yes, Cardano was. And Cardano can be. Cardano can scale to 1 million t/s. It is a network setting. That is a lot more than bitcoin and Ethereum. But, Cardano scales as demand scales. It will speed things up, as it has more users. The proof of stake mechanism has shown it can scale. But, Cardano has not scaled quite yet.

Progress on Problem 2: Interoperability

It is one of tech’s oldest problems. Wireless networking requires a router. But, how bad would it be if the Apple iPhone only connected to Apple routers? Cardano aims to prevent crypto from suffering from the same problem. Cardano aims to connect cryptos together. It wants to help you move your value between them more easily.

In the latest release, you can convert from Ethereum to Cardano! This is using a bridge. Right now, Cardano has comparatively less bridges than most altcoins. This is due to the lack of smart contracts. It will be interesting to see if Alonzo helps the ecosystem develop more bridges and reach its interoperability goal.

KMZ sidechains are expected to be one of the ways to drive forward this interoperability faster and further. It will be interesting to watch their development.

Progress on Problem 3: Sustainability

Bitcoin energy consumption has more than 14x’d since Cardano originally conceived to solve the sustainability problem in 2017. Things are not getting better, but instead much much worse:

Cardano’s proof of stake algorithm through Ouroboros, on the other hand, is working as intended. Leveraging cryptography, combinatorics and mathematical game theory, it has managed to be an effective consensus algorithm that is not nearly as energy intensive.

Ethereum plans to move to the proof of stake model. More than 10,000 cryptocurrencies today now use proof of stake. On the sustainability side, Hoskinson and the Cardano team seemed to have solved the problem and ended up on the right side of history.

In sum, Cardano has made varying progress against its major three goals:

Outside of the key problems Cardano solves, any modern crypto needs an analysis of availability, transactability, and developability.

Availability

Ada is deflationary. It has a maximum supply of 45 billion. Of that, 31.9 billion is in circulation, 71% of which is staked. This is similar to Bitcoin. Bitcoin has 21.5 million maximum, with 18.9 million in circulation. This is unlike Fiat currency issued by governments. They have shown a proclivity to printing plenty of that recently. 💸

Ethereum, on the other hand, has no max. As a result, many investors consider Ada a hedge against Ethereum, not only because it is the #2 smart contract player, but also because it is actually supply limited. Ethereum 2 does plan to implement a max.

Transactability

Cardano only has centralized exchanges right now. In the US, Cardano is available on Coinbase, Kraken, Gemini, and Binance. Globally, it is available on over 100 exchanges. That is good coverage.

But, it is behind Bitcoin, which has made its way to a great percentage of regular finance apps. It is also behind Ethereum and Dogecoin. They are on Robinhood, for instance. It will be important to see the development of decentralized exchanges, in the area of transactability, as well.

There are some cool tools popping up to examine transactions. For instance, Pool.pm is a Cardano blockchain explorer. It shows you all the tokens that are currently being minted on the blockchain. You can also plug your public address into the tool to see everything you hold in your wallet.

Developability

Cardano is still in Haskell. As a functional language, it is good for academic proofs. But, it is not the most practical language from the point of view of users. Ethereum has been written so that developers can develop for it in a great variety of languages.

Separately, the overall roll-out plan for Cardano has had its pros and cons for developers. It is more measured than Ethereum. Things come more slowly, but they tend to be more thought out. For fans of the academic approach, this works well. For those who move fast and want Decentralized Finance (De-Fi) now, Alonzo cannot come soon enough.

To put our evaluation of Cardano together:

There is no analogue to the Cardano story at this point. It is fully its own. After all, this is the number three crypto. Crypto is not a small market anymore. Now, that we have evaluated Cardano thoroughly, let us dive into its top projects today.

Top projects

Alonzo’s smart contracts should vastly increase the size of top projects on Cardano. But, for now, the most important projects fit in three categories: stable coins, decentralized exchanges, and NFTs.

Stable Coins

Stable coins are an interesting and useful technology. They solve a few problems. First, crypto was primarily invented as a way to transfer value without trusting a third party. If you are in a volatile economy like Venezuela or Afghanistan, it is really useful to have access to a stable currency.

Second, trading. In the US, individuals must pay capital gains tax on any gain. Price volatility of a normal crypto can cause loads of those taxes. As a result, many traders rely on native tokens or stable coins to provide a stable priced crypto. Converting to fiat entails more fees than a stable coin.

Third, stable coins are great for peer-to-peer lending. Trying to pay back something that is going up in value is very difficult. But stability enables innovating De-Fi use cases like loans. Putting those three reasons together, it is important to see stable coin projects develop on Cardano. It will be interesting to see if one can become as big as Tether, which $68b market cap as of 9/12.

There are a few stable coin projects that are to being develop atop Cardano. These include:

Stasis

Djed

AgeUSD (which we mentioned above)

Ergo

Cardanians.io

The “one to watch,” is probably AgeUSD. This was set up by Emurgo, the commercialization arm of the Cardano three. As a result, it is receiving institutional support and looks ready to continue the momentum.

Decentralized Exchanges

Establishing credible decentralized exchanges is central to achieving the vision for Cardano. As long as centralized exchanges exist, there will always be custodial risk. To be a truly decentralized system that is self-governed, exchange needs to be executable without a centralized entity. This is why the decentralized exchange projects are worth thinking about. With the upcoming smart contract functionality, these projects will finally be able to take off.

The goal for any of these entities is to become like Uniswap on Ethereum, which has enough liquidity and volume to be credible. It has about 30% market share. It has also improved over time. Some of the top projects that have kicked off include:

And many more…

I have my eye on two. First, OccamX. The team is developing a De-Fi and DAO (decentralized autonomous organization) as well. They are also developing a Cardano-Ethereum bridge. Second, Cardax. They are the only Dex to receive funding from Project Catalyst. The team participated in all the Alonzo test nets. They will be bringing native token swapping and liquidity provision to market.

Any of the projects could run ahead in a few months. It is still very early in this space. But it is an important one to watch.

NFTs

I saved the best for last, NFTs. Some people love them, others hate them. What seems clear is that play-to-earn is taking off on the gaming side, and digital collectibles/art are taking off on the other. There are real and valuable use cases for NFTs. Until recently, all that value was locked up within the Ethereum ecosystem. One of the most important developments in the history of Cardano has been NFTs. Now that value from NFTs lives in multiple blockchains, instead of just Ethereum.

There are loads of projects in this space to explore. New ones arrive daily. I generally use two sites to find them. Wen CNFT is the first. TokenRef is the second. I used TokenRef to see this ada doll which was purchased for 550 Ada on September 12th:

That is over $1000 US dollars for a single NFT. The ecosystem is developing rapidly. What makes for a top project is mainly a choice of taste. Here are 4 of my favorites at different price points, most expensive first:

SpaceBudz, selling for 3000+ ADA

CardanoBits, selling for 225+ ADA

Grandmaster Adventurers, selling for 75+ ADA

AdaDolls, selling for 35+ ADA

There are thousands of new projects in the works. You can even play around with Metromermaids to mint your own Cardano NFT (CNFT)

Now that we have understood Cardano’s history and analyzed it at present, let us look forward. 🔮

Part 3: The Future 📈

Development

Cardano has many threads of development at the platform level and the application layer. There are two that are particularly important to pay attention to: Alonzo and Project Catalyst.

Alonzo

September 12th, the day of publishing of this article, is one of the most historic days in the entire history of Cardano. It is releasing Alonzo, which will mark the beginning of Smart Contracts on Cardano. This is the massive technological unlock that makes stable coins, decentralized exchanges, and hundreds of un-dreamt of use cases possible.

This also marks the end stages of Cardano’s Goguen era. Once all the Alonzo releases are complete, we should be headed towards the fourth major epoch of Cardano, Basho. This is when the team will really focus on scaling. We should hope to see great progress against that problem, including much higher transactions per second.

Project Catalyst

Project Catalyst is a funding mechanism the Cardano foundation uses to fund ventures building applications atop Cardano. We are now on to Fund 6. Fund 5 included NFT business models.

That went quite well.

Fund 6 will be giving out $40K in ADA to about 150 new projects. This will vastly accelerate the development of applications to solve user problems atop the Cardano platform.

🐻 Bear case for Cardano

We have made it! We have fully evaluated Cardano. So, what is the bear case for this #3 cryptocurrency? What are the most viable reasons it will not live up to the potential of its nearly Square-sized market cap? Three things stand out: where is the value, technical difficulties, and being a follower.

1: Where is the value?

Perhaps the simplest bear case for Cardano is that it is hard to draw a line between $100B of market cap and Cardano’s applications. Like most of cryptocurrency, the value has not materialized yet. Profits are not being earned all over the ecosystem. Much of it is being earned in centralized exchanges. As it relates specifically to Cardano’s market cap, it seems that a lot of that value is just a hedge against Ethereum.

2: Technical Difficulties

Technology matters for the competing smart contract blockchains. There is Polkadot, Solana, EOS, and many other strong projects. They have dedicated teams. One of the key ways to evaluate such teams is how often and how strong the code they ship is.

Cardano has not proven that it ships fast or bug free. Recent test net implementations with smart contracts had a concurrency issue where only one could be executed at a time. The development timeline is constantly being pushed back. This could allow another crypto to overtake Cardano, by solving the same problems, but faster and better.

3: Follower

Cardano, in many cases, suffers from second-mover disadvantage. Ethereum had the first version of many of Cardano’s top use cases. From NFTs, to De-Fi, even smart contracts as a whole, Ethereum is the dominant development blockchain on most people’s minds. Even if Cardano does solve some problems Ethereum has, Ethereum is working on Eth2. So Ethereum may eventually solve many of those problems, as it moves to Proof of Stake and beyond.

🐃 Bull case for Cardano

On the other hand, this article has been something of a celebration of Cardano. It is worth nearly $100B. It is the number 3 crypto. What could propel it to even greater heights? Why would one buy and HODL now? You would have to be relying on three tentpoles: the profit model, roadmap, and problems it solves.

1: Profit model seems to be driving development

Unlike other crypto-currencies, Cardano has has a unique funding model. The foundation and Project Catalyst have a track record of spurring development from third parties to create innovative applications. Over time, this should play to Cardano’s strengths and lead to a stream of disruption.

2: Overall roadmap seems to be set in the right direction

Charles Hoskinson appears like the type of crypto-currency founder visionary that many were hoping for with Charlie Lee, the figure of Litecoin. He is a figurehead that is mature, has a measured approach, and is setting an inspiring vision for the giant group developing on Cardano. The overall roadmap he set out in his early Whiteboard video appears to have been spot on with the current problems we see with Ethereum and Bitcoin.

3: Solving three exciting problems

The three problems that Cardano are solving are worth trillions of dollars. If Cardano can truly solve scalability, sustainability, and interoperability on the blockchain, there are hundreds of billions in value to accrue from here. This is just Day 1. So, if the team can execute on its vision, it will be to the moon from here. 🌕 It is all about that big ‘if.’

Milestones to watch for

There are 5 milestones you should watch for after this article’s publishing. This will help adjust your case for or against Cardano. In order of importance, they are:

Smart Contract Rollout

How Cardano Adapts

De-Fi Developments

More Interoperability

Ethiopia Project

1. Smart Contract Rollout

Everything depends on smart contracts. Does the Cardano team finish up the Goguen era soon? Do they move on to the Basho era in a timely fashion? Or do problems with smart contracts slow the development team down?

At launch, smart contracts will be a command line interface. This will mark the beginning of open source smart contract development on Cardano. But, will it be made easier in the future? Will it move on beyond Haskell? These are key milestones to watch.

2. How Cardano Adapts

Stylistically, the most famous dig Vitalik has made about Cardano is they move too slowly, because they are overly concerned with academic-style proof for things. Vitalik’s is always an opinion to consider.

Nimble companies do best. Will Cardano be able to adapt quickly? It has so far. But as other cryptocurrencies innovate, will it be able to take those in? The adaptability factor, combined with speed, will be key for Cardano.

3. De-Fi developments

A platform is just a canvas. Many of the most exciting applications for the Cardano canvas are in the world of decentralized finance. One of the most inspiring visions Charles Hoskinson has shared, for instance, is the universal wallet:

Imagine being able to pay with silver, gold, USD, yen, Bitcoin or Cardano at the diner. That is the vision of a universal wallet.

🤯 When will that be available? It will be important to watch De-Fi developments on Cardano.

4. More Interoperability

Interoperability is one of the problems Cardano intends to solve that it has made some of the least progress on. For the bull case to truly materialize, we will need to see bridges with many more crypto. In addition, we would want to see decentralized exchanges and side chains working well and ubiquitously.

Right now, all of it is somewhat talk. There is one bridge. There should be a potpourri of future bridges and sidechains.

5. Ethiopia project

The Ethiopia project is one of the most ambitious in the history of crypto. If Cardano can solve this problem, it will be a validation for the entire development model. In particular, it will show the executional prowess of the IOHK development team. It will be very interesting to see if this problem will be plagued with technical delays and funding roadblocks, or execute seamlessly.

We’ve done it! We’ve analyzed Cardano’s history, present, and future. Now that we’ve gotten through all that, what are the product growth takeaways? 🚀

Part 4: Product Growth Review 👨🏫

We can learn a million things from Cardano’s stratospheric growth. But if you walk away from anything after these 7,400 words, these four product growth lessons should stick out.

Lesson 1: Solve Problems

The first takeaway from our history and analysis of Cardano is that solving problems is the core. The three products we reviewed today grew themselves. The problems they solved were just that important:

The trust problem.

That development on Bitcoin is hard.

Sustainability, scalability, and interoperability:

Solving important problems that happen frequently is even better. Being truly innovative is a final plus up. All three of these generation of crypto have books full of product growth lessons, but they all rest on this core.

Growth hacks are dead. It is not about hacking growth. It was never about hacking growth. It is not about generating leads that convert poorly. It was never about bad upper funnel traffic. Product growth is about solving core problems for your users. Every growth professional needs to ask,

💭 “Are the features I am shipping going to help solve really important problems for users?”

Lesson 2: Build Platforms

Bitcoin is a platform for trustless payments. Ethereum is a platform for developing atop the blockchain. Cardano is an enhanced smart contract platform for developing atop the blockchain. These types of platform products grow on their own.

It enables others to do the grow work for you. It does not become a race to hire the most developers. Others can develop on your platform. This is part of the magic of the Apple and Google App stores, as growth engines for their companies.

Even if your product, at first, does not start out as a Platform, you can turn it in to a platform. This is what Slack and Salesforce have done with the apps atop their platforms.

Lesson 3: User Generated Development

By taking a portion of all transaction fees for the foundation’s funding, Cardano has a built-in innovation funding mechanism. But that in and of itself is not a product growth lesson. The innovative thing about Cardano is that the funding is used to fund user generated development projects.

Cardano is funding many of the projects being built on its platform. This is something now of a classical product growth lever that Cardano has implemented very well. Even better, this system also helps set up the democratic method so Cardano can go beyond the founders.

Lesson 4: Product Announcement Machine

I am always flabbergasted how many PMs I meet whose features are not used. The dialogue usually goes something like this:

Me: How did that feature your team released last month do?

PM: We have not had significant take-up of the feature amongst our users.

Me: What was the product announcement and GTM strategy?

PM: That was up to product/integrated marketing.

This is essentially the 🤷 response to product announcements.

You should never let a good feature development go to waste! Cardano has an amazing YouTube presence. The whole community goes above and beyond with communication. The channels for IOHK and the Cardano Foundation transparently and openly talk about development progress, roadblocks, and releases. They also have great podcasts and blog posts. Overall, Cardano is a content powerhouse.

Each product release has built up anticipation. Beta testers are lined up and funded. The machine is well oiled. It’s almost Apple-like.

People wait for bated breath, as this article has with the upcoming release of smart contracts on the day of publishing.

Note: I am merely a humble newsletter writer. Thoughts are my own. They do not represent my employer, Affirm.

[1] From my point of view, 95% of articles I read on this topic had flat-out inaccuracies on the history all along the chain. So, after putting on my detective hat, here is what I think really happened. 🕵️

[2] Last week, we studied Max Levchin, who 10 years prior to this story, was also interested in cryptography. He built a revolutionary growth product: PayPal. It generally pays to pay attention to what these folks are interested in.

[3] The thread is worth checking out. It will throw you back to that time period, when fora were where great niche discussions happened. Crazily, the first response to the thread is from the founder of CoinDesk. The website is now huge. You can also click Vitalik’s name to see his 300+ insightful posts on the forum.

[4] Gavin Wood went on to found Polkadot, a Generation 4 or 5 crypto that was launched last year.

[5] Solana is even newer than Cardano – launched in 2018, it incorporates proof of history in addition to proof of stake. In that sense, it is a Generation 4 cryptocurrency.